by Calculated Risk on 1/08/2010 12:22:00 AM

Friday, January 08, 2010

Reis: U.S. Office Vacancy Rate Hits 15 Year High at 17 Percent

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the office vacancy rate starting 1991.

Reis is reporting the vacancy rate rose to 17.0% in Q4, from 16.6% in Q3 and from 14.5% in Q4 2008. The peak following the previous recession was 16.9%.

From Reuters: At 17 pct, US office vacancy rate hits 15-year high

During the fourth quarter the national office vacancy rate climbed 0.40 percentage point from the third quarter to 17 percent, the highest level since 1994.The vacancy rate isn't a record, but there was a record decline in effective rents. Add that to the records announced earlier this week ...

...

During the fourth quarter, asking rent fell 1.1 percent ... effective rent, dropped 1.9 percent ... For the year, effective rent fell 8.9 percent, the largest one-year decline since Reis began tracking it in 1980.

"Never before have landlords been under so much pressure to offer concessions to attract and retain tenants," Calanog said. "Asking rents have fallen at a lower rate, but this just implies further room to fall down the road if conditions do not improve soon."

Thursday, January 07, 2010

More Worries about end of Fed MBS Purchase Program

by Calculated Risk on 1/07/2010 08:27:00 PM

From Liz Rappaport and Jon Hilsenrath at the WSJ: Fed Plan to Stop Buying Mortgages Feeds Recovery Worries

The Federal Reserve's pledge to stop buying mortgages by the end of March is sparking fears among home builders, mortgage investors and even some Fed officials that mortgage rates could rise and knock the fragile housing recovery off course.The authors review the concerns described in the minutes of the December FOMC meeting. From the FOMC minutes:

... some participants still viewed the improved outlook as quite tentative and again pointed to potential sources of softness, including the termination next year of the temporary tax credits for homebuyers and the downward pressure that further increases in foreclosures could put on house prices. Moreover, mortgage markets could come under pressure as the Federal Reserve's agency MBS purchases wind down.Others are even more worried, from the WSJ:

... Ronald Temple, portfolio manager at Lazard Asset Management ... sees mortgage rates rising by a percentage point when the Fed stops buying. A withdrawal of government support, combined with high unemployment and rising mortgage foreclosures, could push home prices down 20%, he said.First, it is very unlikely that mortgage rates would rise by 100bps. My estimate is around 35 bps.

... home builders and others are hoping the Fed will flinch. ... If the Fed stops buying, "it would be the beginning of a crisis again, and we haven't emerged from the last one," said Larry Sorsby, chief financial officer at home builder Hovnanian Enterprises Inc, ... Mr. Sorsby figures the Fed's withdrawal would prompt at least a one-percentage-point rise in mortgage rates, which he fears could squash recent glimmers of more demand for homes. He expects the Fed will, in fact, keep buying. "I doubt they'll just pull out," he said.

Although the Fed has made it clear - repeatedly - that they would either continue the program or restart it if they felt it was necessary, I think it is likely that the Fed will stop buying MBS by the end of March - and then react to whatever happens ...

Fed, FDIC, other Regulators Issue Interest Rate Risk Advisory

by Calculated Risk on 1/07/2010 04:05:00 PM

From the FDIC: FDIC Issues Interest Rate Risk Advisory

The Federal Deposit Insurance Corporation (FDIC), in coordination with the other member agencies of the Federal Financial Institutions Examination Council (FFIEC), released an advisory today reminding institutions of supervisory expectations for sound practices to manage interest rate risk (IRR).Here is the advisory: FFIEC Advisory on Interest Rate Risk Management

...

The member agencies of the FFIEC include the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the National Credit Union Administration, the Office of the Comptroller of the Currency, the Office of Thrift Supervision, and the FFIEC State Liaison Committee. The FDIC currently chairs the FFIEC.

The financial regulators1 are issuing this advisory to remind institutions of supervisory expectations regarding sound practices for managing interest rate risk (IRR). In the current environment of historically low short-term interest rates, it is important for institutions to have robust processes for measuring and, where necessary, mitigating their exposure to potential increases in interest rates.The agencies recommended the following stress testing ...

Current financial market and economic conditions present significant risk management challenges to institutions of all sizes. For a number of institutions, increased loan losses and sharp declines in the values of some securities portfolios are placing downward pressure on capital and earnings. In this challenging environment, funding longer-term assets with shorter-term liabilities can generate earnings, but also poses risks to an institution’s capital and earnings.

