by Calculated Risk on 12/11/2009 08:30:00 AM

Friday, December 11, 2009

Retail Sales increase in November

On a monthly basis, retail sales increased 1.3% from October to November (seasonally adjusted), and sales are up 1.9% from November 2008.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level.

The red line shows retail sales ex-gasoline and shows there has been only a little increase in final demand. The second graph shows the year-over-year change in retail sales since 1993.

The second graph shows the year-over-year change in retail sales since 1993.

Retail sales increased by 1.9% on a YoY basis. The year-over-year comparisons are much easier now since retail sales collapsed in October 2008. Retail sales bottomed in December 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $352.1 billion, an increase of 1.3 percent (±0.5%) from the previous month and 1.9 percent (±0.5%) above November 2008. Total sales for the September through November 2009 period were down 2.1 percent (±0.3%) from the same period a year ago. The September to October 2009 percent change was revised from +1.4 percent (±0.5%) to +1.1 percent (±0.2%).It appears retail sales have bottomed, and there might be a little pickup in final demand.

Thursday, December 10, 2009

WaPo: New TARP Rules to Aid Small Businesses?

by Calculated Risk on 12/10/2009 10:30:00 PM

From David Cho at the WaPo: Joblessness plan revamps rules on bank bailouts (ht Mr. Ridgeback goes to Washington)

The Obama administration is developing a major initiative to tackle ... unemployment by getting federal bailout funds into the hands of small businesses.Another SIV proposal, this time to lend TARP money that isn't ... uh, TARP money? Why does this remind me of Hank Paulson?

The proposal involves spinning off a new entity from the Troubled Assets Relief Program that could give banks access to the government money without restrictions, such as limits on executive pay, as long as they use it to make loans to small businesses. ... No dollar figures have yet been attached to the new small-business lending effort, which is still in development, the sources said.

... [a "special-purpose vehicle"] would be financed by rescue funds and would lend to banks that provide small-business loans. In theory, this structure would free banks of the TARP conditions because they would be getting the money from a separate entity. They could also avoid being labeled as a TARP recipient.

I'd definitely like to see the plan for the next stimulus package, instead of focusing on these contortions to get it funded.

Retail Sales: "Looks like the middle of August out there"

by Calculated Risk on 12/10/2009 08:19:00 PM

November retail sales will be released tomorrow morning, but December is apparently off to a slow start ...

From the WSJ: Sales Lull Has Retailers Worried

The first week of December, typically a lackluster time in the wake of Black Friday, was particularly slow. ... "After solid traffic the first couple of days, it looks like the middle of August out there," said Stephen Baker, vice president of industry analysis for retail watcher NPD Group.And on a key category: Videogames Sales Fall Again in November

Combined November videogame software and hardware revenue fell 7.6% from a year earlier to $2.69 billion, data tracker NPD said Thursday. But revenue from videogame sales fell a surprising 3.1% amid expectations of mild growth in the mid-single-digit percentage range.Without growth in consumer spending, the recovery will be sluggish at best.

HAMP Questions

by Calculated Risk on 12/10/2009 05:19:00 PM

If there were 143,276 cumulative HAMP trial modifications in June - and the maximum length of a trial was extended to five months - how come there were only 31,382 permanent mods and 30,650 disqualified modifications by the end of November?

What happened to the other 82,244 modifications? Have they been extended?

And of the 697,026 active trial modifications, are all the borrowers current? That data seems to be missing from this release (HAMP report here)

My understanding was the HAMP data would show how many trial modifications had started, and the redefault rate by month. That key data is still missing.

HAMP: 31,382 Permanent Mods

by Calculated Risk on 12/10/2009 02:48:00 PM

Update: Treasury link now working, graphic added.

From Diana Olick at CNBC: First Look: Inside The $75 Billion Plan to Save Housing

Of the 759,058 modifications started, 697,026 are still in the three month trial phase. ... Treasury reports that 31,382 trial modifications are now permanent. ... 30,650 modifications were disqualified.Olick has much more.

Click on graph for larger image in new window.

Click on graph for larger image in new window.That is about a 50% failure rate during the trial period - and only a fraction of the eligible borrowers even bother.

Here is the link at Treasury. See here for a list of reports.

Fed Q3 Flow of Funds Report

by Calculated Risk on 12/10/2009 11:59:00 AM

The Fed released the Q3 2009 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth is now off $11.9 Trillion from the peak in 2007, but up $4.9 trillion from the trough earlier this year. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then ... bubbles!  This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (of household real estate) was up to 38% from the all time low of 33.5% earlier this year. The increase was due to a slight increase in the value of household real estate and a decline in mortgage debt.

