by Calculated Risk on 1/20/2010 09:36:00 PM

Wednesday, January 20, 2010

China Grows at 10.7% Year over Year

From Bloomberg: China Accelerates to 10.7% Growth Pace as Bubble Dangers Loom

Gross domestic product rose 10.7 percent from the same period a year ago ... a statistics bureau report showed in Beijing today.Note that the headline number is the increase from Q4 2008 to Q4 2009 - as opposed to the annualized quarterly growth rate reported in the U.S.

The focus for China’s policy makers has now shifted to restraining the inflationary pressures that stem from their success in spurring a rebound. ...

The economy’s third straight quarterly acceleration highlights the risk that inflation may surge and asset bubbles form after monetary policy committee member Fan Gang said in November that growth of more than 10 percent is excessive.

And on the possibility of asset bubbles, from China Economic Review: Shanghai mortgages rise 1,600% in 2009 (ht Brian)

Banks lent out US$14.58 billion in new mortgages in Shanghai in 2009, a 1,600% increase from the previous year, the South China Morning Post reported. Of the total, US$5.7 billion went to buyers of new properties and US$8.88 billion to those buying second-hand properties, according to the People's Bank of China. Average prices of Shanghai homes rose 68% from 2008.

Housing Starts, Vacant Units and the Unemployment Rate

by Calculated Risk on 1/20/2010 06:13:00 PM

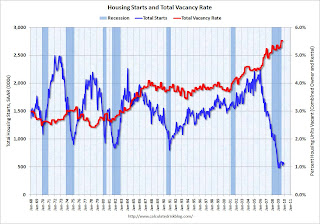

The following two graphs are updates from previous posts with the housing start data released this morning.

The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing through Q3 2009 (Q4 will be released in early February). Click on graph for larger image in new window.

Click on graph for larger image in new window.

It is very unlikely that there will be a strong rebound in housing starts with a record number of vacant housing units.

The vacancy rate has continued to climb even after housing starts fell off a cliff. Initially this was because of a significant number of completions. Also some hidden inventory (like some 2nd homes) have become available for sale or for rent, and lately some households have probably doubled up because of tough economic times. The second graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

The second graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Summer 2010 since housing starts bottomed in April 2009. However, since I expect the housing recovery to be sluggish, I also expect unemployment to remain high throughout 2010 (I think double digits throughout 2010 is very likely without additional job related stimulus).

Until the large overhang of vacant housing is reduced, a significant rebound in housing starts is also very unlikely.

Wells Fargo on Interest Rate Risk

by Calculated Risk on 1/20/2010 04:00:00 PM

Here is a discussion of interest rate risk on the Wells Fargo conference call today (ht Brian):

Analyst: just a follow-up question on rates. I just wanted to understand, Howard, how you are thinking about the impact of the Fed exit on the fixed-income market and how you are planning on managing the balance sheet for that?So they are keeping their "powder dry", expecting an increase in rates. Many other banks are getting healthy on the carry trade ...

Howard Atkins, Wells CFO: Well, that is a good question, Betsy, and the Fed obviously is active in buying MBS. And despite the fact that the yield curve is as positively sloped as it is right now, their active purchases is a factor that is, in some senses, artificially keeping long MBS yields lower than they might otherwise be. At some point presumably, they will either gradually or more quickly reverse course and that could lead to an increase in mortgage interest rates. And as I mentioned a couple of times in my remarks, in possible preparation for that, we have been keeping our powder dry, in effect underinvesting this large base of core deposits that we have for the possibility that that reverses course.

Analyst: So you might get some OCI hit near term, but dry powder leads you to a better outlook for earnings, is that the way to think about it?

Atkins: Yes, again, while the mortgage business is showing good results right now, in effect, on the portfolio side, the investment portfolio, we, in effect, are giving up some current income. We don't believe in the carry trade and we do want to preserve some powder in case rates do go up and we'll have the powder at that point, we will invest the powder at that point to offset some -- whatever is going on in the mortgage business.

John Stumpf, CEO: I see this as the classic short-term view of the business and long-term view of the business. 400 basis points or something like that, which you make in the carry trade today is very attractive. But we think it is the wrong decision long term because we think the bias is for higher rates, not for lower rates and we are willing to wait for that to happen. We think that is the better trade.

Atkins: we are effectively giving up 400 basis points today for possibly a year or so, maybe plus or minus, to avoid the potential risk of a larger number of basis points for 30 years. So the last thing we want to do is get stuck with securities at these low levels of interest rates.

