by Calculated Risk on 11/20/2009 08:55:00 AM

Friday, November 20, 2009

A Few House Price Forecasts

From housing consultant Ivy Zelman commenting on the MBA Delinquency report in the NY Times U.S. Mortgage Delinquencies Reach a Record High

"I’ve been pretty bearish on this big ugly pig stuck in the python and this cements my view that home prices are going back down."From Bloomberg: Housing Recovery in U.S. Set Back to 2010 as Market Wanes

“I don’t think the housing crisis is over,” Mark Zandi, chief economist with Moody’s Economy.com, said in a telephone interview. “I think we’re going to see another leg down.”From Goldman Sachs chief economist Jan Hatzius in a note to clients: A Renewed Sag in the Housing Market (no link)

"Our current working assumption is a 5%-10% drop in home prices through the middle of 2010. ... house prices and credit quality ... to weigh on the US financial system, the availability of bank credit, and ultimately the pace of the economic recovery."My view is that house prices might have bottomed in some non-bubble areas, and also in some low end bubble areas with high foreclosure rates, however I expect further price decline in many mid-to-high end bubble areas.

Thursday, November 19, 2009

More on FHA Loans

by Calculated Risk on 11/19/2009 11:39:00 PM

David Streitfeld at the NY Times adds some color: Easy Loans in Expensive Areas

In January, Mike Rowland was so broke that he had to raid his retirement savings to move [to San Francisco] from Boston.Hopefully this will work out for Mr. Rowland and friends, but now for the chilling quote:

A week ago, he and a couple of buddies bought a two-unit apartment building for nearly a million dollars. They had only a little cash to bring to the table but, with the federal government insuring the transaction, a large down payment was not necessary.

“It was kind of crazy we could get this big a loan,” said Mr. Rowland, 27. “If a government official came out here, I would slap him a high-five.”

...

For decades, most F.H.A. loans were in low-cost states like Texas and Michigan. ... The Economic Stimulus Act of 2008 helped change that by temporarily doubling the maximum loan the F.H.A. insured, to $729,750. A two-unit property like the one bought by Mr. Rowland and his friends can be insured for up to $934,200.

Mr. Bedar, Mr. Rowland and the third partner in their property, Jordan Kurland, are all in the technology field, but their dreams of wealth do not feature stock options.This will end well ... (sorry for sarcasm)

“We’re banking on real estate,” said Mr. Kurland, 24. “Everyone expects prices to keep going up.”

Note: The MBA National Delinquency Survey showed 15.04% of FHA insured loans were delinquent as of the end of Q3, and another 3.32% were in the foreclosure process. The FHA Early Warning System shows that delinquencies are rising steadily on loans originated over the last two years. Not good.

On Negative T Bills

by Calculated Risk on 11/19/2009 09:30:00 PM

There was some buzz earlier today about short term T bill rates turning slightly negative. This happened last year too, but for different reasons ...

From the Financial Times: Short-term US interest rates turn negative

Short-term US interest rates turned negative on Thursday as banks frantically stockpiled government securities in order to polish their balance sheets for the end of the year.John Jansen at Across the Curve explains:

...

The scramble has been exacerbated by the fact that all leading US banks ... will this year close their books at the same time – at the end of December.

excerpted with permission

I do not speak to[o] often of the T bill market but yields in that market continue to collapse. In one recent conversation a market participant noted that bill yields are negative out to February. There are a couple of factors at work here. There is a massive wall of liquidity, a pile of cash which needs a home. That is driving yields lower.And more from John: More on Negative T Bills

Typically as the year end approaches clients tend to unwind profitable trades and reduce balance sheet. I think that some of that deleveraging process has created new piles of cash and that money needs a place to park.

Others are preparing to beautify their balance sheet by having some pristine government paper on the books over year end. Some of that trade has begun as investors purchase paper which will carry them into 2010.

In my closing post I noted that T bill rates are in negative territory and gave some reasons for that. Here is an excerpt from David Ader of CRT on that same topic;No worries ...

