by Calculated Risk on 12/04/2009 08:30:00 AM

Friday, December 04, 2009

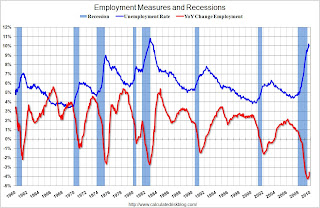

Employment Report: 11K Jobs Lost, 10% Unemployment Rate

From the BLS:

The unemployment rate edged down to 10.0 percent in November, and nonfarm payroll employment was essentially unchanged (-11,000), the U.S. Bureau of Labor Statistics reported today.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 11,000 in November. The economy has lost almost 4.8 million jobs over the last year, and 7.2 million jobs1 during the 23 consecutive months of job losses.

The unemployment rate decreased to 10.0 percent. Year over year employment is strongly negative.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

The 11,000 jobs lost was surprising and was much better than other indicators (like ADP, weekly initial claims, ISM reports) would have indicated. The decrease in the unemployment rate was expected because of the large increase last month (and the unemployment rate is noisy). More to come ...

1Note: The total jobs lost does not include the preliminary benchmark payroll revision of minus 824,000 jobs. (This is the preliminary estimate of the annual revision that will be announced early in 2010).

Employment Report Forecasts

by Calculated Risk on 12/04/2009 12:16:00 AM

Just a few forecasts ...

From CNBC: Look Ahead: Jobs Report Has Markets on Edge

Economists expect November's decline in non farm payrolls to come in at about 125,000, and unemployment is expected to hold steady at 10.2 percent. ... Bill Stone, chief investment strategist at PNC Wealth Management ... said PNC expects job losses of 150,000 for November.From MarketWatch: Another 100,000 jobs lost, economists predict

Another 100,000 jobs were destroyed during November, according to the median forecast of economists surveyed by MarketWatch. It would be the 23rd consecutive month of job losses, the longest losing streak since the 1930s.Goldman is forecasting the report will show 100,000 net jobs lost in November.

The official unemployment rate is expected to remain at 10.2%, the highest since 1983.

Best to all

Thursday, December 03, 2009

BofA Raises $19.3 Billion

by Calculated Risk on 12/03/2009 08:30:00 PM

From Bloomberg: Bank of America Raises $19.3 Billion in Share Sale at $15 Each

Bank of America Corp., which plans to repay $45 billion of U.S. government bailout money, raised $19.3 billion in a sale of securities at $15 apiece, a 4.8 percent discount to its common stock.This means BofA should repay the $45 Billion in TARP money tomorrow or early next week.

I expect other banks - possibly Wells Fargo and Citigroup - to raise capital too. (ht jb)

Fed Chairmen Never Learn

by Calculated Risk on 12/03/2009 04:55:00 PM

In his 2001 testimony, Fed Chairman Alan Greenspan testified before the House Committee on the Budget, and while offering his usual cautions and caveats, Greenspan talked of surpluses for the foreseeable future.

Greenspan spoke of "an on-budget surplus of almost $500 billion ... in fiscal year 2010". The National Debt would soon be retired and the Boomer's retirements secure. Greenspan offered a projection of "an implicit on-budget surplus under baseline assumptions well past 2030 despite the budgetary pressures from the aging of the baby-boom generation, especially on the major health programs."

How did that work out?

The key point is that for the Fed to remain independent, the Fed Chairman - as a rule - should avoid all discussions of fiscal policy.

Now comes Fed Chairman Bernanke today on the deficit. From Ryan Grim at Huffington Post:

"Well, Senator, I was about to address entitlements," Bernanke replied [to Senator Bennett]. "I think you can't tackle the problem in the medium term without doing something about getting entitlements under control and reducing the costs, particularly of health care."No matter if people agree or disagree with Bernanke, to maintain independence the Fed Chairman should not be commenting on the deficit and entitlements.

Bernanke reminded Congress that it has the power to repeal Social Security and Medicare.

"It's only mandatory until Congress says it's not mandatory. And we have no option but to address those costs at some point or else we will have an unsustainable situation," said Bernanke.

...

"Willie Sutton robbed banks because that's where the money is, as he put it," Bernanke said. "The money in this case is in entitlements."

And from Silla Brush at The Hill: Bernanke: 'Little bit early' to make case for second stimulus

Federal Reserve Chairman Ben Bernanke ... Bernanke emphasized that the government has spent less than half of the money in the $787-billion package passed earlier this year and that analysts are still determining its impact.Once again - it doesn't matter whether you agree or disagree with Bernanke - he should not be talking about these issues.

"Only about 30 percent of the funds have been disbursed," Bernanke said. "It's a little bit early to make a strong judgment, a little bit early to decide whether or not to do additional fiscal actions."

A very poor performance today from the Fed Chairman.

