by Calculated Risk on 12/24/2009 10:09:00 AM

Thursday, December 24, 2009

Banks Betting on the Housing Crash

I linked to this in early November ...

From Greg Gordon at McClatchy Newspapers: How Goldman secretly bet on the U.S. housing crash

And now from the NY Times: Banks Bundled Bad Debt, Bet Against It and Won

Weekly Initial Unemployment Claims

by Calculated Risk on 12/24/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 19, the advance figure for seasonally adjusted initial claims was 452,000, a decrease of 28,000 from the previous week's unrevised figure of 480,000. The 4-week moving average was 465,250, a decrease of 2,750 from the previous week's revised average of 468,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Dec. 12 was 5,076,000, a decrease of 127,000 from the preceding week's revised level of 5,203,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 2,750 to 465,250. This is the lowest level since September 2008.

Although falling, the level of the 4 week average is still high, suggesting continuing job losses.

Wednesday, December 23, 2009

A Summary of Housing Posts Today

by Calculated Risk on 12/23/2009 10:02:00 PM

It was a busy day ...

And a non-housing related post:

Best to all

As HAMP Fails, Treasury Flails

by Calculated Risk on 12/23/2009 06:43:00 PM

Update: the title just rhymes. HAMP hasn't "failed", but it is definitely struggling.

From Bloomberg: Homeowners Get More Time for Home-Loan Modifications

Mortgage servicers must give U.S. homeowners more time before kicking them out of the government’s loan-modification program ... Servicers can’t cancel an active Home Affordable trial modification scheduled to expire before Jan. 31 for any reason other than property eligibility requirements, according to a posting today on a government Web site. ...Extend and pretend. Fail and flail.

“The Treasury Department believes that this further guidance and associated requirements will provide more certainty and transparency regarding the final determination of eligibility for borrowers in trial modifications,” Meg Reilly, a department spokeswoman, said in an e-mailed statement.

Here is the press release: Supplemental Directive 09-10 Implements Temporary Review Period for Active HAMP Trial Modifications (ht Effective Demand)

In order to provide servicers an opportunity to remain focused on converting eligible borrowers to permanent HAMP modifications, effective today and lasting through January 31, 2010, Treasury is implementing a review period for all active HAMP trial modifications scheduled to expire on or before January 31, 2010. Active HAMP trial modifications include trial modifications that have been submitted to the Treasury system of record that have not been cancelled by the servicer.

During this review period, servicers should continue to convert eligible borrowers in active HAMP trial modifications to permanent HAMP modifications as quickly as possible in accordance with existing program guidance. Servicers may not cancel an active HAMP trial modification during this period for any reason other than failure to meet the HAMP property eligibility requirements.

During this review period, servicers must confirm the status of borrowers in active HAMP trial modifications scheduled to expire on or before January 31, 2010 as either current or not current. Servicers must also confirm which, if any, documents are due from borrowers. Servicers must send written notification to borrowers as appropriate to inform them that they are at risk of losing eligibility for a permanent HAMP modification because the borrower has (i) failed to make all required trial period payments, (ii) failed to submit all required documentation, or (iii) failed both to make all required trial period payments and to submit all required documentation. The notice must provide the borrower with the opportunity to correct any error in the servicer’s records or submit any missing documents or payments within 30 days of the notice or through January 31, 2010, whichever is later. If a borrower provides evidence of the servicer’s error or corrects the deficiency within the timeframe provided, the servicer must consider the new information and determine if the borrower is eligible to continue in the HAMP modification process.

See-through Hotels

by Calculated Risk on 12/23/2009 05:07:00 PM

With record low occupancy rates (lowest since the Great Depression), it isn't surprising that some hotels are just closing down ...

From the Daily Herald: Arlington Heights Sheraton, Coco Key water park to close (ht Doug)

Barring a last-minute rescue, the 14-story [Sheraton Chicago Northwest] hotel at 3400 W. Euclid Ave., as well as the 65,000-square-foot indoor CoCo Key Water Resort, will cease operation at 5 p.m. Dec. 28.And from the Chicago Tribune: Wyndham O'Hare hotel in Rosemont to close on Jan. 1

...

CoCo Key opened in January, 2007, at a cost of $25 million.

As the largest hotel in Arlington Heights, the Sheraton's closure amounts to a huge loss for the village in terms of sales tax revenues and jobs.

The Wyndham O'Hare at Rosemont will close a week from Friday ... The closing of the 12-floor, 466-room hotel comes at a time of declining revenue in the hotel industry and a struggling convention industry in Chicago. ...See-through hotels!