“We instead take our cue from activity in the financing markets, where year end is playing its hand – Jan bills are trading negative. The story here is not a new one as we saw bills negative at the end of the last quarter, but exacerbated by a more intense year end. We say that because 1) it’s clearly the talking point on funding desks, 2) EVERYONE has a Dec 31 year end as we have no investment banks any longer, and 3) as bank holding companies there’s a likelihood that former IBs, too, need to show cash in something other than a mattress.”

Another analyst whom I read suggested that an exacerbating factor was the maturity of some cash management bills which were not replaced.

Whatever the case, I am certain that the present circumstance is not an indicator of financial stress as plunging bill rates have been in the past.

States: Seriously Delinquent Mortgages vs. Unemployment Rate

by Calculated Risk on 11/19/2009 06:45:00 PM

Here is a scatter graph comparing the seriously delinquency rate for mortgage loans vs. unemployment rate for all states. The seriously delinquent rate include 90+ days delinquent loans, and loans in the foreclosure process for Q3 2009 (Source: MBA). Click on graph for larger image in new window.

Click on graph for larger image in new window.

There is a relationship between delinquency rates and the unemployment rate.

Florida really stands out because of state specific foreclosure laws. Arizona and Nevada also have higher than expected foreclosure rates - possibly because of high investor activity during the housing bubble.

As the unemployment rate continues to rise, the mortgage delinquency rate will increase too.

For more on the MBA National Delinquency Survey, see:

Mortgage Delinquencies and Foreclosures by Period Past Due

by Calculated Risk on 11/19/2009 03:49:00 PM

Click on graph for larger image in new window.

First, on the market ...

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Reader Yuri asked me if the number of 30 day delinquencies is decreasing. He was curious if the overall number of delinquencies is increasing because of the loan modifications and other actions that are limiting the outflow - but that that overall increase might be masking some improvement for the inflow of new delinquencies. This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

The percentage of 30 and 60 day delinquencies have decreased slightly. However the rates are still near record levels.

For the 30 day bucket, there were 3.57% percent delinquent - not much lower than the high in Q1 of 3.77%. For 60 days, the rate was 1.67% - also below the high in Q1.

Clearly most of the increase was in the 90 day and in foreclosure buckets. And that is why the modification programs are so important. The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

Since prime fixed rate mortgages account for about 2/3s of the mortgage market, a large portion of future foreclosures will probably be from these loans.

Hotel RevPAR off 15.7 Percent

by Calculated Risk on 11/19/2009 01:14:00 PM

From HotelNewsNow.com: New Orleans leads ADR, RevPAR declines in STR weekly numbers

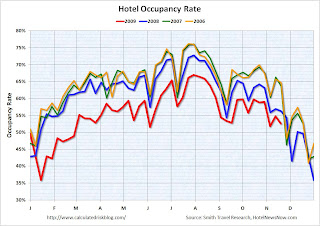

Overall, in year-over-year measurements, the industry’s occupancy fell 6.4 percent to end the week at 52.6 percent, ADR dropped 9.9 percent to US$95.86, and RevPAR decreased 15.7 percent to finish at US$50.47.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was late in 2008 (and will be late in 2009), so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

This is a two year slump for the hotel industry. Although occupancy is off 6.4% compared to 2008, occupancy is off about 18% compared to 2006 and 2007.

Smith Travel Research released an updated hotel forecast 2011 can’t get here too soon .

Occupancy: 2009 will end at -8.8 percent (revised from -8.4 percent); 2010 figures will be down 0.2 percent (revised from -0.6 percent); and 2011 will be up 2.4 percent.Here is a PDF of the new forecast (free registration required)

Average daily rate: 2009 will close down 8.9 percent (revised from -9.7 percent); 2010 will be down 3.4 percent (unchanged from previous forecast); and 2011 will be up 5.5 percent.

“In the current cycle, it’s increasingly easy to predict supply and a little easier to predict demand,” [Mark Lomanno, STR’s president] said. “What is difficult is predicting rate growth ... how aggressive the industry will be in raising rates is virtually impossible to predict.”

...

