by Calculated Risk on 1/12/2010 10:00:00 AM

Tuesday, January 12, 2010

BLS: Near Record Low Job Openings in November

From the BLS: Job Openings and Labor Turnover Summary

There were 2.4 million job openings on the last business day of November 2009, the U.S. Bureau of Labor Statistics reported today. The job openings rate was little changed over the month at 1.8 percent. The openings rate has held relatively steady since March 2009. The hires rate (3.2 percent) and the separations rate (3.3 percent) were essentially unchanged in November.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. Remember the CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people. See Jobs and the Unemployment Rate for a comparison of the two surveys.

The following graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and light blue added together equals total separations.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (purple line) and separations (red and light blue together) are pretty close each month. When the purple line is above total separations, the economy is adding net jobs, when the blue line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 4.176 million hires in November, and 4.340 million separations, or 164 thousand net jobs lost. The comparable CES report showed a gain of 4 thousand jobs in November (after revisions).

Openings near a series low can't be a positive sign. Separations have declined sharply, but hiring has not picked up. This also suggests that eventually (possibly when the March 2010 benchmark revision is announced in Feb 2011), the November net change in employment will be revised down.

Trade Deficit Increases in November

by Calculated Risk on 1/12/2010 08:31:00 AM

The Census Bureau reports:

The ... total November exports of $138.2 billion and imports of $174.6 billion resulted in a goods and services deficit of $36.4 billion, up from $33.2 billion in October, revised. November exports were $1.2 billion more than October exports of $137.0 billion. November imports were $4.4 billion more than October imports of $170.2 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through November 2009.

Both imports and exports increased in November. On a year-over-year basis, exports are off 2.3% and imports are off 5.5%.

The second graph shows the U.S. trade deficit, with and without petroleum, through November.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $72.54 in November - up 85% from the low in February (at $39.22).

Oil import volumes are off 8% from last November.

Overall trade continues to increase, although both imports and exports are still off significantly from the pre-financial crisis levels. Net export growth had been one of the positives for the U.S. economy - but now imports are growing faster than exports.

Monday, January 11, 2010

The Depression of 1948?

by Calculated Risk on 1/11/2010 10:55:00 PM

It is always nice to be mentioned. Henry Blodget called the graph comparing the percent job losses in post WWII recessions "The Scariest Jobs Chart Ever"1. And then Glenn Beck mentioned the graph too, but ... uh, the Depression wasn't in 1948!

If we had the data, the percent job losses during the Great Depression (in the '30s) would probably have been 20% or more - far worse than the current employment recession. It was the Great Depression that led to the expansion of the BLS program to track employment. From the BLS:

With the deepening economic crisis in 1930, President Herbert C. Hoover appointed an Advisory Committee on Employment Statistics, which recommended extension of the BLS program to include the development of hours and earnings series. In 1932, the U.S. Congress granted an increase in the BLS appropriation for the survey. In 1933, average hourly earnings and average weekly hours were published for the first time for total manufacturing, for 90 manufacturing industries, and for 14 nonmanufacturing categories.

During the Great Depression, there was controversy concerning the actual number of unemployed people; no reliable measures of employment or unemployment existed. This confusion stimulated efforts to develop comprehensive estimates of total wage and salary employment in nonfarm industries, and BLS survey data produced such a figure for the first time in 1936.

Click on graph for larger image in new window.

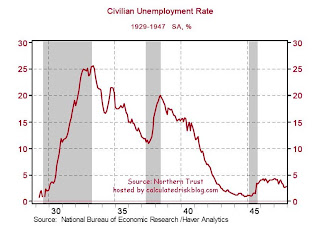

Click on graph for larger image in new window.Although there is some data on unemployment during the Great Depression, it is based on very rough estimates.

As an example, this graph from Northern Trust shows an estimate of the unemployment rate from 1929 through 1947.

And here is a repeat of the "scariest chart ever".

And here is a repeat of the "scariest chart ever".Even after the benchmark revision is added next month, the job losses for the current recession as a percent of peak employment are only about one fourth of the losses in the Great Depression.

1Note: The total jobs lost does not include the preliminary benchmark payroll revision of minus 824,000 jobs. (This is the preliminary estimate of the final benchmark revision that will be announced on February 5, 2010).

CRE: "Almost FREE"

by Calculated Risk on 1/11/2010 07:56:00 PM

Talk about falling rents ... Doug in Chicago sends along this photo "a storefront in a normally bustling neighborhood retail district on North Clark St in Chicago, about a mile south of Wrigley Field". (telephone number blacked out)

Distressed Sales: Sacramento as an Example

by Calculated Risk on 1/11/2010 04:56:00 PM

NOTE: I expect the use of short sales to increase nationwide in 2010. Since the Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the December data.

They started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. About 66 percent of all resales (single family homes and condos) were distressed sales in December. The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs has been declining, but the percent of short sales has been steadily increasing, from 16.7% in June to 24.7% in December.

The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs has been declining, but the percent of short sales has been steadily increasing, from 16.7% in June to 24.7% in December.

When the trial modification period ends, the REO sales will probably increase. Also, I expect short sales to be higher in 2010 than in 2009 (there is more emphasis on short sales and deed-in-lieu of foreclosure now).

Total sales in December were off 14.3% compared to December 2008; the seventh month in a row with declining YoY sales.

On financing, over half the sales were either all cash (24.6%) or FHA loans (27.5%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

Fed Economic Letter: "Global Household Leverage, House Prices, and Consumption"

by Calculated Risk on 1/11/2010 02:21:00 PM

From Reuven Glick and Kevin J. Lansing at the San Francisco Fed: Global Household Leverage, House Prices, and Consumption (ht Amir)

"[O]ver-investment and over-speculation are often important; but they would have far less serious results were they not conducted with borrowed money." —Irving Fisher (1933)And a couple of graphs from the paper. The first graph plots the change in house prices vs. the change in household leverage.

In the United States and many other industrial countries, the recent financial crisis contributed to the longest and most severe economic contraction since the Great Depression. The rapid expansion in the use of borrowed money, or leverage, by households in recent years, is one factor that may help account for the virulence of the downturn.

In the years leading up to the crisis, a combination of factors, including low interest rates, lax lending standards, a proliferation of exotic mortgage products, and the growth of a global market for securitized loans fueled a rapid increase in household borrowing. An influx of new and often speculative homebuyers with access to easy credit helped bid up U.S. house prices to unprecedented levels relative to rents or disposable income. U.S. household leverage, as measured by the ratio of debt to personal disposable income, reached an all-time high, exceeding 130% in 2007 (see Glick and Lansing 2009). National house prices peaked in 2006 and have since dropped by about 30%. The bursting of the housing bubble set off a chain of events that pushed the U.S. economy into a severe recession that started in December 2007.

This Economic Letter shows that the recent U.S. experience is by no means unique. Household leverage in many industrial countries increased dramatically in the years prior to 2007. Countries with the largest increases in household leverage tended to experience the fastest rise in house prices over the same period. Moreover, these same countries tended to experience the most severe declines in consumption once house prices started falling. The common patterns observed across countries suggest that, as in the United States, the unwinding of excess household leverage via increased saving or increased default rates could be a significant drag on consumption and bank lending going forward, possibly muting the vigor of the economic recovery.

Note: this is on a national basis. Professors Atif Mian and Amir Sufi (both University of Chicago Booth School of Business and NBER) published a paper last year showing the same result across U.S. counties), see: The Household Leverage-Driven Recession of 2007 to 2009 or my post last September for excerpts and graphs: MEW and the Wealth Effect

Click on graph for larger image in new window.

Click on graph for larger image in new window. Figure 3 ... shows that countries exhibiting the largest increases in household leverage from 1997 to 2007 also tended to experience the fastest rise in house prices over same period. The pattern suggests that the link between easy mortgage credit and rising house prices held on a global scale.The second graph shows the change in consumption following the financial crisis vs. the change in household leverage prior to the crisis:

Figure 4 shows that countries experiencing the largest increases in household leverage before the crisis tended to experience the most severe recessions, where severity is measured by the percentage decline in real consumption from the second quarter of 2008 to the first quarter of 2009. Consumption fell most sharply in Ireland (-6.7%) and Denmark (-6.3%), both of which saw huge increases in household leverage prior to the crisis. Consumption was flat or fell only slightly in Germany, Austria, Belgium, and France, which were among the countries that saw the smallest increases in household leverage before the crisis. Overall, the data suggest that recession severity in a given country reflects the degree to which prior growth was driven by an unsustainable borrowing trend.Not a surprise, but this suggests growth will be sluggish in the U.S., and regulators should be alert to rapid increases in household leverage.

Bubbles and Employment

by Calculated Risk on 1/11/2010 12:18:00 PM

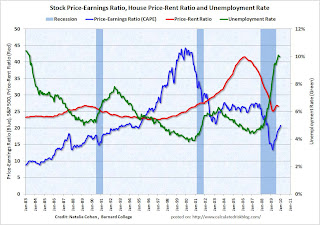

The following graph is from a forthcoming paper by Natalia Cohen, a senior at Barnard College.

Note: the price-earnings and price-rent portion is based on a graph by Paul Krugman, "The Return of Depression Economics and the Crisis of 2008", pg. 145

The graph shows the 10 year stock price-earnings ratio as calculated by Robert Shiller (see here for data and an explanation).

The price-rent ratio is based on work by Fed economist John Krainer and researcher Chishen Wei: "House Prices and Fundamental Value". This calculation uses the American CoreLogic LoanPerformance House Price Index and Owners' Equivalent Rent (Jan 2000 = 25 for convenience).

The unemployment rate is from the BLS. Click on graph for larger image.

Click on graph for larger image.

The graph clearly shows the recent stock and house price bubbles. The smaller late '80s housing bubble is also evident.

The overlay of the unemployment rate on the graph (green) suggests that asset bubbles push down the unemployment rate, and then when the bubbles burst, the unemployment rate increases significantly. There are other factors too, but the bursting of the bubble probably leads to higher sustained unemployment because many workers have non-transferable skills and need to acquire a new skill set.

A good example of this would be construction employment in the recent bubble. The second graph shows residential building construction employment and the price-rent ratio. The increase in residential construction employment in the late '90s was probably due to the stock bubble, but there was a clear increase in employment related to the housing bubble in the late '80s, and the also during the more recent housing bubble.

The second graph shows residential building construction employment and the price-rent ratio. The increase in residential construction employment in the late '90s was probably due to the stock bubble, but there was a clear increase in employment related to the housing bubble in the late '80s, and the also during the more recent housing bubble.

Note: Scales do not start at zero to better show the change. Also this is just residential building construction employment - unfortunately the BLS didn't track residential speciality construction employment separately until 2001. The third graph compares total construction employment and the price-rent ratio. Some of the increase in the late '90s was due to non-residential construction.

The third graph compares total construction employment and the price-rent ratio. Some of the increase in the late '90s was due to non-residential construction.

As we know, there were bubble in both residential and non-residential investment. This pushed up both key categories of construction employment.

Since the recovery in residential construction will probably be sluggish, and private non-residential construction spending is declining rapidly - construction employment will probably continue to decline even with more public spending.

A construction industry group is now arguing that almost one-in-four construction workers is unemployed. But that reality is many of these jobs are not coming back any time soon because the bubbles in residential and non-residential investment pushed construction employment up way too high - and now many of these "unemployed" construction workers will need to develop new skill sets and find alternative employment.

This wasn't the workers fault - they were just responding to the market demand, and construction employment was probably the highest paying job available. However this does suggest that the Fed needs to consider asset bubbles when trying to follow their dual mandate of price stability and maximum sustainable employment. Asset bubbles play a key role in employment, and trying to clean up after the bubble is short term thinking and is not promoting sustainable employment.

Fitch: U.S. CMBS Delinquencies up; Peak Not Until 2012

by Calculated Risk on 1/11/2010 09:53:00 AM

Press Release: Fitch: U.S. CMBS Delinquencies up 42bps; Peak Not Until 2012 (ht ron at Wallstreetpit)

Rising defaults among all property types led to a 42 basis point (bp) increase in U.S. CMBS delinquencies to close out 2009 at 4.71%, according to the latest Loan Delinquency Index results from Fitch Ratings.With rising vacancy rates and falling rents, the CMBS delinquency rates will keep rising; Fitch estimates the rate will rise until 2012.

'Though delinquencies have increased approximately five times from a year ago, they may not peak until 2012', said Managing Director Mary MacNeill. 'An increased amount of loans are coming due over the next two years that will result in delinquencies possibly peaking at 12%.' Fitch's surveillance criteria reflect a forward looking view of performance. Therefore, the current ratings on CMBS transactions recently reviewed by Fitch incorporate significantly higher delinquency rates.

Of the five main property types, each has seen an increase in delinquencies of over 195% since December 2008, ranging from multifamily with 196% increase, to hotel, with a 1,175% increase. Delinquency rates for these properties are as follows (along with total dollars delinquent versus total dollars delinquent as of December 2008):

--Office: 2.66% ($3.9 billion vs. $603.5 million);

--Hotel: 9.13% ($4.6 billion vs. $363.7 million);

--Retail: 4.25% ($5.7 billion vs. $1.2 billion);

--Multifamily: 7.54% ($5 billion vs. $1.6 billion);

--Industrial: 3.57% ($851.3 million vs. $186.2 million).

This is related to these recent commercial real estate stories:

First Foreclosure in Dubai

by Calculated Risk on 1/11/2010 09:00:00 AM

From Bloomberg: Dubai’s First Foreclosure May Open Floodgates in Worst Market (ht Nanoo-Nanoo, Steve)

Dubai’s housing rout sent prices down 52 percent in the past year, prompting some homeowners to abandon their cars and mortgage payments and flee the country. Not one received a foreclosure notice.It is amazing that this is the first foreclosure given all the skips (expats fleeing the country to avoid debtor prison). But Dubai has lacked a clear legal process to handle foreclosures. As reader Steve joked, it is not so much "walk away" in Dubai but "fly away" defaults.

Until now.

Barclays Plc won the sheikdom’s first foreclosure cases in court, clearing the way for lenders holding about $16 billion of Dubai home loans to take action when borrowers don’t pay.

...

Moody’s estimated in September that 12 percent of the 27,000 residential mortgages in the sheikdom would default within 12 to 18 months.

Banks and developers until now have avoided the process of reclaiming homes through the courts, barred by tradition and an arcane legal process that few understood. The Barclays and Tamweel cases may change that ...

Fed's Bullard: Focus on Quantitative Monetary Policy

by Calculated Risk on 1/11/2010 12:15:00 AM

From Bloomberg: Fed’s Bullard Says Asset-Purchase Adjustments Main Policy Issue (ht MrM)

[St. Louis Fed President] James Bullard said the main challenge for U.S. policy makers will be to adjust the asset-purchase program ...It is pretty clear that the Fed will not raise rates any time soon.

The Fed should retain flexibility by adopting a “state- contingent” policy that would allow for the adjustment of such purchases as new information becomes available ... He said it was “disappointing” that markets focus more on interest rates instead of the Fed’s quantitative monetary policy.

...

“Markets are still thinking of monetary policy strictly as changes in interest rates even though the Fed has been conducting successful policy this past year through quantitative easing,” Bullard said. “Markets should be focusing on quantitative monetary policy rather than interest rate policy.”