by Calculated Risk on 11/22/2009 09:34:00 AM

Sunday, November 22, 2009

CRE Owners Seeking Property Tax Relief

From Carolyn Said at the San Francisco Chronicle: S.F. commercial properties seek tax relief

Landmark skyscrapers, signature hotels and upscale retailers glitter in the San Francisco skyline and enhance its cachet. But with commercial real estate slumping, they soon may subtract badly needed cash from the city's coffers.This is another impact of the CRE bust. I would think the city would have had a large budget surplus when property values - and property taxes - were soaring.

...

Collectively, those office towers, hotels, shopping centers and apartment buildings have an assessed value of $21.25 billion - but their owners say they're worth about half that amount. If those claims stand, that could wipe $115.78 million off the property taxes the city collects.

...

The potential property tax reductions come at the worst possible time for a city already grappling with budget cuts and deficits. San Francisco's controller warned last week that the city faces a potential half-billion-dollar deficit in its next fiscal year.

Saturday, November 21, 2009

More on Strategic Defaults

by Calculated Risk on 11/21/2009 09:22:00 PM

From Lew Sichelman at the LA Times: Owners' willingness to 'strategically default' on loans depends largely on how far underwater they are (ht Ann)

Most of the LA Times article is based on the paper by Guiso, Sapienza and Zingales that I covered in June: Moral and Social Constraints to Strategic Default on Mortgages (pdf)

Sichelman adds some comments from real estate agents on the ethics of strategic defaults:

Nellie Arrington of Long & Foster Real Estate in Columbia, Md., says it is "morally wrong, legally wrong and just plain wrong" for an owner to walk away from a mortgage he can afford simply because the balance exceeds the value of the underlying property.And on the other side:

Bob Hunt of Keller Williams O.C. Coastal Realty in San Clemente says the moral duty to protect your family outweighs the moral duty to repay the loan.

"Promise keeping is not the highest moral value," said Hunt, who before his real estate career taught ethics and logic at the University of Redlands. "If I promised to lend you my gun and you are now in a clearly dangerous psychotic stage, breaking my promise would be the right thing to do, not the wrong thing."

The Fed and Mortgage Rates

by Calculated Risk on 11/21/2009 03:20:00 PM

Meredith Whitney expressed concern about what will happen when the Fed stops buying GSE MBS by the end of the first quarter 2010. From Bloomberg: Meredith Whitney Says Bank Stocks Are ‘Grossly’ Overvalued

The Federal Reserve has begun slowing purchases in the $5 trillion market for so-called agency mortgage-backed securities after announcing in September that it would extend the timeline for its $1.25 trillion program to March 31 from year-end. Whitney said that banks are only originating home loans that they can sell to Fannie Mae and Freddie Mac.This raises an interesting question: What is the impact from Fed MBS buying on mortgage rates? I looked at this a couple of months ago: The Impact on Mortgage Rates of the Fed buying MBS and here is an update:

“If Fannie and Freddie can’t sell to an end buyer, i.e. the U.S. government steps back, the mortgage market at minimum contracts, rates go higher, and banks are poised with more writedowns,” said Whitney, founder of Meredith Whitney Advisory Group. “This is probably the issue that scares me most across the board.”

Earlier this year, Political Calculations introduced a tool to estimate mortgage rates based on the Ten Year Treasury yield (based on an earlier post of mine): Predicting Mortgage Rates and Treasury Yields. Using their tool, with the Ten Year yield at 3.356%, this suggests a 30 year mortgage rates of 5.33% based on the historical relationship between the Ten Year yield and mortgage rates.

Freddie Mac released their weekly survey Thursday:

Freddie Mac (NYSE:FRE) today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.83 percent with an average 0.7 point for the week ending November 19, 2009, down from last week when it averaged 4.91 percent. Last year at this time, the 30-year FRM averaged 6.04 percent.This suggests morgage rates are about 50 bps below the expect level ...

Here is an update to the previous graph. Sure enough mortgage rates have been below expectations for about seven months (recent months in yellow with blue outline at lower left).

Here is an update to the previous graph. Sure enough mortgage rates have been below expectations for about seven months (recent months in yellow with blue outline at lower left).Although this is a limited amount of data - and the yellow triangles are within the normal spread - this suggests the Fed's buying of MBS is reducing mortgage rates by about 35 to 50 bps relative to the Ten Year treasury.

It isn't that Fannie and Freddie "can’t sell to an end buyer", it is that the GSEs will be selling for a lower price (higher yield) when the Fed completes the MBS purchase program. At that time mortgage rates will probably rise by about 35 bps to 50 bps (relative to the Ten Year) in order to attract other buyers. Alone that isn't all that "scary".

But combined with the growing problems at the FHA, the distortions in the housing market caused by the first-time home buyer tax credit, rising delinquencies, the uncertainty of the modification programs, and likely further house price declines in many bubble states - there are serious problems ahead for the housing market.

FDIC Bank Failure Update

by Calculated Risk on 11/21/2009 11:01:00 AM

Note: The FDIC will probably release the Q3 Quarterly Banking Profile next week. The report will show the number of banks on the problem bank list, and the status of the Deposit Insurance Fund (DIF).

