by Calculated Risk on 12/17/2009 03:44:00 PM

Thursday, December 17, 2009

Feldstein: House Prices to Fall Further

From Bloomberg: Harvard’s Feldstein Says U.S. Economy Still Mired in Recession

Restrained consumer spending suggests “2010 is going to be a very weak year,” said [Harvard University economics professor and former NBER president Martin Feldstein ] “Thrift in the long run is a very good thing, but increasing thrift as you come out of a recession is going to be a drag."On the recession comments - "The recession isn’t over" - I think he was just referring to the dating of the recession, although he clearly thinks there is a chance of a double dip recession and he expressed concern about is the "danger is we will run out of steam".

...

Regarding the residential property market ... Feldstein said the Obama administration’s effort to revive the housing market is a failure and home prices will continue to decline.

“It was just not well enough designed,” Feldstein said. “They ended up failing.” That suggests the housing slump will “continue to push down house prices,” he said.

“We saw a little pause in home-price declines in the summer but I think that was because of the first-time home buyers program,” Feldstein said. “We’re not going to get that boost.”

Hotel RevPAR Off 8.6%

by Calculated Risk on 12/17/2009 01:21:00 PM

From HotelNewsNow.com: New Orleans tops increases in STR weekly numbers

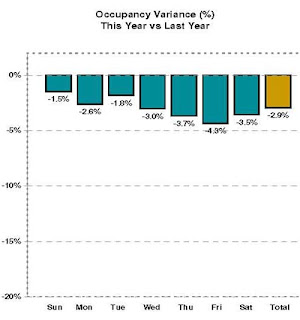

Overall, in year-over-year measurements, the industry’s occupancy fell 2.9 percent to 48.1 percent, Average daily rate dropped 5.9 percent to US$96.04, and Revenue per available room decreased 8.6 percent to US$46.22.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: Some of the holidays don't line up - especially at the end of the year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com (Note: They have a free daily email too for hotel news)

The above graph shows two key points:

The HotelNewsNow press release also has this graph on occupancy variance compared to 2008.

The HotelNewsNow press release also has this graph on occupancy variance compared to 2008.For most of the year business travel (mid-week) has been off significantly more than leisure travel (weekends).

It now appears both categories are off about the same compared to last year.

This seems to be more evidence that the hotel industry has stabilized at this low level as far as occupancy rates, although room rates will still be under pressure because this is the lowest occupancy rate (annual) since the Great Depression.

Does Morgan Stanley "Walking Away" from CRE Contribute to Strategic Defaults?

by Calculated Risk on 12/17/2009 10:59:00 AM

From Bloomberg: Morgan Stanley to Give Up 5 San Francisco Towers Bought at Peak (ht MikeinLongIsland, Brian)

Morgan Stanley ... plans to relinquish five San Francisco office buildings to its lender two years after purchasing them from Blackstone Group LP near the top of the market.Note that Morgan Stanley is current on the loan and is not in foreclosure. They are simply "walking away" because the buildings are worth less than the amount owed.

“This isn’t a default or foreclosure situation,” [Alyson Barnes, a Morgan Stanley spokeswoman] said. “We are going to give them the properties to get out of the loan obligation.”

...

The Morgan Stanley buildings may have lost as much as 50 percent since the purchase ...

On residential, the WSJ has an article: Debtor's Dilemma: Pay the Mortgage or Walk Away? (ht Sabine). The article contains a graph of "strategic defaults" by state - however I'm not sure how this is estimated. In very few cases does the borrower admit they can afford the payments and are just walking away (like Morgan Stanley above). In most cases the borrower either doesn't respond or says they are having a financial crisis.

From a research paper earlier this year on homeowners with negative equity walking away: Moral and Social Constraints to Strategic Default on Mortgages by Guiso, Sapienza and Zingales.

