by Calculated Risk on 1/22/2010 10:42:00 PM

Friday, January 22, 2010

Unofficial Problem Bank Lists Increases to 584

This is an unofficial list of Problem Banks compiled only from public sources. CR NOTE: This was compiled before the 5 bank failures today. There was a "timely" Prompt Corrective Action issued against Charter Bank, Santa Fe, NM and the bank was seized today!

Changes and comments from surferdude808:

The Unofficial Problem Bank List increased by a net two institutions to 584.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Aggregate assets total $305.3 billion, up from $304.8 billion last week. Additions include Pamrapo Savings Bank, Bayonne, NJ ($573 million); Capitol City Bank & Trust Company, Atlanta, GA ($322 million); Bank of Virginia, Midlothian, VA ($226 million); and Independence National Bank, Greenville, GA ($138 million).

Deletions are the two failures last week – Barnes Banking Company ($828 million), and St. Stephens State Bank ($25 million). The other change is a Prompt Corrective Action order issued by the OTS against Charter Bank, Santa Fe, NM ($1.3 billion) on January 20, 2010, which was already operating under a Cease & Desist order.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failures #8 & #9: Evergreen Bank, Seattle, Washington and Columbia River Bank, The Dalles, Oregon

by Calculated Risk on 1/22/2010 09:06:00 PM

Columbia River Bank,

Both washed away.

by Soylent Green is People

From the FDIC: Umpqua Bank, Roseburg, Oregon, Assumes All of the Deposits of Evergreen Bank, Seattle, Washington

Evergreen Bank Seattle, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....From the FDIC: Columbia State Bank, Tacoma, Washington, Assumes All of the Deposits of Columbia River Bank, The Dalles, Oregon

As of September 30, 2009, Evergreen Bank had approximately $488.5 million in total assets and $439.4 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $64.2 million. ... Evergreen Bank is the eighth FDIC-insured institution to fail in the nation this year, and the second in Washington. The last FDIC-insured institution closed in the state was Horizon Bank, Bellingham, on January 8, 2010.

Columbia River Bank, The Dalles, Oregon, was closed today by the Oregon Division of Finance and Corporate Securities, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes five bank failures today, and two with over $1 billion in assets each.

As of September 30, 2009, Columbia River Bank had approximately $1.1 billion in total assets and $1.0 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $172.5 million. ... Columbia River Bank is the ninth FDIC-insured institution to fail in the nation this year, and the first in Oregon. The last FDIC-insured institution closed in the state was Community First Bank, Prineville, on August 7, 2009.

Bank Failure #7: Charter Bank, Santa Fe, New Mexico

by Calculated Risk on 1/22/2010 08:31:00 PM

Hot tamales, fajitas

Zero cold hard cash.

by Soylent Green is People

From the FDIC: Charter Bank, Albuquerque, New Mexico, Assumes All of the Deposits of Charter Bank, Santa Fe, New Mexico

Charter Bank, Santa Fe, New Mexico, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Charter Bank, Albuquerque, New Mexico, a newly-chartered federal savings bank and a subsidiary of Beal Financial Corporation, Plano, Texas, to assume all of the deposits of Charter Bank.A theme today: Charter eats Charter. Premier eats Premier.

...

As of September 30, 2009, Charter Bank had approximately $1.2 billion in total assets and $851.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $201.9 million. ... Charter Bank is the seventh FDIC-insured institution to fail in the nation this year, and the first in New Mexico. The last FDIC-insured institution closed in the state was Zia New Mexico Bank, Tucumcari, on April 23, 1999.

Bank Failure #6: Bank of Leeton, Leeton, Missouri

by Calculated Risk on 1/22/2010 07:05:00 PM

Flyover town with small bank

Not too big to fail

by Soylent Green is People

From the FDIC: Sunflower Bank, National Association, Salina, Kansas, Assumes All of the Deposits of Bank of Leeton, Leeton, Missouri

Bank of Leeton, Leeton, Missouri, was closed today by the Missouri Division of Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Small ones count too.

