by Calculated Risk on 12/18/2009 08:29:00 AM

Friday, December 18, 2009

House Panel to Investigate Citi Tax Break

From the WaPo: Kucinich panel to investigate Citigroup tax ruling

House subcommittee said Thursday that it will investigate the Treasury Department's decision to change a long-standing law so that Citigroup could keep billions of dollars in tax breaks.The key question is who benefits from the law change? The value of the shares the U.S. owns should increase, but only 34% of the share price increase accrues to U.S. taxpayers The other current shareholders receive the rest.

...

The Internal Revenue Service ... ruled last Friday that Citigroup could keep $38 billion in tax breaks that otherwise would decline in value as the government sells its stake in the company. Federal law lets companies shelter profits from taxes in good years based on the amount of losses in previous bad years. But the law restricts the use of past losses if a company changes hands, to discourage profitable companies from buying unprofitable firms to avoid paying taxes.

Treasury's plan to sell its $25 billion stake in Citigroup would have qualified as a change of ownership under the law. ... Treasury officials said the government needed to grant the tax break in order to sell its shares in Citigroup because the company could not afford the loss. Officials also said that preserving the tax break would help the government sell its shares at a higher price.

Of course the U.S. delayed selling shares because of the weak Citi share price (Treasury would have had to sell at a loss), but this is still an issue when Treasury eventually sells.

Thursday, December 17, 2009

Bank CEO Expects Prompt Corrective Action

by Calculated Risk on 12/17/2009 09:26:00 PM

Just a Bank Failure Friday warm up post ... first, the CEO of Barnes Bank is expecting a PCA:

From Paul Beebe at the Salt Lake Tribune: Beleaguered Barnes Bank to brief shareholders

Barnes Bank, under orders to shore up its capital and fix other financial problems, will tell shareholders in a special meeting Friday how much headway it's making.I'm not sure I've ever heard a bank CEO say he expects a PCA. Basically PCAs are Hail Mary passes with a low probability of success. Note: It is common for banks to be seized without a PCA ever being issued.

...

Asked if Barnes is healthy, [Curtis Harris, president and CEO] said, "I probably wouldn't make a comment on that right now."

...

"We understand that a PCA (prompt corrective action order) may be coming. We are looking for that to be coming," Harris said.

Barnes had $827 million in assets at the end of Q3. They have been operating under a written agreement since May 13th with a 60 day period for compliance (sounds like they didn't meet that deadline!).

Also - earlier this week - the FDIC announced plans to hire over 1,600 temporary employees in 2010 to assist with bank closings: FDIC Board Approves 2010 Operating Budget

The 2010 operating budget will increase more than $1.4 billion (55%) from 2009, primarily due to the cyclical nature of bank failures. The receivership funding component of the 2010 budget, the vast majority of which is funded by receiverships, will be $2.5 billion, up from $1.3 billion in 2009. This includes funding for the continuing work associated with bank failures that have occurred over the past two years. The budget also contains contingency funding for the possible continuation of an elevated number of bank failures in 2010. The 2010 budget increase also is partially attributable to increased supervisory activity related to the rising number of troubled banks which the FDIC oversees.Friday afternoons will be busy in 2010.

In conjunction with its approval of the 2010 operating budget, the Board also approved an authorized 2010 staffing level of 8,653 employees, up from 7,010 in 2009. Almost all the additional staff will be hired on a temporary basis. They will be hired primarily to assist with bank closings; to perform follow-on work related to the management and sale of failed bank assets; and to conduct bank examinations and perform other bank supervisory activities.

Report on Housing: 'Shadow Inventory’ Increases Sharply

by Calculated Risk on 12/17/2009 06:48:00 PM

From Bloomberg: ‘Shadow Inventory’ of U.S. Homes Climbs, Report Says

The number of homes that may be in the pipeline for a sale because of foreclosure and delinquency climbed about 55 percent to 1.7 million at the end of September, according to estimates by First American CoreLogic.A few points:

...

“While the visible month’s supply has decreased and is beginning to approach more normal levels, adding in the pending supply reveals there is still quite a bit of inventory that will impact the housing market for the next few years,” First American said.

On high rise, condos from the WSJ (ht William):REOs. There are bank owned properties that have not been put on the market yet. Foreclosures in process and seriously delinquent loans (although some of these may be in the modification process). New high rise condos. These properties are not included in the new home inventory report from the Census Bureau, and do not show up anywhere unless they are listed. Homeowners waiting for a better market. These are homeowners waiting for better market conditions to sell.

In the downtown Miami and neighboring Brickell areas, more than 22,000 condos have been built in the past four years, or more than twice the number added over the previous four decades, says Holliday Fenoglio Fowler LP, which advises real-estate developers and investors.

Feldstein: House Prices to Fall Further

by Calculated Risk on 12/17/2009 03:44:00 PM

From Bloomberg: Harvard’s Feldstein Says U.S. Economy Still Mired in Recession

Restrained consumer spending suggests “2010 is going to be a very weak year,” said [Harvard University economics professor and former NBER president Martin Feldstein ] “Thrift in the long run is a very good thing, but increasing thrift as you come out of a recession is going to be a drag."On the recession comments - "The recession isn’t over" - I think he was just referring to the dating of the recession, although he clearly thinks there is a chance of a double dip recession and he expressed concern about is the "danger is we will run out of steam".

...

Regarding the residential property market ... Feldstein said the Obama administration’s effort to revive the housing market is a failure and home prices will continue to decline.

“It was just not well enough designed,” Feldstein said. “They ended up failing.” That suggests the housing slump will “continue to push down house prices,” he said.

“We saw a little pause in home-price declines in the summer but I think that was because of the first-time home buyers program,” Feldstein said. “We’re not going to get that boost.”

Hotel RevPAR Off 8.6%

by Calculated Risk on 12/17/2009 01:21:00 PM

From HotelNewsNow.com: New Orleans tops increases in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 2.9 percent to 48.1 percent, Average daily rate dropped 5.9 percent to US$96.04, and Revenue per available room decreased 8.6 percent to US$46.22.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: Some of the holidays don't line up - especially at the end of the year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com (Note: They have a free daily email too for hotel news)

The above graph shows two key points:

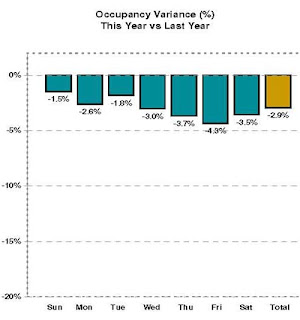

The HotelNewsNow press release also has this graph on occupancy variance compared to 2008.

The HotelNewsNow press release also has this graph on occupancy variance compared to 2008.For most of the year business travel (mid-week) has been off significantly more than leisure travel (weekends).

It now appears both categories are off about the same compared to last year.

This seems to be more evidence that the hotel industry has stabilized at this low level as far as occupancy rates, although room rates will still be under pressure because this is the lowest occupancy rate (annual) since the Great Depression.

Does Morgan Stanley "Walking Away" from CRE Contribute to Strategic Defaults?

by Calculated Risk on 12/17/2009 10:59:00 AM

From Bloomberg: Morgan Stanley to Give Up 5 San Francisco Towers Bought at Peak (ht MikeinLongIsland, Brian)

Morgan Stanley ... plans to relinquish five San Francisco office buildings to its lender two years after purchasing them from Blackstone Group LP near the top of the market.Note that Morgan Stanley is current on the loan and is not in foreclosure. They are simply "walking away" because the buildings are worth less than the amount owed.

“This isn’t a default or foreclosure situation,” [Alyson Barnes, a Morgan Stanley spokeswoman] said. “We are going to give them the properties to get out of the loan obligation.”

...

The Morgan Stanley buildings may have lost as much as 50 percent since the purchase ...

On residential, the WSJ has an article: Debtor's Dilemma: Pay the Mortgage or Walk Away? (ht Sabine). The article contains a graph of "strategic defaults" by state - however I'm not sure how this is estimated. In very few cases does the borrower admit they can afford the payments and are just walking away (like Morgan Stanley above). In most cases the borrower either doesn't respond or says they are having a financial crisis.

From a research paper earlier this year on homeowners with negative equity walking away: Moral and Social Constraints to Strategic Default on Mortgages by Guiso, Sapienza and Zingales.