It is difficult to study the strategic default decision, because it is de facto an unobservable event. While we do observe defaults, we cannot observe whether a default is strategic. Strategic defaulters have all the incentives to disguise themselves as people who cannot afford to pay and so they will appear as non strategic defaulters in all the data.The researchers argued that the pace of strategic defaults is increasing - and that is terrifying for lenders.

This is what I wrote in 2007:

One of the greatest fears for lenders (and investors in mortgage backed securities) is that it will become socially acceptable for upside down middle class Americans to walk away from their homes.And that remains the greatest fear - and it probably doesn't help that companies like Morgan Stanley are walking away from commercial buildings. As the researchers noted, the more people hear about strategic defaults, the more willing they are to walk away. Zingales was quoted in the WSJ earlier this year:

“Our research showed there is a multiplication effect, where the social pressure not to default is weakened when homeowners live in areas of high frequency of foreclosures or know others who defaulted strategically”I wonder if hearing about "rich" banks that are paying "large" bonuses walking away from commercial buildings also weakens the social pressure?

Philly Fed: Region's Manufacturing Sector is Expanding

by Calculated Risk on 12/17/2009 10:00:00 AM

Manufacturing has been one of the bright spots for the economy beause of a combination of inventory restocking and increased exports - and the Philly Fed survey shows continued expansion in December. However, it appears the manufacturing boom is slowing - with the new orders index declining (although still positive) and the future activity index declining "notably".

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

Activity in the region's manufacturing sector is expanding, according to firms polled for this month's Business Outlook Survey. Indexes for general activity, new orders, and shipments all remained positive this month. ...

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from 16.7 in November to 20.4 this month. The index has now remained positive for five consecutive months (see chart). Other broad indicators suggest continued growth this month, but they fell somewhat from their November readings. The current new orders index, which has also remained positive for five consecutive months, decreased 8 points. The current shipments index fell less than 1 point. The current inventory index, although still negative, increased 10 points, to its highest reading in four months. Indicators for unfilled orders and delivery times edged higher and reached their highest readings since well before the recession began at the end of 2007.

Labor market conditions have been stabilizing in recent months, and for the first time since late 2007, more firms reported an increase in employment than reported declines. The current employment index increased 7 points, to its highest reading since October 2007. The workweek index edged four points higher, to 6.4, its second consecutive positive reading. ...

The future general activity index remained positive for the 12th consecutive month but decreased notably from 36.8 in November to 24.4, its lowest reading since March. The future activity index has been trending downward since mid-year. Indexes for future new orders and shipments declined this month, falling 15 points and 7 points, respectively.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

The index has been positive for five months now, after being negative for 19 of the previous 20 months.

Weekly Initial Unemployment Claims

by Calculated Risk on 12/17/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 12, the advance figure for seasonally adjusted initial claims was 480,000, an increase of 7,000 from the previous week's revised figure of 473,000. The 4-week moving average was 467,500, a decrease of 5,250 from the previous week's revised average of 472,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Dec. 5 was 5,186,000, an increase of 5,000 from the preceding week's revised level of 5,181,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 5,250 to 467,500. This is the lowest level since September 2008.

Although falling, the level of the 4 week average is still high, suggesting continuing job losses.

House Approves Next Stimulus

by Calculated Risk on 12/17/2009 12:00:00 AM

Note: This is just the House. The Senate votes early next year.

From Reuters: U.S. House approves $155 billion jobs bill

This includes:

The bill would provide $48.3 billion for infrastructure projects that promise to get workers back on job sites by April. Highway construction projects would get $27.5 billion, while subway, bus and other transit systems would get $8.4 billion.

States would get $23 billion to pay 250,000 teacher salaries and repair school buildings, and $1.2 billion to pay for 5,500 police officers ... $23.5 billion to help pay their share of federal healthcare programs for the poor.The bill doesn't include:

Wednesday, December 16, 2009

Daily Show: Flight Delay

by Calculated Risk on 12/16/2009 09:08:00 PM

Jon Stewart's take on the bank CEOs missing the meeting with President Obama ...

