by Calculated Risk on 12/16/2009 02:15:00 PM

Wednesday, December 16, 2009

FOMC Statement: No Change

Information received since the Federal Open Market Committee met in November suggests that economic activity has continued to pick up and that the deterioration in the labor market is abating. The housing sector has shown some signs of improvement over recent months. Household spending appears to be expanding at a moderate rate, though it remains constrained by a weak labor market, modest income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment, though at a slower pace, and remain reluctant to add to payrolls; they continue to make progress in bringing inventory stocks into better alignment with sales. Financial market conditions have become more supportive of economic growth. Although economic activity is likely to remain weak for a time, the Committee anticipates that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a strengthening of economic growth and a gradual return to higher levels of resource utilization in a context of price stability.Update:

With substantial resource slack likely to continue to dampen cost pressures and with longer-term inflation expectations stable, the Committee expects that inflation will remain subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve is in the process of purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt. In order to promote a smooth transition in markets, the Committee is gradually slowing the pace of these purchases, and it anticipates that these transactions will be executed by the end of the first quarter of 2010. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets.

In light of ongoing improvements in the functioning of financial markets, the Committee and the Board of Governors anticipate that most of the Federal Reserve’s special liquidity facilities will expire on February 1, 2010, consistent with the Federal Reserve’s announcement of June 25, 2009. These facilities include the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility, the Commercial Paper Funding Facility, the Primary Dealer Credit Facility, and the Term Securities Lending Facility. The Federal Reserve will also be working with its central bank counterparties to close its temporary liquidity swap arrangements by February 1. The Federal Reserve expects that amounts provided under the Term Auction Facility will continue to be scaled back in early 2010. The anticipated expiration dates for the Term Asset-Backed Securities Loan Facility remain set at June 30, 2010, for loans backed by new-issue commercial mortgage-backed securities and March 31, 2010, for loans backed by all other types of collateral. The Federal Reserve is prepared to modify these plans if necessary to support financial stability and economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

CPI and Falling Rents

by Calculated Risk on 12/16/2009 11:11:00 AM

From the BLS report on the Consumer Price Index this morning:

The index for all items less food and energy was unchanged in November after rising 0.2 percent in October. The heavily weighted index for shelter, unchanged in October, declined 0.2 percent in November. Within the shelter group, the indexes for rent and owners' equivalent rent both declined 0.1 percent and the lodging away from home index fell 1.5 percent.Owners' equivalent rent (OER) decreased at a 1.5% annualized rate in November, and has decreased at a 1.1% annualized rate over the last three months. OER is the largest component of CPI, and helped keep core CPI unchanged in November. Median CPI from the Cleveland Fed was also unchanged.

Based on reports of falling rents - and a record high vacancy rate, OER will probably continue to fall for some time, keeping core CPI low and possibly negative next year.

Also - falling rents will push up the price-to-rent ratio, and put additional pressure on house prices.

MBA: Mortgage Purchase Applications Flat, Rates Rise

by Calculated Risk on 12/16/2009 09:49:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume increased 0.3 percent on a seasonally adjusted basis from one week earlier. ...Also - most lenders are quoting mortgage rates back above 5% this week.

The Refinance Index increased 0.9 percent from the previous week and the seasonally adjusted Purchase Index decreased 0.1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.92 percent from 4.88 percent, with points decreasing to 1.08 from 1.17 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Note: In the past the MBA index was somewhat predictive of future sales - and was a favorite indicator of Alan Greenspan, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining. Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase.

Although existing home sales will be very strong in November (as buyers rushed to beat the initial tax credit deadline), the indicators for residential investment have been mostly flat to weak in Q4. This includes the NAHB housing market index, housing starts, new home sales and the MBA purchase index.

Although the FOMC statement today will probably be more upbeat on the economy than in November, the statement on housing will probably have a more negative tone. Last month the FOMC said: "Activity in the housing sector has increased over recent months." That is not true now except for existing home sales that are largely irrelevant1 for residential investment and the economy.

