by Calculated Risk on 12/12/2009 01:04:00 PM

Saturday, December 12, 2009

Housing Inventory: A Local Observation

"For Sale" signs are sprouting up all over my neighborhood again. In fact it is hard to find a block without one or two homes for sale. This is a very high number, especially for December.

My neighborhood may be unusual (fairly high priced SoCal area), but I suspect many homeowners have heard about an "improving market" and are testing the water.

This is one of the key categories of "shadow inventory" that we've discussed before:

Note: Homes in the foreclosure process listed in the MLS as "short sales" are not shadow inventory.

Inventory is usually the best metric to follow for the housing market - and according to recent releases inventory is declining for both new and existing homes - however shadow inventory clouds this picture.

Distressed Sales: Sacramento Market as an Example

by Calculated Risk on 12/12/2009 08:52:00 AM

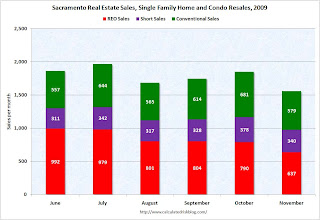

Note: The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the November data.

They started breaking out REO sales last year, but this is only the sixth monthly report with short sales. About 63 percent of all resales (single family homes and condos) were distressed sales in November. The second graph shows the mix for the last six months. It will be interesting to see if foreclosure resales pick up early next year when the early trial modifications period is over.

The second graph shows the mix for the last six months. It will be interesting to see if foreclosure resales pick up early next year when the early trial modifications period is over.

Total sales in November were off 16.1% compared to November 2008; the sixth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (26.4%) or FHA loans (31.4%), suggesting most of the activity in distressed former bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credit), and investors paying cash.

This is a local market still in severe distress.

Friday, December 11, 2009

Volcker: "Not time for business as usual"

by Calculated Risk on 12/11/2009 11:38:00 PM

From Bloomberg: Volcker Says ‘Basic Structure’ of Economy to Impede U.S. Growth

“We have another economic problem which is mixed up in this of too much consumption, too much spending relative to our capacity to invest and to export,” [said Former Federal Reserve Chairman Paul Volcker] “It’s involved with the financial crisis but in a way it’s more difficult than the financial crisis because it reflects the basic structure of the economy.”

...

“It’s likely that economic growth is going to be pretty sluggish for a while.”

Click image for video or click for Bloomberg Video |

Unofficial Problem Bank List, Dec 11, 2009

by Calculated Risk on 12/11/2009 09:09:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

NOTE: This was compiled prior to the bank failures today.

Changes and comments from surferdude808:

Last week’s closings by the FDIC contributed to a decline in the number of institutions and assets on the Unofficial Problem Bank List.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

The list includes 539 institutions with aggregate assets of $298.1 billion down from 542 and $310 billion last week. There were 6 failures last Friday that had combined assets of $12.8 billion, which mostly came from the collapse of AmTrust Bank ($11.4 billion). There was one other removal from the list as the OCC terminated its Supervisory Agreement against Beach First National Bank.

This week there are 4 additions, which include Saehan Bank, Los Angeles, CA ($829 million); Phoenixville Federal Bank and Trust, Phoenixville, PA ($381 million); Pierce Commercial Bank, Tacoma, WA ($267 million); and Bank of Shorewood, Shorewood, IL ($141 million).

Note: The FDIC announced there were 552 bank on the official Problem Bank list at the end of Q3. The difference is a mostly a matter of timing - some enforcement actions haven't been announced yet, and others may be pending.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #132&133: Arizona and Kansas

by Calculated Risk on 12/11/2009 07:16:00 PM

Note: since I get questions now and then - the Haiku was started long ago and is kind of a tradition.

AKA Giant Cash Sinkhole

We can't climb out of

Prairie bank failure

Solution for Solutions:

Arvest to invest

by Soylent Green is People

From the FDIC: Enterprise Bank & Trust, Clayton, Missouri, Assumes All of the Deposits of Valley Capital Bank, National Association, Mesa, Arizona

Valley Capital Bank, National Association, Mesa, Arizona, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Arvest Bank, Fayetteville, Arkansas, Assumes All of the Deposits of SolutionsBank, Overland Park, Kansas

As of September 30, 2009, Valley Capital Bank had total assets of approximately $40.3 million and total deposits of approximately $41.3 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.4 million. ... Valley Capital Bank is the 132nd FDIC-insured institution to fail in the nation this year, and the forth in Arizona. The last FDIC-insured institution closed in the state was Bank USA, National Association, Phoenix, on October 30, 2009.

SolutionsBank, Overland Park, Kansas, was closed today by the Office of the State Bank Commissioner of Kansas, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Less than $300 million hit to the DIF so far today ...

As of September 30, 2009, SolutionsBank had total assets of $511.1 million and total deposits of approximately $421.3 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $122.1 million. ... SolutionsBank is the 133rd FDIC-insured institution to fail in the nation this year, and the third in Kansas. The last FDIC-insured institution closed in the state was First National Bank of Anthony, Anthony, on June 19, 2009.

Bank Failure #131: Republic Federal Bank, National Association, Miami, Florida

by Calculated Risk on 12/11/2009 05:16:00 PM

Palm trees, warm ocean waters

Plus one toasted bank

by Soylent Green is People

From the FDIC: 1st United Bank, Boca Raton, Florida, Assumes All of the Deposits of Republic Federal Bank, National Association, Miami, Florida

Republic Federal Bank, National Association, Miami, Florida, was closed today by the Office of the Comptroller of the Currency (OCC), which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...An early failure ...