The hotel defaulted on a loan at the same time that the bank holding the loan was ... seized in October ... The new owner of the loan, U.S. Bank, was not willing to advance the funds needed to keep the hotel open while in default ...

Residential Investment: Moving Sideways

by Calculated Risk on 12/23/2009 02:24:00 PM

Weak new home sales and housing starts is both good and bad news.

One of the key economic problems right now is there are too many housing units1. This excess inventory includes a large number of single family homes, and a record number of vacant rental units. So fewer housing starts means population and household growth will absorb the excess housing units quicker. So weak new home sales and housing starts is good news for the housing market.

Unfortunately new home sales and housing starts are key drivers out of a recession for both GDP growth and employment. So weak new home sales and housing starts is bad news for the economy and employment.

Here is how it usually works: Housing leads the economy out of the recession, and more housing starts means more jobs, and that leads to more household formation, and that means more housing unit absorption - and that means more housing starts! A virtuous cycle.

However, with sluggish growth in housing starts, job growth will be sluggish, and that means slower housing unit absorption. A sluggish and choppy recovery. And I believe that is the current situation.

It was good news - for the economy - when housing starts and new home sales appeared to reach a bottom earlier this year. That meant the job losses in residential construction would slow and eventually stop.

However the "good" news for housing could only go so far until the huge overhang of existing homes and rental units is reduced. And now the news flow appears to be changing from positive housing news, to moving sideways (or even down).

I don't expect another plunge in housing starts or new home sales, but I think the recovery will be sluggish. And I also expect house prices to fall further, probably to new post-bubble lows nationally - although it is possible that the new lows will only be in real terms (not nominal). The good news on house prices is that most of the price correction is behind us on a national basis, however I expect some areas will still see significant price declines.

Here is a review of recent housing data showing the sluggish recovery (excluding existing home sales that have minimal impact on employment and the economy):

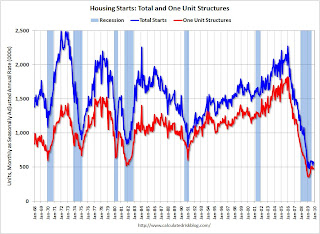

Housing Starts Click on graph for larger image in new window.

Click on graph for larger image in new window.

Housing starts are now moving sideways ...

Total housing starts were at 574 thousand (SAAR) in November, up 8.9% from the revised October rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for six months.

Single-family starts were at 482 thousand (SAAR) in November, up 2.1% from the revised October rate, and 35 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for six months.

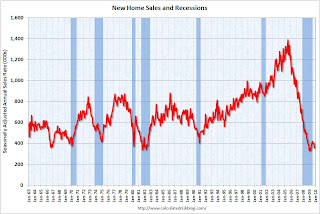

New Home Sales New Home sales are now moving sideways ...

New Home sales are now moving sideways ...

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 8% above the low in January.

Sales of new one-family houses in November 2009 were at a seasonally adjusted annual rate of 355,000 ... This is 11.3 percent (±11.0%) below the revised October rate of 400,000 and is 9.0 percent (±15.3%)* below the November 2008 estimate of 390,000.Builder Confidence

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 16 in December. This is a decline from 17 in November. The record low was 8 set in January.

More moving sideways ...

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

MBA Purchase Index

This graph shows the MBA Purchase Index and four week moving average since 1990.

This graph shows the MBA Purchase Index and four week moving average since 1990.The four week average is close to a 12 year low, and has declined sharply over the last two months.

Although there is a large percentage of cash buyers now, the decline in the purchase application index suggests further weakness in home sales.

House Prices

LoanPerformance announced this week that house prices fell 0.7% in October.

Since most people have been following Case-Shiller (to be released next Tuesday), here is a graph of the LoanPerformance index (with and without foreclosures) and the Case-Shiller Composite 20 index.

This graph shows the three indices with January 2000 = 100.

This graph shows the three indices with January 2000 = 100.The indices mostly move together over time. Notice how the total LoanPerformance index fell further than the index excluding foreclosures - and also rebounded more.

The Case-Shiller index will probably show a decline in October too.

Residential Investment

Residential investment (mostly new home sales and home improvement) usually leads the economy out of a recession.

This graph shows that Residential investment (RI) had declined for 14 consecutive quarters, and then increased slightly in Q3 2009.

This graph shows that Residential investment (RI) had declined for 14 consecutive quarters, and then increased slightly in Q3 2009.Usually residential investment recovers quickly coming out of a recession. However look at the '90/'91 recession - residential investment recovered slowly, and so did employment (a jobless recovery). I expect the recovery in residential investment to be sluggish this time too. Note that the '01 recession was business led (the stock market bust).

