by Calculated Risk on 12/10/2009 05:19:00 PM

Thursday, December 10, 2009

HAMP Questions

If there were 143,276 cumulative HAMP trial modifications in June - and the maximum length of a trial was extended to five months - how come there were only 31,382 permanent mods and 30,650 disqualified modifications by the end of November?

What happened to the other 82,244 modifications? Have they been extended?

And of the 697,026 active trial modifications, are all the borrowers current? That data seems to be missing from this release (HAMP report here)

My understanding was the HAMP data would show how many trial modifications had started, and the redefault rate by month. That key data is still missing.

HAMP: 31,382 Permanent Mods

by Calculated Risk on 12/10/2009 02:48:00 PM

Update: Treasury link now working, graphic added.

From Diana Olick at CNBC: First Look: Inside The $75 Billion Plan to Save Housing

Of the 759,058 modifications started, 697,026 are still in the three month trial phase. ... Treasury reports that 31,382 trial modifications are now permanent. ... 30,650 modifications were disqualified.Olick has much more.

Click on graph for larger image in new window.

Click on graph for larger image in new window.That is about a 50% failure rate during the trial period - and only a fraction of the eligible borrowers even bother.

Here is the link at Treasury. See here for a list of reports.

Fed Q3 Flow of Funds Report

by Calculated Risk on 12/10/2009 11:59:00 AM

The Fed released the Q3 2009 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth is now off $11.9 Trillion from the peak in 2007, but up $4.9 trillion from the trough earlier this year. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then ... bubbles!  This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (of household real estate) was up to 38% from the all time low of 33.5% earlier this year. The increase was due to a slight increase in the value of household real estate and a decline in mortgage debt.

Note: approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less than 38% equity. The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

Mortgage debt declined by $70 billion - but will have to decline substantially (as a percent of GDP) to reach more normal levels.

Hotel RevPAR off 11.9%

by Calculated Risk on 12/10/2009 11:16:00 AM

From HotelNewsNow.com: Luxury leads occupancy increases for second week in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 4.9 percent to end the week at 47.6 percent, average daily rate dropped 7.3 percent to US$96.25, and revenue per available room decreased 11.9 percent to US$45.86.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was later in 2008 and 2009, so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

This is a two year slump for the hotel industry. Although occupancy is off 4.9% compared to 2008, occupancy is off about 17% compared to the same week in 2006.

Leisure travel (weekend occupancy) is off only about 2% compared to the same week in 2008, but business travel (weekday occupancy) is off more suggesting no pickup in business travel - see the graph in the HotelNewsNow report.

Trade Deficit Declines in October

by Calculated Risk on 12/10/2009 08:59:00 AM

The Census Bureau reports:

The ... total October exports of $136.8 billion and imports of $169.8 billion resulted in a goods and services deficit of $32.9 billion, down from $35.7 billion in September, revised. October exports were $3.5 billion more than September exports of $133.4 billion. October imports were $0.7 billion more than September imports of $169.0billion.

Click on graph for larger image.

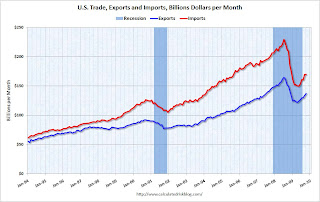

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through October 2009.

Imports and exports increased in October. On a year-over-year basis, exports are off 9% and imports are off 19%.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices decreased slightly to $67.39 in October - still up more than 50% from the prices in February (at $39.22) - and the decline followed seven consecutive monthly increases in the price of oil.

Oil import volumes dropped sharply in October, and the decline in oil imports was the major contributor to decrease in the trade deficit.

Weekly Initial Unemployment Claims Increase to 474,000

by Calculated Risk on 12/10/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 5, the advance figure for seasonally adjusted initial claims was 474,000, an increase of 17,000 from the previous week's unrevised figure of 457,000. The 4-week moving average was 473,750, a decrease of 7,750 from the previous week's revised average of 481,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Nov. 28 was 5,157,000, a decrease of 303,000 from the preceding week's revised level of 5,460,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 7,750 to 473,750. This is the lowest level since October 2008.

Although falling, the level of the 4 week average is still high, suggesting continuing job losses.

"Toxic Titles"

by Calculated Risk on 12/10/2009 12:17:00 AM

See update below for an earlier use of "toxic titles".

