by Calculated Risk on 12/28/2009 06:36:00 PM

Monday, December 28, 2009

Treasury and GSEs: A Failure to Communicate

Last Thursday, Treasury issued an Update on Status of Support for Housing Programs. One of the key points was to increase the cap on Treasury's funding commitment "to accommodate any cumulative reduction in net worth over the next three years".

Here were the reasons given:

Treasury will also amend the terms of its agreements with Fannie Mae and Freddie Mac to support their ongoing stability. The steps outlined today are necessary for preserving the continued strength and stability of the mortgage market.and

emphasis added

The amendments to these agreements announced today should leave no uncertainty about the Treasury's commitment to support these firms as they continue to play a vital role in the housing market during this current crisis.Why not just be explicit and explain the reasons for the change?

I speculated on Saturday that this might have something to do with more modifications. Others thought this was possible, from MarketWatch:

The government may put a mortgage-modification effort, called the Home Affordable Modification Program, or HAMP, into overdrive in coming years, pushing for reductions in the principal outstanding on home loans overseen by Fannie and Freddie, Bose George, an analyst at Keefe, Bruyette & Woods, wrote in a note to investors Monday.Others thought this was wrong, from housing economist Tom Lawler today:

[A] few folks postulated that the Treasury’s move to explicitly up the government’s potential support for Fannie and Freddie might be related to plans by the Treasury to expand the HAMP to include a principal reduction plan, which would accelerate losses on HAMP modifications. I have no clue what’s going on in the minds of Treasury officials, I very much doubt that any such change in the cards soon.Note: of course HAMP already allows principal reductions, but servicers receive no additional subsidy for principal reduction.

Credit Suisse argued that this increases the prospect of "large-scale voluntary buyouts" of delinquent mortgages guaranteed by Fannie and Freddie. Other analysts have argued this could be related to the adoption of FAS 166/167 in January.

And still another analyst suggested Fannie and Freddie would become the world’s biggest SIVs, and he viewed this as an attempt to hold down mortgage rates after the conclusion of the Fed's program to purchase MBS.

Dean Baker wrote at the HuffPost: Fannie Mae and Freddie Mac: Just a Four-Letter Word?

Since Fannie and Freddie went into conservatorship in September of 2008, it has been explicit policy that the government would back up their debt. Originally, $200 billion was committed for this purpose. That amount was subsequently doubled to $400 billion ... [T]he Obama administration should make its case to the public and explain how losses could conceivably run above $400 billion (credit markets don't need reassurance against inconceivable events).And that is really the bottom line: Why did Treasury release this on Christmas Eve with essentially no explanation. This has just lead to speculation and confusion. Why not be explicit? Why should we have to guess?

"What we've got here is ... failure to communicate." (from Cool Hand Luke)

Market Update

by Calculated Risk on 12/28/2009 03:55:00 PM

Since it has been a while ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today. The S&P 500 was first at this level in April 1998; over 11 1/2 years ago.

The S&P 500 is up 67% from the bottom (451 points), and still off 28% from the peak (438 points below the max).

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Credit Suisse: Uncapping Fannie, Freddie Losses Allow for ‘Large-Scale’ Buyouts

by Calculated Risk on 12/28/2009 12:52:00 PM

From Bloomberg: Fannie, Freddie Changes Clear Way for ‘Large-Scale’ Buyouts

The U.S. government’s expanded capital backstops and portfolio limits for Fannie Mae and Freddie Mac increase “the prospect of large-scale” purchases by the companies of delinquent mortgages out of the securities they guarantee, according to Credit Suisse Group analysts.Tanta discussed this possibility a couple of years ago:

...

“This announcement increases the prospect of large-scale voluntary buyouts by removing the portfolio cap hurdle and helping funding by potentially increasing debt-investor confidence,” Mahesh Swaminathan and Qumber Hassan, the Credit Suisse debt analysts in New York, wrote in a report yesterday.

