by Calculated Risk on 1/02/2010 08:43:00 AM

Saturday, January 02, 2010

More Lost Decade

Another "Lost Decade" story, this time in the WaPo by Neil Irwin: Aughts were a lost decade for U.S. economy, workers

It was, according to a wide range of data, a lost decade for American workers. ...

There has been zero net job creation since December 1999. ... Middle-income households made less in 2008, when adjusted for inflation, than they did in 1999 ... And the net worth of American households ... has also declined when adjusted for inflation ...

Click on graph for WaPo page in new window.

Click on graph for WaPo page in new window.This graphic from the WaPo shows job growth by decade, change in GDP, and percent change in household wealth for every decade since 1940.

Hopefully the '10s will be much better.

Friday, January 01, 2010

HAMP Seen Hurting Housing

by Calculated Risk on 1/01/2010 09:15:00 PM

From Peter Goodman at the NY Times: U.S. Loan Effort Is Seen as Adding to Housing Woes

The Obama administration’s $75 billion program to protect homeowners from foreclosure has been widely pronounced a disappointment, and some economists and real estate experts now contend it has done more harm than good.The article covers a number of topics, but I think these are key:

... desperate homeowners have sent payments to banks in often-futile efforts to keep their homes, which some see as wasting dollars they could have saved in preparation for moving to cheaper rental residences. Some borrowers have seen their credit tarnished while falsely assuming that loan modifications involved no negative reports to credit agencies.

This probably leaves the homeowner far underwater (owing more than their home is worth). When these homeowners eventually try to sell, they will probably still face foreclosure - prolonging the housing slump. These are really not homeowners, they are debtowners / renters.

None of these programs is especially attractive, so I expect more delays and "can kicking" that will keep foreclosures elevated for years.More short sales. Short sale activity is already increasing, and the Treasury introduced the Foreclosure Alternatives Program to help with short sales and Deed-in-Lieu of Foreclosure transactions. However servicers are very afraid of short sale fraud (non-arm length transactions), and short sales are also distressed properties - pushing down prices - something Treasury is desperately trying to avoid. Encouraging servicers to write down principal. This would be very expensive, and if paid for by taxpayers - it would be very unpopular because it would appear to favor speculators over the prudent. This is what Mark Zandi, chief economist at Moody's economy.com is supporting: Mr. Zandi argues that the administration needs a new initiative that attacks a primary source of foreclosures: the roughly 15 million American homeowners who are underwater, meaning they owe the bank more than their home is worth.

...

Mr. Zandi proposes that the Treasury Department push banks to write down some loan balances by reimbursing the companies for their losses. ... “We want to overwhelm this problem,” he said. “If we do go back into recession, it will be very difficult to get out.”Converting homeowners to renters. This is something Dean Baker suggested, and is kind of a Single Family Public Housing program. This would avoid the flood of foreclosures, and the banks could sell the homes over several years.

WSJ: Five Key Housing Issues

by Calculated Risk on 1/01/2010 05:54:00 PM

Nick Timiraos at the WSJ writes: Five Key Housing Issues to Watch in 2010

Here is his list:

I reviewed the status of all these issues in Government Housing Support Update

Although all of these issues are important, I'd probably start from a different perspective:

1) What is the current supply situation and how will it be impacted in 2010?

2) What will happen to demand?

3) What will happen to prices?

As an example, the loan modifications and more loan recasts impact supply, whereas higher mortgage rates, tighter lending standards, and the end of the tax credit will all impact demand. I'll try to address these issues in a 2010 housing overview soon.

Impact of Census on Employment and Unemployment Rate

by Calculated Risk on 1/01/2010 01:02:00 PM

What will be the impact of the 2010 Census on employment? Click on graph for larger image in new window.

Click on graph for larger image in new window.

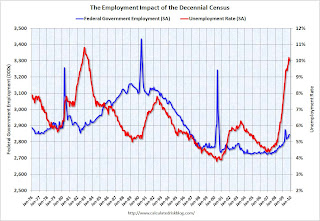

The first graph shows the impact of the decennial Census on Federal Government employment (Seasonally adjusted) and on the unemployment rate.

Note: left on right scales don't start at zero to better show the change.

Every 10 years there is a large spike in Federal Government employment, but the Census has little impact on the unemployment rate. The second graph shows the monthly change in Federal government employment during the last two decennial census periods (1990 and 2000).

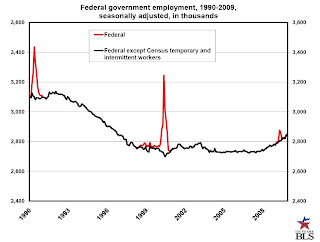

The second graph shows the monthly change in Federal government employment during the last two decennial census periods (1990 and 2000).

There was a surge in payroll employment in March, April and especially in May. And then almost all of the jobs were lost in the June through September period. We should expect a similar pattern this year.

Note: there are reports that the Census Bureau will hire up to 1.4 million people, however that represents some contingency planning, and includes a number of people already hired temporarily in 2009. We can probably expect a couple hundred thousand people added between January through April, and another 500 thousand or so in May. This could push the unemployment rate down slightly, but probably in the 0.1% to 0.2% range. The BLS provides a monthly report of Census hiring. This graph is from the BLS report and shows the historical impact of the Census on Federal Government employment.

