by Calculated Risk on 1/16/2010 05:00:00 AM

Saturday, January 16, 2010

HUD Changes FHA Rule for Flipping

From HUD: HUD takes action to speed resale of foreclosed properties to new owners (ht Soylent Green is People)

... With certain exceptions, FHA currently prohibits insuring a mortgage on a home owned by the seller for less than 90 days. This temporary waiver will give FHA borrowers access to a broader array of recently foreclosed properties.The title of the document is WaivPropFlip2010.pdf (probably stands for Waiver Property Flipper - aptly named)!

...

In today's market, FHA research finds that acquiring, rehabilitating and the reselling these properties to prospective homeowners often takes less than 90 days. Prohibiting the use of FHA mortgage insurance for a subsequent resale within 90 days of acquisition adversely impacts the willingness of sellers to allow contracts from potential FHA buyers because they must consider holding costs and the risk of vandalism associated with allowing a property to sit vacant over a 90-day period of time.

The policy change will permit buyers to use FHA-insured financing to purchase HUD-owned properties, bank-owned properties, or properties resold through private sales. This will allow homes to resell as quickly as possible, helping to stabilize real estate prices and to revitalize neighborhoods and communities.

...

The waiver will take effect on February 1, 2010 and is effective for one year, unless otherwise extended or withdrawn by the FHA Commissioner. To protect FHA borrowers against predatory practices of "flipping" where properties are quickly resold at inflated prices to unsuspecting borrowers, this waiver is limited to those sales meeting the following general conditions:•All transactions must be arms-length, with no identity of interest between the buyer and seller or other parties participating in the sales transaction.Specific conditions and other details of this new temporary policy are in the text of the waiver, available on HUD's website.

•In cases in which the sales price of the property is 20 percent or more above the seller's acquisition cost, the waiver will only apply if the lender meets specific conditions.

•The waiver is limited to forward mortgages, and does not apply to the Home Equity Conversion Mortgage (HECM) for purchase program.

To be clear, this change isn't to help flippers buy - this change is to help homeowners to buy from flippers. Previously the flipper had to own the home for 90 days for the next buyer to obtain an FHA loan, now the period can be less. The 20% price increase is not a limit, however higher price increases require extra verification.

Friday, January 15, 2010

Treasury: No Further HAMP Extensions

by Calculated Risk on 1/15/2010 11:59:00 PM

UPDATE: The trials modification period was originally 3 months, and then was extended to 5 months, and then extended to the end of January. This means that for the borrowers in the trial modification program, there will be no further extensions. For borrowers just entering the trial phase, they will have the normal three month period.

From the WSJ: Paperwork Woes Plague Mortgage Plan

The administration last month gave borrowers who were current on their payments after at least three months an extension until Jan. 31 to provide needed paperwork. But the administration doesn't plan to extend that deadline, Assistant Treasury Secretary Michael Barr said Friday.No extension, but "further guidance".

"We are going to have further guidance for [mortgage] servicers at the end of the month," he said.

Unless something changes, distressed sales (foreclosures and short sales) should start to increase in February. BofA's estimates the number ...

"of homes being taken back by Bank of America [will] range from 11,000 to 14,000 a month in the early part of this year to 29,000 to 35,000 by November and December, said John Ciresi, vice president and portfolio manager for Bank of America in Towson, Md.Here comes the next wave of distressed sales, and based on the BofA estimates, the wave will build all year.

...

The system became "clogged" by a voluntary moratorium on foreclosures while banks met the requirements of President Obama's Making Home Affordable mortgage plan program and by state legislation requiring mediation before banks can start the foreclosure process, Ciresi said ...

Bank of America is getting 40,000 new offers a month on short sales, or homes offered for less than the mortgage balance, Ciresi said."

Here was an earlier post today: HAMP: 66,465 Permanent Mods

Here is the Press Release from Treasury: Administration Releases December Loan Modification Report, Update on Conversion Drive and the December HAMP report.

