by Calculated Risk on 11/16/2009 10:54:00 PM

Monday, November 16, 2009

Update on Las Vegas Cosmopolitan Resort & Casino

In June 2008, reader Brian sent me an email that started:

"When the bankers are selecting color schemes, you know a project isn't going well"He was referring to Deutsche Bank foreclosing on the $3.5 billion Cosmopolitan Resort & Casino in Las Vegas.

Bloomberg has an update: Deutsche Bank Drowning in Vegas on Costliest Bank-Owned Casino

Deutsche Bank AG’s Cosmopolitan Resort & Casino complex in Las Vegas, already the most expensive debacle in the city for a single lender, is now two years behind schedule, $2 billion over budget and under water -- literally.From bad to worse ...

...

So far, Deutsche Bank has had to write down 500 million euros ($748 million) on Cosmopolitan. ... Further north on the Las Vegas Strip, work halted on the Fontainebleau in June with a bankruptcy filing after its lenders, including Deutsche Bank, refused further funding. The 63-story casino resort is about 70 percent complete.

TARP Watchdog: AIG Bailout Transferred Billions from Government to Counterparties

by Calculated Risk on 11/16/2009 09:47:00 PM

In a report (pdf) titled "Factors Affecting Efforts to Limit Payments to AIG Counterparties", Neil Barofsky, special inspector for TARP, wrote that the "negotiating strategy to pursue concessions from [AIG] counterparties offered little opportunity for success, even in the light of the willingness of one of the counterparty to agree to concessions".

He also concluded that the "structure and effect of the FRBNY's assistance to AIG ... effectively transferred tens of billions of dollars of cash from the government to AIG's counterparties".

Here is a story from Bloomberg: Fed’s Strategy ‘Severely Limited’ AIG Bailout, Watchdog Says

Meredith Whitney Expects Double-Dip Recession, FDIC dumps "Cease & Desist"

by Calculated Risk on 11/16/2009 03:51:00 PM

From CNBC (added): Stocks Overvalued, Recession Will Return: Meredith Whitney

From American Banker: FDIC Speaks More Softly, Retains Stick

The FDIC changed the name of its cease-and-desist order to the less ominous-sounding "consent order" (a term already used by other regulators) ... David Barr, an FDIC spokesman, said that the traditional cease-and-desist order will be issued to any banks that refuse to stipulate and instead seek an administrative hearing.A kinder softer name ...

...

The FDIC has not made any of the new orders public so far.

LA Area Port Traffic in October

by Calculated Risk on 11/16/2009 02:24:00 PM

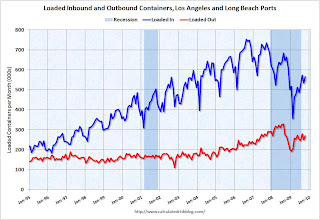

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was 14.7% below October 2008.

Loaded outbound traffic was 1.0% above October 2008.

There was a clear recovery in U.S. exports earlier this year; however exports have been mostly flat since May. This year will be the 3rd best year for export traffic at LA area ports, behind 2007 and 2008.

For imports, traffic is below the October 2003 level, and 2009 will be the weakest year for import traffic since 2002.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline in November.

The lack of further export growth to Asia is discouraging ...

On imports - last year retailers were stuck with too much inventory (the supply chain is long and imports didn't adjust as quickly as exports). It appears retailers will have much less inventory this year for the holidays.

Fed Chairman Ben Bernanke at Economic Club of NY

by Calculated Risk on 11/16/2009 12:15:00 PM

Here is a live video of Bernanke at the Economic Club of NY

Here is the CNBC feed.

Prepared Speech: On the Outlook for the Economy and Policy

How the economy will evolve in 2010 and beyond is less certain. On the one hand, those who see further weakness or even a relapse into recession next year point out that some of the sources of the recent pickup--including a reduced pace of inventory liquidation and limited-time policies such as the "cash for clunkers" program--are likely to provide only temporary support to the economy. On the other hand, those who are more optimistic point to indications of more fundamental improvements, including strengthening consumer spending outside of autos, a nascent recovery in home construction, continued stabilization in financial conditions, and stronger growth abroad.On CRE (added):

My own view is that the recent pickup reflects more than purely temporary factors and that continued growth next year is likely. However, some important headwinds--in particular, constrained bank lending and a weak job market--likely will prevent the expansion from being as robust as we would hope.

