by Calculated Risk on 12/07/2009 11:55:00 AM

Monday, December 07, 2009

Tim Duy's Fed Watch: Structural and Cyclical

From Professor Duy: Structural and Cyclical

For several months, I have been telling stories that decompose US economic activity into what I think of as cyclical and structural dynamics. I believe the distinction is very important to firms, markets, and policymakers who need to be aware when one dynamic is clouding their view of the other.A nice summary of the differences between those who expect a "V-shaped" recovery, and those that believe the recovery will be sluggish. I think growth will be sluggish primarily because of the overhang of excess housing inventory (slowing any recovery in residential investment), and because consumers will increase their saving rate to repair their household balance sheets. There is much more in Dr. Duy's post.

The cyclical dynamics, in my opinion, are the most spectacular, the most visible. The real cyclical fireworks began in the second half of [2008], as the energy price shock decimated household budgets, quickly followed by a financial shock that triggered an additional pullback in demand. Firms unexpectedly found they had far too much excess capacity in this environment, and began the process of "rightsizing." [Job] losses mounted even as falling energy costs and lower interest rates for those not credit constrained began to put a floor under spending.

Eventually, firms would realign capacity with the new level of demand, and job losses would taper off. That would mark the early stages of the cyclical bottom, the point at which growths returns. The initial growth spurt could be very rapid, as firms restock inventory and pent-up demand comes into play. The additional of government stimulus will add additional fuel to the fire.

Once the early stages of recovery are complete, the story shifts from cyclical to structural. The boost from inventory correction, pent-up demand, and government stimulus fade, and the underlying growth rate, the fundamental rates of activity, becomes evident. Now your expectations about the nation's economic direction depend on the weight you place on the structural factors. If you place nearly zero weight on those factors, then growth remains fairly high as the economy rapidly returns to potential. In effect, cyclical dynamics dominate your story; the Fed is simply flipping a switch that shifts the economy from high to low states and back again, a traditional post-WWII business cycle. If you place heavy weight on structural stories, you talk about the inability to revert to past patterns of consumer spending growth due to excessive household debt, a reversion to global imbalances that supports outsized import growth, lack of an asset bubble to compensate for these structural problems, etc. With these stories in your toolkit, you expect a low underlying growth rate - barely at potential growth - in which case the gap between actual and potential output remains distressingly high for possibly years to come.

Trapped under TARP: Regional Banks and Real Estate Loans

by Calculated Risk on 12/07/2009 08:57:00 AM

From Bloomberg: No Escape From TARP for U.S. Banks Choking on Real Estate Loans

... mounting defaults on commercial property may keep regional lenders from repaying bailout funds until at least 2011.Basically small and regional banks were over concentrated in C&D (Construction and Development) and CRE (Commercial Real Estate) loans - and those areas are still under severe stress (CRE will get worse). This is why the FDIC is busy every Friday, and also why many of these small and regional banks will be stuck with TARP for some time (or even fail owing money to the Treasury).

... regional banks ... are almost four times more concentrated in commercial property loans than the nation’s biggest lenders, according to data compiled by Bloomberg on bailout recipients.

The concentration makes regulators less likely to let regional lenders ... leave the Troubled Asset Relief Program, analysts said.

...

The stakes for taxpayers include whether they’ll get back $36.6 billion held by 35 of the largest regional lenders that received TARP money.

...

Among 35 of the biggest regional lenders that retain TARP funds, commercial real estate and construction loans average 37 percent of total loans, compared with 9.5 percent at Citigroup Inc. and Wells Fargo & Co., the two biggest U.S. banks that haven’t announced plans to repay the government, according to data compiled by Bloomberg....

Treasury Forecasts Smaller Loss from TARP

by Calculated Risk on 12/07/2009 12:16:00 AM

From the NY Times: U.S. Forecasts Smaller Loss From Bailout of Banks

The Treasury Department expects to recover all but $42 billion of the $370 billion it has lent to ailing companies since the financial crisis began last year, with the portion lent to banks actually showing a slight profit, according to a new Treasury report.And from the WSJ: Estimated TARP Cost Is Cut by $200 Billion

The new assessment of the $700 billion bailout program, provided by two Treasury officials on Sunday ahead of a report to Congress on Monday, is vastly improved from the Obama administration’s estimates last summer of $341 billion in potential losses from the Troubled Asset Relief Program. ...

The officials said the government could ultimately lose $100 billion more from the bailout program in new loans to banks, aid to troubled homeowners and credit to small businesses.

The article notes that this will reduce the deficit significantly this year.

Sunday, December 06, 2009

Financial Times: Bear Stearns and Lehman Executives Cashed in before Collapse

by Calculated Risk on 12/06/2009 09:18:00 PM

From Lucian Bebchuk, Alma Cohen, and Holger Spamann in the Financial Times: Bankers had cashed in before the music stopped

According to the standard narrative, the meltdown of Bear Stearns and Lehman Brothers largely wiped out the wealth of their top executives. ... That standard narrative, however, turns out to be incorrect. ... our analysis ... shows the banks’ top five executives had cashed out such large amounts since the beginning of this decade that, even after the losses, their net pay-offs during this period were substantially positive.It appears these executives were incentivized to gamble.

excerpted with permission

Mark Thoma has more excerpts Did Bank Executives Lose Enough to Learn their Lesson?

