by Calculated Risk on 11/17/2009 04:54:00 PM

Tuesday, November 17, 2009

More on Industrial Production

Earlier I posted a graph on capacity utilization: Industrial Production, Capacity Utilization Increase Slightly in October

Spencer at Angry Bear is tracking the recovery in industrial production compared to previous recessions.

As the chart shows, this changes the impression the previous reports had given that this was a normal to strong recovery in industrial output to one that it is a weak recovery.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Graph from Spencer.

It is too early to tell, but those expecting a "V" shaped recovery would expect industrial production to be tracking at or above the "severe recessions" line (since this was the worst recession since the Depression).

Before reading too much into this graph, Spencer cautions that an upward revision to Industrial Production is likely:

Much of the initial estimates of monthly industrial production data is based on electricity consumption data. However, the national average temperature days for October 2009 were extremely low at only 50.8 degrees Fahrenheit. In a quick check of my data base this is the second lowest October reading on record going back to 1921. The lowest was 49.4 degrees in 1925 and the only one I saw below 50 -- the highest was 60.0 in 1963. The norm is around 55 degrees so the October temperature days was some 10% below normal. This strongly implies that the electricity usage would have been significantly below normal in October and consequently the industrial production data estimates are undoubtedly biased downward.

DataQuick: SoCal Home Sales Increase

by Calculated Risk on 11/17/2009 02:11:00 PM

From DataQuick: Southland home sales up again, drop in median price smallest in 2 years

Southern California home sales rose in October as prices showed more signs of firming. The median sale price fell by the smallest amount in two years, the result of a shrinking inventory of homes for sale and government and industry efforts to stoke demand and curtail foreclosures ...DataQuick does a good job of describing the uncertainties concerning the housing market.

...

Last month 22,132 new and resale houses and condos closed escrow in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties. That was up 2.8 percent from 21,539 in September and also up 2.8 percent from 21,532 a year earlier, according to MDA DataQuick of San Diego.

October marked the 16th month in a row with a year-over-year sales gain, although last month’s was the smallest of those increases. ...

Sales increases over the last two months can be partially attributed to the recent increase in short sales, which take longer to close escrow. The result is that some summer deals that might normally have closed earlier instead closed in September and October. ...

[also] A rush by some to take advantage of the federal tax credit for first-time buyers ...

FHA mortgages accounted for 38.3 percent of all Southland purchase loans last month, compared with 32.5 percent a year ago and just 2 percent two years ago. ...

“The government is playing a huge role in stabilizing and, to some extent, reinvigorating the housing market,” said John Walsh, MDA DataQuick president. “Its actions have triggered ultra-low mortgage rates, plentiful low-down-payment (FHA) financing, an extended and expanded tax credit for home buyers, and programs and political pressure aimed at reducing foreclosures.”

“The real question now is how well can the market perform next year as some of the government stimulus disappears,” he continued. “The more upbeat outlooks suggest a strengthening economy and job market will help pick up the slack, and that demand for lower-cost foreclosures will remain robust. The more negative forecasts assume, among other things, a much slower economic recovery, more foreclosures than the market can readily digest, and more turbulence in the credit markets.”

The latter outlook suggests today’s market stability is contrived and will prove short-lived – nothing more than a temporary price plateau – while the former suggests home prices are currently at or near bottom.

...

Recent month-to-month and year-over-year gains in the median sale price reflect, in large part, a shift of late toward foreclosures representing a lower percentage of sales. It’s mainly the result of lenders and loan servicers increasingly steering distressed borrowers into either an attempted short sale or loan modification. This reduction in foreclosures is key because over the past two years foreclosed properties were often the most aggressively priced on the market.

Last month, foreclosure resales – houses and condos sold in October that had been foreclosed on in the prior 12 months – made up 40.6 percent of all Southland resales. That was up insignificantly from 40.4 percent in September and down from a high of 56.7 percent in February this year.

As sales of lower-cost foreclosures began to wane earlier this year, sales in higher-cost neighborhoods picked up. High-end homes began to account for a greater share of all sales and helped reverse the steep slide in the median price. Over the past few months, however, the high-end’s share of total sales has flattened out.

...