1 Existing home sales generate some fees and commissions, but home turnover does not add to the value of the housing stock. Some people spend money on improvements and furnishings after buying a home, but this has probably been limited recently because of the types of buyers (mostly first time home buyers with minimum downpayments) and cash-flow investors. Neither group will be adding a pool or other major improvement any time soon!

Housing Starts in November: Moving Sideways

by Calculated Risk on 12/16/2009 08:30:00 AM

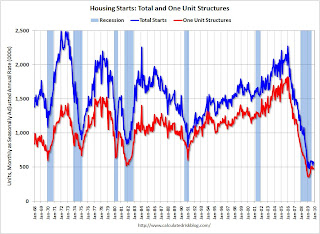

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 574 thousand (SAAR) in November, up 8.9% from the revised October rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for six months.

Single-family starts were at 482 thousand (SAAR) in November, up 2.1% from the revised October rate, and 35 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for six months.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This is both good news and bad news. The good news is the low level of starts means the excess housing inventory is being absorbed - a necessary step for housing (and the economy) to recover. The bad news is economic growth will probably be sluggish - and unemployment elevated - until residential investment picks up.

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 574,000. This is 8.9 percent (±10.2%) above the revised October estimate of 527,000, but is 12.4 percent (±9.1%) below the November 2008 rate of 655,000.

Single-family housing starts in November were at a rate of 482,000; this is 2.1 percent (±9.2%) above the revised October figure of 472,000. The November rate for units in buildings with five units or more was 83,000.

Housing Completions:

Privately-owned housing completions in November were at a seasonally adjusted annual rate of 810,000. This is 8.7 percent (±13.7%)* above the revised October estimate of 745,000, but is 25.3 percent (±10.1%) below the November 2008 rate of 1,084,000.

Single-family housing completions in November were at a rate of 524,000; this is unchanged (±11.7%)* compared with the revised October figure. The November rate for units in buildings with five units or more was 270,000.

Tuesday, December 15, 2009

Citigroup's "Massive" Tax Break

by Calculated Risk on 12/15/2009 11:11:00 PM

The WaPo has an article about a tax break for Citigroup: U.S. gave up billions in tax money in deal for Citigroup's bailout repayment

The Internal Revenue Service on Friday issued an exception to long-standing tax rules for the benefit of Citigroup and a few other companies partially owned by the government. As a result, Citigroup will be allowed to retain billions of dollars worth of tax breaks that otherwise would decline in value when the government sells its stake to private investors.Who benefits? The value of the shares the U.S. owns should increase, but only 34% of the share price increase accrues to U.S. taxpayers The other current shareholders receive the rest. So this doesn't seem to make sense ...

While the Obama administration has said taxpayers are likely to profit from the sale of the Citigroup shares, accounting experts said the lost tax revenue could easily outstrip those profits.

...

Federal tax law lets companies reduce taxable income in a good year by the amount of losses in bad years. But the law limits the transfer of those benefits to new ownership as a way of preventing profitable companies from buying losers to avoid taxes. Under the law, the government's sale of its 34 percent stake in Citigroup, combined with the company's recent sales of stock to raise money, qualified as a change in ownership.

The IRS notice issued Friday saves Citigroup from the consequences by stipulating that the government's share sale does not count toward the definition of an ownership change.

AIA: Architecture Billings Index Shows Contraction in November

by Calculated Risk on 12/15/2009 08:10:00 PM

The American Institute of Architects’ Architecture Billings Index declined to 42.8 in November from 46.1 in October. Any reading below 50 indicates contraction.

"There continues to be a lot of uncertainty in the construction industry that likely will delay new projects in the near future," said Kermit Baker, chief economist at the American Institute of Architects. (via WSJ, press release not online yet) Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through 2010, and probably longer.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Bernanke Responds to Senator Bunning

by Calculated Risk on 12/15/2009 05:07:00 PM

Chairman Bernanke has responded in writing to a series of question from Senator Bunning.

