by Calculated Risk on 1/06/2010 02:00:00 PM

Wednesday, January 06, 2010

FOMC Minutes: Expect Slow Economic Recovery

Here are the December FOMC minutes. Economic outlook:

In their discussion of the economic situation and outlook, meeting participants agreed that the incoming data and information received from business contacts suggested that economic growth was strengthening in the fourth quarter, that firms were reducing payrolls at a less rapid pace, and that downside risks to the outlook for economic growth had diminished a bit further. Although some of the recent data had been better than anticipated, most participants saw the incoming information as broadly in line with the projections for moderate growth and subdued inflation in 2010 that they had submitted just before the Committee's November 3-4 meeting; accordingly, their views on the economic outlook had not changed appreciably. Participants expected the economic recovery to continue, but, consistent with experience following previous financial crises, most anticipated that the pickup in output and employment growth would be rather slow relative to past recoveries from deep recessions. A moderate pace of expansion would imply slow improvement in the labor market next year, with unemployment declining only gradually. Participants agreed that underlying inflation currently was subdued and was likely to remain so for some time. Some noted the risk that, over the next couple of years, inflation could edge further below the rates they judged most consistent with the Federal Reserve's dual mandate for maximum employment and price stability; others saw inflation risks as tilted toward the upside in the medium term.And on real estate:

A number of factors were expected to support near-term expansion in economic activity. Consumer spending appeared to be on a moderately rising trend, reflecting gains in after-tax income and wealth this year. Recent upward revisions to official estimates of the level of household income in recent quarters gave participants somewhat greater confidence that consumer spending would continue to expand. The housing sector showed continuing signs of improvement, though housing starts had leveled out after increasing earlier in the year and activity remained quite low. Businesses seemed to be reducing the pace of inventory reductions. The outlook for growth abroad had improved since earlier in the year, auguring well for U.S. exports. In addition, financial market conditions generally had become more supportive of economic growth. While these developments were positive, participants noted several factors that likely would continue to restrain the expansion in economic activity. Business contacts again emphasized they would be cautious in adding to payrolls and capital spending, even as demand for their products increases. Conditions in the commercial real estate (CRE) sector were still deteriorating. Bank credit had contracted further, and with many banks facing continuing loan losses, tight bank credit could continue to weigh on the spending of some households and businesses. Some participants remained concerned about the economy's ability to generate a self-sustaining recovery without government support. In particular, they noted the risk that improvements in the housing sector might be undercut next year as the Federal Reserve's purchases of MBS wind down, the homebuyer tax credits expire, and foreclosures and distress sales continue. Though the near-term outlook remains uncertain, participants generally thought the most likely outcome was that economic growth would gradually strengthen over the next two years as financial conditions improved further, leading to more-substantial increases in resource utilization.

emphasis added

CRE activity continued to fall markedly in most parts of the country as a result of deteriorating fundamentals, including declining occupancy and rental rates, and very tight credit conditions. Prospects for nonresidential construction remained weak.That last paragraph is important. It appears residential investment will disappoint in Q1, and prices might already be falling again - and that is before the massive government support programs will be wound down over the next 6 months. Of course CRE is getting crushed, but residential investment is usually a key to a recovery - and residential investment will remain sluggish.

In the residential real estate sector, home sales and construction had risen relative to the very low levels reported in the spring; moreover, house prices appeared to be stabilizing and in some areas had reportedly moved higher. Generally, the outlook was for gains in housing activity to continue. However, some participants still viewed the improved outlook as quite tentative and again pointed to potential sources of softness, including the termination next year of the temporary tax credits for homebuyers and the downward pressure that further increases in foreclosures could put on house prices. Moreover, mortgage markets could come under pressure as the Federal Reserve's agency MBS purchases wind down.

More on State Budget Woes

by Calculated Risk on 1/06/2010 12:16:00 PM

From Jennifer Steinhauer at the NY Times: New Year but No Relief for Strapped States

[A]t least 36 states struggle to close budget shortfalls and also begin confronting the next fiscal year’s woes.These "staggering" gaps mean more budget cuts, or more tax increases, or another stimulus package ... unless the state economies improve quickly, and that seems unlikely.

