by Calculated Risk on 1/09/2010 02:10:00 AM

Saturday, January 09, 2010

Late Night Jim the Realtor

Jim writes: "Old what's-her-name left a long trail of wreckage in her fraudulant ways of 2007 - this is the last of 10 houses sold with 100% financing where they increased the sales price by $100,000 over list, pocketed the difference, and promised the buyers that they would rent them out to lease-optionors. All but one was foreclosed, that one the owner coughed up $300,000+ to save his credit."

Friday, January 08, 2010

Bank Failure #1: Horizon Bank, Bellingham, Washington

by Calculated Risk on 1/08/2010 09:17:00 PM

Emerald City's Shangra-La

No eternal life

by Soylent Green is People

Earlier employment posts:

• Employment Report: 85K Jobs Lost, 10% Unemployment Rate for graphs of unemployment rate and a comparison to previous recessions.

• Seasonal Employment-Population Ratio, Part Time Workers, Temporary Workers

• Unemployed over 26 Weeks, Diffusion Index, Seasonal Retail Hiring

From the FDIC: Washington Federal Savings and Loan Association, Seattle, Washington, Assumes All the Deposits of Horizon Bank, Bellingham, Washington

Horizon Bank, Bellingham, Washington, was closed today by the Washington State Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of September 30, 2009, Horizon Bank had approximately $1.3 billion in total assets and $1.1 billion in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $539.1 million. ... Horizon Bank is the first FDIC-insured institution to fail in the nation this year, and the first in Washington. The last FDIC-insured institution closed in the state was Venture Bank, Lacey, on September 11, 2009.

Unofficial Problem Bank List increases to 576

by Calculated Risk on 1/08/2010 07:15:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

The Unofficial Problem Bank List changed by a net of one institution this week to 576 with assets of $304.8 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Additions include North Valley Bank, Redding, CA ($910 million); First Trade Union Bank, Boston, MA ($690 million); Wheatland Bank, Naperville, IL ($481 million); and Decatur First Bank, Decatur, GA ($241 million).

Removals are terminations of Formal Agreements issued by the OCC against First National Bank of Baldwin County, Foley, AL ($263 million); Capitol National Bank, Lansing, MI ($229 million); and First National Bank of Wyoming, Laramie, WY ($218 million). These removals could be temporary as the OCC may be converting the action against these banks from a Formal Agreement to a Consent Order. The OCC is much prompter in posting its terminations than its new actions.

Other changes to list this week are Prompt Corrective Action orders being issued against banks-- Mainstreet Savings Bank, FSB, and Sun American Bank -- that are

already operating under a formal action.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Treasury: HAMP 2nd Lien Program is "moving forward", and more

by Calculated Risk on 1/08/2010 04:14:00 PM

First a summary of employment posts, and some other stories:

• Employment Report: 85K Jobs Lost, 10% Unemployment Rate for graphs of unemployment rate and a comparison to previous recessions.

• Seasonal Employment-Population Ratio, Part Time Workers, Temporary Workers

• Unemployed over 26 Weeks, Diffusion Index, Seasonal Retail Hiring

And other stories:

• From SacBee: Schwarzenegger declares budget emergency, proposes deep cuts

• From Bloomberg: Soured Non-Agency Mortgages Rise to 1.81 Million

• From Bloomberg: Tishman, BlackRock to Miss Stuyvesant Town Payment

HAMP 2nd Lien Program Update

In an email exchange with me, Treasury spokesperson Meg Reilly clarified the status of the HAMP 2nd Lien program today. Ms. Reilly told me the program is "moving forward", and although there are no "official contracts signed yet, ... servicers are committing to the program". She characterized the email received1 by Tom Lawler from HAMP administration as "misleading" (I think that means "incorrect").

Ms. Reilly also wrote:

The Second Lien program is moving forward. Treasury has been working to create program infrastructure and technology, including a new platform that matches second liens to first liens modified under HAMP. Because there has not been a systematic method of notification to second lien holders when a first lien on the same property is modified, ramp up has taken some time. We have made enormous progress and continue to move forward with innovative technological development and program implementation and expect to finalize servicer contracts soon.1 Mr. Lawler has shared with me his email exchange with HAMP administration. His questions were straightforward concerning the status of the 2nd lien program: "Is there a list of servicers who have signed up for the Second Lien Modification Program? (2MP) The last time I checked with y'all, no one had signed up yet." And the response was: "That program is currently on hold and there is no list of servicers that registered before it was placed on hold." I considered the "on hold" important news, although Treasury has clarified that today. (ht to Diana Golobay at HousingWire who contacted Treasury first).