The regulators recognize that some degree of IRR is inherent in the business of banking. At the same time, however, institutions are expected to have sound risk management practices in place to measure, monitor, and control IRR exposures.

emphasis added

When conducting scenario analyses, institutions should assess a range of alternative future interest rate scenarios in evaluating IRR exposure. ... In many cases, static interest rate shocks consisting of parallel shifts in the yield curve of plus and minus 200 basis points may not be sufficient to adequately assess an institution’s IRR exposure. As a result, institutions should regularly assess IRR exposures beyond typical industry conventions, including changes in rates of greater magnitude (e.g., up and down 300 and 400 basis points) across different tenors to reflect changing slopes and twists of the yield curve.

NY Times: "Walk Away From Your Mortgage!"

by Calculated Risk on 1/07/2010 02:33:00 PM

From Roger Lowenstein in the NY Times Magazine: Walk Away From Your Mortgage!. Although Lowenstein doesn't cover new ground, he does provide a nice summary.

No one says defaulting on a contract is pretty or that, in a perfectly functioning society, defaults would be the rule. But to put the onus for restraint on ordinary homeowners seems rather strange. If the Mortgage Bankers Association is against defaults, its members, presumably the experts in such matters, might take better care not to lend people more than their homes are worth.Strategic defaults (or "ruthless defaults" as they are known in the mortgage industry) are not new. But they used to be pretty rare - and it has always been hard to quantify.

Hotels: RevPAR Increases in Final Week of 2009

by Calculated Risk on 1/07/2010 12:17:00 PM

A little year end good news for the hotel industry ...

From HotelNewsNow.com: STR: US hotel weekly results end year on positive note

The industry’s occupancy increased 5.9 percent to end the week at 45.5 percent. Average daily rate dropped 4.0 percent to finish the week at US$99.79. RevPAR for the week rose 1.6 percent to finish at US$45.37.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the weekly occupancy rate starting in 2000 and the 52 week moving average (at a record low since the Great Depression).

This graph shows the clear seasonal pattern for hotel occupancy with a peak in the Summer months due to leisure travel, and a trough at the end of the year.

Next week I'll post the usual graph comparing the current year to each of the previous three years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com (Note: They have a free daily email too for hotel news)

The end of the year can be a little confusing because of the holidays, and mid-to-late January will be the next key weeks to see if business travel is picking up in 2010.

There is also bad news: HotelNewsNow provides the latest Atlas California Distressed Hotels Survey. Excerpt:

Since the beginning of 2009:

• The number of hotels that were foreclosed on rose 313%, from 15 to 62.

• The number of hotels in default increased 479%, from 53 to 307.

• California has 4,468 rooms that have been foreclosed on, up 792%

Apartment Vacancy Rate Highest on Record, Rents Plunge

by Calculated Risk on 1/07/2010 09:11:00 AM

From Reuters: U.S. apartment vacancy rate hits 30-year high

The U.S. apartment vacancy rate rose to an almost 30-year high of 8 percent in the fourth quarter, and rents dropped in the biggest one-year slump in 2009, according to real estate research company Reis Inc.Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at a record 11.1% in Q3 2009. This also fits with the NMHC apartment market survey.

In the fourth quarter, the U.S. apartment vacancy rate rose 0.10 percentage points from the prior quarter, and 1.3 percentage points for the year. At 8 percent, it was the highest national vacancy rate Reis has recorded in its 30 years of tracking the sector.

...

In the fourth quarter, U.S. asking rents fell by an average of 0.7 percent to $1,026 ... the largest single-quarter decline since 1999. For 2009 asking rents fell 2.3 percent, also the largest decline in 30 years. ... Effective rent fell 0.7 percent in the quarter to $964 ... The 3 percent drop for the year was more than three times the deterioration in 2002. [CR Edit: the article said "square foot", but this is clearly monthly rent]

"Never before have we observed rental properties in so much distress, both on the space and pricing side," Calanog said. ...

A record high vacancy rate and a record plunge in rents! Anyone surprised?

And more rent declines are coming, from Nick Timiraos at the WSJ: U.S. Now a Renters' Market

Marcus & Millichap is to release a separate report on Friday that forecasts a further 2% to 3% drop in apartment rents over the next year, most of which will be concentrated over the next six months.This is one of the unintended consequences of government policy: rising rental vacancy rates, falling rents, more losses for CMBS investors and local and regional banks, more bank failures, downward pressure on CPI (rent is largest component of CPI) ... and eventually more downward pressure on house prices as the massive government support for house prices slows (because of the price-to-rent ratio). Hoocoodanode?

