by Calculated Risk on 12/21/2009 10:51:00 PM

Monday, December 21, 2009

House Price Indices: Case-Shiller and LoanPerformance

Earlier today I mentioned that the Fed started using First American CoreLogic's LoanPerformance House Price Index last year for the Flow of Funds report.

And also that LoanPerformance announced today that house prices fell 0.7% in October.

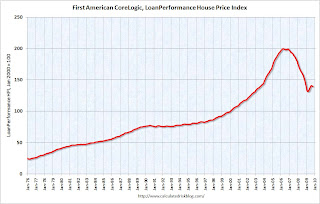

Since most people have been following Case-Shiller, here is a graph of the LoanPerformance index (with and without foreclosures) and the Case-Shiller Composite 20 index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the three indices with January 2000 = 100.

The indices mostly move together over time. Notice how the total LoanPerformance index fell further than the index excluding foreclosures - and also rebounded more.

The Case-Shiller index will probably show a decline in October - although Case-Shiller is an average of three months, so it might be a small decrease. The question is how much further will prices fall?

TARP Deadbeat List Grows to 55

by Calculated Risk on 12/21/2009 07:31:00 PM

From the WaPo: Number of delinquent bailed-out banks rises

A growing number of the recipients face financial problems and have been unable to pay the government. Fifteen banks failed to make the required payments in May, federal data show. The number climbed to 33 banks in August, and 55 banks that failed to make the dividend payments due Nov. 17.Here is the report from the Treasury.

And in excel format under Dividend and Interest Reports.

There are three permanent deadbeats on the list: CIT Group (filed bankruptcy and wiped out its $2.3 billion in TARP debt), UCBH Holdings Inc. was seized by the FDIC (TARP lost $298.7 million), and Pacific Coast National Bank was also seized by the FDIC (TARP lost $4.1 million).

Remember when the TARP capital was supposed to only go to "healthy" financial institutions?

LoanPerformance: House Prices Fall 0.7% in October

by Calculated Risk on 12/21/2009 04:53:00 PM

The Fed's favorite house price indicator from First American CoreLogic’s LoanPerformance ...

From LoanPerformance: Annual Home Prices Continue to Depreciate

On a month-over-month basis ... national home prices declined by -0.7 percent in October 2009 compared to September 2009.Prices are now falling again. It might take a month or two for this to show up in the Case-Shiller index because it is an average over three months.

...

"We are continuing to see improvements in the year-over-year home price change as prices have remained relatively stable since April," said Mark Fleming, chief economist for First American CoreLogic. "The crutches of government support for the housing market have stimulated demand and restricted supply in 2009. How these government supports are removed in 2010 will be critical to the continued stability of the housing market."

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

The index is off 7.9% over the last year, and off 30.1% from the peak.

The index has declined for two consecutive months (-0.16% in September and -0.68% in October). I'll have some comparisons to Case-Shiller later, but it appears house prices are now falling again.

More on Temporary Help

by Calculated Risk on 12/21/2009 02:43:00 PM

First a chart that is being circulated by some of the more optimistic forecasters: Click on graph for larger image.

Click on graph for larger image.

This chart compares the monthly change in temporary help services (shifted 4 months into the future) and the monthly change in total employment. Sure enough temporary help tends to lead total employment.

Note: chart uses three month average change. Source: BLS.

A number of analysts are now forecasting a surge in employment in early 2010 partially based on this chart.

This surge in temporary help is following the usual pattern as Louis Uchitelle notes in the NY Times: Labor Data Show Surge in Hiring of Temp Workers

The hiring of temporary workers has surged, suggesting that the nation’s employers might soon take the next step, bringing on permanent workers, if they can just convince themselves that the upturn in the economy will be sustained.And that is the real question: what comes next.

...

"When a job comes open now, our members fill it with a temp, or they extend a part-timer’s hours, or they bring in a freelancer — and then they wait to see what will happen next,” said William J. Dennis Jr., director of research for the National Federation of Independent Business.

I've been forecasting a strong second half for GDP since late Spring, so I'm not surprised about the pickup in Q3 and Q4 GDP. This increase in GDP has been driven by the stimulus spending, some inventory restocking, and some export growth.

But my concern is about 2010.

And this is the concern of the hiring managers mentioned in the article:

If this restocking of shelves and warehouses were to stop or slow next year, a possibility that concerns Mr. Littlefield and Ms. Baker, then the temps, freelancers and contract workers they and many other employers now use would have a harder time moving from casual to regular employment.If the recovery stalls or even slows - as I expect - then employment will not pick up sharply.

For more, including some cautionary comments from a BLS economist on using temporary help, see Tom Abate's article in the San Francisco Chronicle. And for a graph of temporary help vs. the unemployment rate, see my earlier post on Temporary Help.