Stumpf: Because I think when rates move, they are probably going to move at some speed and I don't think it's going to be maybe a quarter. It could be more than that and it could happen relatively quickly.

Atkins: this is the same thing that we did back in 2002, 2003 when interest rates were also at cyclical low points just before they went up a lot. What we are doing now is not very different from the way the Company has always managed itself.

DOT: Vehicle Miles increase slightly in November

by Calculated Risk on 1/20/2010 02:25:00 PM

With oil prices near $80 per barrel, I've started looking for signs of demand destruction (see: Oil Prices Push Above $81 per Barrel). One of the key signs in early 2008, was the sharp drop in miles driven in the U.S.

So far miles driven (through November) are up slightly year-over-year. The Department of Transportation (DOT) reports:

Travel on all roads and streets changed by +1.4% (3.2 billion vehicle miles) for November 2009 as compared with November 2008. ... Cumulative Travel for 2009 changed by +0.3% (7.6 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the rolling 12 month of U.S. vehicles miles driven.

By this measure (used to remove seasonality) vehicle miles declined sharply in 2008, and have been increasing slowly in recent months.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in November 2009 were 1.4% greater than in November 2008, however miles driven are still down 3.9% compared to November 2007.

So far miles driven is not showing any evidence of demand destruction for oil, but the slow increase in miles is suggesting a sluggish recovery.

Moody's: CRE Prices Increase 1.0% in November, Expect further declines

by Calculated Risk on 1/20/2010 11:19:00 AM

Via the WSJ, from Moody's:

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.After 13 consecutive months of declining property values, the Moody’s/REAL Commercial Property Price Index (CPPI) measured a 1.0% increase in prices in November. Prices began falling over two years ago and significant declines were seen throughout 2009, with several months experiencing 5%+ value drops. The 1.0% growth in prices seen in November is a small bright spot for the commercial real estate sector, which has seen values fall over 43% from the peak. We expect commercial real estate prices to decline further in the months ahead. Prices for properties with short term lease structures, such as multifamily, could show signs of a sustainable recovery later this year, while other property types will likely need longer to turn the corner.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices peaked in late 2007 and have fallen 43% from the peak and are now back to September 2002 levels.

Notices that CRE trails residential (this is usually true for activity, but also for prices here), and that CRE prices fall quicker than residential (CRE prices tend to be less sticky than residential).

MBA: Mortgage Applications Increase Slightly, Rates Fall

by Calculated Risk on 1/20/2010 10:12:00 AM

The MBA reports: Refinance Applications Increase as Mortgage Rates Fall in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 9.1 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 10.7 percent from the previous week and the seasonally adjusted Purchase Index increased 4.4 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.00 percent from 5.13 percent, with points decreasing to 1.05 from 1.17 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is slightly above the 12 year low set last week.

Housing Starts Decline in December

by Calculated Risk on 1/20/2010 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 557 thousand (SAAR) in December, down 4.0% from the revised November rate, and up 16% from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for seven months.

Single-family starts were at 456 thousand (SAAR) in December, down 6.9% from the revised November rate, and 28 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at around this level for seven months.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:As I've noted before, this is both good news and bad news. The good news is the low level of starts means the excess housing inventory is being absorbed - a necessary step for housing (and the economy) to recover.

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 557,000. This is 4.0 percent (±9.3%)* below the revised November estimate of580,000, but is 0.2 percent (±11.5%)* above the December 2008 rate of 556,000.

Single-family housing starts in December were at a rate of 456,000; this is 6.9 percent (±8.5%)* below the revised November figure of 490,000.

Housing Completions:

Privately-owned housing completions in December were at a seasonally adjusted annual rate of 768,000. This is 11.2 percent (±13.6%)* below the revised November estimate of 865,000 and is 25.3 percent (±8.6%) below the December 2008 rate of 1,028,000.

Single-family housing completions in December were at a rate of 503,000; this is 11.1 percent (±10.2%) below the revised November rate of 566,000.

The bad news is economic growth will probably be sluggish - and unemployment elevated - until residential investment picks up.

Investors Flipping Out

by Calculated Risk on 1/20/2010 01:20:00 AM

Robert Selna at the San Francisco Chronicle discusses the surge in investor buying at the Court House steps, and the changes to the FHA rules that allow the resale of homes in less than 90 days (see HUD Changes FHA Rule for Flipping).