Employment and Real GDP

by Calculated Risk on 12/06/2009 04:52:00 PM

Based on the recent trend in the employment report, the U.S. economy might start adding net payroll jobs soon. This post looks at payroll employment vs. the change in real GDP, and estimates the unemployment rate in 12 months for several growth scenarios.

Credit: This idea is from a recent research note by Jan Hatzius.

Note: This is similar to Okun's relationship between GDP and unemployment. Click on graph for larger image.

Click on graph for larger image.

The first graph shows the four quarter change in real GDP and the four quarter change in employment, as a percent of payroll employment (to normalize for changes in payroll over time).

The second graph shows the same data in a scatter graph. There is a clear relationship - the higher the change in the real GDP, the larger the increase in payroll employment.

There is a clear relationship - the higher the change in the real GDP, the larger the increase in payroll employment.

This shows that real GDP has to grow at a sustained rate of about 1% just to keep the net change in payroll jobs at zero.

A 3% increase in real GDP (over a year) would lead to about a 1.5% increase in payroll employment. With approximately 131 million payroll jobs, a 1.5% increase in payroll employment would be just under 2 million jobs over the next year - and the unemployment rate would probably remain close to 10%.

The following table summarizes several growth scenarios. The unemployment rate is from the household survey and depends on the number of people in the work force - so it cannot be calculated directly. The table uses a range of unemployment rates based on 1.6 to 2.1 million people entering the workforce over the next 12 months (a combination of population growth and discouraged workers reentering the work force).

| Real GDP Growth | Percent Payroll Growth | Annual Payroll Growth (000s) | Monthly Payroll Growth (000s) | Approximate Unemployment Rate in One Year |

|---|---|---|---|---|

| 6.0% | 3.5% | 4,563 | 380 | 8.0% to 8.3% |

| 5.0% | 2.8% | 3,684 | 307 | 8.6% to 8.9% |

| 4.0% | 2.1% | 2,806 | 234 | 9.1% to 9.4% |

| 3.0% | 1.5% | 1,928 | 161 | 9.7% to 10.0% |

| 2.0% | 0.8% | 1,049 | 87 | 10.3% to 10.6% |

| 1.0% | 0.1% | 171 | 14 | 10.8% to 11.1% |

I expect a sluggish recovery in 2010, and I think the unemployment rate will stay near 10% for the next year. Those expecting a sharp drop in the unemployment rate are clearly expecting real GDP growth of 5% or more.

Obviously higher growth rates would mean an even quicker decline in the unemployment rate, and a decline in real GDP would mean much higher unemployment rates.

Summary and a Look Ahead

by Calculated Risk on 12/06/2009 12:00:00 PM

Scheduled data for the coming week include the trade report (Thursday) and retail sales (Friday). Also the Treasury is expect to release the Making Home Affordable Program data for November this week and include additional metrics such as the number of permanent modifications and the number of failed trial modifications.

The number of permanent modifications is expected to be in the 10s of thousand.

Also, the Federal Reserve will release the Q3 Flow of Funds report on Thursday.

And a summary ...

The employment report showed a decline of 11,000 payroll jobs in November and a decline in the unemployment rate to 10.0% (from 10.2%). The smaller number of payroll jobs lost was surprising because other indicators (like the ADP report, weekly initial unemployment claims, ISM reports) suggested a larger number of job losses.

From Employment Report: 11K Jobs Lost, 10% Unemployment Rate.

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession is the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Note: The total number of jobs lost does not include the preliminary benchmark payroll revision of minus 824,000 jobs. (This is the preliminary estimate of the annual revision that will be announced early in 2010).

From Seasonal Retail Hiring, Employment-Population Ratio, Part Time Workers

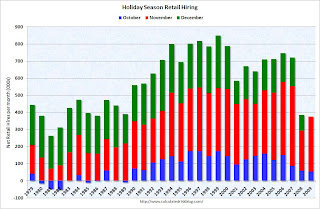

Retailers are hiring seasonal workers at slightly above the pace of last year ...

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.Retailers only hired 54.2 thousand workers (NSA) net in October. This was essentially the same as in 2008 (59.1 thousand NSA). However retailers hired 321.3 thousand workers in November (NSA), an increase from the 233.7 thousand last year. This suggests retailers are a little more optimistic than last year.

From Unemployment: Record number Unemployed over 26 Weeks, Diffusion Index

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are a record 5.887 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 3.8% of the civilian workforce. (note: records started in 1948)

Other Employment posts:

If the Economy lost Jobs, why did the Unemployment Rate decline?

Temporary Help

Manufacturing showed slower expansion: From the Institute for Supply Management: November 2009 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in November for the fourth consecutive month ...Services showed contraction: From the Institute for Supply Management: November 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in November after two consecutive months of expansion ...

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Residential construction spending increased in October, and nonresidential spending continued to decline.

Private residential construction spending is now 63% below the peak of early 2006.