The BLS provides a monthly report of Census hiring. This graph is from the BLS report and shows the historical impact of the Census on Federal Government employment.

There was a small spike in employment in April 2009, and currently the decennial census has little impact on employment. This will be something to check every month - especially from March through September.

Chicago PMI revised down, Treasury makes final TARP Bank Investments

by Calculated Risk on 1/01/2010 09:53:00 AM

A couple of stories that I missed yesterday ...

Dow Jones reports that the Chicago Institute for Supply Management revised down the Chicago PMI to 58.7 on Thursday from the announced reading of 60.0 on Wednesday. The most significant change was to the employment index that now shows contraction at 47.6 compared to the announced 51.2.

And the WSJ reports that the Treasury announced they made their final TARP investment in a bank: Treasury Ends TARP Bank Investments (ht jb)

The U.S. Treasury this week officially ended the bank recapitalization portion of its Troubled Asset Relief Program. ... A Treasury spokesman said [10 small banks] would be the last to receive capital under the effort ...

Thursday, December 31, 2009

Happy New Year

by Calculated Risk on 12/31/2009 11:16:00 PM

| Happy New Year! |

The first week of 2010 will be chock-full of data. Should be very interesting. And oh ... good riddance to the aughts!

From Tanta's sister Cathy ... A little "New Years Eve" Rock Blogging

Jim the Realtor: One Million is the new Two Million

by Calculated Risk on 12/31/2009 08:07:00 PM

Prices are still too high in some areas ... yeah, these people put half a million down - and the foreclosure auction is coming up.

Renters Win!

by Calculated Risk on 12/31/2009 05:14:00 PM

From USA Today: Apartment renters win as vacancy rate climbs (ht Brian)

Rents fell a record 3.5% in 2009 after factoring in freebies, according to MPF Research. MPF projects prices will fall an additional 2% next year ...Note: Reis reported the apartment vacancy rate at a 23 year high 7.8% at the end of Q3 2009, and the Census Bureau reported the total rental vacancy rate at a record 11.1%.

"I've been at this 35 years, and it's by far the worst I've seen it," says Jeff Cronrod of the American Apartment Owners Association.

Nationwide, apartment vacancy is 7.8%, up from 4.8% at the end of 2007, says MPF Vice President Greg Willett.

The article notes that the supply of rental units is growing as investors buy homes to rent for cash flow and some "homeowners who want to move but can't sell their houses because they're worth less than their mortgages are renting them out instead."

Hey, who does that remind you of? (hint)

Reader Poll Results: Economic Outlook for 2010

by Calculated Risk on 12/31/2009 03:15:00 PM

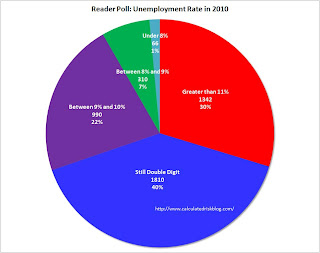

Here are the results of the reader poll. Thanks to the 4,518 people who participated! Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first question was the outlook for GDP growth in 2010. Readers who participated in the poll tend to be pessimistic, with 57% expecting a double dip recession, and another 30% expecting real GDP growth to be below 2% in 2010.

Usually the economy grows very quickly after a severe recession. As an example, following the '48/'49 recession, the economy grew at a double digit growth rate for the first three quarters of the recovery. In the 2nd half of 1959, the economy grew at a 9.7% rate, and in the year following the '73/'75 recession, GDP increased 6.2%.

Since this was the most severe recession since the Great Depression, a normal recovery would probably be 8%+ real GDP growth for a year or so. That isn't going to happen. Even a 4% growth rate would have to be considered sluggish by historical standards.

I'll post more on the reasons for my outlook, but I think the U.S. will avoid a double dip recession, and 2010 GDP growth will be in the 2% to 3% range. The second question concerned the unemployment rate at the end of 2010 (December 2010).

The second question concerned the unemployment rate at the end of 2010 (December 2010).

Most poll participants (70%) are expecting the unemployment rate to be at or above 10% at the end of 2010. I think it might be close, but I agree with the majority on the unemployment rate (still double digits in Dec 2010). There will be a temporary positive impact from the 2010 Census, and I expect another stimulus package (labeled a "jobs package") to be announced in the next few months - and maybe that will push the rate down below double digits.

I'll have more in the next few days. Thanks again for participating! I hope most of us are too pessimistic.

Hotels: Worst Year Since Great Depression

by Calculated Risk on 12/31/2009 12:28:00 PM

In terms of the occupancy rate, 2009 was the worst year since the Great Depression (close to 55%). And last week was no exception with Smith Travel Research reporting the occupancy rate fell to 33.8 percent - the lowest weekly occupancy rate on record.

From HotelNewsNow.com: STR reports US performance for week ending 26 December

In year-over-year measurements, the industry’s occupancy fell 5.4 percent to end the week at 33.8 percent. Average daily rate dropped 8.0 percent to finish the week at US$85.78. Revenue per available room for the week decreased 13.0 percent to finish at US$29.02.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Note: Some of the holidays don't line up - especially at the end of the year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com (Note: They have a free daily email too for hotel news)

The end of the year can be a little confusing because of the holidays, and the next key weeks will be mid-to-late January to see if business travel is picking up in 2010.