From the Chronicle: Investors dominate home flipping, auctions

House flipping, a quick-buck scheme pursued by amateurs and professionals alike during the real estate boom, now is dominated by investors willing to pay all cash, who troll auctions for foreclosures that banks are gradually trying to siphon off their books.Flipping to FHA buyers - all the cool kids are doing it!

...

The figures, from research firm ForeclosureRadar.com in Discovery Bay, ... indicate that at December Bay Area auctions, about 2o percent of the sales went to investors rather than back to foreclosing lenders. In December 2008, that number was 3.2 percent.

...

Previously, the FHA refused to provide mortgage insurance for homes resold within 90 days to prevent fraud. A common scam was for investors to purchase a house, make minor repairs and sell it to a straw buyer who never planned to pay off their loan.

That kind of ploy artificially ramped up housing prices, left the FHA with inflated insurance claims, and made for vacant and blighted housing.

The FHA rule reversal is scheduled to last for one year starting Feb. 1 and includes some limited safeguards.

Tuesday, January 19, 2010

NY Times: FHA Expected to Announce New Standards Wednesday

by Calculated Risk on 1/19/2010 09:15:00 PM

From David Streitfeld at the NY Times: F.H.A. to Raise Standards for Mortgage Insurance

The Federal Housing Administration ... is expected to announce on Wednesday that it is tightening standards.There is much more in the article.

Borrowers who get an F.H.A.-insured loan will soon have to pay a higher initial insurance premium. The new premium will be 2.25 percent of the value of the loan, up from 1.75 percent.

... The maximum amount of assistance will drop to 3 percent of the value of the property, from the current 6 percent.

Other changes will try to hold lenders who participate in the F.H.A. program more accountable by publicly reporting their performance rankings.

...

As of December, the F.H.A. was insuring 5.8 million single-family residences that had a total loan balance of $750 billion. More than half a million of the loans were seriously delinquent and heading toward foreclosure.

These are small changes and what HUD has been signaling for some time. But they will make a difference at the margin.

Bernanke Asks for GAO review of AIG Aid

by Calculated Risk on 1/19/2010 07:48:00 PM

Here is the letter from Fed Chairman Ben Bernanke to the GAO.

[T]o afford the public the most complete possible understanding of our decisions and actions in this matter, and to provide a comprehensive response to questions that have been raised by members of Congress, the Federal Reserve would welcome a full review by GAO of all aspects of our involvement in the extension of credit to AIG. GAO is authorized to conduct this review under its current authority (31 USC 714(e)).From Sudeep Reddy at the WSJ: Bernanke Invites GAO to Audit AIG Bailout

The Federal Reserve will make available to the GAO all records and personnel necessary to conduct this review.

In a bid to soften congressional criticism, Federal Reserve Chairman Ben Bernanke on Monday invited the Government Accountability Office to audit the central bank’s involvement in the U.S. rescue of American International Group Inc. In a letter to Acting Comptroller General Gene Dodaro, Bernanke said the Fed would provide “all records and personnel necessary” for the auditing arm of Congress to review the rescue. ...And more from Bloomberg: Bernanke Seeks ‘Full Review’ by GAO of Fed’s AIG Aid

The invitation from Bernanke does not change existing policies about congressional reviews of the Fed. The GAO already has authority to review the central bank’s involvement in the AIG bailout, along with other company-specific rescues by the Fed and Treasury Department.

Bernanke’s letter coincides with efforts by lawmakers to obtain more details on the Fed’s oversight of AIG after e-mails released this month showed that the New York Fed asked the company to withhold information from the public about payments to banks.Mark Thoma adds:

The House Committee on Oversight and Government Reform last week subpoenaed all documents related to the New York Fed decision to fully reimburse banks that bought protection from AIG and efforts to persuade AIG to keep information about the payments from the public.

The New York Fed said today it delivered 250,000 pages of documents to the House panel. The materials show that the New York Fed’s actions “assisted AIG in ensuring the accuracy of its disclosures and protected important U.S. taxpayer interests,” the bank said. The New York Fed reiterated that its former president and now-Treasury Secretary Timothy F. Geithner had no role or knowledge of the disclosure matters.

Most people won't realize Bernanke is asking for something the GAO could have done on its own (though perhaps with less cooperation) ... so the politics work in the Fed's favor. And it does send the message that the Fed doesn't think it has anything to hide.This is both good politics and good policy.

Note: I added the section from Bloomberg on Geithner too - he is being attacked for something that happened apparently after he left the NY Fed.