Moody's: CRE Prices Off 1.5% in October

by Calculated Risk on 12/21/2009 12:23:00 PM

From Bloomberg: U.S. Commercial Real Estate Index Falls 1.5%

The Moody’s/REAL Commercial Property Price Indices fell 1.5 percent in October from September, according to data compiled by Bloomberg. Prices fell 36 percent from a year ago and are 44 percent below the peak in October 2007.Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices peaked in late 2007 and have fallen 44% from the peak and are now back to September 2002 levels. The pace of the price declines has slowed.

Notices that CRE trails residential (this is usually true for activity, but also for prices here), and that CRE prices fall quicker than residential (residential prices tend to be sticky).

OCC and OTS: Foreclosures, Delinquencies increase in Q3

by Calculated Risk on 12/21/2009 10:40:00 AM

From Jim Puzzanghera at the LA Times: Foreclosures for major sector of bank industry topped 1 million in third quarter, report says

The number of home foreclosures for a major sector of the banking industry topped 1 million for the first time in the third quarter of the year as struggles spread to homeowners with prime loans and modified mortgage payments, according to new data released today by ... the Office of the Comptroller of the Currency and the Office of Thrift Supervision.Here is the press release and report.

...

The report highlighted some troubling trends as ... Difficulties increased for holders of prime mortgages, with the percentage of those loans that were 60 days or more delinquent increasing to 3.2%, up almost 20% from the second quarter and more than double the rate of a year ago.

In addition, holders of mortgages whose payments had been lowered through government or private modification plans re-defaulted at high rates. More than half of all homeowners with modified loans fell 60 days or more behind in their payments within six months of the modification taking place.

Much of the report focuses on modifications and recidivism, but this report also shows how the foreclosure problem has moved to prime loans.

Click on graph for larger image.

Click on graph for larger image.This report covers about 65% of all mortgages. There are far more prime loans than subprime loans - and the percentage of delinquent prime loans is much lower than for subprime loans. However, there are now significantly more prime loans than subprime loans seriously delinquent. And prime loans tend to be larger than subprime loans, so the losses from each prime loan will probably be higher.

Overall, mortgage performance continued to decline as a result of continuing adverse economic conditions including rising unemployment and loss in home values. The percentage of current and performing mortgages fell to 87.2 percent of the servicing portfolio. Seriously delinquent mortgages loans 60 or more days past due and loans to delinquent bankrupt borrowers—rose to 6.2 percent of the servicing portfolio. Foreclosures in process increased to 3.2 percent, while new foreclosure actions remained steady for the third consecutive quarter at 369,209. Of particular note, delinquencies among prime mortgages, the largest category of mortgages, continued to climb. The percentage of prime mortgages that were seriously delinquent in the third quarter was 3.6 percent, up 19.6 percent from the second quarter and more than double the percentage of a year ago.

emphasis added

The second graph shows foreclosure activity.

Notice that foreclosure in process are increasing sharply, but completed foreclosures were only up slightly.

The next wave of completed foreclosures is about to break, but the size of the wave depends on the modification programs.

There was some good news on redefaults:

The percentage of modified loans 60 or more days delinquent or in process of foreclosure increased steadily in the months subsequent to modification (see Table 2 [see below]). Modifications made after the third quarter of 2008 appeared to perform relatively better than older vintages. The most recent modifications made in the second quarter of 2009 had the lowest percentage of mortgages (18.7 percent) that were 60 or more days delinquent three months subsequent to modification. This lower three-month re-default rate may be an early indicator of sustainability for loan modifications that reduce monthly payments.

For earlier modifications, the redefault rates was around 60% after 12 months, but the little bit of good news is "only" 18.7% of recent modifications have redefaulted with 3 months (this is lower than the previous modifications). I expect a large percentage of the homeowners to redefault eventually because the modification efforts still leave the homeowners with significant negative equity (they are more renters than owners).

For earlier modifications, the redefault rates was around 60% after 12 months, but the little bit of good news is "only" 18.7% of recent modifications have redefaulted with 3 months (this is lower than the previous modifications). I expect a large percentage of the homeowners to redefault eventually because the modification efforts still leave the homeowners with significant negative equity (they are more renters than owners).

Flow of Funds: Change in House Price Index

by Calculated Risk on 12/21/2009 09:34:00 AM

Yesterday I was sent an email arguing that the Fed was now using the Case-Shiller index for the Flow of Funds report. This is not correct.