There are questions on Fed policy, gold, the dollar, and much more. Here are a couple of questions:

Bunning: 58. Are you concerned that the debt to GDP ratio in this country is more than 350%? Do you believe a high debt to GDP ratio is reason for tightening Fed policy? Why or why not?Two points: we see graphs all the time showing the total debt to GDP at around 350%, but that double counts financial intermediation.

Bernanke: The current ratio of public and private debt to GDP, including not only the debt of the nonfinancial sector but also the debt of the financial sector, is about 350 percent. (Many analysts prefer to focus on the debt of the nonfinancial sectors because, they argue, the debt of the financial sector involves some double-counting--for example, when a finance company funds the loans it provides to nonfinancial companies by issuing bonds. The ratio of total nonfinancial debt to GDP is about 240 percent.) Private debt has been declining as households and firms have been reducing spending and paying down pre-existing obligations. For example, households, who are trying to repair their balance sheets, reduced their outstanding debt by 1.3 percent (not at an annual rate) during the first three quarters of this year.

In contrast, public debt is growing rapidly. Putting fiscal policy on a sustainable trajectory is essential for promoting long-run economic growth and stability. Currently, the ratio of federal debt to GDP is increasing significantly, and those increases cannot continue indefinitely. The increases owe partly to cyclical and other temporary factors, but they also reflect a structural federal budget deficit. Stabilizing the debt to GDP ratio at a moderate level will require policy actions by the Congress to bring federal revenues and outlays into closer alignment in coming years.

The ratio of government debt to GDP does not have a direct bearing on the appropriate stance of monetary policy. Rather, the stance of monetary policy is appropriately set in light of the outlook for real activity and inflation and the relationship of that outlook to the Federal Reserve’s statutory objectives of maximum employment and price stability. Of course, government indebtedness may exert an indirect influence on monetary policy through its potential implications for the level of interest rates consistent with full employment and low inflation. But in that respect, fiscal policy is just one of the many factors that influence interest

rates and the economic outlook.

emphasis added

The 240% number is probably a better representation of the debt burden of the United States. Here is an example from Rolfe Winkler at Reuters (source: Reuters)

On the structural deficits: I've been writing about this for years. Nothing is more concerning than a large structural deficit during periods of high employment (like earlier in this decade when Bernanke was Chairman of the CEA). I don't recall Bernanke every mentioning the structural deficit when he was on the CEA.

Senator Bunning: 5. We saw the crowding out of the private mortgage market caused by Freddie and Fannie’s overwhelming control of mortgages during 2002 to 2006 period. Do you think there is a danger to allowing an extended public-controlled mortgage market? And what steps is the Fed taking to reestablish a private mortgage market?OK, this was a trick question, but Bernanke missed it. We did NOT see the crowding out of the private mortgage market in the period mentioned - in fact the private mortgage market expanded dramatically in the 2004 through 2006 period as shown in the following graph from San Francisco Fed Senior Economist John Krainer: Recent Developments in Mortgage Finance

This is figure 3 from the Economic Letter. This shows the surge in non-agency securitized loans, and loans held in bank portfolios, in 2004 through 2006 (the worst loans).

This is figure 3 from the Economic Letter. This shows the surge in non-agency securitized loans, and loans held in bank portfolios, in 2004 through 2006 (the worst loans). [T]he sources of mortgage finance have shifted as the housing market has gone from boom to bust. Figure 3 plots the evolution of these funding sources over the past decade. Fannie Mae and Freddie Mac combined have consistently been the largest players in the market, owning or guaranteeing about half or more of the mortgages in the sample at any given time. Non-agency securitization peaked in the first quarter of 2006, when it accounted for nearly 40% of new originations.There is much more in the Q&A.

DataQuick: SoCal Home Sales Increase in November

by Calculated Risk on 12/15/2009 02:36:00 PM

This is no surprise - existing home sales will be through the roof nationwide in November as buyers rushed to beat the initial deadline for the homebuyer tax credit. Also ignore the median price - it is skewed by the mix of properties sold.

