by Calculated Risk on 1/22/2010 10:00:00 AM

Friday, January 22, 2010

Unemployment Rate Increased in 43 States in December

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally higher in December. Forty-three states and the District of Columbia recorded over-the-month unemployment rate increases, four states registered rate decreases, and three states had no rate change, the U.S. Bureau of Labor Statistics reported today. Over the year, jobless rates increased in all 50 states and the District of Columbia.

...

Michigan again recorded the highest unemployment rate among the states, 14.6 percent in December. The states with the next highest rates were Nevada, 13.0 percent; Rhode Island, 12.9 percent; and South Carolina, 12.6 percent. North Dakota continued to register the lowest jobless rate, 4.4 percent in December, followed by Nebraska and South Dakota, 4.7 percent each. The rate in South Carolina set a new series high, as did the rates in three other states: Delaware (9.0 percent), Florida (11.8 percent), and North Carolina (11.2 percent). The rate in the District of Columbia also set a new series high (12.1 percent).

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Sixteen states and D.C. now have double digit unemployment rates. Indiana, Missouri and Washington are all close.

Five states are at record unemployment rates: South Carolina, Florida, North Carolina, Georgia and Delaware, and several other states are close.

ABC News: Senate leadership uncertain if enough votes to re-confirm Bernanke

by Calculated Risk on 1/22/2010 08:47:00 AM

From ABC News: Senate Dems Not Sure They Can Get Enough Votes to Reconfirm Bernanke

... ABC News has learned that the Senate Democratic leadership isn't sure there are enough votes to re-confirm Ben Bernanke for another term as chairman of the Federal Reserve.From the WSJ: Fed's Bernanke Faces Tighter Vote in Senate

Bernanke's term expires on Jan. 31.

...

[Sen. Bernie Sanders, I-Vt.], Sen. Jim Bunning, R-Ky., Sen. Jim DeMint, R-S.C., and Sen. David Vitter, R-La., have all put holds on Bernanke's nomination, requiring 60 votes to proceed to a vote.

Ben Bernanke's confirmation for a second term as Federal Reserve chairman will go down to the wire and could be a closer vote than seemed likely just a few weeks ago.

...

Mr. Bernanke met with Senate Majority Leader Harry Reid Thursday as Democratic and Republican leaders surveyed senators to tally votes on the nomination. Mr. Bernanke needs 60 supporters to win approval for another four-year term.

HAMP Changes Coming

by Calculated Risk on 1/22/2010 12:27:00 AM

But what changes isn't exactly clear ...

From Peter Goodman at the NY Times: Treasury Weighs Fixes to a Program to Fend Off Foreclosures

The Treasury is likely to alter the program by making pay stubs an acceptable means of verifying income, rather than requiring tax documents ...Unless I'm missing something, the only change to be announced next week, mentioned in the article, is allowing borrowers to use pay stubs to verify income, as opposed to providing tax documents. That doesn't make much sense since it is pretty easy to provide tax documents, and underwriting in arrears is one of the keys to the program (the failure to document income was one of the problems with nontraditional mortgages). This sounds like another delaying tactic.

The changes by the Treasury Department are expected to include greater assistance for homeowners no longer able to make mortgage payments because their paychecks have shrunk ... The Treasury was still debating the method ... looking at either direct cash assistance or a grace period in which borrowers could postpone payments. That component may not be announced next week, but would follow soon after.

...

The changes to be introduced next week are unlikely to address what has emerged as a potent factor propelling a wave of foreclosures: the roughly 15 million borrowers who are said to be underwater ...

Thursday, January 21, 2010

More on Falling Apartment Rents and Rising Vacancy Rates

by Calculated Risk on 1/21/2010 09:55:00 PM

Kind of a theme ...

From Carolyn Said at the San Francisco Chronicle: Rents, occupancy fall in 4th quarter

Both national and Bay Area rents have fallen steadily for the past five quarters, said apartment data specialist RealFacts of Novato.Oh no, everyone is freaking out!

...

Nationally, the average monthly rent was $933, down from $994 a year earlier, while the occupancy rate is 91.3 percent, compared with 92.2 percent a year ago.