As of December 31, 2009, Bank of Leeton had approximately $20.1 million in total assets and $20.4 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.1 million. ... Bank of Leeton is the sixth FDIC-insured institution to fail in the nation this year, and the first in Missouri. The last FDIC-insured institution closed in the state was Gateway Bank of St. Louis, on November 6, 2009.

Bank Failure #5 in 2010: Premier American Bank, Miami, Florida

by Calculated Risk on 1/22/2010 06:07:00 PM

Premier American Bank

Like Icarus, scorched

by Soylent Green is People

From the FDIC: Premier American Bank, Miami, Florida, National Association, Assumes All of the Deposits of Premier American Bank, Miami, Florida

Premier American Bank, Miami Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Premier American Bank, National Association, Miami, Florida, a newly-chartered national institution, to assume all of the deposits of Premier American Bank. Premier American Bank, N.A. is a subsidiary of Bond Street Holdings, LLC, Naples, Florida.There were 140 bank failures in 2009, 25 in 2008 and 3 in 2007, so that makes 171 for this cycle.

...

As of September 30, 2009, Premier American Bank had approximately $350.9 million in total assets and $326.3 million in total deposits.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $85 million.... Premier American Bank is the fifth FDIC-insured institution to fail in the nation this year, and the first in Florida. The last FDIC-insured institution closed in the state was Peoples First Community Bank, Panama City, on December 18, 2009.

Real House Prices, Price-to-Rent Ratio

by Calculated Risk on 1/22/2010 04:00:00 PM

Earlier First American CoreLogic reported that house prices declined in November. This is the Fed's favorite house price index. This post looks at real prices and the price-to-rent ratio, but first a look at the market ...Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

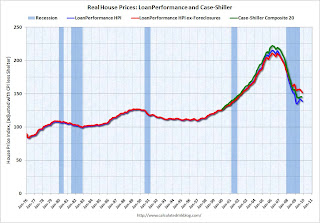

The second graph shows the First American CoreLogic LoanPerformance house price index through November (with and without foreclosures) and the Case-Shiller Composite 20 index through October in real terms (all adjusted with CPI less Shelter). It is interesting to look at the sharp decline in the index with foreclosures at the end of 2008 - this was what housing economist Tom Lawler described as "destickification" in the high foreclosure areas.

It is interesting to look at the sharp decline in the index with foreclosures at the end of 2008 - this was what housing economist Tom Lawler described as "destickification" in the high foreclosure areas.

Notice the LoanPerformance price index without foreclosures (in red) is now at the lowest level since July 2002 in real terms (inflation adjusted).

This isn't like 2005 when prices were way out of the normal range by most measures - and it is possible that total national prices bottomed in 2009 (although I think prices will fall further), but prices ex-foreclosures probably still have a ways to go, even with all the government programs aimed at supporting house prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through November 2009 using the First American CoreLogic LoanPerformance House Price Index: This graph shows the price to rent ratio (January 2000 = 1.0).

This graph shows the price to rent ratio (January 2000 = 1.0).

This suggests that house prices are still a little too high on a national basis. Also rents are still falling and the OER index tends to lag market rents by a few months. And that will push up the price-to-rent ratio, putting more pressure on house prices.

First American CoreLogic: House Prices Decline in November

by Calculated Risk on 1/22/2010 02:26:00 PM

The Fed's favorite house price indicator from First American CoreLogic’s LoanPerformance ...

From LoanPerformance: Home Prices Continue to Depreciate

On a month-over-month basis ... national home prices declined by 0.2 percent in November 2009 compared to October 2009.

...

Including distressed transactions, the HPI has fallen 30.0 percent nationally through November from its peak in April 2006. Excluding distressed properties, the national HPI has fallen 21.8 percent from the same peak.

...

"On average, we are expecting home prices to turn around next spring," said Mark Fleming, chief economist for First American CoreLogic. "While the share of REO sales are down, allowing price declines to moderate, there is concern moving forward with the levels of shadow inventory, negative equity, and the ability of modification programs to mitigate this risk."