Revenue per available room: 2009’s RevPAR will decline 17.0 percent (revised from 17.1 percent; it will drop 3.6 percent in 2010 (revised from -4.0 percent) before jumping 5.5 percent in 2011.

Supply: The number of guestrooms will end 2009 up 3.2 percent (revised from +3.0 percent); up 1.8 percent in 2010; and up 0.8 percent in 2011.

“The construction pipeline will mostly be built between now and early 2011,” Lomanno said.

...

Demand: Room demand in 2009 will be down 6.0 percent (revised from -5.5 percent) before turning positive in 2010 at +1.6 percent (revised from +1.3 percent). Demand will grow 3.2 percent in 2011, according to the STR forecast.

...

“Clearly commercial real estate will be a second shoe dropping in 2010,” [Randy Smith, STR’s co-founder and chairman] said. “That’s going to be a process that will hurt demand for the hotel industry. A huge chunk of demand for our industry will continue to be wiped out as long as the construction industry is on its back.”

The good news is the supply of new hotels is slowing sharply. The bad news is that means less construction employment - and also negatively impacts hotel occupancy.

MBA Forecasts Foreclosures to Peak in 2011

by Calculated Risk on 11/19/2009 11:08:00 AM

On the MBA conference call concerning the "Q3 2009 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

Note: Many more questions this time!

A few graphs ...

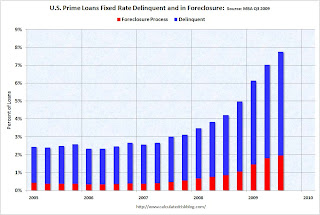

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for about 76% of all loans.

"We're all subprime now!" NOTE: Tanta first wrote this saying in 2007 in response to the 'contained to subprime' statements.

The second graph shows just fixed rate prime loans (about two-thirds of all loans).

The second graph shows just fixed rate prime loans (about two-thirds of all loans).Prime ARMs have a higher delinquency rate than Prime FRMs, but the foreclosure crisis has now spread to Prime fixed rate loans.

Note that even in the best of times (with rapidly rising home prices in 2005), just over 2% of prime FRMs were delinquent or in foreclosure. However the cure rate was much higher back then since a delinquent homeowner could just sell their home.

The third graph shows the delinquency and in foreclosure process rates for subprime loans.

The third graph shows the delinquency and in foreclosure process rates for subprime loans. Although the increases have slowed, about 40% of subprime loans are delinquent or in foreclosure.

And a final comment: historically house prices do not bottom until after foreclosure activity peaks in a certain area. Since the subprime crisis delinquency rates might be peaking, it would not be surprising if prices are near a bottom in the low end areas. But in general I'd expect further declines in house prices - especially in mid-to-high end areas.

MBA: Record 14.4 Percent of Mortgage Loans in Foreclosure or Delinquent in Q3

by Calculated Risk on 11/19/2009 10:00:00 AM

The MBA reports a record 14.4 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2009. This is an increase from 13.2% in Q2 2009.

From the MBA: Delinquencies Continue to Climb in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 9.64 percent of all loans outstanding as of the end of the third quarter of 2009, up 40 basis points from the second quarter of 2009, and up 265 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate increased 108 basis points from 8.86 percent in the second quarter of 2009 to 9.94 percent this quarter.

Top Line Results

The delinquency rate breaks the record set last quarter. The records are based on MBA data dating back to 1972.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 4.47 percent, an increase of 17 basis points from the second quarter of 2009 and 150 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 14.41 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 1.42 percent, up six basis points from last quarter and up 35 basis points from one year ago.

The percentages of loans 90 days or more past due, loans in foreclosure, and foreclosures started all set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

Increases Driven by Prime and FHA Loans

“Despite the recession ending in mid-summer, the decline in mortgage performance continues. Job losses continue to increase and drive up delinquencies and foreclosures because mortgages are paid with paychecks, not percentage point increases in GDP. Over the last year, we have seen the ranks of the unemployed increase by about 5.5 million people, increasing the number of seriously delinquent loans by almost 2 million loans and increasing the rate of new foreclosures from 1.07 percent to 1.42 percent,” said Jay Brinkmann, MBA’s Chief Economist.