Consumer Credit Declines for Record 10th Straight Month

by Calculated Risk on 1/08/2010 03:00:00 PM

The Federal Reserve reports:

Consumer credit decreased at an annual rate of 8-1/2 percent in November. Revolving credit decreased at an annual rate of 18-1/2percent, and nonrevolving credit decreased at an annual rate of 3 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year (YoY) change in consumer credit. Consumer credit is off 3.9% over the last 12 months - and falling fast. The previous record YoY decline was 1.9% in 1991.

Consumer credit has declined for a record 10 straight months - and declined for 13 of the last 14 months and is now 4.5% below the peak in July 2008. It is difficult to get a robust recovery without an expansion of consumer credit - unless the recovery is built on business spending and exports (seems unlikely).

Note: The Fed reports a simple annual rate (multiplies change in month by 12) as opposed to a compounded annual rate. Consumer credit does not include real estate debt.

FDIC Sells Equity interest in $1 Billion in CRE Loans

by Calculated Risk on 1/08/2010 01:52:00 PM

From the FDIC: FDIC Announces Winning Bidder of $1 Billion in Loans

The Federal Deposit Insurance Corporation (FDIC) has closed on a sale of an equity interest in a limited liability company (LLC) created to hold certain assets out of 22 failed bank receiverships. ...That is a reminder that today is the first "Bank Failure Friday" of 2010 - and that most of the bank failures this year will be because of CRE loans.

A total of 21 groups submitted bids to purchase a 40 percent ownership interest in the newly formed LLC. The participating FDIC receiverships will hold the remaining 60 percent equity interest in the LLC.

The FDIC as Receiver for the failed banks conveyed to the LLC a portfolio of approximately 1200 distressed commercial real estate loans, of which seventy percent were delinquent. Collectively, the loans have an unpaid principal balance of $1.02 billion. Seventy-five percent of the collateral of the portfolio is located in Georgia, California, Nevada and Florida. The participating FDIC receiverships provided financing to the LLC by issuing approximately $233 million of corporate guaranteed notes. Colony Capital paid a total of approximately $90.5 million (net of working capital) in cash for its 40 percent equity stake in the LLC, which equals approximately 44 percent of the unpaid principal balance of the assets. As the LLC's managing equity owner, Colony Capital will provide for the management, servicing and ultimate disposition of the LLC's assets.

...

All of the loans were from banks that have failed during the past 18 months.

Unemployed over 26 Weeks, Diffusion Index, Seasonal Retail Hiring

by Calculated Risk on 1/08/2010 10:59:00 AM

The underlying details of the employment report are mostly weak. A couple of exceptions are the manufacturing diffusion index has increased significantly over the last couple of months (see below), and temporary help hiring has been strong (see previous post). Otherwise this report was grim: Average weekly earnings declined. Average weekly hours were flat.

And three more graphs ...

Unemployed over 26 Weeks The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are a record 6.13 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.0% of the civilian workforce. (note: records started in 1948)

Diffusion Index The second graph shows the BLS diffusion indexes for total private employment and manufacturing employment.

The second graph shows the BLS diffusion indexes for total private employment and manufacturing employment.

Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Both the "all industries" and "manufacturing" employment diffusion indices had been trending up - meaning job losses are becoming less widespread. The manufacturing diffusion index has increased significantly over the last couple months.

Back in March, I pointed out the increase in the diffusion index was "a sliver of good news" in a very grim employment report. The diffusion index in March suggested that the situation was no longer getting worse.

Now the index shows job losses are less widespread. However this still shows a minority of industries are hiring, and the all industries diffusion index will probably be above 50 when the employment recovery begins. (For more on how this is constructed, see the BLS Handbook)

Seasonal Retail Hiring

Here is the final seasonal retail hiring graph for the year ... Retailers hired significantly more seasonal workers in 2009 than in 2008, although this was still the lowest numbers of seasonal hires (excluding 2008) since 1989.

Retailers hired significantly more seasonal workers in 2009 than in 2008, although this was still the lowest numbers of seasonal hires (excluding 2008) since 1989.

It is important to note that total retail payroll jobs - even with the increase in seasonal hires - was 426,000 fewer in December 2009 than in December 2008. This means retailers cut back sharply on permanent employees and relied a little more on seasonal employees this year.