Foreclosure activity remains high by historical standards, although mortgage default notices have flattened out or trended lower in many areas lately.

emphasis added

The increase in FHA insured loans is amazing: from 2% in 2007 to 39.3% last month.

NAHB: Builder Confidence Flat in November

by Calculated Risk on 11/17/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

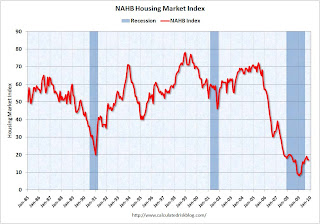

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 17 in November. October was revised down from 18 to 17. The record low was 8 set in January.

This is very low - and this is what I've expected - a long period of builder depression.

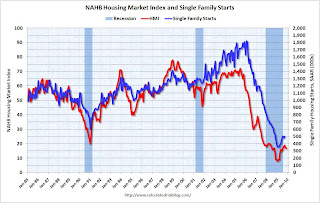

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts (October starts will be released Wednesday Nov 18th).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts (October starts will be released Wednesday Nov 18th).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month. But it appears that those expecting a sharp rebound in starts are probably wrong.

Press release from the NAHB (added): Builder Confidence Unchanged in November

Fed's Lacker: Fed Can't be "paralyzed by patches of lingering weakness"

by Calculated Risk on 11/17/2009 10:46:00 AM

From Richmond Fed President Jeffrey Lacker The Economic Outlook:

Earlier this year some economists were highlighting the risk that the low level of economic activity could push the rate of inflation down, perhaps even below zero. I think the risk of a substantial further reduction in inflation has diminished substantially since then. The historical record suggests that the early years of a recovery is when the risk is greatest that confidence in the stability of inflation erodes and we see an upward drift in inflation and inflation expectations. This risk could be particularly pertinent to the current recovery, given the massive and unprecedented expansion in bank reserves that has occurred, and the widespread market commentary expressing uncertainty over whether the Federal Reserve is willing and able to promptly reverse that expansion.Lacker is one of the inflation hawks on the FOMC.

As a technical matter, I do not see any problem – we do have the tools to remove as much monetary stimulus as necessary to keep inflation low and stable. The harder problem is the same one that we face after every recession, which is choosing when and how rapidly to remove monetary stimulus. There is no doubt that we must be aware of the danger of aborting a weak, uneven recovery if we tighten too soon. But if we hope to keep inflation in check, we cannot be paralyzed by patches of lingering weakness, which could persist well into the recovery. In assessing when we will need to begin taking monetary stimulus out, I will be looking for the time at which economic growth is strong enough and well-enough established, even if it is not yet especially vigorous.

First, I think we could see further declines in inflation in 2010; even the possibility of core PCI deflation. I don't think the risk of further declines has "diminished substantially".

Second, I think Q3 GDP will be revised down based on subsequent data (like the trade report), and GDP growth will be lower than Lacker expects in early 2010. I think Lacker is overly optimistic on the economy.

Also - historically the Fed hasn't raised rates until well after unemployment peaks, and I doubt they will raise rates until late in 2010 at the earliest (and probably later). Here is a graph from a previous post in September (the unemployment rate is now 10.2%):

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Industrial Production, Capacity Utilization Increase Slightly in October

by Calculated Risk on 11/17/2009 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.1 percent in October ... Manufacturing production moved down 0.1 percent and the output of mines decreased 0.2 percent, but the index for utilities rose 1.6 percent. At 98.6 percent of its 2002 average, total industrial production was 7.1 percent below its level of a year earlier. Capacity utilization for total industry moved up 0.2 percentage point to 70.7 percent, a rate 10.2 percentage points below its average for 1972 through 2008, and capacity utilization for manufacturing was unchanged at 67.6 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series has increased for four straight months, and is up from the record low set in June (the series starts in 1967).

Note: y-axis doesn't start at zero to better show the change.

This is just one month, but the recovery in industrial production slowed in October.

Report: Record Mortgage Loan Delinquency Rates in Q3

by Calculated Risk on 11/17/2009 08:29:00 AM

TransUnion reports that the 60 day mortgage delinquency rate increased to a record 6.25% in Q3, from 5.81% in Q2.