It is difficult to study the strategic default decision, because it is de facto an unobservable event. While we do observe defaults, we cannot observe whether a default is strategic. Strategic defaulters have all the incentives to disguise themselves as people who cannot afford to pay and so they will appear as non strategic defaulters in all the data.The researchers argued that the pace of strategic defaults is increasing - and that is terrifying for lenders.

This is what I wrote in 2007:

One of the greatest fears for lenders (and investors in mortgage backed securities) is that it will become socially acceptable for upside down middle class Americans to walk away from their homes.And that remains the greatest fear - and it probably doesn't help that companies like Morgan Stanley are walking away from commercial buildings. As the researchers noted, the more people hear about strategic defaults, the more willing they are to walk away. Zingales was quoted in the WSJ earlier this year:

“Our research showed there is a multiplication effect, where the social pressure not to default is weakened when homeowners live in areas of high frequency of foreclosures or know others who defaulted strategically”I wonder if hearing about "rich" banks that are paying "large" bonuses walking away from commercial buildings also weakens the social pressure?

Philly Fed: Region's Manufacturing Sector is Expanding

by Calculated Risk on 12/17/2009 10:00:00 AM

Manufacturing has been one of the bright spots for the economy beause of a combination of inventory restocking and increased exports - and the Philly Fed survey shows continued expansion in December. However, it appears the manufacturing boom is slowing - with the new orders index declining (although still positive) and the future activity index declining "notably".

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

Activity in the region's manufacturing sector is expanding, according to firms polled for this month's Business Outlook Survey. Indexes for general activity, new orders, and shipments all remained positive this month. ...

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from 16.7 in November to 20.4 this month. The index has now remained positive for five consecutive months (see chart). Other broad indicators suggest continued growth this month, but they fell somewhat from their November readings. The current new orders index, which has also remained positive for five consecutive months, decreased 8 points. The current shipments index fell less than 1 point. The current inventory index, although still negative, increased 10 points, to its highest reading in four months. Indicators for unfilled orders and delivery times edged higher and reached their highest readings since well before the recession began at the end of 2007.

Labor market conditions have been stabilizing in recent months, and for the first time since late 2007, more firms reported an increase in employment than reported declines. The current employment index increased 7 points, to its highest reading since October 2007. The workweek index edged four points higher, to 6.4, its second consecutive positive reading. ...

The future general activity index remained positive for the 12th consecutive month but decreased notably from 36.8 in November to 24.4, its lowest reading since March. The future activity index has been trending downward since mid-year. Indexes for future new orders and shipments declined this month, falling 15 points and 7 points, respectively.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

The index has been positive for five months now, after being negative for 19 of the previous 20 months.

Weekly Initial Unemployment Claims

by Calculated Risk on 12/17/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 12, the advance figure for seasonally adjusted initial claims was 480,000, an increase of 7,000 from the previous week's revised figure of 473,000. The 4-week moving average was 467,500, a decrease of 5,250 from the previous week's revised average of 472,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Dec. 5 was 5,186,000, an increase of 5,000 from the preceding week's revised level of 5,181,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 5,250 to 467,500. This is the lowest level since September 2008.

Although falling, the level of the 4 week average is still high, suggesting continuing job losses.

House Approves Next Stimulus

by Calculated Risk on 12/17/2009 12:00:00 AM

Note: This is just the House. The Senate votes early next year.

From Reuters: U.S. House approves $155 billion jobs bill

This includes:

The bill would provide $48.3 billion for infrastructure projects that promise to get workers back on job sites by April. Highway construction projects would get $27.5 billion, while subway, bus and other transit systems would get $8.4 billion.

States would get $23 billion to pay 250,000 teacher salaries and repair school buildings, and $1.2 billion to pay for 5,500 police officers ... $23.5 billion to help pay their share of federal healthcare programs for the poor.The bill doesn't include:

Wednesday, December 16, 2009

Daily Show: Flight Delay

by Calculated Risk on 12/16/2009 09:08:00 PM

Jon Stewart's take on the bank CEOs missing the meeting with President Obama ...

Click here if the embed doesn't work.