by Calculated Risk on 12/15/2009 02:36:00 PM

Tuesday, December 15, 2009

DataQuick: SoCal Home Sales Increase in November

This is no surprise - existing home sales will be through the roof nationwide in November as buyers rushed to beat the initial deadline for the homebuyer tax credit. Also ignore the median price - it is skewed by the mix of properties sold.

A few key points:

From DataQuick: Southland home sales and prices up

A total of 19,181 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 13.3 percent from October’s 22,132, and up 14.7 percent from 16,720 for November 2008, according to MDA DataQuick of San Diego.

Sales almost always decline from October to November. The year-over-year increase was the 17th in a row. In DataQuick’s statistics, which go back to 1988, the average November had 22,312 sales. ...

Sales have been stoked in recent months by several factors: A federal tax credit for first-time buyers, which had been set to expire last month before it was extended and expanded; robust investor activity, especially inland; super-low mortgage rates; the availability of government-insured, low-down-payment mortgages for first-time buyers; and the allure of a potential “deal” on a distressed property.

“This market is still really lopsided. Foreclosures and short sales are huge factors. There’s still not a lot of discretionary buying and selling outside the more affordable markets....” said John Walsh, MDA DataQuick president.

...

Foreclosure resales – houses and condos sold in November that had been foreclosed on in the prior 12 months – made up 39.1 percent of all Southland resales. That was the lowest since May 2008 when it was also 39.1 percent. It hit a high of 56.7 percent last February.

... Last month 38.1 percent of all purchase loans were FHA-insured mortgages, the same as in October and up from 34.5 percent a year ago. Two years ago FHA accounted for just 2.5 percent of purchase loans.

Absentee buyers purchased 19.1 percent of all homes sold last month ...

Foreclosure activity remains high by historical standards, although mortgage default notices have flattened out or trended lower in many areas.

NAHB: Builder Confidence Declines in December

by Calculated Risk on 12/15/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 16 in December. This is a decline from 17 in November. The record low was 8 set in January.

This is very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (November starts will be released Wednesday Dec 16th).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (November starts will be released Wednesday Dec 16th).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

To be blunt: Those expecting a sharp rebound in starts from the bottom are wrong. And remember - residential investment is usually the best leading indicator for the economy.

Press release from the NAHB: Builder Confidence Edges Down in December

The December HMI fell one point to 16, its lowest point since June of this year. Two out of three component indexes also were down, with a one-point decline to 16 registered for current sales conditions and a two-point decline to 26 registered for sales expectations in the next six months. The component gauging traffic of prospective buyers remained unchanged for a third consecutive month, at 13.

Regionally, December’s HMI results were somewhat mixed. The Northeast posted a three point gain to 23, while the West posted a one-point gain to 19, the South registered no change at 17, and the Midwest posted a two-point decline, to 12.

Credit Card Charge-Offs Increase

by Calculated Risk on 12/15/2009 11:28:00 AM

From Reuters: Capital One, Discover credit-card charge-offs rise (ht shill)

Capital One Financial Corp (COF.N) and Discover Financial Services (DFS.N) reported that credit-card charge-offs rose in November -- a sign that consumers remain under stress.

In a regulatory filing on Tuesday, Capital One said the annualized net charge-off rate -- debts the company believes it will never collect -- for U.S. credit cards rose to 9.60 percent in November from 9.04 percent in October.

In another regulatory filing, Discover said its charge-off rate rose to 8.98 percent from 8.54 percent after two months of declines.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the COF annualized credit card charge-off rate since January 2005.

Notice the spike in 2005 associated with a surge in bankruptcy filings ahead of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Capital One credit card charge-offs hit 9.83% in July (annualized) - above the peak in 2005 - and were near the peak again in November. It is likely that charge-offs will be above 10% soon.

Update: US Credit Card Charge-Offs Rise in November

JPMorgan Chase ... said charge-offs -- loans the company does not expect to be repaid -- rose to 8.81 percent in November from 8.02 percent in October.

...

Bank of America... said its charge-off rate fell for third straight month -- to 13.00 percent in November from 13.22 percent in October. However, it is still the credit card issuer with the highest default and delinquency rates.

Industrial Production, Capacity Utilization Increase in November

by Calculated Risk on 12/15/2009 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.8 percent in November after having been unchanged in October. Manufacturing production advanced 1.1 percent, with broad-based gains among both durables and nondurables. ... At 99.4 percent of its 2002 average, total industrial production was 5.1 percent below its level of a year earlier. Capacity utilization for total industry moved up 0.7 percentage point to 71.3 percent, a rate 9.6 percentage points below its average for the period from 1972 through 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up from the record low set in June (the series starts in 1967), and still well below the level of last year.

Note: y-axis doesn't start at zero to better show the change.

NY Fed: Manufacturing Conditions "Level Off"

by Calculated Risk on 12/15/2009 08:34:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers leveled off in December, following four months of improvement. The general business conditions index fell 21 points, to 2.6. The indexes for new orders and shipments posted somewhat more moderate declines but also moved close to zero. Input prices picked up a bit, as the prices paid index rebounded to roughly its November level; however, the prices received index moved further into negative territory, suggesting that price increases are not being passed along. Current employment indexes slipped back into negative territory.Here is the general business conditions index. Note that the data only goes back to July 2001 (chart to Jan 2002). Any reading above zero is expansion, so this index shows manufacturing was expanding since August. (chart from NY Fed)

Monday, December 14, 2009

Thoughts on TARP Repayment

by Calculated Risk on 12/14/2009 09:56:00 PM

There seems to be a sense that the banks are rushing to repay the TARP funds so they can pay bonuses. I think it is more likely that are just taking advantage of the opportunity to raise capital.

From Eric Dash and Andrew Martin at the NY Times: Wells Fargo to Repay U.S., a Coda to the Bailout Era

Wells joins Citigroup, Bank of America and JPMorgan Chase, its largest rivals, in shedding the stigma of taxpayer support and the restrictions on compensation that came with it.Exactly.

...

[David H. Ellison, a portfolio manager at FBR Funds] said banks appeared to be “rushing in” to pay back the government, so they can offer bigger bonuses to their executives and get lawmakers off their backs.

But the prospect of huge losses on mortgages and commercial real estate loans early next year might also be causing the repayment stampede, he said.

“It may be as much about raising capital as it is paying off TARP,” he said.

What has made this doable now is the massive support for asset prices by the Government (and taxpayers). This includes the Fed's MBS purchase program, the loose lending by the FHA, the FTHB tax credit, the HAMP, and more. These programs have limited the losses at the financial firms. Maybe this will work - as I noted last year, house prices in low end bubble areas might have bottomed - although prices are clearly still too high in many mid-to-high end bubble areas and eventually will decline (at least in real terms) to more supportable levels. And that probably means more losses for the banks.

Also in the article, Dash and Martin write that some financial experts think "If the economy takes a turn for the worse ... these same large banks will return to the government for a new round of aid." I don't think so.

I doubt there will be a TARP II. If any of these banks get in trouble again, they will probably be dissolved, management fired, and the shareholders wiped out. Isn't that implicit in paying back the TARP? Isn't that a key component of financial reform?

Report: Wells Fargo to repay TARP

by Calculated Risk on 12/14/2009 06:19:00 PM

From the WSJ: Wells Fargo to repay entire $25 billion in bailout aid, use proceeds from $10.4 billion stock sale.

The last of the big banks ...

Press Release from Wells Fargo: Wells Fargo to Repay Entire $25 Billion TARP Investment; Announces $10.4 Billion Common Stock Offering

Wells Fargo & Company announced today that, pursuant to terms approved by U.S. banking regulators and the U.S. Treasury, it will redeem the $25 billion of series D preferred stock issued to the U.S. Treasury in October 2008 under the government’s Troubled Asset Relief Program (TARP), upon successful completion of a $10.4 billion common stock offering.

“TARP stabilized our country’s financial system when confidence in financial markets around the world was being tested unlike any other period in our history. Its success also generated financial returns for taxpayers, including $1.4 billion in dividends paid to the U.S. Treasury by Wells Fargo,” said Wells Fargo President and CEO John Stumpf. “Now we’re ready to fully repay TARP in a way that serves the interests of the U.S. taxpayer, as well as our customers, team members and investors.”