Weekly Initial Unemployment Claims

by Calculated Risk on 1/07/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 2, the advance figure for seasonally adjusted initial claims was 434,000, an increase of 1,000 from the previous week's revised figure of 433,000. The 4-week moving average was 450,250, a decrease of 10,250 from the previous week's revised average of 460,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Dec. 26 was 4,802,000, a decrease of 179,000 from the preceding week's unrevised level of 4,981,000.

Click on graph for larger image in new window.

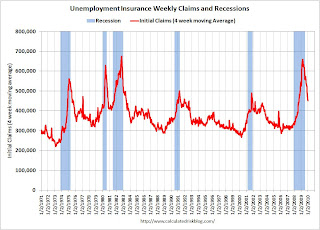

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 10,250 to 450,250. This is the lowest level since September 2008.

The decline in the 4-week average is good news, although the level is still relatively high and suggests continued job losses, or at best, minimal job gains. Also we have also to be careful because the data can be volatile during the holidays with large seasonal adjustments.

Wednesday, January 06, 2010

Report: HAMP Second Lien Modification Program “On Hold”

by Calculated Risk on 1/06/2010 09:37:00 PM

Housing economist Tom Lawler emailed the HAMP administrative website to obtain a list of servicers who had signed up for the Second Lien Modification Program. Here is the response he received:

“That program is currently on hold and there is no list of servicers that registered before it was placed on hold.”The Second Lien program was announced on April 28, 2009 by Treasury:Parallel Second Lien Program to Help Homeowners Achieve Greater Affordability

The Second Lien Program announced today will work in tandem with first lien modifications offered under the Home Affordable Modification Program to deliver a comprehensive affordability solution for struggling borrowers. Second mortgages can create significant challenges in helping borrowers avoid foreclosure, even when a first lien is modified. Up to 50 percent of at-risk mortgages have second liens, and many properties in foreclosure have more than one lien. Under the Second Lien Program, when a Home Affordable Modification is initiated on a first lien, servicers participating in the Second Lien Program will automatically reduce payments on the associated second lien according to a pre-set protocol. Alternatively, servicers will have the option to extinguish the second lien in return for a lump sum payment under a pre-set formula determined by Treasury, allowing servicers to target principal extinguishment to the borrowers where extinguishment is most appropriate.And from the HAMP website:

The Second Lien Modification Program is a complementary program to the Home Affordable Modification Program designed for first lien mortgages. This Program is expected to reach approximately 1 - 1.5 million responsible homeowners who are struggling to afford their mortgage payments. The Second Lien Modification Program coordinates with HAMP's first mortgage modification program to lower payments on second mortgages and offer comprehensive affordability solutions for homeowners.I guess that program is falling a little short.

CRE and CMBS

by Calculated Risk on 1/06/2010 06:30:00 PM

A few related stories ...

From Jon Prior at HousingWire: CMBS Delinquencies Reach New All-Time High

For the first time since the industry began forming commercial mortgage-backed securities (CMBS), delinquencies reached above 6%, according to a report from Trepp, which studies commercial real estate trends.And from the MBA: Commercial/Multifamily Real Estate Market Continues to Feel Effects of Economic Downturn

For the month of December, 6.07% of CMBS loans fell behind by 30 days or more, up from 5.65% in November and a far climb from 1.21% in December 2008.

Commercial real estate markets show the strains of the downturn.More on the MBA Quarterly report with graphs from Diana Golobay at HousingWire: Commercial, Multifamily Lags With Vacancy, Delinquency, MBA Says

Vacancy rates rose in the third quarter for all major property types. For apartment properties, vacancy rates rose from 6.5 percent in the third quarter of 2008 to 8.4 percent in the third quarter of 2009. Industrial properties saw vacancy rates rise from 9.8 percent to 13.0 percent; office properties saw a rise from 16.0 percent to 19.4 percent and retail vacancies rose from 12.9 percent to 18.6 percent.

And asking rents have been falling – by 6 percent for apartments, 9 percent for industrial properties, 9 percent for office properties and 8 percent for retail properties. Even with lease terms muting some of the impact, the combination of falling rents and rising vacancies has placed greater pressure on properties’ bottom-lines.