For many of the states, the new year spells the end to accounting maneuvers, one-off solutions, tax increases and service cuts that were as deep as lawmakers thought they could bear. ...

“A budget gap of 5 percent or 10 percent in any given year is a tough problem,” said Corina Eckl, fiscal director at the National Conference of State Legislatures. “But we’re talking about gaps in excess of 20 percent over multiple years. The size of these gaps is staggering.”

... states averted deeper cuts than anticipated last year because of the federal stimulus package. But those dollars will shrink over the next fiscal year, and unless jobs return and tax revenues rise, or Congress sends them more aid, states will most likely continue to be overextended.

ISM Non-Manufacturing Shows Slight Expansion in December

by Calculated Risk on 1/06/2010 10:00:00 AM

This is another weak service report. According to this survey, the service sector barely expanded in December, and employment also contracted "for the 23rd time in the last 24 months".

From the Institute for Supply Management: December 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December after one month of contraction, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Worldwide. "The NMI (Non-Manufacturing Index) registered 50.1 percent in December, 1.4 percentage points higher than the 48.7 percent registered in November, indicating growth in the non-manufacturing sector for three out of the last four months. The Non-Manufacturing Business Activity Index increased 4.1 percentage points to 53.7 percent, reflecting growth after contracting for one month. The New Orders Index decreased 3 percentage points to 52.1 percent, and the Employment Index increased 2.4 percentage points to 44 percent. The Prices Index increased 0.9 percentage point to 58.7 percent in December, indicating a slight increase in prices paid from November. According to the NMI, seven non-manufacturing industries reported growth in December. Respondents' comments vary by industry and, for the most part, are either neutral or slightly more optimistic about business conditions."

...

Employment activity in the non-manufacturing sector contracted in December for the 23rd time in the last 24 months. ISM's Non-Manufacturing Employment Index for December registered 44 percent. This reflects an increase of 2.4 percentage points when compared to the 41.6 percent registered in November. Four industries reported increased employment, 12 industries reported decreased employment, and two industries reported unchanged employment compared to November.

emphasis added

MBA: Mortgage Purchase Applications Lowest in 12 Years

by Calculated Risk on 1/06/2010 08:56:00 AM

The MBA reports: Mortgage Applications Drop the Week of Christmas and Remain Flat the Week After

The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the weeks ending December 25, 2009 and January 1, 2010. For the week ending December 25, 2009, the Market Composite Index, a measure of mortgage loan application volume, decreased 22.8 percent on a seasonally adjusted basis from the prior week. For the week ending January 1, 2010, this index increased 0.5 percent on a seasonally adjusted basis. ...

For the week ending December 25, 2009, the Refinance Index decreased 30.5 percent from the previous week and the seasonally adjusted Purchase Index decreased 4.0 percent from one week earlier. The following week, the Refinance Index decreased 1.6 percent and the seasonally adjusted Purchase Index increased 3.6 percent.

...

For the week ending January 1, 2010, the average contract interest rate for 30-year fixed-rate mortgages increased to 5.18 percent with points decreasing to 1.28.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Note: In the past the MBA index was somewhat predictive of future sales - and was a favorite indicator of Alan Greenspan, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining. Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase.

Despite the problems, it is hard to ignore the sharp decline in purchase applications since mid-October. The four week moving average is now at the lowest level since November 1997.

ADP: Private Employment Decreased 84,000 in December

by Calculated Risk on 1/06/2010 08:22:00 AM

ADP reports:

Nonfarm private employment decreased 84,000 from November to December 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from October to November was revised by 24,000, from a decline of 169,000 to a decline of 145,000.Note: ADP is private nonfarm employment only (no government jobs).

The decline in December was the smallest since March of 2008.

The BLS reported a 18,000 decrease in nonfarm private employment in November (11,000 total nonfarm), and ADP originally estimated November private nonfarm employment losses at 169,000; so ADP wasn't close at all to the BLS number last month - although the trend is the same.

