by Calculated Risk on 12/31/2009 10:20:00 AM

Thursday, December 31, 2009

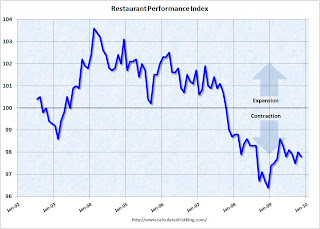

Restaurant Index Shows Contraction in November

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading below 100 shows contraction for this index. The index is a year-over-year index, so the headline index might be slow to recognize a pickup in business, but the underlying details suggests ongoing weakness.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remained Uncertain as the Restaurant Performance Index Declined for the Third Time in the Last Four Months

[T]he National Restaurant Association’s ... Restaurant Performance Index (RPI) ... stood at 97.8 in November, down 0.2 percent from its October level. In addition, the RPI remained below 100 for the 25th consecutive month, which signifies contraction in the index of key industry indicators.

“Although the RPI remained below 100 for the 25th consecutive month, which signals contraction, restaurant operators are cautiously optimistic that conditions will improve in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Restaurant operators reported a positive six-month sales outlook for the first time in three months, and remained optimistic that the economy will improve during the next six months.”

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 96.0 in November – down 0.5 percent from October and tied for its second-lowest level on record. In addition, November represented the 27th consecutive month below 100, which signifies contraction in the current situation indicators.

Restaurant operators reported negative same-store sales for the 18th consecutive month in November, with the overall results similar to the September and October performances. ...

Customer traffic also remained soft in November, as restaurant operators reported net negative traffic for the 27th consecutive month. ...

Along with soft sales and traffic levels, operators reported a dropoff in capital spending activity. Thirty-three percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, down from 40 percent who reported similarly last month.

emphasis added

Weekly Initial Unemployment Claims Decline

by Calculated Risk on 12/31/2009 08:32:00 AM

Note: For fun, see the reader polls on the right sidebar for 2010 economic outlook. Polling ends today at 3 PM ET.

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 26, the advance figure for seasonally adjusted initial claims was 432,000, a decrease of 22,000 from the previous week's revised figure of 454,000. The 4-week moving average was 460,250, a decrease of 5,500 from the previous week's revised average of 465,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Dec. 19 was 4,981,000, a decrease of 57,000 from the preceding week's revised level of 5,038,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 5,500 to 460,250. This is the lowest level since September 2008.

The decline in initial claims is good news, although the 4-week average suggests continuing job losses. Also we have also to be careful because data can be volatile during the holidays.

New York General Fund Deficit

by Calculated Risk on 12/31/2009 12:06:00 AM

From the NY Times: New York State Has First Deficit in General Fund

... For the first time in history, [New York]’s main bank account is poised to end the year in the red.No problem - just write IOUs.

... New York had a negative balance of $174 million in its general fund on Wednesday, with nearly $1 billion in bills owed by day’s end. ... To fill the gap, New York will be forced to rely on ... raiding its short-term investment pool ... But that account itself is dangerously low, with only about $800 million on hand, compared with a balance in more flush years of as much as $16 billion.

And the lower the short-term balance falls, the harder it is for the state to cover its day-to-day bills and the closer New York moves toward a previously unimaginable eventuality: A government check that bounces.

Wednesday, December 30, 2009

Jim the Realtor: Squatter Scam

by Calculated Risk on 12/30/2009 08:03:00 PM

This is a pretty bold squatter. According to Jim, the squatter moved in right after the tenant left ... and when the landlord (in foreclosure) showed up, the squatter called the cops and accused him of trying to break in - and apparently was able to obtain a restraining order against the owner ... it is now Jim's problem!

Treasury Commits $3.8 Billion more to GMAC

by Calculated Risk on 12/30/2009 04:55:00 PM

From the Treasury: Treasury Annouces [SIC] Resturcturing of Commitment To GMAC

Treasury will commit $3.8 billion of new capital to GMAC ... Prior to today's actions, Treasury had invested $12.5 billion in preferred stock of GMAC. Treasury owns $13.1 billion in preferred stock in GMAC, through purchases and the exercise of warrants, and 35 percent of the common equity in GMAC.From the WaPo: U.S. taking majority ownership of GMAC

The Treasury Department said it will increase its stake in GMAC to 56 percent from 35 percent. It also will hold about $14 billion in what amount to loans that GMAC may eventually be required to repay.

Reader Poll on Economic Outlook

by Calculated Risk on 12/30/2009 03:12:00 PM

I've added two polls on the right sidebar.

Predict the 2010 GDP growth and the Dec 2010 unemployment rate.

I'll post the poll results here tomorrow and post my own thoughts over the weekend.