“Prime fixed-rate loans continue to represent the largest share of foreclosures started and the biggest driver of the increase in foreclosures. 33 percent of foreclosures started in the third quarter were on prime fixed-rate and loans and those loans were 44 percent of the quarterly increase in foreclosures. The foreclosure numbers for prime fixed-rate loans will get worse because those loans represented 54 percent of the quarterly increase in loans 90 days or more past due but not yet in foreclosure.

“The performance of prime adjustable rate loans, which include pay-option ARMs in the MBA survey, continue to deteriorate with the foreclosure rate on those loans for the first time exceeding the rate for subprime fixed-rate loans. In contrast, both subprime fixed-rate and subprime adjustable rate loans saw decreases in foreclosures.

“The foreclosure rate on FHA loans also increased, despite having a large increase in the number of FHA-insured loans outstanding. The number of FHA loans outstanding has increased by about 1.1 million over the last year. This increase in the denominator depresses the delinquency and foreclosure percentages. If we assume these newly-originated loans are not the ones defaulting and remove the big denominator increase from the calculation results, the foreclosure rate would be1.76 percent rather than 1.31 percent reported.

....

“The outlook is that delinquency rates and foreclosure rates will continue to worsen before they improve. First, it is unlikely the employment picture will get better until sometime next year and even then jobs will increase at a very slow pace. Perhaps more importantly, there is no reason to expect that when the economy begins to add more jobs, those jobs will be in areas with the biggest excess housing inventory and the highest delinquency rates. Second, the number of loans 90 days or more past due or in foreclosure is now a little over 4 million as compared with 3.9 million new and previously occupied homes currently for sale, although there is likely some overlap between the two numbers. The ultimate resolution of these seriously delinquent loans will put added pressure on the hardest hit sections of the country.”

Weekly Initial Unemployment Claims: 505,000

by Calculated Risk on 11/19/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 14, the advance figure for seasonally adjusted initial claims was 505,000, unchanged from the previous week's revised figure of 505,000. [Revised from 502,000] The 4-week moving average was 514,000, a decrease of 6,500 from the previous week's revised average of 520,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Nov. 7 was 5,611,000, a decrease of 39,000 from the preceding week's revised level of 5,650,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 6,500 to 514,000, and is now 144,750 below the peak in April.

The level is still very high suggesting continuing job losses in November.

Wednesday, November 18, 2009

The Failure of Regulatory Oversight

by Calculated Risk on 11/18/2009 10:33:00 PM

This is a recurring theme: a bank fails, the Inspector General reviews the failure and discovers that the field examiners saw problems starting around 2002, and ... nothing happened for years.

We saw this with the Federal Reserve and the failure of Riverside Bank of the Gulf Coast, and with the FDIC / OTS and the failure of IndyMac.

Eric Dash at the NY Times has more: Pathology of a Crisis

At bank after bank, the examiners are discovering that state and federal regulators knew lenders were engaging in hazardous business practices but failed to act until it was too late. At Haven Trust, for instance, regulators raised alarms about lax lending standards, poor risk controls and a buildup of potentially dangerous loans to the boom-and-bust building industry. Despite the warnings — made as far back as 2002 — neither the bank’s management nor the regulators took action. Similar stories played out at small and midsize lenders from Maryland to California.This is screaming for an open and transparent Congressional investigation (or something like the Pecora Commission, ht Mock Turtle). After the examiners discovered problems at the banks in a timely fashion, what happened next? Were further actions blocked by supervisors? Did examiners feel each bank was an isolated incident? How will the new regulatory structure solve this problem?

And a chilling quote from Eric Dash's article:

“Hindsight is a wonderful thing,” said Timothy W. Long, the chief bank examiner for the Office of the Comptroller of the Currency. “At the height of the economic boom, to take an aggressive supervisory approach and tell people to stop lending is hard to do.”But isn't that the regulator's job?

Note: Alison Vekshin at Bloomberg had an excellent article last month on the same topic: FDIC Failed to Limit Commercial Real-Estate Loans, Reports Show