by Calculated Risk on 12/09/2009 03:02:00 PM

Wednesday, December 09, 2009

Expected Mortgage Rates

With the Ten Year Treasury yield at 3.42%, I was wondering what that would mean for mortgage rates. Click on graph for larger image.

Click on graph for larger image.

This graph is from Political Calculations: Predicting Mortgage Rates and Treasury Yields (based on one of my posts).

Using their calculator and a Ten Year Yield of 3.42%, we would expect the 30 year Freddie Mac fixed mortgage rate to be around 5.38%. Of course it is lower than expected - as it has been from most of the year - and some of the difference from the expected rate is probably due to the Fed's MBS purchases (also prepayment speed is a factor - and also just randomness).

The following table shows the difference between the expected and actual rate for the last 6 months. This suggests that mortgage rates will rise about 30 to 50 bps relative to the Ten Year Treasury yield when the Fed stops buying MBS.

| Ten Year Treasury Yield | Expected Mortgage Rate | Freddie Mac Mortgage Rate | Spread | |

|---|---|---|---|---|

| May | 3.28% | 5.28% | 4.86% | 0.42% |

| June | 3.71% | 5.59% | 5.42% | 0.17% |

| July | 3.54% | 5.46% | 5.22% | 0.24% |

| Aug | 3.58% | 5.49% | 5.19% | 0.30% |

| Sep | 3.39% | 5.36% | 5.06% | 0.30% |

| Oct | 3.37% | 5.34% | 4.95% | 0.39% |

| Nov | 3.40% | 5.36% | 4.88% | 0.48% |

| Average | 0.33% |

Volcker to Bankers: "Wake up, gentlemen"

by Calculated Risk on 12/09/2009 12:40:00 PM

“Has there been one financial leader to say this is really excessive? Wake up, gentlemen. Your response, I can only say, has been inadequate.”From The Times: ‘Wake up, gentlemen’, world’s top bankers warned by former Fed chairman Volcker

Paul Volcker, former Fed Chairman, Dec 8, 2009

“I wish someone would give me one shred of neutral evidence that financial innovation has led to economic growth — one shred of evidence,” said Mr Volcker ... He said that financial services in the United States had increased its share of value added from 2 per cent to 6.5 per cent, but he asked: “Is that a reflection of your financial innovation, or just a reflection of what you’re paid?”And from the Telegraph: Ex-Fed chief Paul Volcker's 'telling' words on derivatives industry

"You can innovate as much as you like, but do it within a structure that doesn't put the whole economy at risk."

...

Mr Volcker argued that banks did have a vital role to play as holders of deposits and providers of credit. This importance meant it was correct that they should be "regulated on one side and protected on the other". He said riskier financial activities should be limited to hedge funds to whom society could say: "If you fail, fail. I'm not going to help you. Your stock is gone, creditors are at risk, but no one else is affected."

Rail Traffic in November

by Calculated Risk on 12/09/2009 09:27:00 AM

From the Association of American Railroads: Rail Time Indicators Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows U.S. average weekly rail carloads. This can be a little misleading because the data is impacted by the Thanksgiving holiday, and most of the decline is in coal. (see the notes below)

From AAR:

• In November 2009, U.S. freight railroads originated 1,089,077 carloads, an average of 272,269 carloads per week. That’s down 8.2%, or 96,900 carloads, from November 2008’s 1,185,977 carloads (when the weekly average was 296,494 carloads) and down 17.4% from November 2007’s 1,318,023 total (a weekly average of 329,506 carloads).The AAR report has a number of other graphs for various sectors like autos and housing. As an example they compare U.S. Housing Starts with U.S. and Canadian Rail Carloads of Lumber, Wood & Forest Products.

• Coal had 78,535 fewer carloads in November 2009 than November 2008, accounting for most of the 96,900 total carload decline for the month.

• U.S. intermodal traffic (which isn’t included in carload figures) totaled 794,184 trailers and containers in November 2009, an average of 198,546 per week. That’s down 6.7% from November 2008 (when the weekly average was 212,879 units) and down

14.1% from November 2007, when the weekly average was 231,124.

• Freight railroading is a 24/7/365-days a year business, but Thanksgiving week is always one of the lowest-volume weeks of the year and therefore holds down the November average.

• If Thanksgiving week were excluded, November would have been the highest volume month for U.S. railroads since November 2008 for both carload and intermodal traffic.

MBA: Mortgage Refinance Applications Increase

by Calculated Risk on 12/09/2009 08:46:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 8.5 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 11.1 percent from the previous week and the seasonally adjusted Purchase Index increased 4.0 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.88 percent from 4.79 percent, with points increasing to 1.17 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This ends a six week run of declining 30-year fixed rates which may have triggered the increase in refinance applications.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

In the past, the MBA index was somewhat predictive of future sales, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining.

Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase. However - even with the increase in the purchase index this week - the recent plunge in the purchase index is probably worth watching.

Tuesday, December 08, 2009

BLS: Near Record Low Labor Turnover

by Calculated Risk on 12/08/2009 11:59:00 PM

From the BLS: Job Openings and Labor Turnover Summary

There were 2.5 million job openings on the last business day of October 2009, the U.S. Bureau of Labor Statistics reported today. The job openings rate was unchanged over the month at 1.9 percent. The openings rate has held relatively steady since March 2009. The hires rate (3.0 percent) and the separations rate (3.2 percent) were essentially unchanged and remained low.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. Remember the CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people. See Jobs and the Unemployment Rate for a comparison of the two surveys.

The following graph shows job openings (yellow line), hires (blue Line), Quits (green bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and green added together equals total separations.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (blue line) and separations (red and green together) are pretty close each month. When the blue line is above total separations, the economy is adding net jobs, when the blue line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 3.966 million hires in October, and 4.203 million separations, or 237 thousand net jobs lost.

I'm not sure if openings are predictive of future hires (the data set is limited), but openings near a series low can't be a positive. Separations have declined sharply, with fewer quits and layoffs, but hiring has not picked up. And quits at a series low suggests those that are employed were holding on to their current jobs in October.

Book Review: "American Apocalypse"

by Calculated Risk on 12/08/2009 08:23:00 PM

Meredith Whitney's comments this morning sounded like something right out of "American Apocalypse I":

The government is running out of ways to help the economy as the US faces major issues regarding credit and employment ahead, banking analyst Meredith Whitney told CNBC.In American Apocalypse, Nova imagines the economic recovery stalling, leading to the collapse of another major financial firm, the unemployment rate rising to 14% and the fabric of society starting to unravel.

"I think they're out of bullets," Whitney said in an interview during which she reinforced remarks she made last month indicating she is strongly pessimistic about the prospects for recovery.

Primary among her concerns is the lack of credit access for consumers who she said are "getting kicked out of the financial system."

Nova's protagonist, Gardener, loses his job, and is forced to face the challenges of the street. Almost vacant strip malls, "car people", "tree people" and tent cities are all part the scenery.

I am sure that someday a history will be written of our times, I am just not sure from whose perspective it will be written. Eventually there will be a Gibbons to write the Decline and Fall, but I am positive it will not be Europe or America that produces the author.Oh no, watch out for the ICA!

The fragmentation of information sources was accelerating. Print had failed as a business model, at least of the daily news; digital broadcast news was homogeneous for the most part. The only difference in the networks was what shade of the official color you wanted. Online news was the least regulated and most interesting; the only problem was the amount of noise one had to sift through to find a reliable source. I was still reading Calculated Risk then, this was before the 'Information Consolidation Act' shut him down.

Nova has a website where he is currently posting chapters from Part II.

The book is fast paced and gripping; a terrifying portrait of what seems a little too possible.

Disclosure: Nova sent me an unsolicited proof copy of his book. I’ve received no compensation for this review.

JPMorgan: 200,000 HAMP Mods Offered, Only 2% Permanent

by Calculated Risk on 12/08/2009 05:38:00 PM

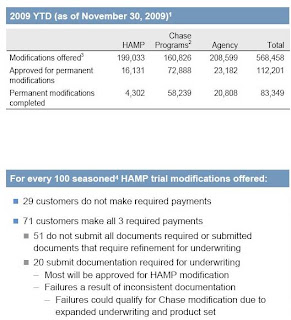

The following information is from the JPMorgan Chase presentation today at the Goldman Sachs Financial Services Conference. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first slide (page 18 in the presentation) shows the progress of the various modification programs at JPM Chase. Only 2% of all trial modification have become permanent (4,302 or 199,033 trial mods).

29% fail to make all their payments during the trial modification program. Another 51% fail to submit all documentation.

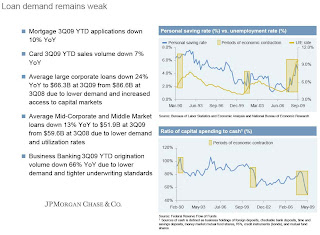

The other modification programs are having more success. The second slide is even more important (slide 15 in the presentation). This shows the weak demand for loans in all categories.

The second slide is even more important (slide 15 in the presentation). This shows the weak demand for loans in all categories.