...

The biggest rent declines in the Bay Area were for units that cannot accommodate roommates ... Average rents fell 9.5 percent for studios and 10.9 percent for junior one bedrooms compared with a year ago, RealFacts said.

... about 60 percent of [SoCal] properties are offering concessions, such as a first month's free for new long-term leases, or gifts of iPods or flat-screen TVs.

"Everybody's freaking out and trying to bring in people anyway they can," [Denise Castellucci, a spokeswoman for RealFacts] said.

[The worst areas were] ... Phoenix, where fourth-quarter rents were down 8.7 percent compared with the prior quarter; Las Vegas, down 8.2 percent; Salt Lake City, down 7.3 percent; and Denver, down 6.1 percent.

Note that the rent declines do not include concessions, so effective rents have fallen even further.

This is good news for renters, but this will also lead to more apartment defaults, higher default rates for apartment CMBS, and more losses for small and regional banks - and more bank failures.

And falling rents are already pushing down owners' equivalent rent (OER). OER has declined since August 2009, and will probably continue to decline throughout 2010. Since OER is the largest component of CPI, this will apply downward pressure on CPI all year. And lower rents will also put pressure on house prices, since renting is a competing product.

Rents Fall to 3 1/2 Year Low in Orange County

by Calculated Risk on 1/21/2010 06:31:00 PM

From Jeff Collins at the O.C. Register: O.C. rents fall 6.7% to mid-2006 level

The average rent for a unit in a large Orange County apartment complex fell to $1,473 a month in the fourth quarter of 2009, the fifth straight quarter to see monthly rents drop.Reis reported that the U.S. apartment vacancy rate hit a record high in Q4, and the Census Bureau reported the total rental vacancy rate was at a record 11.1% in Q3 (Q4 numbers will be released in early February).

Apartment tracker RealFacts reports today that numerous empty apartments forced local landlords to cut rent $105 a month on average — 6.7% — vs. the fourth quarter of 2008. And it’s the lowest average rent in 3 1/2 years.

“They’ve come down quite a bit,” observed Hugo Gonsalez, manager for Nextrent.com, a Santa Ana rental listing service. “You see eight empty units (in an apartment complex) where you used to see one.”

The higher vacancy rate is being driven by people doubling up during the recession, and also by the first time home buyer tax credit. This is pushing down rents, and will also put pressure on house prices (since renting is an alternative).

Banks Paying Property Taxes and more on Short Sale Fraud

by Calculated Risk on 1/21/2010 03:34:00 PM

A couple of articles ...

From Eric Wolff at the North County Times: REAL ESTATE: Banks lowering [Property Tax] delinquency rates

Property tax delinquency rates are down in both San Diego and Riverside counties, because banks are paying back taxes on foreclosures, officials said.This makes sense because the late fees and interest rates are very high on unpaid property taxes, and the lender will end up paying them anyway in foreclosure (this saves paying the interest and late fees). If the homeowner is able to keep the home, the lender will charge the homeowner for the taxes paid. I was actually surprised the lenders weren't more proactive about unpaid property taxes, but maybe they were hoarding their cash last year.

As the economy began to sour in 2007 and unemployment rose, the percentage of property tax delinquents in both counties jumped. But the past two years have seen a steady increase in the percentage of people who were paying on time ---- mostly, tax officials said, because financial institutions have been taking over foreclosed properties and getting the taxes caught up.

...

"The decrease in our tax delinquency rate is most likely due to financial institutions stepping up and paying in the instances where the property tax payer cannot, or is unfortunately under foreclosure action," [Don Kent, the Riverside County treasurer] said.

And much has been made about Diana Olick's excellent articles on off the settlement payouts to 2nd lien holders: Big Banks Accused of Short Sale Fraud.

Eric Wolff wrote about this last year: Wrinkle raises questions in home short sales

A new twist on mortgage fraud is making already difficult short sales darn near impossible, say local real estate agents.Is anyone listening? Regulators? Bueller?

...

In recent months, second lenders have begun to demand extra money in a side deal to get them to approve the short sale. And some don't want the seller to tell their first lender anything about it, real estate agents say ---- a condition that may constitute mortgage fraud by violating state and federal disclosure requirements.

Obama Proposes new Bank Rules on Size and Trading

by Calculated Risk on 1/21/2010 12:08:00 PM

From the WSJ: Obama Proposes New Bank Regulations

The White House wants commercial banks that take deposits from customers to be barred from investing on behalf of the bank itself—what's known as proprietary trading—and said the administration will seek new limits on the size and concentration of financial institutions.More from Bloomberg: Obama Calls for Limiting Banks’ Size, Trading

... Banks shielded from risk through federal-deposit insurance, or aided in financial crises by low-interest loans from the Federal Reserve Board, would no longer be allowed to engage in trading unrelated to their customers' interests, one senior administration official said.

Under the proposed rule, commercial banks would be prohibited from owning, investing in or advising hedge funds or private equity firms. Bank regulators would not be simply given the discretion to enforce such rules. They would be required to do so.

...

Administration officials said they also want to toughen an existing cap on bank market share. Since 1994, no bank can have more than 10% of the nation's insured deposits. The Obama administration wants that cap to include non-insured deposits and other assets.

Philly Fed Index Shows Expansion in January

by Calculated Risk on 1/21/2010 10:00:00 AM

Manufacturing has been one of the bright spots for the economy beause of a combination of inventory restocking and increased exports - and the Philly Fed survey shows continued expansion in January.

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from a revised reading of 22.5 in December to 15.2 this month. The index has now remained positive for five consecutive months (see Chart). Indicators for new orders and shipments suggest continued growth this month, but they also declined somewhat from their December readings. The current new orders index, which has remained positive for six consecutive months, decreased 5 points. The current shipments index fell 4 points. The current inventory index, although still negative, increased 4 points, to its highest reading in 26 months. Indicators for unfilled orders and delivery times edged higher and are both positive, suggesting stronger economic conditions.

Labor market conditions have been stabilizing in recent months, and for the second consecutive month, the percentage of firms reporting an increase in employment was higher than the percentage reporting declines. The current employment index increased 2 points, to its highest reading since February 2008.

...

The future general activity index remained positive for the 13th consecutive month and increased notably from a revised reading of 35.9 in December to 43. ... For the ninth consecutive month, the percentage of firms expecting employment to increase over the next six months (28 percent) exceeded the percentage expecting declines (14 percent).

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

The index has been positive for five months now, after being negative or zero for 21 straight months.

Weekly Initial Unemployment Claims Increase

by Calculated Risk on 1/21/2010 08:31:00 AM

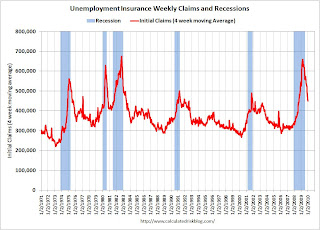

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 16, the advance figure for seasonally adjusted initial claims was 482,000, an increase of 36,000 from the previous week's revised figure of 446,000. The 4-week moving average was 448,250, an increase of 7,000 from the previous week's revised average of 441,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 9 was 4,599,000, a decrease of 18,000 from the preceding week's revised level of 4,617,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 7,000 to 448,250.

This is just one week - and the weekly data is noisy - but the level is still relatively high and suggests continued job losses in January.

Wednesday, January 20, 2010

Obama to Propose New Bank Rules

by Calculated Risk on 1/20/2010 10:56:00 PM

Supposedly a return to the "spirit of Glass Steagall" ...

From the WSJ: Obama to Propose New Limits on Banks (ht MrM)

President Barack Obama on Thursday is expected to propose new limits on the size and risk taken by the country's biggest banks ...From Bloomberg: Obama to Propose New Financial Rules On Proprietary Trading

Obama, who is meeting tomorrow with former Federal Reserve Chairman Paul Volcker, will propose the new rules as a part of an overhaul of financial regulations to help limit the size of financial institutions ...This sounds like a Volcker like approach to regulating the largest banks.