Earlier employment posts today:

Employment-Population Ratio, Part Time Workers, Temporary Workers

by Calculated Risk on 1/08/2010 09:30:00 AM

Here are a few more graphs based on the (un)employment report ...

Employment-Population Ratio

The Employment-Population ratio continues to plunge, falling to 58.2% in December - the lowest level since 1983. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

The Labor Force Participation Rate fell to 64.6% (the percentage of the working age population in the labor force). This is the lowest since the early 80s.

When the job market starts to recover, many of these people will reenter the workforce and look for employment - and that will keep the unemployment rate elevated for some time.

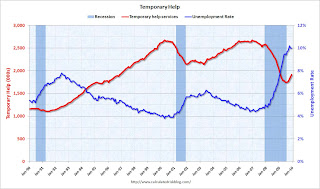

Temporary Workers

From the BLS report:

Temporary help services added 47,000 jobs in December. Since reaching a low point in July, temporary help services employment has risen by 166,000.

This graph shows temporary help services (seasonally adjusted) and the unemployment rate. Unfortunately the data on temporary help services only goes back to 1990, but it does appear temporary help and the unemployment rate have been inversely correlated.

This graph shows temporary help services (seasonally adjusted) and the unemployment rate. Unfortunately the data on temporary help services only goes back to 1990, but it does appear temporary help and the unemployment rate have been inversely correlated.The thinking is that before companies hire permanent employees following a recession, employers will first increase the hours worked of current employees and also hire temporary employees. Since the number of temporary workers increased sharply, some people think this might be signaling the beginning of an employment recovery.

However, there has been some evidence of a shift by employers to more temporary workers, and the saying may become "We are all temporary now!", so use this increase with caution.

Tom Abate at the San Francisco Chronicle recently provided some caution on using temporary help as a guide:

BLS economist Amar Mann said an analysis by the San Francisco office suggests that employers are getting more sophisticated about using temp hiring as a clutch to downshift into recessions and upshift into recoveries.Part Time for Economic Reasons

...

"Employers are getting more savvy about using just-in-time labor on the way down and on the way up," he said

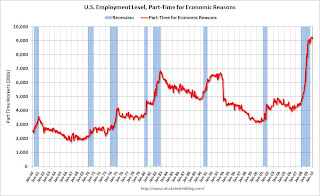

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged at 9.2 million in December and has been relatively flat since March. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined slightly to 9.165 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined slightly to 9.165 million. The all time record was set in October.

Overall this is a grim employment report.

Earlier employment post today:

Employment Report: 85K Jobs Lost, 10% Unemployment Rate

by Calculated Risk on 1/08/2010 08:30:00 AM

From the BLS:

Nonfarm payroll employment edged down (-85,000) in December, and the unemployment rate was unchanged at 10.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment fell in construction, manufacturing, and wholesale trade, while temporary help services and health care added jobs.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 85,000 in December. The economy has lost almost 4.2 million jobs over the last year, and 7.24 million jobs1 since the beginning of the current employment recession.

The unemployment rate was steady at 10.0 percent. Year over year employment is declining, but still strongly negative.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

The 85,000 jobs lost was in line with other indicators (like ADP, weekly initial claims, ISM reports). The BLS is now reporting a small increase in payroll jobs in November (4,000), however that is because October was revised down by 16,000 jobs!

1Note: The total jobs lost does not include the preliminary benchmark payroll revision of minus 824,000 jobs. (This is the preliminary estimate of the annual revision that will be announced early in 2010).

Reis: U.S. Office Vacancy Rate Hits 15 Year High at 17 Percent

by Calculated Risk on 1/08/2010 12:22:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the office vacancy rate starting 1991.

Reis is reporting the vacancy rate rose to 17.0% in Q4, from 16.6% in Q3 and from 14.5% in Q4 2008. The peak following the previous recession was 16.9%.

From Reuters: At 17 pct, US office vacancy rate hits 15-year high

During the fourth quarter the national office vacancy rate climbed 0.40 percentage point from the third quarter to 17 percent, the highest level since 1994.The vacancy rate isn't a record, but there was a record decline in effective rents. Add that to the records announced earlier this week ...

...

During the fourth quarter, asking rent fell 1.1 percent ... effective rent, dropped 1.9 percent ... For the year, effective rent fell 8.9 percent, the largest one-year decline since Reis began tracking it in 1980.

"Never before have landlords been under so much pressure to offer concessions to attract and retain tenants," Calanog said. "Asking rents have fallen at a lower rate, but this just implies further room to fall down the road if conditions do not improve soon."