by Calculated Risk on 11/12/2009 01:20:00 PM

Thursday, November 12, 2009

Hotel RevPAR off 11.8 Percent

From HotelNewsNow.com: Boston leads RevPAR gains in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 3.6 percent to 54.8 percent, average daily rate dropped 8.5 percent US$97.19, and RevPAR decreased 11.8 percent to US$53.29.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was late in 2008, so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

This is a two year slump for the hotel industry. Although occupancy is off 3.6% compared to 2008, occupancy is off about 17% compared to 2006 and 2007.

The occupancy rate really fell off a cliff in October 2008, and the good news is the occupancy rate for 2009 is tracking closer and closer to 2008.

Smith Travel Research is now predicting a slight uptick in occupancy rates in 2010 to 55.8% from an estimate of 55.2% in 2009. However average daily room rates (ADR), and revenue per available room (RevPAR) are expected to continue to decline slightly in 2010. The "good news" for the hotel industry is supply coming online is dropping sharply, and is expected to stay low for a few years. Of course that is bad news for construction workers ...

FHA Reserves Fall Sharply, Well Below Required Minimum

by Calculated Risk on 11/12/2009 11:08:00 AM

From David Streitfeld at the NY Times: Housing Agency Says Cash Reserves Are Down Sharply

The Federal Housing Administration said Thursday morning that its cash reserves had dwindled significantly in the last year after a record drop in home prices.From the FHA: Annual Actuarial Study Shows Capital Reserve Ratio Below Mandated Level; FHA Credit Policy Reforms Expected to Address Risk, Raise Reserve Levels

...

The results of the F.H.A.’s annual audit showed the agency’s capital reserves to be 0.53 percent, far under the 2 percent minimum mandated by Congress. A year ago, the capital reserves were 3 percent.

The independent study shows that FHA has sustained significant losses from loans made before 2009, and the capital reserve ratio has fallen below the congressionally mandated threshold, but concludes that under most economic scenarios considered FHA’s reserves would remain above zero.More links:

FHA’s capital reserve ratio, which is determined through findings from the independent actuarial study, measures reserves held in excess of those needed to cover projected losses over the next 30 years. The review projects the capital reserve ratio to be 0.53 percent of total insurance in force this year, below the two-percent statutory threshold. This capital ratio fell from 3 percent in the fall of 2008, reflecting difficult conditions in the housing market. The 0.53 percent capital ratio (which represents the funds held in the Capital Reserve Account) is in addition to the auditor’s base case estimate of the 30-year reserves needed to pay for losses on existing loans (which are held in the Financing Account). Combining those two accounts, FHA holds $31 billion in its total reserves today, or more than 4.5 percent of total insurance-in-force.

...

As part of its efforts to manage risk, FHA is modeling more extreme scenarios than those used by the actuary, including scenarios showing the reserves going below zero. FHA is committed not only to understanding its risks, but also to developing policy responses appropriate to addressing that risk.

emphasis added

Annual Report to Congress Regarding the Financial Status of the FHA Mutual Mortgage Insurance Fund

FHA Fiscal Year 2009 Actuarial Review Briefing

MBA: Purchase Applications Fall to Nine Year Low

by Calculated Risk on 11/12/2009 09:05:00 AM

The MBA reports: Mortgage Refinance Applications Increase, Purchase Applications at Nine Year Low

The Market Composite Index, a measure of mortgage loan application volume, increased 3.2 percent on a seasonally adjusted basis from one week earlier. ...It appears the post home buyer tax credit slump had started, although the tax credit will be extended and the eligibility expanded - so the slump might be delayed ... also existing home sales in October will probably be very strong - that is not good news for housing and the economy (since it was just demand from marginal buyers pulled forward at a very high cost).

The Refinance Index increased 11.3 percent from the previous week and the seasonally adjusted Purchase Index decreased 11.7 percent from one week earlier. The seasonally adjusted Purchase Index is at its lowest level since December 2000.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.90 percent from 4.97 percent, with points increasing to 1.03 from 1.01 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

Weekly Initial Unemployment Claims: 502 Thousand

by Calculated Risk on 11/12/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims decreased to 502,000:

In the week ending Nov. 7, the advance figure for seasonally adjusted initial claims was 502,000, a decrease of 12,000 from the previous week's revised figure of 514,000. [revised from 512,000] The 4-week moving average was 519,750, a decrease of 4,500 from the previous week's revised average of 524,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Oct. 31 was 5,631,000, a decrease of 139,000 from the preceding week's revised level of 5,770,000.

Click on graph for larger image in new window.

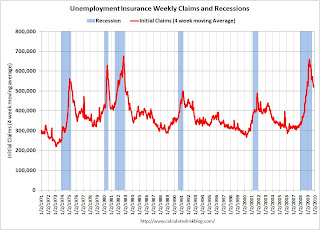

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 4,500 to 519,750, and is now 139,000 below the peak in April. The significant decline from the peak strongly suggests that initial weekly claims have peaked for this cycle.

The level is still very high suggesting continuing job losses.

Wednesday, November 11, 2009

Fannie, Freddie, Counterparty Risk and More

by Calculated Risk on 11/11/2009 10:08:00 PM

Yesterday I posted some excerpt from Freddie Mac's 10-Q:

We believe that several of our mortgage insurance counterparties are at risk of falling out of compliance with regulatory capital requirements, which may result in regulatory actions that could threaten our ability to receive future claims payments, and negatively impact our access to mortgage insurance for high LTV loans.The WSJ has more tonight, including the risks to Fannie Mae: Fannie, Freddie Warn on More Losses

Fannie Mae has about $109.5 billion of mortgage-insurance coverage in force ... Freddie Mac had $63.4 billion in mortgage insurance and $12.2 billion in bond insurance.And this a key sentence:

The reduction in private insurance coverage has contributed to the rise in the volume of loans backed by the Federal Housing Administration ...Instead of using private mortgage insurance for loans greater than 80% LTV, low down payment borrowers are now using FHA insurance.

That will probably end well ...

Also - the WSJ has more on the new FDIC "Prudent Commercial Real Estate Loan Workouts" guidance issued Oct 30th: Banks Hasten to Adopt New Loan Rules. Here is the new FDIC guidance that states performing loans "made to creditworthy borrowers" will not require write downs "solely because the value of the underlying collateral declined".

BofE's Mervyn King: Worst Over, "Long hard haul" Ahead

by Calculated Risk on 11/11/2009 07:25:00 PM

From The Times: The worst is over, says Bank of England Governor

Better-than-expected unemployment figures and a rosier growth forecast from the Bank of England raised hopes yesterday that Britain was beginning to claw its way towards economic recovery.The following graphs are from the BofE November 2009 Inflation Report. The first graph shows the projections for GDP.

...

Mervyn King, Governor of the Bank, said Britain had “only just started along the road to recovery” and that it would be “a long hard haul” back to regain the level of activity of two years ago before the financial crisis hit.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note that GDP isn't expect to return to pre-recession levels until sometime in 2011 (mean estimate).

Note from BofE: To the left of the first vertical dashed line, the distribution reflects the likelihood of revisions to the data over the past; to the right, it reflects uncertainty over the evolution of GDP growth in the future. The second dashed line is drawn at the two-year point of the projection.

The second graph shows the projections for inflation.

The BofE expects a short-term increase in inflation because of higher oil prices, but then below trend inflation through most of 2011.

The BofE expects a short-term increase in inflation because of higher oil prices, but then below trend inflation through most of 2011.Note that the line is drawn at the 2% target inflation rate (not zero).

From the BofE: Price stability is defined by the Government’s inflation target of 2%.

WSJ on Permanent Modifications

by Calculated Risk on 11/11/2009 04:30:00 PM

Ruth Simon at the WSJ has some details on permanent modifications: Mortgage Program Gathers Steam After Slow Start

The administration won't release figures on completed modifications until December, but so far it appears that very few trial modifications are becoming permanent, often because of a lack of documentation.Diani Olick at CNBC wrote yesterday:

...

J.P. Morgan Chase & Co. said last week that more than 92,000 of its customers have made at least three trial payments under the program, but just 26% of them had submitted all the required documents for a permanent fix.

...

At Morgan Stanley's Saxon Mortgage Services, about 26,000 of the 39,000 borrowers in the program have made more than three trial payments. Roughly 500 have received completed modifications.

emphasis added

Insiders however tell me that a lot of that paperwork has to do with those so-called "stated-income" loans ...In my list of possible upside surprises / downside risks for the economy, the percent of permanent modifications is related to the #1 downside risk. If few of these modifications are successful, there could be a flood of foreclosures on the market next year.

Unsolicited Principal Reduction Offer from BofA

by Calculated Risk on 11/11/2009 03:01:00 PM

Here is an unsolicited Principal Reduction Loan Modification (pdf) offer from BofA. (ht Dwight)

A few background details:

The offer from BofA:

If the homeowner accepts the offer, he would still owe more on the 1st than the house is worth (the 2nd mortgage would have to be resolved). The personal issue still exists, and reducing the monthly payments by a couple of hundred dollars probably will not help. My understanding is the homeowner is considering trying for a short sale, but it is interesting that BofA is sending out unsolicited principal reduction offers - probably to NegAm borrowers.

UPDATE: The number is answered by a recording that announces they are a "debt collector", and then says they are now closed (probably for Veterans Day)

Economic Outlook: Possible Upside Surprises, Downside Risks

by Calculated Risk on 11/11/2009 01:15:00 PM

As I've noted several times, my general outlook is for GDP growth to be decent in Q4 (similar to Q3) and for sluggish and choppy GDP growth in 2010. I've been asked to list some possible upside surprises, and downside risks, to this forecast.

Possible Upside Surprises:

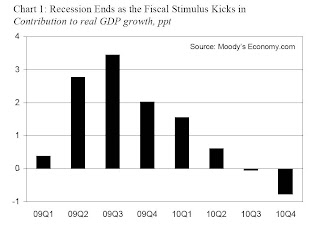

Click on graph for larger image in new window.

Click on graph for larger image in new window.This suggests that all the growth in Q3 was due to the stimulus package, and the impact will now wane - only 2% in Q4, and 1.5% in Q1 2010 - and then the package will be a drag on the economy (impact on GDP growth will be negative) in the 2nd half of 2010.

With unemployment above 10%, there will be significant political pressure for another stimulus package - especially if the economy starts to slow in the first half of 2010. This next package could be several hundred billion (maybe $500 billion) and could increase GDP growth in 2010 above my forecast.

Possible Downside Risks:

I expect another wave of foreclosures in early 2010, and the impact of the housing tax credit to wane, and eventually lower house prices especially in higher priced bubble areas (although I think we've seen the bottom in many other areas). My expectation is prices will fall in real terms for several years. But if prices fall further than I expect that could have a serious impact on banks (more losses) and consumer confidence (less spending).

These are just some possible upside surprises and downside risks. I'm sure there are plenty more ...

FHA Temporarily Relaxes Condo Rules

by Calculated Risk on 11/11/2009 11:23:00 AM

Last week the FHA released a temporary guidance that relaxed some of the rules for condominiums. From the FHA: Temporary Guidance for Condominium Policy

The Miami Herald has the key points: FHA moves to boost condo market

• Increase from 30 percent to 50 percent the number of units in a project that can be financed with FHA loans. FHA, however, will make exceptions, even allowing up to 100 percent, when buildings meet an additional set of more stringent criteria.This temporary guidance is in effect from December 7, 2009 through December 31, 2010.

• Require at least 50 percent of units in a complex to be owner-occupied or sold to owners who plan to live in the units. Bank-owned units may be disqualified from the percentage calculation.

• Reduce a presale requirement in new construction to 30 percent, compared with 70 percent for loans from conventional lenders.