Unofficial Problem Bank List Increases to 582

by Calculated Risk on 1/15/2010 09:30:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

Since last week, the Unofficial Problem Bank List increased by a net 6 institutions to 582 and aggregate assets were virtually unchanged.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

There was removal, which was the failed Horizon Bank ($1,3 billion). Seven institutions were added, with most being smaller national banks as the OCC released its actions for December 2009.

As suggested in the narrative last week, there were several national banks added back to list as the OCC replaced terminated Formal Agreements with Consent Orders. These add backs include First National Bank of Baldwin County, Foley, AL ($263 million); Capitol National Bank, Lansing, MI ($229 million); and First National Bank of Wyoming, Laramie, WY ($218 million.

The only other modification was a Prompt Corrective Action order issued by the Federal Reserve against Old Southern Bank, Orlando, FL ($384 million).

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #4 in 2010: Barnes Banking Company, Kaysville, Utah

by Calculated Risk on 1/15/2010 08:03:00 PM

Crestfallen bank expiring

Mortally wounded

by Soylent Green is People

From the FDIC: FDIC Creates a Deposit Insurance National Bank of Kaysville, Utah to Protect Insured

Depositors of Barnes Banking Company, Kaysville, UtahNo one wanted this one.

Barnes Banking Company, Kaysville, Utah, was closed today by the Utah Department of Financial Institutions, which appointed Federal Deposit Insurance Corporation (FDIC) as receiver. ....

The FDIC will mail checks directly to customers with CDs and IRAs. ...

As of September 30, 2009, Barnes Banking Company had $827.8 million in total assets and $786.5 million in total deposits. ...

The cost to the FDIC's Deposit Insurance Fund is estimated to be $271.3 million. Barnes Banking Company is the fourth bank to fail this year and the first in Utah. The last FDIC-insured institution closed in the state was America West Bank, Layton, on May 1, 2009.

Bank Failures 2&3 for 2010: Illinois & Minnesota

by Calculated Risk on 1/15/2010 07:11:00 PM

Whistling past the graveyard

Our first Friday FAIL

by Soylent Green is People

From the FDIC: First American Bank, Elk Grove Village, Illinois Assumes All of the Deposits of Town Community Bank and Trust, Antioch, Illinois

Town Community Bank and Trust, Antioch, Illinois, was closed today by the Illinois Department of Financial Professional Regulation, Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: First State Bank of St. Joseph, St. Joseph, Minnesota, Assumes All of the Deposits of St. Stephen State Bank, St. Stephen, Minnesota

As of September 30, 2009, Town Community Bank and Trust had approximately $69.6 million in total assets and $67.4 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.8 million. ... Town Community Bank and Trust is the second FDIC-insured institution to fail in the nation this year, and the first in Illinois. The last FDIC-insured institution closed in the state was Independent Bankers' Bank, Springfield, on December 18, 2009.

St. Stephen State Bank, St. Stephen, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...They may be small, but they count!

As of September 30, 2009, St. Stephen State Bank had approximately $24.7 million in total assets and $23.4 million in total deposits. First State Bank of St. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.2 million.... St. Stephen State Bank is the third FDIC-insured institution to fail in the nation this year, and the first in Minnesota. The last FDIC-insured institution closed in the state was Prosperan Bank, Oakdale, on November 6, 2009.

Short Sale Fraud, BofA 2010 Foreclosure Forecast, and more HAMP

by Calculated Risk on 1/15/2010 03:35:00 PM

[T]here appears to be yet a new mortgage fraud out there today, allegedly perpetuated by agents of, yes, the big banks. ... Since many second lien holders are getting very little, they are now allegedly requesting money on the side from either real estate agents or the buyers in the short sale. When I say "on the side," I mean in cash, off the HUD settlement statements, so the first lien holder doesn't see it.First lien holders are afraid of short sale fraud, but the biggest concerns are sales to related parties and under-the-table kick backs to the seller. Hopefully Olick's story will lead to an investigation.

Throughout the country, estimates of homes being taken back by Bank of America range from 11,000 to 14,000 a month in the early part of this year to 29,000 to 35,000 by November and December, said John Ciresi, vice president and portfolio manager for Bank of America in Towson, Md.

...

The system became "clogged" by a voluntary moratorium on foreclosures while banks met the requirements of President Obama's Making Home Affordable mortgage plan program and by state legislation requiring mediation before banks can start the foreclosure process, Ciresi said ...

Ciresi anticipates a rise in the foreclosure rate in 2010 because 60 percent of loan modifications failed and went into foreclosure. It's a combination of property devaluation and people losing their jobs, he said.

Bank of America is getting 40,000 new offers a month on short sales, or homes offered for less than the mortgage balance, Ciresi said.

Click on graph for larger image in new window.

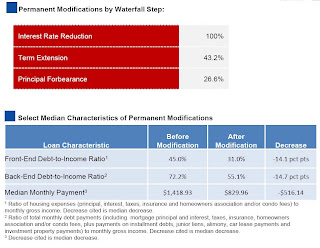

Click on graph for larger image in new window.The top slide shows the waterfall steps for modifications: first the servicer lowers the interest rate (for a few years only), then they extend the term, and if that doesn't get the DTI down to 31%, the servicer forbears some principal (not forgive - this is a balloon payment).

The further down the waterfall, the worse off the borrower. As reader ghostfaceinvestah noted in the comments:

"Remember, under HAMP, principal forbearance is the last step to lower payments when interest rate reductions aren't enough. These people are the really desperate ... They won't be paying off those loans, ever."The second part of the slide shows the DTI before and after the modification. The average HAMP borrower had total DTI of 72.2% before the modification (how did they eat?). Usually anything above 40% would be considered high. After the modification, these borrowers still had a back end DTI over 55%. They just have too much debt.

HAMP: 66,465 Permanent Mods

by Calculated Risk on 1/15/2010 12:21:00 PM

From Treasury: Administration Releases December Loan Modification Repot, Update on Conversion Drive Click on graph for larger image in new window.

Click on graph for larger image in new window.

Just over 66,000 modifications are now permanent, and this shows about a 43% failure rate (loans permanent divided by loans permanent + loans no longer active)

Here is the link at Treasury. See here for a list of reports.

If there were 270,000 cumulative HAMP trial modifications in July - how come there were only 66,465 permanent mods and 48,924 disqualified modifications by the end of December? The numbers don't add up.

What happened to the other 150,000+ modifications? I guess they have all been extended until the end of January.

And of the 787,231 active trial modifications, are all the borrowers current? My understanding was the HAMP data would show how many trial modifications had started, and the redefault rate by month. That key data is still missing.

Note: Nice misspelling in the press release title. I like "repot" for modifications!

JPMorgan on Modifications

by Calculated Risk on 1/15/2010 10:39:00 AM

Here is an exchange between Meredith Whitney and Jamie Dimon on the JPMorgan conference call this morning (ht Brian):

Whitney: [W]e're reaching a critical point in terms of all of the loan modification efforts and this is an industry question but then how it specifically affects your Company, given the fact that the industry feedback and statistics on the loan modification efforts are not good, so you question what's the next initiative and the issue of principal forbearance. How much momentum do you think that has, can you comment on what stage we are in terms of obviously the extension ends [soon] with the last slug is over in February, so where do you think we are in terms of the government’s efforts to influence banks to do certain things?A few comments:

Dimon: Well remember we do modifications of our own and we do the government modifications and I do think they're kind of new, it was complex, and I think people will get better at it over time, Meredith. We have not thought of a better way to do it than loan by loan, which is does the person want to live there, can they afford to live there, and we really think that the payment, how much you're paying is more important than principal. Even if you are going to do something on principal, to do it right you have to do it loan by loan and it effectively comes a similar kind of thing. The difficulty is the loan by loan part and we've asked the government and I think they tried to streamline a little bit to have programs because there's too much paperwork involved in it so a lot of the reasons we're not getting to final modifications half the time we don't finish the paperwork, so they need the lower payments but they weren't finishing the paperwork so we're trying to get better at it, honestly, we rack our brains to figure out if there's a better way to do it and you can do it more macro than loan by loan but once you start talking about macro, you're going to get involved in a lot of issues about whether the people live there, whether they have the ability to pay, whether they were honest when they first told people how much their incomes were, so we're working through it.