Private non-residential construction spending is 20.6% below the peak of last October.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for November (red, light vehicle sales of 10.93 million SAAR from AutoData Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for November (red, light vehicle sales of 10.93 million SAAR from AutoData Corp).Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July.

Excluding July and August, this was the strongest month since October 2008 (12.5 million SAAR) before sales fell off the final cliff.

The current level of sales are still very low, and are below the lowest point for the '90/'91 recession (even with a larger population).

Best wishes to all.From the American Bankruptcy Institute: November Consumer Bankruptcy Filings Drop 18 Percent from Previous Month HUD's Donovan: "Next Steps" for FHA Fed's Beige Book: Economy "improved modestly" Restaurant Index Shows Contraction in October Hotel RevPAR off 8.4 Percent Unofficial Problem Bank List, Dec 4, 2009

Temporary Help

by Calculated Risk on 12/06/2009 09:12:00 AM

Tom Abate writes in the San Francisco Chronicle: In economic woes, firms count on temp workers

A surge in temporary employment was one of the encouraging aspects of a Labor Department report issued Friday.

Click on graph for larger image.

Click on graph for larger image.This graph shows temporary help services (seasonally adjusted) and the unemployment rate. Unfortunately the data on temporary help services only goes back to 1990, but it does appear temporary help and the unemployment rate have been inversely correlated.

The thinking is that before companies hire permanent employees following a recession, employers will first increase the hours worked of current employees and also hire temporary employees. Since the number of temporary workers increased sharply, some people think this might be signaling the beginning of an employment recovery.

Tom Abate adds some caution:

BLS economist Amar Mann said an analysis by the San Francisco office suggests that employers are getting more sophisticated about using temp hiring as a clutch to downshift into recessions and upshift into recoveries.So use the increase in temporary help with caution.

Mann said temp jobs started down a month after overall employment dropped during the 1990-91 recession. But by the 2001 downturn, employers started cutting temps about five months before they started issuing pink slips to the general workforce.

In the current recession, he said, companies began shedding temps 12 months before they started cutting permanent payrolls.

A similar pattern prevailed in the two prior recoveries, Mann said. Temp jobs came back at the same time as overall employment after the 1991 recovery. Temporary employment rebounded five months before the general job market turned positive following the 2001 dip.

If that pattern holds, it could be next summer before general payrolls start to grow.

Mann refused to speculate about the timing, but said temps are playing an increasing role in the job cycle.

"Employers are getting more savvy about using just-in-time labor on the way down and on the way up," he said.

Is Dubai Holding the next Dubai World?

by Calculated Risk on 12/06/2009 01:22:00 AM

From The Times: Banks face fresh Dubai debt fears

FEARS are growing among western banks that Dubai Holding, the personal investment vehicle of the emirate’s ruler, Sheikh Mohammed bin Rashid al-Maktoum, will be the next state-owned Dubai company to default.Just more potential losses for the Royal Bank of Scotland and HSBC.

The conglomerate went on a debt-fuelled spending spree in the past decade, borrowing $12 billion (£7.3 billion) to fund ambitious projects ...

Together, Dubai World and Dubai Holding are thought to account for 60% to 70% of Dubai’s total debt. Research from Bank of America Merrill Lynch indicates that Dubai Holding has $1.8 billion due for repayment next year.

Saturday, December 05, 2009

Fannie and Freddie Put Back More Loans to Lenders

by Calculated Risk on 12/05/2009 09:09:00 PM

From the WSJ: Soured Loans Put Lenders on the Hook

As home loans sour at a rapid clip, mortgage finance giants Fannie Mae and Freddie Mac are aggressively bouncing back defectively underwritten loans to lenders. The result: higher loan-loss reserves for the lenders and new headwind for banks trying to escape the housing downturn.It is a small number, but it is a start. These are mostly prime loans too - most of the subprime and Alt-A loans were securitized by Wall Street, not the GSEs.

For lenders such as Wells Fargo & Co., Bank of America Corp., J.P. Morgan Chase & Co. and Citigroup Inc., which are among the largest sellers of mortgages to Fannie and Freddie, this could mean buying back souring loans at a loss.

...

Through Sept. 30, Freddie Mac put back about $2.7 billion of single-family mortgages to lenders, more than double the $1.2 billion of a year earlier.

...

In 2008, Fannie Mae bounced back roughly a quarter of the loans on 94,652 real-estate owned properties, or REOs, properties that have been reclaimed by Fannie after foreclosure. Through Sept. 30, Fannie Mae REO properties totaled 98,428. Many of these loans are plain-vanilla prime 30-year fixed-rate mortgages ...

Autos: Google Domestic Trends

by Calculated Risk on 12/05/2009 06:29:00 PM

We've looked at this resource from Google before: Domestic Trends. Google is tracking search trends for several specific sectors of the economy.

As an example, below is a screen capture of the Auto Buyers Index.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows the seasonality of car buying, plus the Cash-for-clunkers surge in searches. Click on link for interactive graph - you can also plot the data YoY.

The YoY data for autos has recently turned slightly negative.

I also recommend real estate, rental and unemployment.

The YoY rental index has just turned positive, and the unemployment index has turned up again.