by Calculated Risk on 11/24/2009 12:10:00 PM

Tuesday, November 24, 2009

House Prices: Real Prices, Price-to-Rent, and Price-to-Income

Here are three key measures of house prices: Price-to-Rent, Price-to-Income and real prices based on the Case-Shiller quarterly national home price index.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through Q3 2009 using the Case-Shiller National Home Price Index (SA): Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price to rent ratio (Q1 1987 = 1.0) for the Case-Shiller national Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is mostly behind us as of Q3 2009 on a national basis. However this ratio could easily decline another 5% to 10% or so, and with rents now falling, prices could fall even more.

Notice the price-to-rent ratio is currently almost as high as during the late '80s housing bubble.

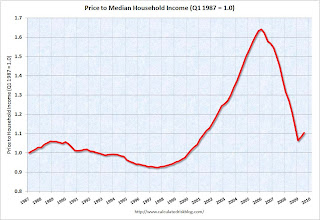

Price-to-Income:

The second graph shows the price-to-income ratio: This graph is based off the Case-Shiller national index, and the Census Bureau's median income tables, and flat for 2009.

This graph is based off the Case-Shiller national index, and the Census Bureau's median income tables, and flat for 2009.

Using national median income and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area). However this does shows that the price-to-income is still too high, and that this ratio needs to fall another 10% or so. A further decline in this ratio could be a combination of falling house prices and/or rising nominal incomes.

Real Prices This graph shows the real and nominal house prices based on the Case-Shiller national index. (Q1 2000 = 100 for nominal index)

This graph shows the real and nominal house prices based on the Case-Shiller national index. (Q1 2000 = 100 for nominal index)

Nominal prices are adjusted using CPI less Shelter.

The Case-Shiller real prices are still above prices in the '90s and perhaps real prices will decline another 10% or so. Prices can and do increase in real terms - especially in areas with land constraints. Also newer homes are larger than older homes - so the real prices are higher.

Summary

These measures are useful, but somewhat flawed. These measures give a general idea about house prices, but in the short run there are more important factors like inventory levels and credit issues. All of this data is on a national basis and it would be better to use local area price-to-rent, price-to-income and real prices.

It appears that house prices - in general - are still too high. However prices depend on the local supply and demand factors. In many lower priced bubble areas supply has declined sharply (because of the loan modification efforts and local moratoria), and demand was very strong in Q3 from the first-time home buyer frenzy and cash flow investors. This has pushed up prices at the low end, and suggests price might fall some again at the low end - although probably not to new lows.

However in the mid-to-high end of the bubble areas - with significant supply and little demand - prices are still too high. And I expect further declines in those areas and probably nationwide (although this isn't as obvious as it was in 2005 since most of the price declines are over).

FDIC Q3 Banking Profile: 552 Problem Banks

by Calculated Risk on 11/24/2009 10:42:00 AM

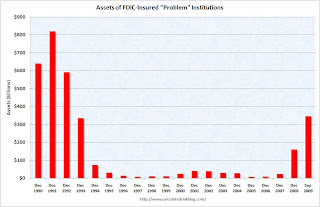

The FDIC released the Q3 Quarterly Banking Profile today. The FDIC listed 552 banks with $345.9 billion in assets as “problem” banks in Q3, up from 416 banks with $299.8 billion in assets in Q2, and 252 and $159.4 billion in assets in Q4 2008.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 513 problem banks - and will probably increase this week. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of FDIC insured "problem" banks since 1990.

The 552 problem banks reported at the end of Q3 is the highest since 1993.

The second graph shows the assets of "problem" banks since 1990. The assets of problem banks are the highest since 1992.

The assets of problem banks are the highest since 1992.

On the Deposit Insurance Fund:

The Deposit Insurance Fund (DIF) decreased by $18.6 billion during the third quarter to a negative $8.2 billion (unaudited) primarily because of $21.7 billion in additional provisions for bank failures. Also, unrealized losses on available-for-sale securities, combined with operating expenses, reduced the fund by $1.1 billion. Accrued assessment income added $3.0 billion to the fund during the quarter, and interest earned, combined with realized gains from sale of securities and surcharges from the Temporary Liquidity Guarantee Program, added $1.2 billion.The number of failures is now up to 124.