On the Challenger job-cut report from MatketWatch: Layoffs drop 10% to 45,094 in December, Challenger says

Big U.S. companies announced 45,094 job reductions in December, the fewest since the recession began two years ago. December's total was down 10% from November's 50,349 and down 73% from December 2008.The BLS reports Friday, and the consensus is for no change in net jobs, and a 10.0% unemployment rate for December.

In the fourth quarter, companies announced just 151,121 job reductions, the fewest since early 2000 and down 67% from the fourth quarter of 2008, Challenger said Wednesday.

For all of 2009, big companies announced 1.288 million job cuts, up about 5% from 2008's total and the most since 2002. About 70% of the year's total occurred in the first six months of the year.

Reis: Strip Mall Vacancy Rate Hits 10.6%, Highest on Record

by Calculated Risk on 1/06/2010 12:04:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From Reuters: US shopping center vacancies hit records - report

Strip malls ... had a vacancy rate of 10.6 percent in the fourth quarter, surpassing the high set in 1991, Reis economist Ryan Severino said in a report released on Wednesday.This is up from 10.3% in Q3 2009 and 8.9% in Q4 2008.

The vacancy rate at large regional malls rose to 8.8 percent from 8.6 percent the third quarter.The 8.8% is the highest since Reis began tracking regional malls in 2000.

"Our outlook for retail properties as a whole is bleak," Severino said in a statement. "... we do not foresee a recovery in the retail sector until late 2012 at the earliest.""Late 2012 at the earliest" ... ouch!

Tuesday, January 05, 2010

Leonhardt: Bernanke Should Discuss Fed Failures

by Calculated Risk on 1/05/2010 09:39:00 PM

From David Leonhardt at the NY Times: If Fed Missed That Bubble, How Will It See a New One? (ht Ann)

So why did Mr. Greenspan and Mr. Bernanke get it wrong?Bernanke continues to dodge the key questions: what went wrong with regulation, and how will the new regulatory structure catch a bubble the next time?

The answer seems to be more psychological than economic. They got trapped in an echo chamber of conventional wisdom. Real estate agents, home builders, Wall Street executives, many economists and millions of homeowners were all saying that home prices would not drop, and the typically sober-minded officials at the Fed persuaded themselves that it was true. “We’ve never had a decline in house prices on a nationwide basis,” Mr. Bernanke said on CNBC in 2005.

He and his colleagues fell victim to the same weakness that bedeviled the engineers of the Challenger space shuttle, the planners of the Vietnam and Iraq Wars, and the airline pilots who have made tragic cockpit errors. They didn’t adequately question their own assumptions. It’s an entirely human mistake.

Which is why it is likely to happen again.

What’s missing from the debate over financial re-regulation is a serious discussion of how to reduce the odds that the Fed — however much authority it has — will listen to the echo chamber when the next bubble comes along. A simple first step would be for Mr. Bernanke to discuss the Fed’s recent failures, in detail. If he doesn’t volunteer such an accounting, Congress could request one.

Suggesting “better and smarter" execution just doesn't cut it.

Pimco's Gross on Fed MBS Purchases

by Calculated Risk on 1/05/2010 06:49:00 PM

From an interview in Time: Pimco's Bill Gross Sees 2010 as Year of Reckoning. Excerpts on MBS:

Gross: I think the Fed's statements suggest that they really want to exit in some fashion from the buying program. The first step in that direction, logically, would be to stop buying and our sense is that they're at least going to try that. But based on our forecasts for the second half of the year they may have to re-initiate it, and that will be difficult to do once they stop because it then becomes a political hot potato.So Bill Gross is thinking we will see about a 50 bps increase in mortgage rates when the Fed stops buying MBS, but admits he really doesn't know. He also thinks the Fed will stop buying - probably on the current schedule - but he thinks they may want to re-initiate the program in the 2nd half of 2010.

All that said, I think they'll stop buying mortgage agency securities, and the trillion-and-a-half dollar check that's been written over the past 9 to 12 months basically disappears. ...