The presentation isn't all gloomy (see page 14):

Overall CommentarySome initial signs of stability in consumer delinquency trends, but we are not certain if this trend will continue Prime and subprime mortgage delinquencies impacted by foreclosure moratorium, extended REO timelines and trial modifications

Survey: Companies More Upbeat on Sales, Negative on Jobs

by Calculated Risk on 12/08/2009 04:06:00 PM

From Bloomberg: Companies in U.S. More Upbeat on Sales Than Jobs, Surveys Show

Chief executive officers, supply managers and small business leaders in the U.S. said a pickup in sales next year will not lead to a surge in hiring, surveys showed.Here is the Business Roundtable CEO survey. Of the CEOs surveyed, 68% percent sales to increase over the next 6 months, but only 19% thought their U.S. employment would increase (compared to 31% who thought their employment would decrease).

Three times as many company chiefs anticipate sales will grow over the next six months than project payrolls will climb, according to a survey by the Washington-based Business Roundtable. A poll by the Institute for Supply Management found service companies, which account for almost 90 percent of the economy, forecast additional job cuts in 2010.

Here is the ISM survey: Economic Recovery Continues in 2010. On service employment:

For 2010, 15 percent of respondents expect higher levels of employment, 27 percent anticipate lower levels, and 58 percent expect their employment levels to be unchanged.This shows that hiring plans are still weak, although the recent Manpower survey showed some improvement in hiring plans.

Morgan Stanley: Fed to Raise Rates in 2nd Half of 2010

by Calculated Risk on 12/08/2009 01:47:00 PM

In a research note titled: "The Fed Will Exit in 2010", Morgan Stanley's Richard Berner and David Greenlaw forecast that the Fed will raise the Fed Funds rate in the 2nd half of 2010 to 1.5%.

They are forecasting GDP to increase 2.8% in both 2010 and 2011, and for unemployment to peak in Q1 2010 at 10.3%, and decline to 9.5% in 2011.

The GDP and unemployment rate forecasts are consistent with each other (see my post: Employment and Real GDP), but the real question is why do they expect the Fed to raise rates in the 2nd half of 2010 with a sluggish recovery?

The reason is they expect inflation expectations to pickup, and the Fed to react by raising rates (to 1.5% by the end of 2010, and 2.0% by the end of 2011). That would be unusually since the Fed historically waits until sometime well after the unemployment rate peaks.

The following graph is from I post I wrote in September: Fed Funds and Unemployment Rate Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Here is more from Paul Krugman: When should the Fed raise rates? (even more wonkish)

Goldman Sachs recently forecast that the Fed will be on hold through 2011:

The key features of our 2011 outlook: (1) a strengthening in growth from 2.1% on average in 2010 to 2.4% in 2011, with real GDP rising at an above-potential 3½% pace in late 2011; (2) a peaking in unemployment in mid-2011 at about 10¾%; (3) extremely low inflation – close to zero on a core basis during 2011; and (4) a continuation of the Fed’s (near) zero interest rate policy (ZIRP) throughout 2011.Although there are other considerations - such as inflation expectations, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011 or even later.

Treasury: "Thousands of Borrowers" have received Permanent Modifications

by Calculated Risk on 12/08/2009 10:53:00 AM

From Bloomberg: Most Targeted for Mortgage Relief Don’t Qualify, Official Says

A majority of the 3.2 million borrowers targeted by the U.S. Treasury Department for mortgage relief under the administration’s foreclosure prevention program are unlikely to qualify, an agency official said.Testimony from Treasury Assistant Secretary for Financial Stability Herbert Allison: “The Private Sector and Government Response to the Mortgage Foreclosure Crisis”

...

Although we know that not every borrower will qualify for a permanent modification, we are disappointed in the permanent modification results so far,” said Allison, who is the former chief executive officer for federally controlled mortgage- finance giant Fannie Mae.

The Home Affordable Modification Program (HAMP), which provides eligible homeowners the opportunity to significantly reduce their monthly mortgage payment, is a key part of this effort, designed to help millions of homeowners remain in their homes and prevent avoidable foreclosures. As of November 17, over 680,000 borrowers are in active modifications, saving an average of over $550 a month on their monthly mortgage payments. Servicers report that over 900,000 borrowers have received offers to begin trial modifications.Only "thousands" of borrowers? Ouch. The actual data should be released this week.

...

Our most immediate and critical challenge is converting trial modifications to permanent modifications. All mortgage modifications begin with a trial phase to allow borrowers to submit the necessary documentation and determine whether the modified monthly payment is sustainable for them.

...

Currently servicers report that about 375,000 trial modifications will have finished a three month trial period with timely payments before 12/31/2009. Informal survey data from servicers indicate receipt of complete documents in about 30% of active trial modifications – these modifications where borrowers have returned all required documents need to be decisioned by servicers as quickly as possible. For other borrowers, servicers report that the large majority are current on their payments, but have some of the required documentation missing from applications. Housing counselors and homeowners report that servicers are losing documents, while servicers report that homeowners are not providing documents despite repeated outreach. Thousands of borrowers have successfully converted trial modifications to permanent modifications – but this is a low number compared to the total number of trial modifications.