Fannie Mae has always had the option to repurchase seriously delinquent loans out of its MBS at par (100% of the unpaid principal balance) plus accrued interest to the payoff date. This returns principal to the investors, so they are made whole. If Fannie Mae can work with the servicer to cure these loans, they become performing loans in Fannie Mae’s portfolio. If they cannot be cured, they are foreclosed, and Fannie Mae shows the charge-off and foreclosure expense on its portfolio’s books (these are no longer on the MBS’s books, since the loan was bought out of the MBS pool).I suspect the uncapping the losses of Fannie and Freddie is related to modifications (update: others don't think this has anything to do with mods)

Now, Fannie also sometimes has the obligation to buy loans out of an MBS pool. But we are—Fannie Mae made this clear both in the footnote to Table 26 of the Q and in the conference call—talking about optional repurchases. Why would Fannie Mae buy nonperforming loans it doesn’t have to buy? Because it has agreed to workout efforts on these loans, including but not necessarily limited to pursuing a modification. Under Fannie Mae MBS rules, worked out loans have to be removed from the pools (and the MBS has to receive par for them, even if their market value is much less than that).

emphasis added

Divergent Views on Treasury Yields in 2010

by Calculated Risk on 12/28/2009 10:46:00 AM

Here are a couple of stories with very different views ...

From Bloomberg: Morgan Stanley Sees 5.5% Note as U.S. Faces Deficits (ht Bob_in_MA)

Yields on benchmark 10-year notes will climb about 40 percent to 5.5 percent, the biggest annual increase since 1999, according to David Greenlaw, chief fixed-income economist at Morgan Stanley in New York. The surge will push interest rates on 30-year fixed mortgages to 7.5 percent to 8 percent, almost the highest in a decade, Greenlaw said.And the LA Times has comments from PIMCO's El Erian (Update: the article is not clear when El Erian made these comments, but the article is dated Dec 27, 2009):

El-Erian says people are fooling themselves if they think all the bullish data of late means a strong recovery is in the offing. So he's buying Treasurys and selling riskier stuff.Earlier Greenlaw argued that the Fed would start raising rates in the 2nd half of 2010 because of rising inflation, even with a fairly weak economy. I think it is unlikely that the Fed will raise rates in 2010 (although possible) - and I'll definitely take the under on Greenlaw's 2010 prediction of 7.5%+ rates on 30-year fixed mortgages - that seems extremely unlikely.

His bet: Investors will get scared again and want U.S.-guaranteed debt so they know they'll get repaid.

CRE: Office Space Update

by Calculated Risk on 12/28/2009 08:48:00 AM

The Square Feet Commercial Real Estate Blog has a post on a new lease signed in San Jose for 188 thousand square feet: (ht Eric)

Talk about a low effective rent. Not only is the tenant getting two years free rent, but the tenant improvements are about 4 years of rent (the lease is triple net, so the tenant is also paying taxes, insurance and maintenance).10-Year Term September 1, 2010 commencement 2-Years Free Rent $1.90 NNN start (year 3), with $.10 annual bumps (CR update: Monthly rent) $100 PSF Tenant Improvement dollars (over shell) Right to cancel after 7 years

And the tenant can cancel after 7 years ... the landlord is mostly just covering expenses.

To review - at the end of Q3, Reis reported the national office vacancy rate rose to 16.5% in Q3 from 15.9% in Q2. We should have the Q4 numbers in early January.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the office vacancy rate starting 1991.

The peak following the previous recession was 17%.

I've also heard there has been a sharp increase in occupied available space (tenants planning to downsize), suggesting the vacancy rate could increase significatly in 2010.

NY Times: Recession Cases Flooding Courts

by Calculated Risk on 12/28/2009 12:31:00 AM

A couple of earlier posts:

From William Glaberson at the NY Times: The Recession Begins Flooding Into the Courts (ht Liam)

New York State’s courts are closing the year with 4.7 million cases — the highest tally ever — and new statistics suggest that courtrooms are now seeing the delayed result of the country’s economic collapse.And this is apparently happening all across the country.

...

New York’s judges are wading into these types of cases by the tens of thousands, according to the new statistics, cases involving not only bad debts and soured deals, but also filings that are indirect but still jarring measures of economic stresses, like charges of violence in families torn apart by lost jobs and homes in jeopardy.