Fifty insured institutions with combined assets of $68.8 billion failed during the third quarter of 2009, the largest number since the second quarter of 1990 when 65 insured institutions failed. Ninety-five insured institutions with combined assets of $104.7 billion failed during the first three quarters of 2009, at a currently estimated cost to the DIF of $25.0 billion. The DIF’s reserve ratio was negative 0.16 percent on September 30, 2009, down from 0.22 percent on June 30, 2009, and 0.76 percent one year ago. The September 30, 2009, reserve ratio is the lowest reserve ratio for a combined bank and thrift insurance fund since June 30, 1992, when the ratio was negative 0.20 percent.

Case Shiller Home Price Graphs

by Calculated Risk on 11/24/2009 09:56:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for September this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). NOTE: This is the Not Seasonally Adjusted data - the link is broken for the SA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 29.9% from the peak, and up about 0.4% in September.

The Composite 20 index is off 29.1% from the peak, and up 0.3% in September. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 8.5% from September 2008.

The Composite 20 is off 9.4% from September 2008.

This is still a very significant YoY decline in prices.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices decreased (SA) in 11 of the 20 Case-Shiller cities in September (NSA).

Prices decreased (SA) in 11 of the 20 Case-Shiller cities in September (NSA).

In Las Vegas, house prices have declined 55.4% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.7% from the peak - and up in 2009. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

I'll have more on prices (compare to stress, price-to-rent) later.

Case-Shiller House Prices Increase in September

by Calculated Risk on 11/24/2009 09:12:00 AM

Note: I will have graphs as soon as S&P releases the data online.

S&P reports the Composite 10 index increased 0.3% in September, and the Composite 20 index increased 0.3% (both SA). Eleven cities posted increases, nine showed price declines.

From S&P:

“We have seen broad improvement in home prices for most of the past six months,” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “However, the gains in the most recent month are more modest than during the seasonally strong summer months. Fewer cities saw month to month improvements in September than in August in both seasonally adjusted and unadjusted figures. Nationally, the U.S. National Composite rose by 3.1% in both the 2nd and 3rd quarters of 2009. Both the 10-City and 20-City Composites posted their fifth consecutive monthly increase with September’s report."

Q3 GDP Revised Down to 2.8%

by Calculated Risk on 11/24/2009 08:30:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.8 percent in the third quarter of 2009, (that is, from the second quarter to the third quarter), according to the "second" estimate released by the Bureau of Economic Analysis.Personal consumption expenditures (PCE) were revised down to 2.9% from 3.4%. And investment in nonresidential structures was revised down to -15.1% from -9.0%.

...

The second estimate of the third-quarter increase in real GDP is 0.7 percentage point lower, or $23.7 billion, than the advance estimate issued last month, primarily reflecting an upward revision to imports and downward revisions to personal consumption expenditures and to nonresidential fixed investment that were partly offset by an upward revision to exports.

Mortgages: 23% of Borrowers have Negative Equity

by Calculated Risk on 11/24/2009 12:43:00 AM

From the WSJ: 1 in 4 Borrowers Under Water

The proportion of U.S. homeowners who owe more on their mortgages than the properties are worth has swelled to about 23% ...The report should be available online soon.

Home prices have fallen so far that 5.3 million U.S. households are tied to mortgages that are at least 20% higher than their home's value ...

[N]egative equity "is an outstanding risk hanging over the mortgage market," said Mark Fleming, chief economist of First American Core Logic. "It lowers homeowners' mobility because they can't sell, even if they want to move to get a new job."

Monday, November 23, 2009

Forecasts: Unhappy Holidays for Restaurants and Hotels

by Calculated Risk on 11/23/2009 10:23:00 PM

Update on the Chicago Fed Index post: According to the Chicago Fed, the "CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough". Earlier I was excerpting from the entering recession section. This suggests - using this index - it is still too early to call the end of the recession.

