by Calculated Risk on 1/06/2010 08:56:00 AM

Wednesday, January 06, 2010

MBA: Mortgage Purchase Applications Lowest in 12 Years

The MBA reports: Mortgage Applications Drop the Week of Christmas and Remain Flat the Week After

The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the weeks ending December 25, 2009 and January 1, 2010. For the week ending December 25, 2009, the Market Composite Index, a measure of mortgage loan application volume, decreased 22.8 percent on a seasonally adjusted basis from the prior week. For the week ending January 1, 2010, this index increased 0.5 percent on a seasonally adjusted basis. ...

For the week ending December 25, 2009, the Refinance Index decreased 30.5 percent from the previous week and the seasonally adjusted Purchase Index decreased 4.0 percent from one week earlier. The following week, the Refinance Index decreased 1.6 percent and the seasonally adjusted Purchase Index increased 3.6 percent.

...

For the week ending January 1, 2010, the average contract interest rate for 30-year fixed-rate mortgages increased to 5.18 percent with points decreasing to 1.28.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Note: In the past the MBA index was somewhat predictive of future sales - and was a favorite indicator of Alan Greenspan, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining. Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase.

Despite the problems, it is hard to ignore the sharp decline in purchase applications since mid-October. The four week moving average is now at the lowest level since November 1997.

ADP: Private Employment Decreased 84,000 in December

by Calculated Risk on 1/06/2010 08:22:00 AM

ADP reports:

Nonfarm private employment decreased 84,000 from November to December 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from October to November was revised by 24,000, from a decline of 169,000 to a decline of 145,000.Note: ADP is private nonfarm employment only (no government jobs).

The decline in December was the smallest since March of 2008.

The BLS reported a 18,000 decrease in nonfarm private employment in November (11,000 total nonfarm), and ADP originally estimated November private nonfarm employment losses at 169,000; so ADP wasn't close at all to the BLS number last month - although the trend is the same.

On the Challenger job-cut report from MatketWatch: Layoffs drop 10% to 45,094 in December, Challenger says

Big U.S. companies announced 45,094 job reductions in December, the fewest since the recession began two years ago. December's total was down 10% from November's 50,349 and down 73% from December 2008.The BLS reports Friday, and the consensus is for no change in net jobs, and a 10.0% unemployment rate for December.

In the fourth quarter, companies announced just 151,121 job reductions, the fewest since early 2000 and down 67% from the fourth quarter of 2008, Challenger said Wednesday.

For all of 2009, big companies announced 1.288 million job cuts, up about 5% from 2008's total and the most since 2002. About 70% of the year's total occurred in the first six months of the year.

Reis: Strip Mall Vacancy Rate Hits 10.6%, Highest on Record

by Calculated Risk on 1/06/2010 12:04:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From Reuters: US shopping center vacancies hit records - report

Strip malls ... had a vacancy rate of 10.6 percent in the fourth quarter, surpassing the high set in 1991, Reis economist Ryan Severino said in a report released on Wednesday.This is up from 10.3% in Q3 2009 and 8.9% in Q4 2008.

The vacancy rate at large regional malls rose to 8.8 percent from 8.6 percent the third quarter.The 8.8% is the highest since Reis began tracking regional malls in 2000.

"Our outlook for retail properties as a whole is bleak," Severino said in a statement. "... we do not foresee a recovery in the retail sector until late 2012 at the earliest.""Late 2012 at the earliest" ... ouch!

Tuesday, January 05, 2010

Leonhardt: Bernanke Should Discuss Fed Failures

by Calculated Risk on 1/05/2010 09:39:00 PM

From David Leonhardt at the NY Times: If Fed Missed That Bubble, How Will It See a New One? (ht Ann)

So why did Mr. Greenspan and Mr. Bernanke get it wrong?Bernanke continues to dodge the key questions: what went wrong with regulation, and how will the new regulatory structure catch a bubble the next time?

The answer seems to be more psychological than economic. They got trapped in an echo chamber of conventional wisdom. Real estate agents, home builders, Wall Street executives, many economists and millions of homeowners were all saying that home prices would not drop, and the typically sober-minded officials at the Fed persuaded themselves that it was true. “We’ve never had a decline in house prices on a nationwide basis,” Mr. Bernanke said on CNBC in 2005.

