by Calculated Risk on 1/19/2010 04:30:00 PM

Tuesday, January 19, 2010

Short Sale 'Fraud', SoCal Home Sales, FHA to Tighten Standards

A few articles of interest ...

This alleged activity by banks - paying 2nd lien holders without proper disclosure - appears outrageous. Based on Olick's reporting, this practice appears to be widespread. Kudos to Olick and hopefully the regulators are reading.

Southern California home sales in December remained above year-ago levels for the 18th consecutive month, bolstered by gains in many mid- to high-end communities. \The market is still mostly first time homebuyers and investors.

...

The December sales tally was the highest for that month since 24,209 homes sold in December 2006, but it was still 11.2 percent below the average for a December – 25,143 sales – over the past 22 years.

...

December’s foreclosure resales remained well below peak levels but were still a large force in the market, edging higher than the prior month for the first time since last February. Foreclosure resales – houses and condos sold in December that had been foreclosed on in the prior 12 months – were 39.6 percent of resales, up from 39.0 percent in November but down from 53.5 percent in December 2008. They hit a high of 56.7 percent last February, then tapered or leveled off month-to-month until last month’s uptick.

...

Government-insured FHA loans, a popular choice among first-time buyers, accounted for 39.6 percent of all home purchase mortgages in December.

Absentee buyers – mostly investors and some second-home purchasers – bought 19.2 percent of the homes sold in December. Buyers who appeared to have paid all cash – meaning there was no indication that a corresponding purchase loan was recorded – accounted for 24.9 percent of December sales, based on an analysis of public records.

And the high percentage of FHA buyers is a good lead into the third story ...

Souring FHA-insured mortgages are threatening the agency's finances. Congress is pressuring [FHA commissioner, Mr. Stevens] to tighten the easy-money standards that once helped people like him, and he is expected to announce revisions as early as this week.

AIA: Architecture Billings Index Shows Contraction in December

by Calculated Risk on 1/19/2010 02:53:00 PM

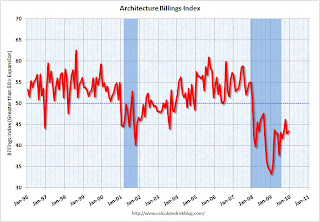

Note: The NAHB housing market index (HMI) release is for residential, and the Architecture Billings Index (ABI) is for non-residential with a nine to twelve month lead.

The WSJ reports that the American Institute of Architects’ Architecture Billings Index increased slightly to 43.4 in December from 42.8 in November. It was at 46.1 in October. Any reading below 50 indicates contraction.

The ABI press release is not online yet. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through 2010, and probably longer.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

NAHB: Builder Confidence Declines in January

by Calculated Risk on 1/19/2010 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 15 in January. This is a decrease from 16 in December and 17 in November

The record low was 8 set in January. This is still very low - and this is what I've expected - a long period of builder depression. The HMI has been in the 15 to 19 range since May.

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts (December starts will be released Wednesday Jan 19th).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts (December starts will be released Wednesday Jan 19th).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

And right now they are moving sideways - at best.

Press release from the NAHB: (added) Builder Confidence Declines in January

The January HMI fell one point to 15, its lowest point since June of 2009. Two of its three component indexes registered one-point declines, with the index gauging current sales conditions and the index gauging traffic of prospective buyers falling to 15 and 12, respectively. The index gauging sales expectations in the next six months held even, at 26.

The HMI edged down by a single point in three regions, with the Northeast falling to 22, the Midwest down to 11 and the South declining to 16. The HMI fell three points in the West, to 16.

NY Budget "Slashes services, Raises fees"

by Calculated Risk on 1/19/2010 10:31:00 AM

New York has the earliest start to the new fiscal year, and other states will soon follow, see: Illinois: "state of insolvency"

From CNNMoney: New York budget plan a sign of things to come for the states (ht energyecon)

New York's governor unveiled a painful budget plan Tuesday that slashes services, raises fees and implements some creative actions to close a yawning $7.4 billion fiscal gap.

...

"There are no more easy answers. We cannot keep spending money that we do not have," Paterson said in a written statement.

...

The state's woes are a bellwether of what others around the nation are facing. New York's fiscal year starts in April, the earliest of any state.

Citigroup: Fourth Quarter Net Loss of $7.6 Billion

by Calculated Risk on 1/19/2010 08:10:00 AM

Press Release: Fourth Quarter Net Loss of $7.6 Billion

Citigroup today reported a full year 2009 net loss of $1.6 billion ... Managed revenues were $91.1 billion for the year. The fourth quarter 2009 net loss was $7.6 billion ...More from Eric Dash at the NY Times: Citigroup Reports a $1.6 Billion Loss for Year

"We ... cut costs by over $13 billion annually, reduced headcount by 100,000, and reduced assets by $500 billion from peak levels." [said Vikram Pandit, Chief Executive Officer of Citigroup]

[L]osses in Citigroup’s domestic mortgages and credit units overwhelmed gains from investment banking, a trend that is likely to continue. Bank executives set aside another $700 million to cover consumer losses in the fourth quarter, bringing the total amount of reserves to about $36 billion at year’s end.The confessional is still open.

Monday, January 18, 2010

CRE: Sign of the Times

by Calculated Risk on 1/18/2010 10:13:00 PM

Note: Here is a weekly summary and a look ahead.

Below is a sign on the Broadway Auto Row in Oakland on Broadway. This is where the Chrysler/Jeep/Kia dealer used to be - the "Heart of the Marketplace".

Now dark and for lease. A sign of the times (photo credit: Bob)

Jim the Realtor: Monument to Excess

by Calculated Risk on 1/18/2010 06:45:00 PM

First, from the NY Times back in April: Vandals Strip a Vacant Villa in California

Suzy Brown ... was sued by her neighbors and ran afoul of the local planning department over plans to use the villa as a “spiritual retreat” and high-end drug rehabilitation center.And a video from Jim today, the banked owned property is listed at $2.7 million. Crazy!

But none of that prepared Ms. Brown for what happened last month when the 16,000-square-foot house fell into foreclosure. Vandals ripped out $1 million worth of fixtures, including toilets, according to a crime report filed on March 26 by a broker for Chevy Chase Bank.

...

Ms. Brown said she and 60 co-investors put $13 million into the construction and maintenance of the property, which they called Vivienda Estate, from 2004 to 2006, combining a $6 million down payment with $7 million from two mortgages and a private loan.

By the time she left last month, she had failed to make payments for one year and owed the bank $6.5 million, she said.

Illinois: "state of insolvency"

by Calculated Risk on 1/18/2010 04:00:00 PM

From Crain's ChicagoBusiness: Illinois enters a state of insolvency (ht Walt)

While it appears unlikely or even impossible for a state to hide out from creditors in Bankruptcy Court, Illinois appears to meet classic definitions of insolvency: Its liabilities far exceed its assets, and it's not generating enough cash to pay its bills. ... "I would describe bankruptcy as the inability to pay one's bills," says Jim Nowlan, senior fellow at the University of Illinois' Institute of Government and Public Affairs. "We're close to de facto bankruptcy, if not de jure bankruptcy."There is much more in the article, including a discussion of how pension payments are rising sharply.

...

Despite a budget shortfall estimated to be as high as $5.7 billion, state officials haven't shown the political will to either raise taxes or cut spending sufficiently to close the gap.

... Unpaid bills to suppliers are piling up. State employees, even legislators, are forced to pay their medical bills upfront because some doctors are tired of waiting to be paid by the state. The University of Illinois, owed $400 million, recently instituted furloughs, and there are fears it may not make payroll in March if the shortfall continues.

For more on the problems of states, see the recent Rockefeller Institute report: Recession or No Recession, State Tax Revenues Remain Negative

The first three quarters of 2009 were the worst on record for states in terms of the decline in overall state tax collections, as well as the change in personal income and sales tax collections. The Great Recession hit virtually every single source of tax revenue and pushed a number of states to revise revenue forecasts numerous times throughout fiscal 2009 and 2010, with significant impacts on services.

Preliminary data for the October-December quarter suggest that fiscal conditions remain weak. ... While December data could change this troubling picture, there is little reason to expect reported revenues for that month to be strong. Continued weakness in revenues, along with continued if more moderate growth in expenditures, make further mid-year budget revisions and spending cuts highly likely.

According to the National Conference of State Legislatures (NCSL), new budget gaps have opened in at least 31 states since FY 2010 began. ... The continued weakening of state tax revenues in fiscal 2010 will force states to take further drastic measures.

More Hotels Opening in 2010

by Calculated Risk on 1/18/2010 02:02:00 PM

Here is a followup to my earlier post about more hotel rooms coming online amid the worst occupancy slump since the Great Depression ...

From Jane Levere at the NY Times: Ailing Hotel Industry Is on Brink of Major Expansion

Though it may seem counterintuitive at a time when many hotels around the country are having trouble filling their rooms, nearly 100 hotels are scheduled to open in major American cities this year.This is probably the final surge in hotel construction related to the CRE bubble.

New York will have the most new hotels, 46, according to Smith Travel Research, a hotel research company in Hendersonville, Tenn., followed by Houston with 30. New hotels are opening as well in Atlanta, Boston, Chicago, Dallas, Miami, Los Angeles and Washington, D.C. That does not include new hotels opening in the suburbs of these cities.

So how can so many hotels be opening even though the economy and travel remain so slow?

The answer, according to Mark Lomanno, president of Smith Travel Research, is that “hotel building cycles rarely mesh just right with economic cycles.” Planning a new hotel can take two to four years and construction another one to four years. ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows investment in lodging as a percent of GDP since 1959 through Q3 2009 (data from BEA).

Even though lodging investment is falling rapidly, the level is still very high from a historical perspective because, as Mark Lomanno noted, it takes several years to finish major hotel projects.

As these hotels are completed in 2010, lodging investment will fall to low levels for several years as happened in previous investment busts. And that means more construction job losses are coming.

Oil Prices and Domestic Petroleum Exploration and Wells Investment

by Calculated Risk on 1/18/2010 11:05:00 AM

In late 2008 we discussed that the dramatic decline in oil prices would lead to a sharp decline in domestic investment in petroleum exploration and wells. Sure enough domestic investment was cut by 50% in the 2nd half of 2009 ...

The following graph compares real oil prices (data from the St. Louis Fed, adjusted with CPI) and real investment in petroleum exploration and wells in the U.S. (data from the BEA).

This doesn't include investment in alternative energy sources. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Not surprisingly there is a strong correlation between oil prices and investment. With oil prices now around $80 per barrel again, domestic investment will probably increase in 2010.

The increase in oil prices is also concerning. Notice that large increases in oil prices have frequently been followed by recessions. This is a topic that Professor Hamilton has researched and discussed several times over the years, see: Will rising oil prices derail the recovery? Of course oil prices are still far below the peak.

Note: right scale doesn't start at zero to show the correlation between the series.