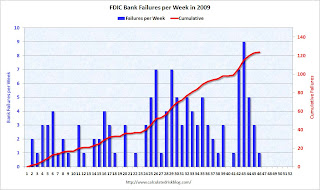

The FDIC closed another bank on Friday, and that brings the total FDIC bank failures to 124 in 2009. The following graph shows bank failures by week in 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: Week 1 on graph ends Jan 9th.

The bank failures seem to come in bunches, and with 6 weeks to go it seems 140 to 150 or so bank failures is likely this year.

The 2nd graph covers the entire FDIC period (annually since 1934). This is the most failures per year since 1992 (181 failures).

This is the most failures per year since 1992 (181 failures).

As far as failures per week - there were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits. Also the cumulative estimated losses for the DIF, since early 2007, is now close to $50 billion.

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.

Fed Watch: "The Fed in a Corner"

by Calculated Risk on 11/21/2009 09:02:00 AM

From Tim Duy: The Fed in a Corner

Over the years, I have warned a seemingly countless number of undergraduates that Fed's hold on monetary independence was tenuous at best. Independence is not guaranteed by the Constitution. Congress made the Fed, and Congress can unmake the Fed. The Fed could only maintain the privilege of independence if policymakers pursued policy paths that fostered maximum, sustainable growth. Deviating from such paths would have consequences.There is much more in the piece.

The Fed is quickly learning the extent of those consequences, as Congress launches an assault on the Fed's independence.

...

The Fed earns accolades from academics for its handling of the crisis, in particular since the Lehman failure. Fair enough; I have few quibbles with policy since last fall. But what about the years before Lehman, when the crisis was building? Where was the Fed then? Did they abdicate regulatory responsibility? How did banks develop such incredible exposure to off-balance sheet SIV's? How could the Fed ignore increasingly predatory lending in the mortgage market? What exactly was Timothy Geithner, then president of the all important New York Fed, regulating and supervising? Clearly not Citibank.

Clearly the Fed (and other regulators) failed to properly supervise financial firms. We need to understand how and why this happened. (See The Failure of Regulatory Oversight)

Jim the Realtor: Trustee Sale

by Calculated Risk on 11/21/2009 12:30:00 AM

Jim is featuring a few trustee sale opportunities recently ... the total loan on this one is about $650,000 and the opening bid is $331,500 for a 2100 sq ft house on over 4 acres in a remote area of San Diego:

Friday, November 20, 2009

Unofficial Problem Bank List Increases to 513

by Calculated Risk on 11/20/2009 09:03:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

The Unofficial Problem Bank List increased by a net six institutions to 513 while aggregate assets declined to $302.3 billion from $304 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

There were 12 institutions added to the list with an average asset size of $194 million. The largest among the new faces include Modern Bank, National Association, New York, NY ($601 million); Eagle National Bank, Upper Darby, PA ($284 million), and The First National Bank of Wynne, Wynne, AR ($275 million). The OCC issued a Prompt Corrective Action order on September 30, 2009 to Marshall Bank, National Association, Hallock, MN ($60 million).

Six institutions were removed this week with half being failures last Friday including Orion Bank ($2.6 billion) and Century Bank, a Federal Savings Bank ($756 million). Three other banks were removed when their enforcement action was terminated including The First National Bank of Manchester and The Morris County National Bank of Naples. The only other change to the list this week is the OCC’s change in action against First National Bank in Pawhuska ($37 million) from a Formal Agreement to a Cease & Desist Order on October 22, 2009.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #124 in 2009: Commerce Bank of Southwest Florida, Fort Myers, Florida

by Calculated Risk on 11/20/2009 05:04:00 PM

Carved up by the Central Bank

MMMM Commerce Bank, Yum!

by Soylent Green is People

From the FDIC: Central Bank, Stillwater, Minnesota, Assumes All of the Deposits of Commerce Bank of Southwest Florida, Fort Myers, Florida

Commerce Bank of Southwest Florida, Fort Myers, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Off to a quick start ...

As of August 28, 2009, Commerce Bank of Southwest Florida had total assets of $79.7 million and total deposits of approximately $76.7 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $23.6 million. .... Commerce Bank of Southwest Florida is the 124th FDIC-insured institution to fail in the nation this year, and the twelfth in Florida. The last FDIC-insured institution closed in the state was Orion Bank, Naples, on November 13, 2009.

Moody's: CRE Prices Off 43% from Peak

by Calculated Risk on 11/20/2009 02:47:00 PM

From Globe St.: Values Off 43% From 2007 Peak

Prices nationwide have fallen 42.9% from their October 2007 peak, according to the latest Moody’s/REAL Commercial Property Price Index report issued Thursday, while Real Capital Analytics says total transaction volume for 2009 will be the lowest of the decade. The November Moody’s/REAL report ... covers transactions through Sept. 30 ... September’s index represented a 3.9% value decline compared to August.Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

...

"Further price declines are almost certain over the short term," says Nick Levidy, Moody’s managing director, in a statement. "However, it is notable that the pace of deterioration appears to be moderating."

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.