And from early this morning: Reis: Strip Mall Vacancy Rate Hits 10.6%, Highest on Record

New Research on Mortgage Modifications and Principal Reduction

by Calculated Risk on 1/06/2010 03:54:00 PM

I've excerpted below from a paper by New York Fed Researchers Andrew Haughwout, Ebiere Okah, and Joseph Tracy: Second Chances: Subprime Mortgage Modification and Re-Default

Although the paper uses subprime data, the general results are applicable to all mortgages. The researchers point out that principal reductions lead to much lower redefault rates (that is obvious, but still worth noting). They also note that principal reductions help mitigate the mobility problem - as I've noted before, the lack of worker mobility slows the potential growth of the economy, leads to lower home maintenance, and possibly "diminished support for local public goods"1.

But the authors don't suggest who should pay for the reductions in principal. If this was a government program, it would be very expensive and unpopular. Diana Olick wrote today at CNBC: Are Principal Writedowns the Answer to Housing Crisis?

I would honestly rather see my home's value go down than see the guy next door ... who made a poor/negligent financial decision get a mulligan at my expense.I think that would be the overwhelming public reaction.

Some people point to Lewis Ranieri's apparent success with principal reductions, from Fortune: Lewie Ranieri wants to fix the mortgage mess

Now Ranieri is championing an inventive solution for fixing the mess he's accused of enabling in the first place. Ranieri has raised $825 million from 31 foundations and corporate and public pension funds, including the South Carolina Retirement Systems, to form the Selene Residential Mortgage Opportunity Fund.This only works because Ranieri bought the distressed mortgages at a deep discount, and his company has no reputation risk. Ranieri wants his borrowers to know that he will reduce their principal.

Selene's mission is simple: to buy delinquent mortgages at a deep discount, work with homeowners to get them paying again, and resell the now stable loans for profit. To get homeowners to do their part, Ranieri is taking the radical step of substantially lowering their mortgage balances.

Imagine what would happen to Wells Fargo or Bank of America if their borrowers found out that the banks would substantially reduce their principal if they were 1) underwater (negative equity), and 2) stopped making their payments. The delinquency rate and losses would skyrocket!

So there is no easy solution. Government supported principal reductions will probably not happen, and private principal reductions - although happening - will not become widespread. This means more foreclosures and short sales (or as I always joke, build a time machine and stop the bubble early - that might be easier!)

And here are some excerpts from the paper:

Our analysis of those modifications in which payments were meaningfully reduced indicates that re-default rates – around 57% in the first year – are distressingly high. Yet the magnitude and form of modifications make a difference. Mortgages that receive larger payment reductions are significantly less likely to redefault, as are those that are modified in such a way as to restore the borrower’s equity position. Of course, these kinds of modifications are not mutually exclusive, since reductions in mortgage balances offer both increased equity and reduced payments.1 Housing Busts and Household Mobility by Fernando Ferreira, Joseph Gyourko (both from Wharton) and Joseph Tracy (New York Fed).

Our findings have potentially important implications for the design of modification programs going forward. The Administration’s HAMP program is focused on increasing borrowers’ ability to make their monthly payments, as measured by the DTI. Under HAMP, reductions in payments are primarily achieved by subsidizing lenders to reduce interest rates and extend mortgage term. While such interventions can reduce re-default rates, an alternative scheme would simultaneously enhance the borrower’s ability and willingness to pay the debt, by writing down principal in order to restore the borrower’s equity position. We estimate that restoring the borrower’s incentive to pay in this way can double the reduction in re-default rates achieved by payment reductions alone.

Another distinction between modifications that reduce the monthly payment by cutting the interest rate as compared to reducing the principal is the likely impact on household mobility. Ferreira et al (2010) using over two decades of data from the American Housing Survey estimate that each $1,000 in subsidized interest to a borrower reduces the two-year mobility rate by 1.4 percentage points. Modifying the interest rate to a below market rate creates an in-place subsidy to the borrower leading to a lock-in effect. .... modification creates an annual subsidy of over $3,000. The results in Ferreira et al (2010) imply that this will lead to on average a reduction in the household two-year mobility rate of over 4.4 percentage points – more than a forty percent reduction in the overall rate. In contrast, reducing the monthly payment through reducing the principal on the mortgage does not create an in-place subsidy and would not lead to a lock-in effect.

emphasis added