As of September 30, 2009, Republic Federal Bank, N.A. had total assets of approximately $433.0 million and total deposits of approximately $352.7 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $122.6 million. ... Republic Federal Bank, N.A. is the 131st FDIC-insured institution to fail in the nation this year, and the 13th in Florida. The last FDIC-insured institution closed in the state was Commerce Bank of Southwest Florida, Fort Myers, on November 20, 2009.

San Francisco Bank: "Not-so-smart" CRE Loans

by Calculated Risk on 12/11/2009 04:00:00 PM

Since it is Friday, here are a couple of articles from San Francisco Magazine on some "not-so-smart" apartment loans ... the first on the lender, the second on the borrower.

From David Johnson: When smart money said "no more," not-so-smart Marin bank loaned the Lembis $41 million. (ht Eric)

The Lembi real-estate implosion (see “War of Values,” December 2009) is on the verge of claiming another casualty: little Tamalpais Bank of San Rafael, which lent $41 million to the Lembi family and has now declared virtually its entire portfolio of commercial mortgages to be in default.And from Danelle Morton: War of values

... Walter and Frank Lembi, the father and son behind the CitiApartments rental behemoth, used more than $1 billion in financing from international investment banks and purchased more than 170 San Francisco apartment buildings between 2003 and 2008, bringing the total number of buildings they owned to 300 ...

Tamalpais Bank made most of the Lembi loans between December 2007 and April 2008. ... by this past September, the Lembis had defaulted on all except one of their loans, leaving Tamalpais Bank with a $38 million hole in its portfolio. The size of the loans was equivalent to more than 75 percent of the bank’s total capital.

“Lending that much of the bank’s capital to a single borrower is inherently reckless, imprudent, and simply unsafe and unsound,” said Richard Newsom, a retired San Francisco bank regulator. “Originating such a huge concentration of credit to one borrower in that period is beyond unsafe and unsound, because the commercial real-estate market was already starting to crack at that time.”

emphasis added

Since 2003, the [Lembi] family, through its various corporate entities, had acquired more than 170 properties—close to $1 billion in real estate—on top of the 130 or so they’d already owned. This briefly made them the largest private landlord in a city where 65 percent of residents are tenants.This is similar to the strategy of the buyers of Peter Cooper Village and Stuyvesant Town in New York; the plan was to somehow remove the rent controlled tenants and increase the rents significantly. It worked about the same.

There seemed to be no pattern to their acquisitions. They bought everything from grande dames, like the Park Lane on Nob Hill, to ratty dumps in the Tenderloin.

...

The Lembis were primarily interested in properties built before 1979: In other words, buildings covered by rent control. The reason is spelled out in a confidential document prepared by the investment bank Credit Suisse in winter 2008. The document focuses on the group of 24 properties that included the Carlomagno buildings. It shows, unit by unit, how the Lembis planned to replace 85 percent of the tenants. The family had set aside $9 million for “relocation costs,” and another $13 million for renovations. Once the apartments were fixed up, the document states, CitiApartments planned to raise rents by an average of 59 percent.

House Approves Bank Reform

by Calculated Risk on 12/11/2009 02:33:00 PM

Note: Mortgage cram downs were defeated.

From CNBC: What's In the House Financial Services Reform Bill

From the NY Times: House Votes to Tighten Regulation of Wall Street

Q3 2009: Mortgage Equity Extraction Strongly Negative

by Calculated Risk on 12/11/2009 11:30:00 AM

Note: This is not MEW data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008. My thanks to Jim Kennedy and the other Fed contributors for the previous MEW updates. For those interested in the last Kennedy data, here is a post, and the spreadsheet from the Fed is available here.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q3 2009, the Net Equity Extraction was minus $91 billion, or negative 3.3% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined in Q3, and this was partially because of debt cancellation per foreclosure sales, and some from modifications, like Wells Fargo's principal reduction program, and partially due to homeowners paying down their mortgages as opposed to borrowing more. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be negative.

Equity extraction was very important in increasing consumer spending during the housing bubble (some disagree with this, but I think they are wrong). Atif Mian and Amir Sufi of the University of Chicago Booth School of Business wrote a piece earlier this year: Guest Contribution: Housing Bubble Fueled Consumer Spending

Findings in our research suggest ... the rise in house prices from 2002 to 2006 was a main driver of economic growth during this time period, and the subsequent collapse of house prices is likely a main contributor to the historic consumption decline over the past year.Don't expect the Home ATM to be reopened any time soon - so any significant increase in consumer spending will come from income growth, not borrowing.

University of Michigan Consumer Sentiment

by Calculated Risk on 12/11/2009 10:01:00 AM

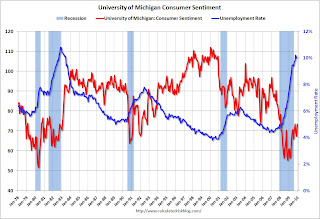

From MarketWatch: Consumer sentiment soars in early Dec

Consumer sentiment improved markedly in early December, according to media reports on Friday of the Reuters/University of Michigan index. The consumer sentiment index rose to 73.4 in early December from 67.4 in November. ... This is the highest level of consumer sentiment since September.Although this is being reported as "soars" and above expectations, sentiment is still low - at recesssion levels - and this is just a rebound to the September level.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Consumer sentiment is a coincident indicator - it tells you what you pretty much already know.

This graph shows consumer sentiment and the unemployment rate. There are other factors impacting sentiment too - like gasoline prices - but it is no surprise that consumer sentiment is still very low.