He and his colleagues fell victim to the same weakness that bedeviled the engineers of the Challenger space shuttle, the planners of the Vietnam and Iraq Wars, and the airline pilots who have made tragic cockpit errors. They didn’t adequately question their own assumptions. It’s an entirely human mistake.

Which is why it is likely to happen again.

What’s missing from the debate over financial re-regulation is a serious discussion of how to reduce the odds that the Fed — however much authority it has — will listen to the echo chamber when the next bubble comes along. A simple first step would be for Mr. Bernanke to discuss the Fed’s recent failures, in detail. If he doesn’t volunteer such an accounting, Congress could request one.

Suggesting “better and smarter" execution just doesn't cut it.

Pimco's Gross on Fed MBS Purchases

by Calculated Risk on 1/05/2010 06:49:00 PM

From an interview in Time: Pimco's Bill Gross Sees 2010 as Year of Reckoning. Excerpts on MBS:

Gross: I think the Fed's statements suggest that they really want to exit in some fashion from the buying program. The first step in that direction, logically, would be to stop buying and our sense is that they're at least going to try that. But based on our forecasts for the second half of the year they may have to re-initiate it, and that will be difficult to do once they stop because it then becomes a political hot potato.So Bill Gross is thinking we will see about a 50 bps increase in mortgage rates when the Fed stops buying MBS, but admits he really doesn't know. He also thinks the Fed will stop buying - probably on the current schedule - but he thinks they may want to re-initiate the program in the 2nd half of 2010.

All that said, I think they'll stop buying mortgage agency securities, and the trillion-and-a-half dollar check that's been written over the past 9 to 12 months basically disappears. ...

TIME: Because they might have to restart the buying program later?

Yes, I think the Fed wonders about this as well. ... They won't sell — it's a near impossibility to unload what they've purchased over past 12 months. But they'll at least stop buying.

TIME: Won't that put upward pressure on interest rates?

I think it will. I mean the mortgage market would be your first place to look in terms of something that's overvalued that would become normalized. Nobody knows what the Fed's buying is worth — we think about half a percentage point on rates, but we don't know.

But secondly, there's a ripple affect. ... They're buying a trillion dollars of them, or have over the past 9-12 months, and so we sold them a lot of ours. Now, what did we do with the money? We bought Treasuries, we bought corporate bonds, and so the bond markets in general have benefited, as have stocks because this available money effectively flows through the capital markets. ... How that affects the markets, I just don't know. I'm not eagerly anticipating the answer, but I think it holds some surprises in 2010, not just in mortgage securities but stocks as well. We could miss the money, put it that way.

emphasis added

U.S. Light Vehicle Sales 11.25 Million SAAR in December

by Calculated Risk on 1/05/2010 03:48:00 PM

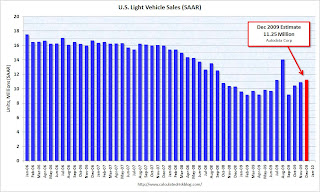

Click on graph for larger image in new window.

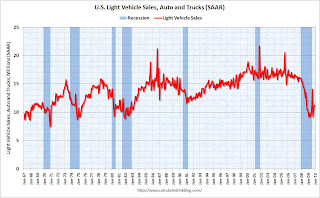

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for December (red, light vehicle sales of 11.25 million SAAR from AutoData Corp). The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July.

Excluding August, December was the strongest month since September 2008 (12.5 million SAAR) before sales fell off the final cliff.

The current level of sales are still very low, and are still below the lowest point for the '90/'91 recession (even with a larger population). On an annual basis, 2009 sales were probably just above the level of 1982 (10.357 million light vehicles).

Iceland President Refuses to Sign Bill to Compensate UK Investors

by Calculated Risk on 1/05/2010 02:23:00 PM

From the Guardian: Iceland president vetoes collapsed Icesave Bank's bill to UK

Iceland was plunged back into crisis after its president refused to sign a bill promising to repay more than €3.8bn (£3.4bn) to Britain and the Netherlands after the collapse of the country's Icesave bank in 2008.And from The Times: Iceland blocks repayment of £2.3bn to Britain

Olafur Grimsson said he would force a referendum on the deeply unpopular legislation, causing a schism within the Icelandic government, with prime minister Johanna Sigurdardottir maintaining that the money would be repaid.