[T]he broad impact of the recession is clear in hundreds of thousands of new cases across the judicial system, including people challenging their real estate taxes, home foreclosures, contract disputes and family offenses.I've been tracking the surge in personal bankruptcy filings, and an increase in business disputes always happens during a recession, but what is really is sad is all the family disputes.

Sunday, December 27, 2009

Krugman: Another Contraction Possible

by Calculated Risk on 12/27/2009 09:39:00 PM

From ABC News: Krugman: 'Reasonably High Chance' the Economy Will Contract (see link for short video)

After being asked about Stiglitz suggestion that the economy might contract in the 2nd half of 2010, Paul Krugman responds:

Yeah, its a reasonably high chance - its less than 50/50 odds - but we have now a recovery that ... is being driven by fiscal stimulus which is going to fade out in the 2nd half of next year, and by inventory bounce ...On the fading out of stimulus, Menzie Chinn writes: Levels versus Growth Rates and the Impact of ARRA with a graph of the impact on GDP level and GDP growth from the stimulus. Professor Krugman has a good explanation too: Stimulus timing

Note: I discussed the transitory impact of changes in inventory yesterday: Inventories and Q4 GDP

Government Housing Support Update

by Calculated Risk on 12/27/2009 05:52:00 PM

Note: Scroll down or click for Last Week Summary and a Look Ahead

As everyone knows there has been a massive government effort to support house prices. Some of this has been aimed at limiting supply (modification programs, various foreclosure moratoria), and some has been aimed at increasing demand (tax credit, lower mortgage rates, loose lending standards).

Here is a quote from Secretary Geithner from a recent Newsweek interview by Daniel Gross:

"We were very careful from the beginning ... to say that we are going to focus the bulk of the financial force on bringing interest rates and mortgage rates down to cushion the fall in housing prices and help stabilize home values, which will feed into people's basic sense of financial stability."To help keep this straight, here is a list of the status of a number of programs:

Proponents of the $8,000 credit for first-time buyers and the $6,500 credit for move-up buyers made it clear during the debate on Capitol Hill that the benefits would not be renewed when they expire. And a lobbyist for the National Assn. of Realtors confirmed that at the group's annual convention last month.

Lawmakers "made us promise practically in blood that we would not come back" for another extension, Linda Goold, the Realtor group's director of tax policy, told her members.

During the debate, Sen. Johnny Isakson (R-Ga.), a former real estate broker and a longtime proponent of the tax credit, promised his colleagues, "This is the last extension."

[T]he Federal Reserve is in the process of purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt. In order to promote a smooth transition in markets, the Committee is gradually slowing the pace of these purchases, and it anticipates that these transactions will be executed by the end of the first quarter of 2010.

The program that Treasury established under HERA to support the mortgage market by purchasing Government-Sponsored Enterprise (GSE) -guaranteed mortgage-backed securities (MBS) will end on December 31, 2009. By the conclusion of its MBS purchase program, Treasury anticipates that it will have purchased approximately $220 billion of securities across a range of maturities.

In order to provide servicers an opportunity to remain focused on converting eligible borrowers to permanent HAMP modifications, effective today and lasting through January 31, 2010, Treasury is implementing a review period for all active HAMP trial modifications scheduled to expire on or before January 31, 2010. Active HAMP trial modifications include trial modifications that have been submitted to the Treasury system of record that have not been cancelled by the servicer.

During this review period, servicers should continue to convert eligible borrowers in active HAMP trial modifications to permanent HAMP modifications as quickly as possible in accordance with existing program guidance. Servicers may not cancel an active HAMP trial modification during this period for any reason other than failure to meet the HAMP property eligibility requirements.

Treasury is now amending the [Preferred Stock Purchase Agreements (PSPAs)] to allow the cap on Treasury's funding commitment under these agreements to increase as necessary to accommodate any cumulative reduction in net worth over the next three years. At the conclusion of the three year period, the remaining commitment will then be fully available to be drawn per the terms of the agreements.