TIME: Because they might have to restart the buying program later?

Yes, I think the Fed wonders about this as well. ... They won't sell — it's a near impossibility to unload what they've purchased over past 12 months. But they'll at least stop buying.

TIME: Won't that put upward pressure on interest rates?

I think it will. I mean the mortgage market would be your first place to look in terms of something that's overvalued that would become normalized. Nobody knows what the Fed's buying is worth — we think about half a percentage point on rates, but we don't know.

But secondly, there's a ripple affect. ... They're buying a trillion dollars of them, or have over the past 9-12 months, and so we sold them a lot of ours. Now, what did we do with the money? We bought Treasuries, we bought corporate bonds, and so the bond markets in general have benefited, as have stocks because this available money effectively flows through the capital markets. ... How that affects the markets, I just don't know. I'm not eagerly anticipating the answer, but I think it holds some surprises in 2010, not just in mortgage securities but stocks as well. We could miss the money, put it that way.

emphasis added

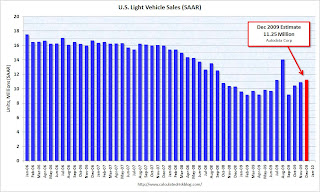

U.S. Light Vehicle Sales 11.25 Million SAAR in December

by Calculated Risk on 1/05/2010 03:48:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

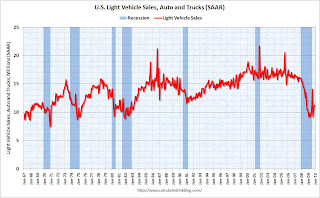

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for December (red, light vehicle sales of 11.25 million SAAR from AutoData Corp). The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July.

Excluding August, December was the strongest month since September 2008 (12.5 million SAAR) before sales fell off the final cliff.

The current level of sales are still very low, and are still below the lowest point for the '90/'91 recession (even with a larger population). On an annual basis, 2009 sales were probably just above the level of 1982 (10.357 million light vehicles).

Iceland President Refuses to Sign Bill to Compensate UK Investors

by Calculated Risk on 1/05/2010 02:23:00 PM

From the Guardian: Iceland president vetoes collapsed Icesave Bank's bill to UK

Iceland was plunged back into crisis after its president refused to sign a bill promising to repay more than €3.8bn (£3.4bn) to Britain and the Netherlands after the collapse of the country's Icesave bank in 2008.And from The Times: Iceland blocks repayment of £2.3bn to Britain

Olafur Grimsson said he would force a referendum on the deeply unpopular legislation, causing a schism within the Icelandic government, with prime minister Johanna Sigurdardottir maintaining that the money would be repaid.

The escalating row threatens to further destablise the Icelandic economy, which went into meltdown after the failure of its three big banks, cutting off further aid from the International Monetary Fund and jeopardising efforts to join the European Union. The credit rating agency Fitch immediately downgraded Iceland, describing the latest political row as a "significant setback".

The British Government's already stretched finances came under further pressure today when Iceland's President vetoed the repayment of a £2.3 billion loan from the British taxpayer.Here is the actual Declaration: DECLARATION BY THE PRESIDENT OF ICELAND

The cash was paid out by Britain in 2008 to compensate UK investors in Icesave, whose parent bank Landsbanki had collapsed.

Alistair Darling, the Chancellor, handed over the money because he had promised that UK savers would not lose a penny to Landsbanki's bankruptcy.

... I have decided, according to Article 26 of the Constitution, to refer this new Act to the people. As stated in the Constitution, the new Act will nevertheless become law and the referendum will take place “as soon as possible.”

If the Act is approved in the referendum then naturally it will remain in force. If the referendum goes the other way, then the Act No. 96/2009, which the Althingi passed on 28 August, on the basis of the agreement with the Governments of the United Kingdom and the Netherlands, will continue to be law, recognizing that the people of Iceland acknowledge their obligations. That Act was passed by the Althingi with theinvolvement of four of the parliamentary parties, as stated in the President’s declaration of 2 September.

Now the people have the power and the responsibility in their hands.