Demand for commercial property has dropped as the economy has weakened, leading to significant declines in property values, increased vacancy rates, and falling rents. These poor fundamentals have caused a sharp deterioration in the credit quality of CRE loans on banks' books and of the loans that back commercial mortgage-backed securities (CMBS). Pressures may be particularly acute at smaller regional and community banks that entered the crisis with high concentrations of CRE loans. In response, banks have been reducing their exposure to these loans quite rapidly in recent months. Meanwhile, the market for securitizations backed by these loans remains all but closed. With nearly $500 billion of CRE loans scheduled to mature annually over the next few years, the performance of this sector depends critically on the ability of borrowers to refinance many of those loans. Especially if CMBS financing remains unavailable, banks will face the tough decision of whether to roll over maturing debt or to foreclose.More:

I expect moderate economic growth to continue next year. Final demand shows signs of strengthening, supported by the broad improvement in financial conditions. Additionally, the beneficial influence of the inventory cycle on production should continue for somewhat longer. Housing faces important problems, including continuing high foreclosure rates, but residential investment should become a small positive for growth next year rather than a significant drag, as has been the case for the past several years. Prospects for nonresidential construction are poor, however, given weak fundamentals and tight financing conditions.

...

Jobs are likely to remain scarce for some time, keeping households cautious about spending. As the recovery becomes established, however, payrolls should begin to grow again, at a pace that increases over time. Nevertheless, as net gains of roughly 100,000 jobs per month are needed just to absorb new entrants to the labor force, the unemployment rate likely will decline only slowly if economic growth remains moderate, as I expect.

Business Inventories Decline in September

by Calculated Risk on 11/16/2009 10:00:00 AM

The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed inventories are still declining. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Census Bureau reported:

Manufacturers’ and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,303.4 billion, down 0.4 percent (±0.1%) from August 2009 and down 13.4 percent (±0.3%) from September 2008.Inventory levels are still a little high compared to lower sales levels, and further inventory reductions are probably coming. Although changes in private inventories made a positive contribution to Q3 GDP in the preliminary report, the usual inventory restocking cycle at the beginning of a recovery will probably be muted without a pickup in final demand.

The total business inventories/sales ratio based on seasonally adjusted data at the end of September was 1.32. The September 2008 ratio was 1.32.

Retail Sales Increase in October

by Calculated Risk on 11/16/2009 08:30:00 AM

On a monthly basis, retail sales increased 1.4% from September to October (seasonally adjusted), and sales are off 1.7% from October 2008. Excluding auto sales and parts, retail sales rose 0.2% in October.

The increase in October was mostly a rebound from the decline in September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level.

The red line shows retail sales ex-gasoline and shows there has been little increase in final demand. The second graph shows the year-over-year change in retail sales since 1993.

The second graph shows the year-over-year change in retail sales since 1993.

Real retail sales declined by 1.7% on a YoY basis. The year-over-year comparisons are much easier now since retail sales collapsed in October 2008. Retail sales bottomed in December 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $347.5 billion, an increase of 1.4 percent (±0.5%) from the previous month, but 1.7 percent (±0.5%) below October 2008. Total sales for the August through October 2009 period were up 1.5 percent (±0.3%) from the same period a year ago. The August to September 2009 percent change was revised from -1.5 percent (±0.5%) to -2.3 percent (±0.3%).It appears retail sales have bottomed, but there has been little pickup in final demand.

IMF: China Needs Stronger Currency

by Calculated Risk on 11/16/2009 12:13:00 AM

From Reuters: Stronger Yuan Needed for Global Rebalancing: IMF Chief

IMF Managing Director Dominique Strauss-Kahn said ... [China needs to increase emphasis on domestic demand], especially private consumption ...And from Paul Krugman: World Out of Balance

"A stronger currency is part of the package of necessary reforms," he said. "Allowing the renminbi (yuan) and other Asian currencies to rise would help increase the purchasing power of households, raise the labour share of income, and provide the right incentives to reorient investment."

... Looking forward, we can expect to see both China’s trade surplus and America’s trade deficit surge.This is something I need to think about. The U.S. trade deficit has been closely correlated to Mortgage Equity Withdrawal (MEW, aka "Home ATM"), and I doubt MEW is coming back soon, so I'm not sure we will see a huge increase in the deficit this time (excluding China and oil exporting companies). So this might impact other countries (like Europe) more than the U.S.

That, at any rate, is the argument made in a new paper by Richard Baldwin and Daria Taglioni of the Graduate Institute, Geneva. As they note, trade imbalances, both China’s surplus and America’s deficit, have recently been much smaller than they were a few years ago. But, they argue, “these global imbalance improvements are mostly illusory — the transitory side effect of the greatest trade collapse the world has ever seen.”

...

But with the financial crisis abating, this process is going into reverse. Last week’s U.S. trade report showed a sharp increase in the trade deficit between August and September. And there will be many more reports along those lines.

So picture this: month after month of headlines juxtaposing soaring U.S. trade deficits and Chinese trade surpluses with the suffering of unemployed American workers. If I were the Chinese government, I’d be really worried about that prospect.

Sunday, November 15, 2009

Housing Starts and Vacant Units: No "V" Shaped Recovery

by Calculated Risk on 11/15/2009 07:31:00 PM

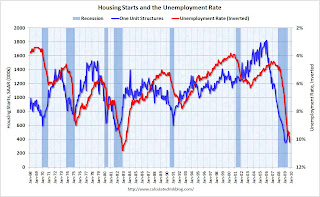

On Friday I posted a graph showing the historical relationship between housing starts and the unemployment rate (repeated as the 2nd graph below). The graph shows that housing leads the economy both into and out of recessions, and the unemployment rate lags housing by about 12 to 18 months.

It appears that housing starts bottomed earlier this year, however I don't think we will see a sharp recovery in housing this time - and I also think unemployment will remain high throughout 2010. As I noted in the earlier post, there is still a large overhang of vacant housing in the United States, and a sharp bounce back in housing starts is unlikely.

The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing. Click on graph for larger image in new window.

Click on graph for larger image in new window.

It is very unlikely that there will be a strong rebound in housing starts with a record number of vacant housing units.

The vacancy rate has continued to climb even after housing starts fell off a cliff. Initially this was because of a significant number of completions. Also some hidden inventory (like some 2nd homes) have become available for sale or for rent, and lately some households have probably doubled up because of tough economic times.

Note: the increase in the vacancy rate in the '80s was due to several factors including demographics (baby boomers moving from renting to owning), and overbuilding of apartment units (part of S&L crisis).

Here is a repeat of the earlier graph: This graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

This graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Spring or Summer 2010. However, since I expect the housing recovery to be sluggish, I also expect unemployment to remain high throughout 2010.

Krugman Suggests $300 Billion Jobs Program

by Calculated Risk on 11/15/2009 03:32:00 PM

"There’s no hard and fast number, but ... I have in mind something like $300 Billion, you could do quite a lot that’s actually targeted on jobs."In the following interview, with Alison van Diggelen of Fresh Dialogues, Paul Krugman offers some suggestions for addressing the high unemployment rate (transcript here):

Professor Paul Krugman, Nov 12, 2009

And two pieces - the first from the NY Times, and the second from Krugman's blog.

From Krugman in the NY Times: Free to Lose

[T]hese aren’t normal times. Right now, workers who lose their jobs aren’t moving to the jobs of the future; they’re entering the ranks of the unemployed and staying there. Long-term unemployment is already at its highest levels since the 1930s, and it’s still on the rise.And from his blog: It’s the stupidity economy

And long-term unemployment inflicts long-term damage. Workers who have been out of a job for too long often find it hard to get back into the labor market even when conditions improve. And there are hidden costs, too — not least for children, who suffer physically and emotionally when their parents spend months or years unemployed.

So it’s time to try something different.

Just to be clear, I believe that a large enough conventional stimulus would do the trick. But since that doesn’t seem to be in the cards, we need to talk about cheaper alternatives that address the job problem directly. Should we introduce an employment tax credit, like the one proposed by the Economic Policy Institute? Should we introduce the German-style job-sharing subsidy proposed by the Center for Economic Policy Research? Both are worthy of consideration.

The point is that we need to start doing something more than, and different from, what we’re already doing.

[S]ome readers have asked why I’m not making the same arguments for America now that I was making for Japan a decade ago. The answer is that I don’t think I’ll get anywhere, at least not until or unless the slump goes on for a long time.

OK, so what’s next? The second-best answer would be a really big fiscal expansion, sufficient to mostly close the output gap. The economic case for doing that is really clear. But Washington is caught up in deficit phobia, and there doesn’t seem to be any chance of getting a big enough push.

That’s why, at this point, I’m turning to what I understand perfectly well to be a third-best solution: subsidizing jobs and promoting work-sharing.