The escalating row threatens to further destablise the Icelandic economy, which went into meltdown after the failure of its three big banks, cutting off further aid from the International Monetary Fund and jeopardising efforts to join the European Union. The credit rating agency Fitch immediately downgraded Iceland, describing the latest political row as a "significant setback".

The British Government's already stretched finances came under further pressure today when Iceland's President vetoed the repayment of a £2.3 billion loan from the British taxpayer.Here is the actual Declaration: DECLARATION BY THE PRESIDENT OF ICELAND

The cash was paid out by Britain in 2008 to compensate UK investors in Icesave, whose parent bank Landsbanki had collapsed.

Alistair Darling, the Chancellor, handed over the money because he had promised that UK savers would not lose a penny to Landsbanki's bankruptcy.

... I have decided, according to Article 26 of the Constitution, to refer this new Act to the people. As stated in the Constitution, the new Act will nevertheless become law and the referendum will take place “as soon as possible.”

If the Act is approved in the referendum then naturally it will remain in force. If the referendum goes the other way, then the Act No. 96/2009, which the Althingi passed on 28 August, on the basis of the agreement with the Governments of the United Kingdom and the Netherlands, will continue to be law, recognizing that the people of Iceland acknowledge their obligations. That Act was passed by the Althingi with theinvolvement of four of the parliamentary parties, as stated in the President’s declaration of 2 September.

Now the people have the power and the responsibility in their hands.

Ford: December U.S. Sales up 32.8% Compared to 2008

by Calculated Risk on 1/05/2010 12:01:00 PM

From MarketWatch: Ford December U.S. sales up 32.8% to 184,655 units

From CNBC: Ford December Sales Jump 23.3%

Ford Press Release.

We need to see the details to see why the two reports are different, but this is based on an easy comparison; in December 2008 U.S. light vehicle sales fell sharply to 10.3 million (SAAR) following the financial crisis.

I'll add the other major reports as updates to this post.

UPDATE: From MarketWatch: Chrysler Dec. U.S. sales fall 3.7% to 86,523

UPDATE2: GM posts 6.1% decline in December U.S. sales

UPDATE3: Toyota Dec. U.S. auto sales up 32% to 187,860

Once all the reports are released, I'll post a graph of the estimated total December sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET.

Pending Home Sales Decrease Sharply

by Calculated Risk on 1/05/2010 09:49:00 AM

The Pending Home Sales Index,* a forward-looking indicator based on contracts signed in November, fell 16.0 percent to 96.0 from an upwardly revised a 114.3 in October, but is 15.5 percent higher than November 2008 when it was 83.1.On the extended and expanded tax credit:

[Lawrence Yun, NAR chief economist] projects an additional 900,000 first-time buyers will qualify for the extended tax credit in addition to about 2 million who have already purchased; 1.5 million repeat buyers also are expected to benefit from the credit.The extended and expanded tax credit was estimated to cost taxpayers $10.8 billion, but based on Mr. Yun's numbers, the tax credit will cost close to $17 billion (way over the initial estimate and just like the first tax credit, most buyers who receive the tax credit would have bought anyway).

Personal Bankruptcy Filings Increase Sharply in 2009

by Calculated Risk on 1/05/2010 08:40:00 AM

The WSJ reports: Personal Bankruptcy Filings Rising Fast

Overall, personal bankruptcy filings hit 1.41 million last year, up 32% from 2008, according to the National Bankruptcy Research Center ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by year.

Note: Data from Administrative Office of the U.S. Courts, 2009 is estimated using media reports of data from the National Bankruptcy Research Center.

The annual rate is at about the same level as prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

"I can't see over the top of the files on my desk," said Cathleen Moran, a bankruptcy attorney at Moran Law Group in Mountain View, Calif., likening it to the rush of clients before the revised law went into effect.

| Click on cartoon for larger image in new window. And a repeat: Cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |