by Calculated Risk on 1/10/2010 09:28:00 PM

Sunday, January 10, 2010

Update on "Foreclosureville, U.S.A."

Note: Here is a weekly summary and look ahead.

Evelyn Nieves at HuffingtonPost has an update on Stockton, CA: Stockton, California Is Foreclosureville, USA, Has One Of The Worst Foreclosure Rates In The United Sates. A short excerpt:

Stockton is a changed place. Whole neighborhoods have been decimated by the mortgage disaster. The tax base has shrunken. City services and municipal jobs have been cut. Unemployment hovers at about 16 percent. Economists predict it will take years for Stockton to recover from the housing bust.A long way from normal ...

...

Housing developments built for commuters have been hit the hardest, since they were the ones to attract newcomers fleeing the huge spike in prices closer to the Bay area. Those whose livelihoods depend on a healthy housing environment – real estate brokers, contractors, day laborers – are barely holding on here.

...

The heart of Foreclosureville, U.S.A. – the Stockton subdivision that had more bank repossessions than any other place in the country for much of the last two years – is starting to look like its old self again.

The "For Sale" signs that overwhelmed Weston Ranch are mostly gone, and the lawns where weeds grew like corn stalks are shorn.

Foreclosure businesses that sprang up, including one that spray-painted brown lawns green and another that offered a foreclosure bus tour, have folded. Every time a foreclosure hits the market, bargain hunters snap it up.

But looks are deceiving. In Weston Ranch, financial devastation struck like a natural disaster and the ground has not yet settled. Speculators are buying houses to rent out. On streets where everyone knew everyone, no one knows anyone.

Fed MBS Purchases: 90% Complete

by Calculated Risk on 1/10/2010 06:28:00 PM

Note: Here is a weekly summary and look ahead.

The Hartford Courant quoted Boston Fed President Eric S. Rosengren as saying he expects mortgage rates to rise 50 to 75 bps when the Fed MBS purchase program ends.

And that is an excuse to update the status of the program. From the Atlanta Fed weekly Financial Highlights:  Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

[T]he agency-backed MBS purchase program is ... onThe Fed purchased an additional $12 billion net in MBS over the last week, bringing the total to $1.127 trillion or just over 90% complete.

schedule, with more than $1.1 trillion purchased by year-end.The Fed purchased a net total of $9.3 billion of agency-backed MBS through the week of December 30. This brings its total purchases up to $1.115 trillion, and by the end of the first quarter 2010 the Fed will purchase $1.25 trillion (thus, it is 89% complete).

Weekly Summary and a Look Ahead

by Calculated Risk on 1/10/2010 01:59:00 PM

Economic news this week includes the trade report for November on Tuesday (consensus is for an increase in the trade deficit from $32.9 billion in October to around $35 billion in November). Retail sales for December will be released on Thursday (consensus is for 0.2% increase ex-auto), and CPI and Industrial Production / Capacity Utilization (for December) on Friday.

I expect the AAR rail traffic report, DOT's vehicle miles, and West coast port traffic data all to be released this week too.

And a summary of last week ...

Here are couple of graphs based on the employment report this week:

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost). The current employment recession is the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Note: The total jobs lost does not include the annual benchmark payroll revision that will be announced on February 5, 2010. The preliminary estimate is for a downward revision of 824,000 jobs - pushing the total jobs lost over 8 million.

The second graph (blue line) is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The second graph (blue line) is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are a record 6.13 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.0% of the civilian workforce. (note: records started in 1948).

For more on the employment report:

-> Employment Report: 85K Jobs Lost, 10% Unemployment Rate

-> Employment-Population Ratio, Part Time Workers, Temporary Workers

-> Unemployed over 26 Weeks, Diffusion Index, Seasonal Retail Hiring

This graph shows the office vacancy rate starting in 1991.

This graph shows the office vacancy rate starting in 1991.Reis is reporting the vacancy rate rose to 17.0% in Q4, from 16.6% in Q3 and from 14.5% in Q4 2008. The peak following the previous recession was 16.9%.

-> On offices from Reuters: At 17 pct, US office vacancy rate hits 15-year high

-> On apartments from Reuters: U.S. apartment vacancy rate hits 30-year high

-> On malls from Reuters: US shopping center vacancies hit records - report

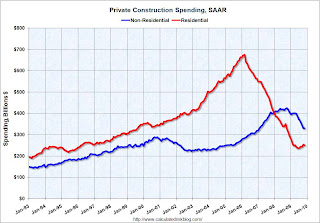

Residential construction spending was off slightly in November, and is now only 5.8% above the bottom earlier in 2009. Non-residential appeared flat in November, but that was only because of a downward revision to October spending. The collapse in non-residential construction spending continues ...