Click here if the embed doesn't work.

NY Times: U.S. Reconsidering Citi Stake Sale

by Calculated Risk on 12/16/2009 05:46:00 PM

From Eric Dash at the NY Times: U.S. Said to Reconsider Quick Sale of Citigroup Stake

Two days after Citigroup moved to untangle itself from Washington, the Treasury reversed course Wednesday and backed away from plans to immediately sell a portion of its stake in the banking giant ... The decision came after Citigroup badly misread the financial markets on Wednesday and struggled to sell new shares to pay back its bailout funds.Oops.

Bernanke's ARM Explodes, Refinances into Fixed Rate Mortgage

by Calculated Risk on 12/16/2009 05:29:00 PM

From TIME Magazine: Person of the Year 2009 Extended Interview

TIME: Do you have a mortgage?

Bernanke: Oh, yes, we refinanced.

TIME: Oh, perfect. When?

Bernanke: About 5%. A couple of months ago.

TIME: Good time.

Bernanke: Yes. We had to do it because we had an adjustable rate mortgage and it exploded, so we had to.

TIME: So, did you get a fixed rate at 5%? I think this might be the most valuable piece of information. (Laughter.)

Bernanke: Thirty years fixed rate at a little over 5%.

Comments on FOMC Statement, TIME Cover, and More

by Calculated Risk on 12/16/2009 04:11:00 PM

First, my thanks to everyone who visits this blog. Thanks - I appreciate the feedback in the comments and via email too.

I think the most important point in the FOMC statement was that they reiterated the ending dates for the Fed facilities and MBS purchases. The Fed is giving advance warning that these facilities will expire as previously announced. It would take a major credit or economic event to change these dates at this point.

There is some concern about what will happen when the Fed stops buying agency MBS. The important thing to remember is that there will be buyers; it is just a matter of price. My guess is that mortgage rates will rise about 35 bps (maybe 50 bps) relative to the Ten Year treasury when the Fed stops buying MBS. It could be more or less, but I'm surprised by how few analysts have tried to estimate the impact. There are some sites that think there will no buyers for agency MBS once the Fed stops the purchase program. That isn't correct; as I noted it is just a matter of price.

There are some sites that think there will no buyers for agency MBS once the Fed stops the purchase program. That isn't correct; as I noted it is just a matter of price.

But this gives me an excuse to post this photo: Canaille the Cat models the proper attire when visiting those sites!

Credit: Planet Wally

The other important point in the Fed statement was the recognition that the housing sector is not as strong as it appeared in November. The wording change was small:

Dec: "The housing sector has shown some signs of improvement over recent months."

Nov: "Activity in the housing sector has increased over recent months"

As I noted this morning, existing home sales will be very strong in November (as buyers rushed to beat the initial tax credit deadline), but the indicators for residential investment have been mostly flat to weak in Q4. This includes the NAHB housing market index, housing starts, new home sales and the MBA purchase index.

Residential investment (RI) is the best leading indicator for the economy, and I expect the recovery in RI to be sluggish. In the fourth quarter GDP will be strong because of inventory restocking and stimulus spending, but my guess is 2010 will mostly be weak (I'll try to quantify this soon).

Also: I try to post data that I think is informative and useful. In that sense the blog is like a filing cabinet of economic data for me and hopefully for all the readers.

I'm going to try to post more analysis (this is a common request - and I know I've posted less analysis recently).

And finally - draw your own conclusions from the two covers below. I think Larry Summers looks as uncomfortable as the Canaille the Cat above. Paul Krugman beat me to this: Bernanke and the cover curse

Paul Krugman beat me to this: Bernanke and the cover curse

Credits (ht JA):

Person of the Year 2009: Ben Bernanke

TIME Magazine Cover: Rubin, Greenspan & Summers - Feb. 15, 1999