Here is what actually happened (ht Nancy Vanden Houten at SMRA):

1) Starting with the Q3 2008 report, the Federal Reserve switched from the OFHEO / FHFA house price index to the LoanPerformance house price index. From the Fed in the notes to the Q3 2008 report:

The market value of residential real estate (B.100, B.102, and B.103) has been revised from 2000:Q1 forward to reflect improved data sources. The value of owner-occupied housing in 2001:Q3, 2003:Q2, and 2005:Q2 is now benchmarked to data from the American Housing Survey, and changes in the value of single-family homes in non-benchmark quarters are now estimated using a repeat-sales house-price index from LoanPerformance (a division of First American CoreLogic). Previously we used a price index from the Federal Housing Finance Agency (formerly the Office of Federal Housing Enterprise Oversight).2) LoanPerformance revised their index in Q3 2009, and this showed up as a substantial change for household real estate value. From the Q3 2009 report:

The market value of residential real estate (B.100, B.102, and B.103) has been revised from 2000:Q1 forward to reflect revised data for the repeat-sales house-price index from LoanPerformance (a division of First American CoreLogic).The reason this change wasn't obvious in Q3 2008 was that the value of household real estate didn't change significantly for the most recent quarters (although using the LoanPerformance index showed a larger bubble).

The following graph shows the value of household real estate from the Flow of Funds report for all the reports since Q2 2008.

Q2 2008 was based on the FHFA / OFHEO index (blue).

All other reports were based on the LoanPerformance index.

The LoanPerformance index was revised significantly in Q3 2009 (red).

Click on table for larger image in new window.

Click on table for larger image in new window.When the Fed switched to the LoanPerformance index there was a relatively small change to the value in Q2 2008, so I missed this change.

However when the LoanPerformance index was revised in Q3, the value of household real estate plunged by over $2 trillion in Q2 2009! That stood out.

Thanks again to Nancy.

Chicago Fed Index: Some Improvement in Economic activity in November

by Calculated Risk on 12/21/2009 08:31:00 AM

From the Chicago Fed: Index shows economic activity improved in November

Led by improvements in production-related and employment-related indicators, the Chicago Fed National Activity Index increased to –0.32 in November, up sharply from –1.02 in October.

...

The index’s three-month moving average, CFNAI-MA3, increased to –0.77 in November from –0.87 in October. November’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The level of activity, however, remained in a range that has historically been consistent with the early stages of a recovery following a recession.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"When the economy is coming out of a recession, the CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough. Specifically, after the onset of a recession, when the index first crosses +0.20, the recession has ended according to the NBER business cycle measures. ... The critical question is: how early does the CFNAI-MA3 reveal this turning point? For four of the last five recessions, this happened within five months of the business cycle trough."Although improved in November, the Chicago Fed National Activity Index is still negative. According to Chicago Fed, it is still early to call the official recession over.

Sunday, December 20, 2009

Greece, Dubai Updates

by Calculated Risk on 12/20/2009 09:34:00 PM

From the WSJ: ECB Member Says No Bailouts

The European Central Bank won't bail out debt-stricken member states such as Greece, which must repair its public finances on its own, ECB governing council member Ewald Nowotny said.And from Bloomberg: Dubai World May Not Present Standstill Offer Yet, Bankers Say

"One has to be very clear: The ECB has no mandate or intention to take into account the situation of a specific country, especially not with regard to public finances," he said in an interview late Friday.

...

The ECB said Friday that it expected banks in the euro zone to see much higher losses than it had previously thought, mainly from their exposure to Eastern Europe and commercial real estate.

Dubai World ... may be unable to present a “standstill” offer to lenders today as the terms of government support for the state-owned holding company have yet to be agreed, two bankers involved in the talks said.No updates on Spain, Ireland and Eastern Europe, but sovereign debt will remain a hot topic.

The complexity of Dubai World Group and its funding structure are to blame for the delay, one banker said ...

For a summary of the last week and a look ahead, please see my earlier post. Best to all.

The Lost Decade

by Calculated Risk on 12/20/2009 06:31:00 PM

We've discussed this several times, and I expect to see a number of articles about the lost decade for the stock market and employment over the next few weeks.

From the WSJ: Stocks' 'Nightmare' Decade

In nearly 200 years of recorded stock-market history, no calendar decade has seen such a dismal performance as the 2000s.This is definitely a "quirk of the calendar", but is has been a difficult 10 years.

Investors would have been better off investing in pretty much anything else, from bonds to gold or even just stuffing money under a mattress.

...

It edges out the 0.2% decline stocks suffered during the Depression years of the 1930s, which up until now held the title of worst decade.

...

To some degree these statistics are a quirk of the calendar, based on when the 10-year period starts and finishes. The 10-year periods ending in 1937 and 1938 were worse ...

On employment, there were 130,532,000 payroll jobs in December 1999, and 130,996,000 payroll jobs in November 2009; an increase of 464 thousand jobs. However the preliminary estimate of the annual benchmark revision "indicates a downward adjustment to March 2009 total nonfarm employment of 824,000". So it appear there will be fewer payroll jobs at the end of the aughts than at the beginning.

Of course another argument is the decade actually started on Jan 1, 2001 (not 2000) and that is similar to the debate over when the millennium started and ended - but I think most people partied like it was 1999!