Note: approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less than 38% equity. The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

Mortgage debt declined by $70 billion - but will have to decline substantially (as a percent of GDP) to reach more normal levels.

Hotel RevPAR off 11.9%

by Calculated Risk on 12/10/2009 11:16:00 AM

From HotelNewsNow.com: Luxury leads occupancy increases for second week in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 4.9 percent to end the week at 47.6 percent, average daily rate dropped 7.3 percent to US$96.25, and revenue per available room decreased 11.9 percent to US$45.86.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was later in 2008 and 2009, so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

This is a two year slump for the hotel industry. Although occupancy is off 4.9% compared to 2008, occupancy is off about 17% compared to the same week in 2006.

Leisure travel (weekend occupancy) is off only about 2% compared to the same week in 2008, but business travel (weekday occupancy) is off more suggesting no pickup in business travel - see the graph in the HotelNewsNow report.

Trade Deficit Declines in October

by Calculated Risk on 12/10/2009 08:59:00 AM

The Census Bureau reports:

The ... total October exports of $136.8 billion and imports of $169.8 billion resulted in a goods and services deficit of $32.9 billion, down from $35.7 billion in September, revised. October exports were $3.5 billion more than September exports of $133.4 billion. October imports were $0.7 billion more than September imports of $169.0billion.

Click on graph for larger image.

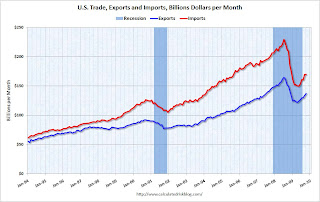

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through October 2009.

Imports and exports increased in October. On a year-over-year basis, exports are off 9% and imports are off 19%.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices decreased slightly to $67.39 in October - still up more than 50% from the prices in February (at $39.22) - and the decline followed seven consecutive monthly increases in the price of oil.

Oil import volumes dropped sharply in October, and the decline in oil imports was the major contributor to decrease in the trade deficit.

Weekly Initial Unemployment Claims Increase to 474,000

by Calculated Risk on 12/10/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 5, the advance figure for seasonally adjusted initial claims was 474,000, an increase of 17,000 from the previous week's unrevised figure of 457,000. The 4-week moving average was 473,750, a decrease of 7,750 from the previous week's revised average of 481,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Nov. 28 was 5,157,000, a decrease of 303,000 from the preceding week's revised level of 5,460,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 7,750 to 473,750. This is the lowest level since October 2008.

Although falling, the level of the 4 week average is still high, suggesting continuing job losses.

"Toxic Titles"

by Calculated Risk on 12/10/2009 12:17:00 AM

See update below for an earlier use of "toxic titles".

Just another addition to the crisis lexicon ... "toxic titles" ... from Fed Governor Elizabeth Duke: Keys to Successful Neighborhood Stabilization (ht Brian)

Communities with weak underlying economies are characterized by a long trend of population loss, gradual impoverishment, and strained municipal resources. For cities like Cleveland, Detroit, and Indianapolis the increase in foreclosures over the last few years has exacerbated a pre-existing vacancy problem. The increased rates of foreclosures and the related economic downturn have hastened a cycle of decreasing property values. Declines in state and local property and sales tax revenues result in even more vacant homes and deteriorating neighborhoods.I've seen toxic titles before in downturns with properties listed for $1 and still no takers ...

Many community organizations and homeowners have been frustrated by the difficulties of working with mortgage lenders and servicers, and these problems are even more exaggerated in weaker market cities. In the most devastated neighborhoods, some lenders do not even complete the foreclosure process or record the outcome of foreclosure sales because the cost of foreclosing exceeds the value of the property. Anecdotal evidence suggests that these "toxic titles" have placed significant numbers of properties in a difficult state of legal limbo.

UPDATE: Here is an earlier use of "toxic titles" from an article by Mary Kane in Jan 2008: ‘Toxic Titles’ Haunt Cities in Mortgage Meltdown

'Walkaways wind up with “toxic titles,’’ [Kermit Lind, a Cleveland law professor who specializes in housing cases] says. The mortgage company retains a lien, or a charge, on the house, but the borrower still is considered the owner. The property sits in limbo, with the mortgage usually exceeding what it would sell for, because of its decline. If the city has to tear it down, it adds its own $8,000 to $10,000 demolition lien. Not surprisingly, potential buyers aren’t exactly lining up. Non-profit neighborhood groups that could fix up the property face long and expensive legal battles to claim it.