AmTrust Lawyers Discuss Bank Seizure

by Calculated Risk on 12/03/2009 02:44:00 PM

From the Plain Dealer: AmTrust sale appears inevitable, according to attorneys

Peter Goldberg doesn't expect to be the CEO of AmTrust Bank much longer, but his expertise will be needed to help the AmTrust and its employees once the bank is taken over by regulators and sold to another bank.This is probably forcing the FDIC's hand to take action soon (like tomorrow).

That revelation was among many made Thursday during the initial hearing of AmTrust Bank's parent company, AmTrust Financial Corp., in U.S. Bankruptcy Court in Cleveland.

... attorneys for AmTrust Financial and its major creditors ... talked candidly about AmTrust's dismal condition and made it clear they've already started planning for what happens after AmTrust is sold.

Here is another article from the Plain Dealer on the bankruptcy filing of the bank hold company: AmTrust's bankruptcy filing may be a lesson learned from WaMu

Hotel RevPAR off 8.4 Percent

by Calculated Risk on 12/03/2009 11:57:00 AM

From HotelNewsNow.com: Luxury leads occupancy increases in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 1.7 percent to end the week at 40.7 percent. Average daily rate dropped 6.7 percent to finish the week at US$84.81. Revenue per available room for the week decreased 8.4 percent to finish at US$34.54.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was later in 2008 and 2009, so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

This is a two year slump for the hotel industry. Although occupancy is off 1.7% compared to 2008, occupancy is off about 14% compared to Thansgiving week in 2006 and 2007.

The good news is the occupancy rate is at about the same level as 2008 (off just 1.7 percent). The bad news is this is a very low occupancy rate - 2009 will be the lowest since the Great Depression - and this is still pushing down room rates.

ISM Non-Manufacturing Shows Contraction in November

by Calculated Risk on 12/03/2009 10:04:00 AM

From the Institute for Supply Management: November 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in November after two consecutive months of expansion, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.This is a grim report. According to this survey, the service sector contracted in November, and employment also contracted at about the same rate as in October.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Worldwide. "The NMI (Non-Manufacturing Index) registered 48.7 percent in November, 1.9 percentage points lower than the 50.6 percent registered in October, indicating contraction in the non-manufacturing sector after two consecutive months of expansion. The Non-Manufacturing Business Activity Index decreased 5.6 percentage points to 49.6 percent, reflecting contraction after three consecutive months of growth. The New Orders Index decreased 0.5 percentage point to 55.1 percent, and the Employment Index increased 0.5 percentage point to 41.6 percent. The Prices Index increased 4.8 percentage points to 57.8 percent in November, indicating an increase in prices paid from October. According to the NMI, six non-manufacturing industries reported growth in November. Respondents' comments remain cautious about business conditions and reflect concern over the length of time for economic recovery."

...

Employment activity in the non-manufacturing sector contracted in November for the 22nd time in the last 23 months. ... Three industries reported increased employment, 11 industries reported decreased employment, and four industries reported unchanged employment compared to October. Comments from respondents include: "Permanent and seasonal layoffs" and "Some reduction in workforce due to slow second- and third-quarter sales."

emphasis added

Bernanke Confirmation Hearing

by Calculated Risk on 12/03/2009 10:01:00 AM

Fed Chairman Ben Bernanke's confirmation hearing before the Senate Banking Committee.

Here is the CNBC feed.

And a live feed from C-SPAN.

Prepared Testimony: Confirmation hearing

Weekly Initial Unemployment Claims: 457,000

by Calculated Risk on 12/03/2009 08:36:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 28, the advance figure for seasonally adjusted initial claims was 457,000, a decrease of 5,000 from the previous week's revised figure of 462,000 [revised from 466,000]. The 4-week moving average was 481,250, a decrease of 14,250 from the previous week's revised average of 495,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Nov. 21 was 5,465,000, an increase of 28,000 from the preceding week's revised level of 5,437,000. The 4-week moving average was 5,541,500, a decrease of 75,750 from the preceding week's revised average of 5,617,250.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 14,350 to 481,250. This is the lowest level since last November.

Although falling, the level is still high suggesting continuing job losses.

Fed's Sack: MBS Purchases Lowered Mortgage Rates by 100 bps

by Calculated Risk on 12/03/2009 12:00:00 AM

From the WSJ Real Time Economics: The Fed’s Market’s Guy Eyes Asset Sales and Rate Increases (ht Paul)

Brian Sack, who runs the markets group of the Federal Reserve Bank of New York, spoke to the Money Marketeers of New York University ...This is significantly higher than my estimate of 35 to 50 bps and suggest mortgage rates might rise sharply next spring (the MBS purchase program is scheduled to conclude by the end of the first quarter of 2010).

Mr. Sack’s group estimates that the Fed’s purchases of $300 billion in long-term Treasury securities earlier this year helped to push yields on 10-year Treasury notes down by about half a percentage point. ... Purchases of mortgage backed securities, he says, pushed those rates down by a full percentage point.

Update: Apparently Sack's might have been referring to the decline from the peak of the panic (not clear from the brief excerpt). Of course the purchases started in January - months after the peak of the panic - and that isn't what people are interested in.