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

The index is off 5.7% over the last year, and off 30.0% from the peak.

The index has declined for three consecutive months. I'll have some comparisons to Case-Shiller later, but according to First American CoreLogic, prices are now falling again. It might take another month for this to show up in the Case-Shiller index because it is an average over three months.

Hotel RevPAR off 16.7% in 2009

by Calculated Risk on 1/22/2010 12:18:00 PM

From HotelNewsNow.com: STR: US hotel industry ends '09 with double-digit RevPAR drop

Revenue per available room fell 16.7 percent to US$53.71 during 2009, according to year-end reports from Smith Travel Research.The occupancy rate in 2009 was the lowest since the Great Depression.

The industry’s occupancy fell 8.7 percent to 55.1 percent for the year and average daily rate dropped 8.8 percent to US$97.51.

“Good riddance to 2009, a year which we believe will go down as the worst in the modern hotel industry,” said Mark Lomanno, president at STR.

And on the weekly number, from HotelNewsNow.com: STR reports US performance for week ending 16 January 2010

In year-over-year measurements, the industry’s occupancy ended the week virtually flat with an 0.8-percent decrease to 47.8 percent. Average daily rate dropped 7.4 percent to finish the week at US$94.78. RevPAR for the week fell 8.2 percent to finish at US$45.33.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Notes: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays. It appears the occupancy rate might have stopped falling (Smith Travel Research reported the occupancy rate was off 0.8% compared to the same week in 2009), and business travel is the key over the next few months. However the low occupancy rate will continue to put pressure on the average daily room rate.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Unemployment Rate Increased in 43 States in December

by Calculated Risk on 1/22/2010 10:00:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally higher in December. Forty-three states and the District of Columbia recorded over-the-month unemployment rate increases, four states registered rate decreases, and three states had no rate change, the U.S. Bureau of Labor Statistics reported today. Over the year, jobless rates increased in all 50 states and the District of Columbia.

...

Michigan again recorded the highest unemployment rate among the states, 14.6 percent in December. The states with the next highest rates were Nevada, 13.0 percent; Rhode Island, 12.9 percent; and South Carolina, 12.6 percent. North Dakota continued to register the lowest jobless rate, 4.4 percent in December, followed by Nebraska and South Dakota, 4.7 percent each. The rate in South Carolina set a new series high, as did the rates in three other states: Delaware (9.0 percent), Florida (11.8 percent), and North Carolina (11.2 percent). The rate in the District of Columbia also set a new series high (12.1 percent).

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Sixteen states and D.C. now have double digit unemployment rates. Indiana, Missouri and Washington are all close.

Five states are at record unemployment rates: South Carolina, Florida, North Carolina, Georgia and Delaware, and several other states are close.

ABC News: Senate leadership uncertain if enough votes to re-confirm Bernanke

by Calculated Risk on 1/22/2010 08:47:00 AM

From ABC News: Senate Dems Not Sure They Can Get Enough Votes to Reconfirm Bernanke

... ABC News has learned that the Senate Democratic leadership isn't sure there are enough votes to re-confirm Ben Bernanke for another term as chairman of the Federal Reserve.From the WSJ: Fed's Bernanke Faces Tighter Vote in Senate

Bernanke's term expires on Jan. 31.

...

[Sen. Bernie Sanders, I-Vt.], Sen. Jim Bunning, R-Ky., Sen. Jim DeMint, R-S.C., and Sen. David Vitter, R-La., have all put holds on Bernanke's nomination, requiring 60 votes to proceed to a vote.

Ben Bernanke's confirmation for a second term as Federal Reserve chairman will go down to the wire and could be a closer vote than seemed likely just a few weeks ago.

...

Mr. Bernanke met with Senate Majority Leader Harry Reid Thursday as Democratic and Republican leaders surveyed senators to tally votes on the nomination. Mr. Bernanke needs 60 supporters to win approval for another four-year term.