From TransUnion: Mortgage Loan Delinquency Rates on Course to Hit Record in 2009

Mortgage loan delinquency (the ratio of borrowers 60 or more days past due) increased for the 11th straight quarter, hitting an all-time national average high of 6.25 percent for the third quarter of 2009. This statistic is traditionally seen as a precursor to foreclosure and increased 7.57 percent from the previous quarter's 5.81 percent average. While still increasing, this quarter marks the third consecutive period the delinquency rate increase has decelerated. For comparison purposes, the delinquency rate from the fourth quarter 2008 to first quarter 2009 saw an increase of almost 14 percent, and the percent change from first quarter to second quarter 2009 increased by 11.3 percent. Year-over-year, mortgage borrower delinquency is up approximately 58 percent (from 3.96 percent).The MBA will release delinquency data on Thursday.

Mortgage borrower delinquency rates in the third quarter of 2009 continued to be highest in Nevada (14.5 percent) and Florida (13.3 percent), while the lowest mortgage delinquency rates were found in North Dakota (1.7 percent), South Dakota (2.3 percent) and Vermont (2.6 percent). Areas showing the greatest percentage growth in delinquency from the previous quarter were Wyoming (+17.9 percent), Kansas (+17.4 percent) and North Dakota (+16 percent). Bright spots for the quarter included the District of Columbia, showing a decline in mortgage delinquency rates, down 0.19 percent from the previous quarter.

Monday, November 16, 2009

Merle Hazard: Give me that Old Time Recession

by Calculated Risk on 11/16/2009 11:55:00 PM

Some late night entertainment from Merle Hazard (other hits include Inflation or Deflation?, Mark to Market and H-E-D-G-E)

Note: Merle will be performing live at the annual convention of the American Economic Association, Sunday, January 3, 2010, 8 p.m. in Atlanta.

Update on Las Vegas Cosmopolitan Resort & Casino

by Calculated Risk on 11/16/2009 10:54:00 PM

In June 2008, reader Brian sent me an email that started:

"When the bankers are selecting color schemes, you know a project isn't going well"He was referring to Deutsche Bank foreclosing on the $3.5 billion Cosmopolitan Resort & Casino in Las Vegas.

Bloomberg has an update: Deutsche Bank Drowning in Vegas on Costliest Bank-Owned Casino

Deutsche Bank AG’s Cosmopolitan Resort & Casino complex in Las Vegas, already the most expensive debacle in the city for a single lender, is now two years behind schedule, $2 billion over budget and under water -- literally.From bad to worse ...

...

So far, Deutsche Bank has had to write down 500 million euros ($748 million) on Cosmopolitan. ... Further north on the Las Vegas Strip, work halted on the Fontainebleau in June with a bankruptcy filing after its lenders, including Deutsche Bank, refused further funding. The 63-story casino resort is about 70 percent complete.

TARP Watchdog: AIG Bailout Transferred Billions from Government to Counterparties

by Calculated Risk on 11/16/2009 09:47:00 PM

In a report (pdf) titled "Factors Affecting Efforts to Limit Payments to AIG Counterparties", Neil Barofsky, special inspector for TARP, wrote that the "negotiating strategy to pursue concessions from [AIG] counterparties offered little opportunity for success, even in the light of the willingness of one of the counterparty to agree to concessions".

He also concluded that the "structure and effect of the FRBNY's assistance to AIG ... effectively transferred tens of billions of dollars of cash from the government to AIG's counterparties".

Here is a story from Bloomberg: Fed’s Strategy ‘Severely Limited’ AIG Bailout, Watchdog Says

Meredith Whitney Expects Double-Dip Recession, FDIC dumps "Cease & Desist"

by Calculated Risk on 11/16/2009 03:51:00 PM

From CNBC (added): Stocks Overvalued, Recession Will Return: Meredith Whitney

From American Banker: FDIC Speaks More Softly, Retains Stick

The FDIC changed the name of its cease-and-desist order to the less ominous-sounding "consent order" (a term already used by other regulators) ... David Barr, an FDIC spokesman, said that the traditional cease-and-desist order will be issued to any banks that refuse to stipulate and instead seek an administrative hearing.A kinder softer name ...

...

The FDIC has not made any of the new orders public so far.