From Jerry Hirsch at the LA Times: Restaurants brace for dreary season as consumers lose appetite for dining out

The number of people visiting restaurants has plunged for four consecutive quarters, according to NPD Group, a market research firm. ... chains such as McCormick & Schmick's, the seafood house, and Morton's, the steak purveyor, saw same-store sales, or sales at restaurants open at least a year, fall 18.8% and 16.8%, respectively ... according to Bellwether Food Group, a food industry consulting firm.And from Joe Sharkey at the NY Times: For the Hotel Industry, Recovery is a Long Way Off

Bellwether doesn't project an industry rebound to pre-recession levels until 2012.

...

Research firm NPD doesn't expect an industry turnaround any time soon. ... In 33 years of tracking restaurant traffic, NPD "has never seen this type of a weakness for this long of a period," [Bonnie Riggs, a restaurant industry analyst with NPD in Chicago] said ...

Bjorn Hanson, a clinical associate professor at the Tisch Center, said that average domestic hotel occupancy this year would be about 55 percent.The occupancy dip following the 9/11 attacks was barely below 60%, so, according to Hanson's comments, the current hotel recession is the worst since the Great Depression.

Average national occupancy has dipped below 60 percent only twice before since the 1920s, he said, during the Great Depression, and in the aftermath of the 2001 terrorist attacks.

Report: Fed asks Big Banks for TARP Repayment Plans

by Calculated Risk on 11/23/2009 08:11:00 PM

From Bloomberg: Fed Said to Ask Banks to Submit Plans to Repay TARP (ht MrM)

The central bank this month asked Bank of America Corp. and eight other banks to [submit repayment plans with a timetable]. ... Together the nine banks have received about $142 billion in TARP funds ... The banks in the stress test that have yet to repay TARP are Bank of America, PNC, Citigroup Inc., Fifth Third Bancorp, GMAC Inc., KeyCorp, Regions Financial Corp., SunTrust Banks Inc. and Wells Fargo & Co.I'd like to see the plans made public. I'd especially like to see Citi's, BofA's, and GMAC's plans.

The Fed conducted the stress tests, but didn't the Treasury loan the money? Shouldn't the Treasury be asking for the repayment plans? Just asking ...

Moody’s: Credit Card Delinquencies Rise

by Calculated Risk on 11/23/2009 05:32:00 PM

From Bloomberg: Late Card Payments Rose in October, Moody’s Reports

Loans at least 30 days overdue, a signal of future defaults, rose to 6.12 percent in October from 5.97 percent in September, Moody’s said ... defaults fell last month to 10.04 percent from 10.72 percent in September, reflecting lower delinquency rates earlier in the year.This is the highest delinquency rate since February. At noted in the article, credit card defaults tend to track unemployment, so the default rate will probably continue to rise.

...

Write-offs may peak at 12 percent to 13 percent in 2010, Moody’s analysts Will Black and Jeffrey Hibbs said in the report.

Existing Home Sales: Distressing Gap

by Calculated Risk on 11/23/2009 01:45:00 PM

After the expected spike in existing home sales last month, I quoted legendary basketball coach John Wooden:

"Never mistake activity for achievement."It is worth repeating this month.

First, it is important to remember that existing home sales are largely irrelevant for the economy. What matters for the economy are new home sales, housing starts and residential investment. And there has been little improvement in these key indicators.

This really shows up on the following graph:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales (left axis) through October, and new home sales (right axis) through September.

The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent spike in existing home sales was due primarily to the first time homebuyer tax credit.

But what matters for the economy - and jobs - is new home sales, and new home sales are still very low because of huge overhang of existing home inventory and rental properties.

Second, normally a decline in inventory and the months-of-supply would be considered a positive for the existing home market, however much of the apparent recent improvement in months-of-supply is related to the artificial - and likely short lived - boost in activity.

It is not all bad news. The second graph shows the year-over-year change in existing home inventory.

It is not all bad news. The second graph shows the year-over-year change in existing home inventory. This inventory has been declining for some time, and is off almost 15% compared to last year. However the level of inventory is still high, and much of the recent inventory "improvement" has come at the expense of vacant rental units; the rental vacancy rate is now at a record 11.1%.

The key to reducing the overall inventory is new household formation, and the key to new household formation is jobs. Encouraging renters to become owners accomplishes nothing in reducing the overall housing inventory, and leads some analysts to mistake activity for achievement.