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Private residential construction spending is now 62.9% below the peak of early 2006.

Private non-residential construction spending is 22.5% below the peak of October 2008.

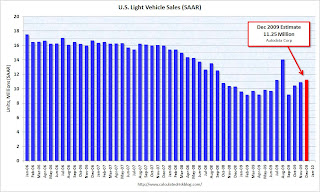

U.S. Light Vehicle Sales 11.25 Million SAAR in December

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for December (red, light vehicle sales of 11.25 million SAAR from AutoData Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for December (red, light vehicle sales of 11.25 million SAAR from AutoData Corp).Excluding August (sales driven by "Cash-for-clunkers"), December was the strongest month since September 2008 (12.5 million SAAR) before sales fell off the final cliff.

The current level of sales are still very low, and are still below the lowest point for the '90/'91 recession (even with a larger population). On an annual basis, 2009 sales were probably just above the level of 1982 (10.357 million light vehicles).

Best wishes to all.

China's Exports Increase, Possible Renminbi Appreciation Seen in 2010

by Calculated Risk on 1/10/2010 11:44:00 AM

From Patti Waldmeir in the Financial Times: China’s exports rise as economy picks up

Exports climbed 17.7 per cent last month from a year earlier and imports shot up 55.9 per cent, according to official figures released on Sunday. ...This was an easy comparison because exports collapsed last year.

Andy Rothman, CLSA’s chief China economist, predicted ... that if the export recovery continues, that would give China’s leaders the political cover they need to resume renminbi appreciation by mid-year, with a possible increase of 3 per cent for 2010.

excerpted with permission

The article quotes Rothman arguing that the Chinese government has been waiting for three things before resuming appreciation of the renminbi: 1) economic recovery in China, 2) stabilization in Europe and the U.S., and 3) sustained Chinese export growth (for several months). Rothman thinks the first two have happened, and that if export growth continues, the Chinese will allow the renminbi to appreciate later this year.

Fed's Rosengren Expects Mortgage Rates to Rise up to 75bps

by Calculated Risk on 1/10/2010 08:39:00 AM

From Kenneth Gosselin and Dan Harr at The Hartford Courant: Boston Fed Chief Expects Mortgage Rates To Rise This Spring (ht MrM)

Eric S. Rosengren, president and chief executive of the Boston Fed, said in an interview at The Courant that he expects [mortgage] rates to rise when the [Fed MBS purchase] program ends — or before, as the end approaches.So Rosengren is expecting a 50 to 75 bps increase when the Fed MBS purchase program ends. That is slightly higher than my forecast of 35 to 50 bps.

"Actually, I've been surprised that we haven't seen more of a backing up already," Rosengren said. "You maybe would have thought you would have seen rates move up more quickly than they have, but nonetheless that is a concern."

...

The mortgage rate increase of one-half to three-fourths of a percentage point from the end of the Fed program would happen regardless of any Fed action in interest rates, Rosengren said.

...

Rosengren said the Fed could choose to extend the mortgage buying program if the economy deteriorated dramatically.

"That's not in our forecast," Rosengren said. "That's not what we're expecting."

Saturday, January 09, 2010

Daily Show: Moment of Zen

by Calculated Risk on 1/09/2010 09:46:00 PM

Off topic: In 2006, Calvin Trillin predicts ... (click link if embed doesn't work)

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Moment of Zen - Calvin Trillin's Prediction | ||||

| www.thedailyshow.com | ||||

| ||||

Haves and Have Nots

by Calculated Risk on 1/09/2010 06:27:00 PM

Tough times for the "have nots" ...

For the Unemployed, New Job Often Means a Pay Cut

but not so bad for the "haves" ...

From Louise Story and Eric Dash at the NY Times: For Top Bonuses on Wall Street, 7 Figures or 8?

Bank executives are grappling with a question that exasperates, even infuriates, many recession-weary Americans: Just how big should their paydays be? Despite calls for restraint from Washington and a chafed public, resurgent banks are preparing to pay out bonuses that rival those of the boom years.And in the UK from James Quinn at the Telegraph: Record bonus pot at JP Morgan

JP Morgan's pay-out looks set to be the highest ever offered by the bank. Based on analyst consensus, it will be 28pc up on 2008 and 2007 levels ... The investment bank's refusal to rein back bonuses is likely to be seen as an act of defiance both by the US and UK governments.It must feel good to be a bankster! (thread music)

HAMP Loan Modifications and the Fifth Amendment

by Calculated Risk on 1/09/2010 02:21:00 PM

CR Note: This is a guest post from albrt.