A few key points:

From DataQuick: Southland home sales and prices up

A total of 19,181 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 13.3 percent from October’s 22,132, and up 14.7 percent from 16,720 for November 2008, according to MDA DataQuick of San Diego.

Sales almost always decline from October to November. The year-over-year increase was the 17th in a row. In DataQuick’s statistics, which go back to 1988, the average November had 22,312 sales. ...

Sales have been stoked in recent months by several factors: A federal tax credit for first-time buyers, which had been set to expire last month before it was extended and expanded; robust investor activity, especially inland; super-low mortgage rates; the availability of government-insured, low-down-payment mortgages for first-time buyers; and the allure of a potential “deal” on a distressed property.

“This market is still really lopsided. Foreclosures and short sales are huge factors. There’s still not a lot of discretionary buying and selling outside the more affordable markets....” said John Walsh, MDA DataQuick president.

...

Foreclosure resales – houses and condos sold in November that had been foreclosed on in the prior 12 months – made up 39.1 percent of all Southland resales. That was the lowest since May 2008 when it was also 39.1 percent. It hit a high of 56.7 percent last February.

... Last month 38.1 percent of all purchase loans were FHA-insured mortgages, the same as in October and up from 34.5 percent a year ago. Two years ago FHA accounted for just 2.5 percent of purchase loans.

Absentee buyers purchased 19.1 percent of all homes sold last month ...

Foreclosure activity remains high by historical standards, although mortgage default notices have flattened out or trended lower in many areas.

NAHB: Builder Confidence Declines in December

by Calculated Risk on 12/15/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 16 in December. This is a decline from 17 in November. The record low was 8 set in January.

This is very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (November starts will be released Wednesday Dec 16th).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (November starts will be released Wednesday Dec 16th).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

To be blunt: Those expecting a sharp rebound in starts from the bottom are wrong. And remember - residential investment is usually the best leading indicator for the economy.

Press release from the NAHB: Builder Confidence Edges Down in December

The December HMI fell one point to 16, its lowest point since June of this year. Two out of three component indexes also were down, with a one-point decline to 16 registered for current sales conditions and a two-point decline to 26 registered for sales expectations in the next six months. The component gauging traffic of prospective buyers remained unchanged for a third consecutive month, at 13.

Regionally, December’s HMI results were somewhat mixed. The Northeast posted a three point gain to 23, while the West posted a one-point gain to 19, the South registered no change at 17, and the Midwest posted a two-point decline, to 12.

Credit Card Charge-Offs Increase

by Calculated Risk on 12/15/2009 11:28:00 AM

From Reuters: Capital One, Discover credit-card charge-offs rise (ht shill)

Capital One Financial Corp (COF.N) and Discover Financial Services (DFS.N) reported that credit-card charge-offs rose in November -- a sign that consumers remain under stress.

In a regulatory filing on Tuesday, Capital One said the annualized net charge-off rate -- debts the company believes it will never collect -- for U.S. credit cards rose to 9.60 percent in November from 9.04 percent in October.

In another regulatory filing, Discover said its charge-off rate rose to 8.98 percent from 8.54 percent after two months of declines.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the COF annualized credit card charge-off rate since January 2005.

Notice the spike in 2005 associated with a surge in bankruptcy filings ahead of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Capital One credit card charge-offs hit 9.83% in July (annualized) - above the peak in 2005 - and were near the peak again in November. It is likely that charge-offs will be above 10% soon.

Update: US Credit Card Charge-Offs Rise in November

JPMorgan Chase ... said charge-offs -- loans the company does not expect to be repaid -- rose to 8.81 percent in November from 8.02 percent in October.

...

Bank of America... said its charge-off rate fell for third straight month -- to 13.00 percent in November from 13.22 percent in October. However, it is still the credit card issuer with the highest default and delinquency rates.