Fed MBS Purchases: Over 85% Complete

by Calculated Risk on 12/14/2009 02:23:00 PM

Just an update on the status of the Fed's MBS purchase program.

From the Atlanta Fed weekly Financial Highlights:  From the Atlanta Fed:

From the Atlanta Fed:

The Fed purchased an additional $16 billion net in MBS over the last week.The Fed purchased a net total of $16 billion of agency-backed MBS in each of the last three weeks, with the last one through December 2. This purchase brings its total purchases up to $1.058 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 85% complete). In the last two months, the average weekly amount of MBS purchased has been smaller, averaging $17 billion over the last 10 weeks versus the average of $23.4 billion before that period.

And on the Fed balance sheet:

And on the Fed balance sheet: The balance sheet shrank slightly between November 26 and December 2 to $2.24 trillion.Note that the Fed balance sheet is mostly Agency & MBS and Tresuries now.

FDIC's Bair takes the "Over"

by Calculated Risk on 12/14/2009 12:03:00 PM

On Saturday I wrote that I'd take the "over" - more bank failures in 2010 than 2009. This is primarily because many FDIC insured banks are overly exposed to Construction & Development (C&D) and Commercial Real Estate (CRE) loans.

FDIC Chairwoman Sheila Bair is also taking the "over".

From CNBC: Worst of Bank Failures Isn't Over Yet: FDIC's Bair

Bank failures will continue to accelerate into next year despite "some encouraging signs" that things are turning around for the battered industry, FDIC Chair Sheila Bair told CNBC.A industry contact told me this weekend that they expect 400 bank failures in 2010.

... Bair did not quantify how bad the failures would get but said the worst isn't over yet for institutions that will suffer even as the economy improves.

"There's a lag generally with bank recovery from the overall economy," she said. "We do think bank failures will continue to go up next year but will peak. Even at higher levels than we have this year, it's still far below where we were during the S&L days."

...

"Even though the insured depository institutions are having their share of problems, it's really much lower than it was during the S&L days simply because most of this occurred outside the insured banks," Bair said.

Amid the problems for the industry, Bair said the Federal Deposit Insurance Corp's financial standing remains solid. She said the FDIC will head into 2010 with about $60 billion in cash reserves.

Refinance Activity and Interest Rates

by Calculated Risk on 12/14/2009 10:35:00 AM

The Mortgage Bankers Association's (MBA) current forecast for refinance activity in 2010 is $693 billion, and falling further in 2011 to $591 billion. The MBA is currently estimating 2009 refinance originations will be $1,246 billion - so they expect activity to fall almost in half.

This gives me an excuse for a graph or two (as if I need one). Click on graph for larger image in new window.

Click on graph for larger image in new window.

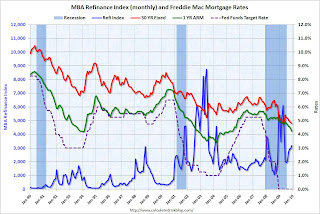

Refinance activity picks up when mortgage rates fall (for obvious reasons), and this graph shows the monthly refinance activity (MBA refinance index) and the Freddie Mac 30 year fixed mortgage rate and one year adjustable mortgage rate - and the Fed Funds target rate since Jan 1990.

Mortgage rates would have to fall further in 2010 to get another increase in refinance activity, and with the Fed MBS purchase program scheduled to end by the end of Q1, it seems unlike that rates will fall - unless the program is extended or the economy weakens significantly.

Notice that following the '90/'91 and '01 recessions, the Fed kept lowering the Fed Funds rate because of high unemployment rates. This spurred refinance activity. The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

Every time the 10 year yield drops sharply, refinance activity picks up. But notice what happened at the end of 1995. The Ten Year yield dropped, but the increase in refinance activity was muted. This was because mortgage rates didn't fall below the rates of a couple years earlier - and many people had already refinanced at those lower rates. The same thing will happen in 2010 and 2011 - there will only be a surge in refinance activity if rates fall below the rates of 2009.