•Focus on enforcement and lender accountability

•Reduce the maximum seller concession from 6% to 3%.

•Raise the minimum FICO score.

•Increase the up-front cash for borrower (it isn't clear if this is an increase in the downpayment, currently a minimum of 3.5%, or requiring the borrower to pay more fees).

•Increase FHA insurance premiums.

There is probably more ...

Weekly Summary and a Look Ahead

by Calculated Risk on 12/27/2009 12:58:00 PM

The key economic report this holiday week is the Case-Shiller house price index for October that will be released on Tuesday. The Case-Shiller index is actually an average for 3 months and the concensus is for further gains, although the house price index from LoanPerformance showed a decline in October.

In other economic news, the Chicago PMI will be released on Wednesday. Other recent regional indicators - the New York Fed's Empire State Manufacturing Survey and Richmond Fed’s Survey of Manufacturing Activity - have suggested a slowing in the manufacturing sector.

The monthly trucking and restaurant surveys will also be released this week.

And a summary of last week ...

The NAR reports: Another Big Gain in Existing-Home Sales as Buyers Respond to Tax Credit

Existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 7.4 percent to a seasonally adjusted annual rate of 6.54 million units in November from 6.09 million in October, and are 44.1 percent higher than the 4.54 million-unit pace in November 2008.

Click on graph for larger image in new window.

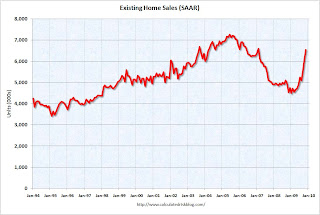

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Nov 2009 (6.54 million SAAR) were 7.4% higher than last month, and were 44% higher than Nov 2008 (4.54 million SAAR).

Here is more on existing home sales.

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 355 thousand. This is a sharp decrease from the revised rate of 400 thousand in October (revised down from 430 thousand).

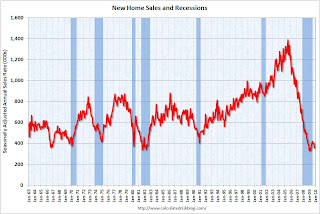

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 8% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 8% above the low in January. Sales of new one-family houses in November 2009 were at a seasonally adjusted annual rate of 355,000 ... This is 11.3 percent (±11.0%) below the revised October rate of 400,000 and is 9.0 percent (±15.3%)* below the November 2008 estimate of 390,000.See this post for more on New Home sales.

The following graph shows the ratio of existing home sales divided by new home sales through November.

This ratio has increased again to a new all time high.

This ratio has increased again to a new all time high. The ratio of existing to new home sales increased at first because of the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent increase in the ratio was partially due to the timing of the first time homebuyer tax credit (before the extension) - and partially because the tax credit spurred existing home sales more than new home sales.

From commentary on home sales see: Residential Investment: Moving Sideways

From Bloomberg: U.S. Commercial Real Estate Index Falls 1.5%

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

CRE prices only go back to December 2000.

CRE prices only go back to December 2000.The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices peaked in late 2007 and have fallen 44% from the peak and are now back to September 2002 levels.

Servicers can’t cancel an active Home Affordable trial modification scheduled to expire before Jan. 31 for any reason other than property eligibility requirements, according to a posting today on a government Web site.

The Treasury said it would provide capital as needed to Fannie Mae and Freddie Mac over the next three years, in a move aimed at soothing investors' concerns about the government's continued support of the mortgage giants.

Best wishes to all.

Chinese Premier: No Change to Exchange Rate Policy

by Calculated Risk on 12/27/2009 09:14:00 AM

From the Financial Times: Wen resolute on strength of currency

The Financial Times quotes Chinese Premier Wen Jiabao as saying: ”We will not yield to any pressure of any form forcing us to appreciate. ... The purpose [of these calls for appreciation] is to hold back China’s development."

In recent weeks the demands for China to appreciate its currency in order to help a rebalancing of the global economy have increased to include not only the US and the European Union but also developing nations such as Brazil and Russia.This is one of the key global imbalances and it looks like China will still not allow their currency to appreciate.

excerpted with permission