Whitney: Okay, do you get a sense that there's something right behind HAMP, that there’s another solution for the government or is it more your efforts?

Dimon: We're trying to do this, look, we're trying to have ideas and they are trying to have ideas but if we had a brilliant one we would be very supportive of doing it. We want to do the right thing for the people.

Whitney: Okay, so a point of clarification on your answer, issue of principal forbearance is not something that people should be overly concerned about with respect to reserves and capital for the bank?

Dimon: No, I think if there's a macro government force on something like that you could have a fairly significant effect on loan loss reserves and losses, etc.

Whitney: But is that a real, any momentum?

Dimon: Honestly Meredith you probably know as well as we do.

Whitney: I don't know. I can't help myself on that one.

And more on JPMorgan's results from the WSJ: J.P. Morgan Chase Profit Surges to $3.3 Billion

Chief Financial Officer Michael Cavanagh was largely silent when asked by reporters when the bank might be done setting aside money for further losses, and when business and consumers would start borrowing again.Update: And more JPMorgan from HousingWire: JP Morgan Posts Q4 Profit Despite Mortgage Losses

"There are signs that things are stabilizing, but ... the dramatic nature of the financial crisis we went through and the extraordinary responses" make the current environment different from previous economic recoveries, he said during a conference call. "We remain cautious."

Chairman and Chief Executive James Dimon said in a news release, "While we are seeing some stability in delinquencies, consumer-credit costs remain high, and weak employment and home prices persist. Accordingly, we remain cautious."

Industrial Production, Capacity Utilization Increase in December

by Calculated Risk on 1/15/2010 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.6 percent in December. The gain primarily resulted from an increase of 5.9 percent in electric and gas utilities due to unseasonably cold weather. Manufacturing production edged down 0.1 percent, while the output of mines rose 0.2 percent. The change in the overall index was revised up in October, but it was revised down in November; for the fourth quarter as a whole, total industrial production increased at an annual rate of 7.0 percent. At 100.3 percent of its 2002 average, output in December was 2.0 percent below its year-earlier level. Capacity utilization for total industry edged up to 72.0 percent in December, a rate 8.9 percentage points below its average for the period from 1972 to 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up from the record low set in June (the series starts in 1967), and still below the level of last year.

Note: y-axis doesn't start at zero to better show the change.

Industrial production is still 10.7% below the level of December 2007.

CPI, Rents and Real Earnings

by Calculated Risk on 1/15/2010 08:33:00 AM

From the BLS report on the Consumer Price Index this morning:

On a seasonally adjusted basis, the December Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent ... the indexes for rent and owners' equivalent rent were unchanged ...Owners' equivalent rent (OER) declined slightly in December, and has decreased at about a 1% annualized rate since peaking four months ago. OER is important because it is the largest component of CPI.

The index for all items less food and energy rose 0.1 percent in December after being unchanged in November.

Based on reports of falling rents - and a record high apartment vacancy rate, OER will probably decline fall for some time, keeping core CPI low and possibly negative next year. Also - falling rents will push up the price-to-rent ratio, and put additional pressure on house prices.

The BLS also reported on declining real earnings in 2009:

Real average hourly earnings did not change from November to December ... Real average hourly earnings fell 1.3 percent, seasonally adjusted, from December 2008 to December 2009. A 0.3 percent decline in average weekly hours combined with the decrease in real average hourly earnings resulted in a 1.6 percent decrease in real average weekly earnings during this period.