by Calculated Risk on 12/26/2009 09:17:00 PM

Saturday, December 26, 2009

Jim the Realtor: "Flippers Galore"

A flipper is trying for $1 million profit on this ocean front home. Jim says this guy has flipped 271 properties this year ...

Inventories and Q4 GDP

by Calculated Risk on 12/26/2009 05:49:00 PM

Back in October, as a preview to the Q3 GDP report, I wrote: Inventory Restocking and Q3 GDP

I noted that GDP growth in Q3 and Q4 weren't in question because of a transitory boost from changes in private inventories and from stimulus spending.

Here is a repeat of the graph showing the contributions to GDP from changes in private inventories for the last several recessions. The blue shaded area is the last two quarters of each recession, and the light area is the first four quarters of each recovery. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Red line is the median of the last 5 recessions - and indicates about a 2% contribution to GDP from changes in inventories, for each of the first two quarters coming out of a recession.

The key is this boost is transitory.

Last quarter I thought a 1% to 2% contribution from changes in inventories was possible. The actual contribution was 0.69%. I suspect that changes in inventories will add more to Q4; probably closer to 2%.

I also thought Personal Consumption Expenditures (PCE) would be fairly strong in Q3, especially because of the cash-for-clunkers program. My guess was "3% PCE growth in Q3, and that would mean a contribution to GDP of about 2%." The final numbers were 2.8% and a contribution of 1.96%.

The following graph shows real Personal Consumption Expenditures (PCE) through November 2009 (in 2005 dollars). Note that the y-axis doesn't start at zero to better show the change. The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

Using the "two-month method" for estimating Q4 PCE growth gives an estimate of just under 1%. However - note that PCE in August was distorted by the cash-for-clunkers program (and that impacts the two-month method). So my guess is PCE growth in Q4 will be around 1.7% or a contribution to GDP of 1.2% or so. (less than the growth in Q3).

As I've noted, residential investment has been moving sideways, although that will show up more in Q1 2010 than in Q4. So we can add in a positive contributions from net exports, some increase in residential investment (although smaller than in Q3), an increase in equipment and software investment - and subtract out investment in non-residential structures - and Q4 should look pretty healthy.

In a reserach note this week, Ed McKelvey at Goldman Sachs called the 2nd half "ho-hum":

"At a time of the year when ho-ho-ho is the catchword, the first six months of the US economic recovery look distinctly ho-hum following the latest reports. ... Although we continue to estimate a 4% growth rate for the fourth quarter, with upside risk to that figure, the composition of this growth is not strong. Almost half of it comes from a sharp slowing in the rate at which inventories are being drawn down ..."

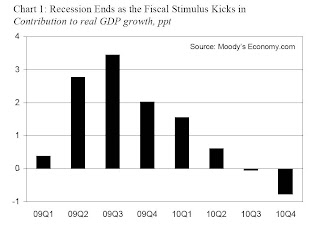

And it is probably a good time to repeat this graph from economy.com's Mark Zandi suggesting the greatest impact from the stimulus package is now behind us.

And it is probably a good time to repeat this graph from economy.com's Mark Zandi suggesting the greatest impact from the stimulus package is now behind us.This suggests that all of the growth in Q3 was due to the stimulus package (and then some), and the impact is now waning - only 2% in Q4, and 1.5% in Q1 2010 - and then the impact on GDP growth will be negative in the 2nd half of 2010.

As "ho-hum" as the 2nd half of 2009 was, I expect GDP growth to be more sluggish in 2010 for the following reasons:

So I still think GDP growth will be sluggish in 2010, with downside risks.

Note: There are several upside and downside risks to this view.

Fannie, Freddie and the Struggles of HAMP

by Calculated Risk on 12/26/2009 01:08:00 PM

Note: As I noted, this was just speculation ...

It is possible that the Treasury directive on Wednesday to extend the review period for all active HAMP trial modifications until at least Jan 31, 2010, and the announcement on Thursday to uncap the potential losses for Fannie and Freddie are somewhat related.

There is a possibility that the Treasury is planning on introducing a principal reduction component to HAMP in January, and this could lead to significantly larger losses for Fannie and Freddie (just speculation on my part). There has been no announcement yet, and even if this is proposed it might only apply to Fannie and Freddie related loans, and not private MBS (the number of Fannie/Freddie loans compared to private MBS varies significantly by servicer).

In general HAMP is a fine modification program, but its reach is limited. As I noted in February when the program was announced:

[A] problem with Part 2 is that this lowers the interest rate for borrowers far underwater, but other than the $1,000 per year principal reduction and normal amortization, there is no reduction in the principal. This probably leaves the homeowner far underwater (owing more than their home is worth). When these homeowners eventually try to sell, they will probably still face foreclosure - prolonging the housing slump. These are really not homeowners, they are debtowners / renters.Of course Treasury initially oversold the HAMP program claiming the initiative would "reach up to 3 to 4 million at-risk homeowners". Now they are defining "reach" as being "offered to".

The key problem for the Treasury is they are concerned house prices will become unglued again if another flood of foreclosures hit the market. And this in turn could lead to further losses for the banks.

Freddie Mac economist: 6% Mortgage rates by end of 2010

by Calculated Risk on 12/26/2009 11:30:00 AM

From Dina ElBoghdady at the WaPo: Freddie sees mortgage rates hitting 6% in 2010

[T]he average rate on a 30-year, fixed-rate mortgage rose to 5.05 percent this week and could climb to 6 percent by the end of 2010, if not sooner, according to giant mortgage financier Freddie Mac.This is similar to the comments made by Mark Zandi of economy.com earlier in the week:

...