Just another addition to the crisis lexicon ... "toxic titles" ... from Fed Governor Elizabeth Duke: Keys to Successful Neighborhood Stabilization (ht Brian)

Communities with weak underlying economies are characterized by a long trend of population loss, gradual impoverishment, and strained municipal resources. For cities like Cleveland, Detroit, and Indianapolis the increase in foreclosures over the last few years has exacerbated a pre-existing vacancy problem. The increased rates of foreclosures and the related economic downturn have hastened a cycle of decreasing property values. Declines in state and local property and sales tax revenues result in even more vacant homes and deteriorating neighborhoods.I've seen toxic titles before in downturns with properties listed for $1 and still no takers ...

Many community organizations and homeowners have been frustrated by the difficulties of working with mortgage lenders and servicers, and these problems are even more exaggerated in weaker market cities. In the most devastated neighborhoods, some lenders do not even complete the foreclosure process or record the outcome of foreclosure sales because the cost of foreclosing exceeds the value of the property. Anecdotal evidence suggests that these "toxic titles" have placed significant numbers of properties in a difficult state of legal limbo.

UPDATE: Here is an earlier use of "toxic titles" from an article by Mary Kane in Jan 2008: ‘Toxic Titles’ Haunt Cities in Mortgage Meltdown

'Walkaways wind up with “toxic titles,’’ [Kermit Lind, a Cleveland law professor who specializes in housing cases] says. The mortgage company retains a lien, or a charge, on the house, but the borrower still is considered the owner. The property sits in limbo, with the mortgage usually exceeding what it would sell for, because of its decline. If the city has to tear it down, it adds its own $8,000 to $10,000 demolition lien. Not surprisingly, potential buyers aren’t exactly lining up. Non-profit neighborhood groups that could fix up the property face long and expensive legal battles to claim it.

Wednesday, December 09, 2009

The Rentership Society

by Calculated Risk on 12/09/2009 09:09:00 PM

Mark Whitehouse writes about the advantages of renting in the WSJ: American Dream 2: Default, Then Rent (ht Pat)

Whitehouse describes one former homeowner with a monthly income of $8,300. He was paying $4,800 a month on his home and he was basically working to pay his mortgage. He was really a "debt owner" since the home was worth far less than the amount owed. He now rents a similar home for $2,200 a month and is enjoying life:

[H]e now has the wherewithal to do things he couldn't when he was stretching to pay the mortgage. He recently went to concerts by Rob Thomas and Mat Kearney. He also kept his black BMW 6 Series coupe, which has payments of about $700 a month.This is one of the tragedies of the housing bubble - it encouraged people to become homeowners before they were really ready and also encouraged them to buy too much home (58% DTI for the mortgage is definitely "house poor"). Many of these people will not buy again for years, if ever.

"I don't know if I'll buy another house again, because it's such a huge headache," he says.

The article also mentions the "stealth stimulus" from all the delinquencies:

For the 4.8 million U.S. households that ... haven't paid their mortgages in at least three months, the added cash flow could amount to about $5 billion a month ... "It's a stealth stimulus," says Christopher Thornberg of Beacon Economics ...

Subprime Home Invasion

by Calculated Risk on 12/09/2009 07:04:00 PM

From KTLA: Home of Subprime Lender Targeted by Violent Robbers (ht WestSac_grrl)

Three suspects are under arrest after a violent home invasion robbery in a gated Newport Beach community ... The home is owned by Daniel Sadek, a prominent former subprime lender.There is no evidence of a connection to the collapse of Quick Loan.

...

Police did not immediately know whether the men who invaded Sadek's home were collecting on a debt or were there to rob him. They were taking cash and jewelry ...

Sadek made and lost a fortune in the subprime mortgage business. Quick Loan Funding, which he founded in 2002, wrote about $4 billion in subprime mortgages before it collapsed in 2007

The house was the scene of a fire two weeks ago.

CNBC: Citi to Repay TARP

by Calculated Risk on 12/09/2009 03:53:00 PM

From Maria Bartiromo at CNBC: Citi Plans to Repay TARP Via Stock Offering: Sources

Citigroup plans to pay back some of the $45 billion in TARP money it received last year by raising capital through a stock offering, CNBC has learned.Are the regulators sure they have enough capital?

An announcement could come as early as Thursday.