Please feel free to post your predictions in the comments too - and I'll link to this post next year.

Best to all

House Prices and the Unemployment Rate

by Calculated Risk on 12/30/2009 12:35:00 PM

Here is a comparison of real house prices and the unemployment rate using the LoanPerformance national house price data (starts in 1976) and Case-Shiller Composite 10 index (starts in 1987). Both indexes are adjusted by CPI less shelter. This is an update to a post earlier this year. Click on image for larger graph in new window.

Click on image for larger graph in new window.

The two previous national declines in real house prices are evident on the graph (early '80s and early '90s). The dashed green lines are drawn at the peak of the unemployment rate following the peak in house prices.

In the early '80s, real house prices declined until the unemployment rate peaked, and then increased sluggishly for a few years. Following the late 1980s housing bubble, real house prices declined for several years after the unemployment rate peaked.

Although there are periods when there is no relationship between the unemployment rate and house prices, this graph suggests that house prices will not bottom (in real terms) until the unemployment rate peaks (or later, especially since the current bubble dwarfs those previous housing bubbles). This also suggests that real house prices are probably 10% or more too high on a national basis.

Chicago Purchasing Managers Increases in December

by Calculated Risk on 12/30/2009 09:51:00 AM

From MarketWatch: Chicago purchasing index reaches 16-month high

More businesses in the Chicago region were expanding in December than at any time in the past 16 months, based on the latest data from the Chicago purchasing managers index. The business activity index rose to 60.0% from 56.1% in November...Readings above 50% indicate expansion, and below 50% indicate contraction, so this suggests business activity is increasing.

This index is for both manufacturing and service activity in the Chicago region. In general the Chicago area is considered representative of the mix of manufacturing and non-manufacturing business activity in the nation.

The national ISM manufacturing index will be released Monday, and the ISM non-manufacturing index next Wednesday.

Japan: Twenty Years Later

by Calculated Risk on 12/30/2009 07:56:00 AM

From The Times: Japan pledges to end economic spiral (ht Jonathan)

Japan’s four-month-old Government ... today vowed to enlarge the economy by 150 trillion yen (£1 trillion) ...Talk about a high level of debt to GDP.

The Democratic Party of Japan said that the scheme would deliver annual real GDP growth of at least 2 per cent between now and 2020 and ... is thought to be an attempt by the Government to quash rising domestic fears over the country’s gargantuan mound of public debt. The debt equates to about 180 per cent of GDP and will probably hit 200 per cent in the wake of the record budget announced last week.

Halfway through the Government’s ten-year plan, Japan's debt relative to GDP may rise to 246 per cent, according to analysts from the International Monetary Fund.

...

Since its property bubble burst 20 years ago, Japan has borrowed heavily to stimulate the economy and recent years have seen the level of debt spiral wildly.

Tuesday, December 29, 2009

Fannie, Freddie Changes

by Calculated Risk on 12/29/2009 11:04:00 PM

There has been much more on the Dec 24th press release from Treasury.

From the WSJ: Questions Surround Fannie, Freddie

From Tim Duy: Why Christmas Eve?

I think Linda Lowell at HousingWire has a good explanation: Treasury Updates Its GSE Support; And the Mainstream Misleads

First on the timing:

It’s in the law: the Treasury’s authorization in [Housing and Economic Recovery Act (HERA) of 2008] to alter the terms, conditions and amounts under any agreements (such as the PSPAs) to purchase Fannie or Freddie obligations expires December 31, 2009. After that date, new authorization would be required from Congress.That explains the timing. My guess is some people at Treasury aren't working this week, so last Thursday was the deadline.

As far as why uncap Fannie and Freddie even though the current caps looked sufficient:

Too much is at stake, for taxpaying homeowners, to leave outstanding even a small “tail risk” that one of the enterprises would penetrate the cap. We’ve all seen how politics - even the agendas of a small minority - can stall lawmaking by the majority. Read the law (HERA): if a deficiency goes unfunded, the deficient enterprise goes into receivership.And receivership (as opposed to the current conservatorship) means the enterprise would be wound down. So Ms. Lowell suggests this was probably to avoid a low probability event that could have triggered a huge political battle - and put the housing market at further risk since the housing market is currently "overwhelmingly supported by FHA/Ginnie Mae, Fannie and Freddie".

Also, on my earlier speculation about whether this was related to HAMP, Nick Timiraos at the WSJ writes:

A Treasury representative said the bailout caps were suspended "specifically to ensure continued confidence in Fannie Mae and Freddie Mac, but were not based on any considerations" related to an expansion of the administration's loan-modification program.I guess this qualifies as a huge nothingburger.