The key catalyst for interest rates going forward will be the end of a Federal Reserve program that buys a sizable chunk of mortgage-backed securities issued by firms such as Fannie Mae and Freddie Mac. ... the Fed has committed to winding down the program by March.

...

Amy Crews Cutts, deputy chief economist at Freddie Mac, said interest rates are bound to rise to 6 percent by the end of 2010 because private buyers will demand a higher rate of return on the securities than the Fed did.

"If you told me by the end of 2010 a 30-year rate was at 6 percent, that sounds about right," says Mark Zandi, chief economist at Moody's. "I don't think there's any question rates are headed up."Rates are definitely moving up, and they will move higher as the Fed winds down the MBS purchase program. Although 6% is possible, I'll take the under in 2010. The reason is I think the recovery will be sluggish and choppy - and that will keep rates down.

Note: Some people think 30 year mortgage rates will increase 100 bps or even 200 bps when the Fed stops buying MBS - so they expect 6% to 7% mortgage rates by April - but I think that estimate is too high.

Doubling Your Money while Earning 0.01 Percent

by Calculated Risk on 12/26/2009 07:49:00 AM

Something every saver knows ...

From Stephanie Strom at the NY Times: At Tiny Rates, Saving Money Costs Investors

The elderly and others on fixed incomes have been especially hard hit. Many have seen returns on savings, C.D.’s and government bonds drop to niggling amounts recently ...That is what my statement says too - not exactly the best return. But in less than 7,000 years the money will double!

" ... what’s going to happen now as C.D.’s mature is that retirees and the elderly are going to take anywhere from a half to three-quarters ... cut in their incomes,” said Joe Parks, a retired accountant in Houston ...

“What the average citizen doesn’t explicitly understand is that a significant part of the government’s plan to repair the financial system and the economy is to pay savers nothing and allow damaged financial institutions to earn a nice, guaranteed spread,” said [Bill Gross of PIMCO] ... Mr. Gross said he read his monthly portfolio statement twice because he could not believe that the line “Yield on cash” was 0.01 percent. At that rate, he said, it would take him 6,932 years to double his money.

Friday, December 25, 2009

Unofficial Problem Bank List: 545 Banks

by Calculated Risk on 12/25/2009 10:06:00 PM

The FDIC is on holiday, but not surferdude808 (He says Merry Christmas!)

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

Last week’s closures had a large impact on the Unofficial Problem Bank List. Seven institutions with $14.5 billion in assets were removed from last week’s list because of failure.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

The failures included First Federal Bank of California ($6.1 billion), Imperial Capital Bank ($4.1 billion), Peoples First Community Bank ($1.8 billion), New South Federal Savings Bank ($1.5 billion), Independent Bankers' Bank ($584 million), and Rockbridge Commercial Bank ($294 million). Other removals include Manatee River Community Bank ($152 million), which merged with First America Bank, Osprey, FL; and Golden First Bank ($25 million), as the OTS terminated its formal action.

Regulators did deliver some not so good Christmas gifts this week as formal actions were issued to three institutions including Midwest Bank and Trust Company, Elmwood Park, IL ($3.5 billion); Centrue Bank, Streator, IL ($1.3 billion); and Bayside Savings Bank, Port Saint Joe, FL ($86 million).

With these changes, the Unofficial Problem Bank List includes 545 institutions with aggregate assets of $295.6 billion.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Happy Holidays

by Calculated Risk on 12/25/2009 05:00:00 PM

A holiday tradition - from Tanta's 2007 Post: A Very Nerdy Christmas (see her post for an explanation of the origins of the Mortgage Pig™)

With the new rules for Fannie and Fredde, maybe it should be "Is that a Pig? No, it's Fannie Mae!"

Happy Holidays to all! CR

Happy Holidays

by Calculated Risk on 12/25/2009 11:59:00 AM

From the Yosemite Association, a live web cam view of Half Dome in Yosemite. Happy Holidays to all!

Some Holiday Music

by Calculated Risk on 12/25/2009 08:59:00 AM

Peter Cetera (formerly of the band "Chicago") and his daughter Claire perform Blue Christmas in 2008 with Sasha.

Sasha hasn't competed since the World Championships in March 2006, but she will be making a comeback at the U.S. Championships on Jan 21st (short) and Jan 23rd (long) in Spokane.

Thursday, December 24, 2009

Hotel RevPAR Off only 5.6%

by Calculated Risk on 12/24/2009 10:10:00 PM

From HotelNewsNow.com: STR reports US performance for week ending 19 December

In year-over-year measurements, the industry’s occupancy declined 0.5 percent to end the week at 42.6 percent. Average daily rate dropped 5.2 percent to finish the week at US$87.98. Revenue per available room for the week decreased 5.6 percent to finish the period at US$37.47. The 0.5-percent occupancy decrease was the best full-week performance of the year for that metric. The 5.2-percent ADR drop was the third best full-week performance of the year behind two consecutive weeks in January. The 5.6-percent fall in RevPAR was the best full-week performance of the year.

A major snow storm on the East Coast and easier year-over-year comparisons helped buoy the numbers.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Note: Some of the holidays don't line up - especially at the end of the year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com (Note: They have a free daily email too for hotel news)

As I've been mentioning, there is now growing evidence that the hotel industry has stabilized at this low occupancy rate, although room rates will still be under pressure because this is the lowest occupancy rate (annual) since the Great Depression.

The end of the year can be a little confusing because of the holidays, and the next key week will be mid-to-late January to see if business travel is picking up in 2010.