CR sent along this story concerning a foreclosure case in California (ht Lyle). The homedebtor enjoyed some initial success arguing a non-judicial foreclosure was a violation of due process. As it happens I'm out of the country, so this will be a relatively short post.

The homedebtors are named Huxtable and Agnew. Interestingly, Agnew is also listed as the "lead attorney" for the plaintiffs. The plaintiffs defaulted in late 2007, and the bank began a non-judicial foreclosure process in late 2008. The plaintiffs filed suit in federal court to stop the foreclosure, naming as defendants Timothy Geithner, the FHFA the lender and the servicer. The plaintiffs were allegedly denied a HAMP modification, and they claim the government and the bank violated the plaintiffs' right to "due process under the Fifth Amendment for failing to create rules implementing HAMP that comport with due process."

The bank tried to have itself dismissed from the case because Fifth Amendment procedural due process applies to the government, not private companies. For whatever reason, this bank apparently considers itself a private company and not part of the federal government at this time. The judge refused to dismiss the case because the plaintiffs might be able to prove the government has "insinuated itself into a position of interdependence" with the bank. The phrase seems apt, felicitous even, and perchance in the fulness of time may prove to be widely applicable. But this is only a very preliminary decision, and the court will need to take a look at the relationship between this particular bank and the government.

The court may also need to consider whether the plaintiffs have any constitutionally protectable interest. The Fifth Amendment says, among other things, that no person may be "deprived of life, liberty, or property, without due process of law." A deeply underwater homedebtor facing a lawful non-judicial foreclosure process may not have much property interest in the home. It is possible to have a property interest in certain types of government benefits if the benefits are an entitlement explicitly created by law. It is not clear whether HAMP creates such an entitlement, and that may end up being the main issue in the case.

Due process was a mildly hot topic in the comments a few weeks ago, so I'll provide some additional thoughts on the subject next weekend. Please leave questions and suggestions in the comments here and I'll check back later.

The text of the Huxtable case is available at a foreclosure consultant site here, which also has a number of other foreclosure cases. I haven't been able to follow the comments while traveling, and I probably won't be able to monitor the comments for this short post, so sorry if I've overlooked a hat tip.

CR note: The opinion is interesting reading! This is a guest post from albrt.

Labor Force Participation Rate

by Calculated Risk on 1/09/2010 12:02:00 PM

There have been a number of comments about the recent collapse in the labor force participation rate. The rate has declined from 65.4% in July to 64.6% in December.

If the participation rate was at the same level as in July, the unemployment rate would probably be around 10.8%.

This gives me an excuse for a long term graph. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the total participation rate, and for men and women, starting in 1948. Although there are still far more men in the labor force than women (we are talking labor force, not payroll jobs!), the participation rate for men has been declining for decades. The participation rate for women was increasing steadily until the late 90s, and has decreased slightly since then.

However, since July, the participation rate for both men and women has fallen sharply. For men, the rate has fallen from 72.0% to 71.0%, or a decline of 801,000 men.

For women, the rate has fallen from 59.2% to 58.6%, or a decline of 491,000 women.

This is a total of almost 1.3 million people who have left the labor force since July. This is a key reason the unemployment rate is only at 10.0%.

Eurozone Unemployment also at 10%

by Calculated Risk on 1/09/2010 09:32:00 AM

Forgot to mention yesterday that unemployment in the eurozone also hit 10%:

From the Financial Times: Eurozone unemployment hits 10%

The Netherlands’ jobless rate is 3.9 per cent ... Spanish unemployment ... is at 19.4 per cent, nearly three times its level before its credit-fuelled economy collapsed. Germany has 7.6 per cent unemployment.More from Eurostat: Euro area unemployment rate up to 10.0% (pdf)

...

The jobless rate has been contained by extraordinary measures that have protected the labour market, most notably the sharp rise in “short-work” schemes, where governments subsidise employers to keep workers on their payrolls through the downturn.

excerpted with permission

Click on graph for larger image in new window.

Click on graph for larger image in new window.These figures are published by Eurostat, the statistical office of the European Union.

Among the Member States, the lowest unemployment rates were recorded in the Netherlands (3.9%) and Austria (5.5%), and the highest rates in Latvia (22.3%) and Spain (19.4%).

Compared with a year ago, all Member States recorded an increase in their unemployment rate. The smallest increases were observed in Germany (7.1% to 7.6%), Luxemburg (5.2% to 6.0%) and Malta (6.2% to 7.0%). The highest increases were registered in Latvia (10.2% to 22.3%), Estonia (6.5% to 15.2% between the third quarters of 2008 and 2009) and Lithuania (6.4% to 14.6% between the third quarters of 2008 and 2009).