1 The excess housing unit problem could be fixed by lower house prices and lower rents. Rents are now falling, and house prices have started falling again - so that will help.

Ratio of Existing to New Home Sales at Record High

by Calculated Risk on 12/23/2009 11:14:00 AM

Here is more on the "distressing gap" between existing and new home sales.

The following graph shows the ratio of existing home sales divided by new home sales through November. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This ratio has increased again to a new all time high.

The ratio of existing to new home sales increased at first because of the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent increase in the ratio was partially due to the timing of the first time homebuyer tax credit (before the extension) - and partially because the tax credit spurred existing home sales more than new home sales.

On timing issues: New home sales are counted when the contract is signed, and usually before construction begins. So to close before the original Dec 1st deadline, the contract had to be signed early this Summer. Existing home sales are counted when escrow closes. And the recent surge in existing home sales was primarily due to buyers rushing to beat the tax credit.

November will probably remain the record high since existing home sales will decline sharply in December. The second graph shows the same information with existing home sales (left axis), and new home sales (right axis). This is updated through the November data released this morning.

The second graph shows the same information with existing home sales (left axis), and new home sales (right axis). This is updated through the November data released this morning.

Although distressed sales will stay elevated for some time, I expect this gap to eventually close.

The ratio could decline because of an increase in new home sales, or a decrease in existing home sales - I expect a combination of both over time.

New Home Sales Decrease Sharply in November

by Calculated Risk on 12/23/2009 10:00:00 AM

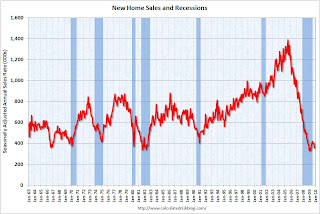

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 355 thousand. This is a sharp decrease from the revised rate of 400 thousand in October (revised down from 430 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

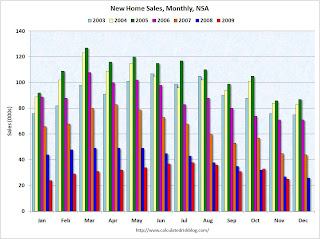

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. In November 2009, a record low 25 thousand new homes were sold (NSA); the previous record low was 26 thousand in November 1966.

Sales in November 2009 were below November 2008 (27 thousand).  The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 8% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 8% above the low in January.

Sales of new one-family houses in November 2009 were at a seasonally adjusted annual rate of 355,000 ... This is 11.3 percent (±11.0%) below the revised October rate of 400,000 and is 9.0 percent (±15.3%)* below the November 2008 estimate of 390,000.And another long term graph - this one for New Home Months of Supply.

There were 7.9 months of supply in November - significantly below the all time record of 12.4 months of supply set in January.

There were 7.9 months of supply in November - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of November was 235,000. This represents a supply of 7.9 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, and sales have probably bottomed too. New home sales are far more important for the economy than existing home sales, and new home sales will remain under pressure until the overhang of existing housing inventory declines much further.

Obviously this is a very weak report. I'll have more later ...

November PCE and Saving Rate

by Calculated Risk on 12/23/2009 08:30:00 AM

From the BEA: Personal Income and Outlays, November 2009

Personal income increased $49.7 billion, or 0.4 percent, and disposable personal income (DPI) increased $54.1 billion, or 0.5 percent, in November, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $47.9 billion, or 0.5 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in November, compared with an increase of 0.4 percent in October.

...

Personal saving -- DPI less personal outlays -- was $525.1 billion in November, compared with $516.7 billion in October. Personal saving as a percentage of disposable personal income was 4.7 percent in November, the same as in October.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the November Personal Income report. The saving rate was 4.7% in November.

I expect the saving rate to continue to rise - possibly to 8% or more - slowing the growth in PCE.

The following graph shows real Personal Consumption Expenditures (PCE) through November (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

Using the two-month method for estimating Q4 PCE growth gives an estimate of just under 1%. However - note that PCE in August was distorted by the cash-for-clunkers program. So my guess is PCE growth in Q4 will be around 1.7%.

MBA: Mortgage Applications Decrease Sharply

by Calculated Risk on 12/23/2009 07:24:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume decreased 10.7 percent on a seasonally adjusted basis from one week earlier. ...Rates are probably back above 5% now.

The Refinance Index decreased 10.1 percent from the previous week and the seasonally adjusted Purchase Index decreased 11.6 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages remained flat at 4.92 percent, with points increasing to 1.23 from 1.08 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Note: In the past the MBA index was somewhat predictive of future sales - and was a favorite indicator of Alan Greenspan, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining. Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase.

However it is hard to ignore the sharp decline in purchase applications over the last couple of months.