by Calculated Risk on 1/26/2010 03:49:00 PM

Tuesday, January 26, 2010

NY Times: AIG Hearing Preview

From the NY Times Dealbook: A Preview of the House’s A.I.G. Hearing

DealBook has obtained the prepared testimony of three of the witnesses called by the House Oversight and Government Reform Committee: Thomas C. Baxter, general counsel of the Federal Reserve Bank of New York; Stephen Friedman, the former chairman of the New York Fed, and Elias Habayeb, the former chief financial officer of A.I.G.Dealbook provides the statements of all three.

In his prepared remarks, Mr. Baxter defended the A.I.G. bailout, saying a bankruptcy by the insurer “would have had catastrophic consequences for our financial system and our economy.” He called the decision to rescue A.I.G. “a difficult one,” but one that the Fed’s policymakers felt compelled to make.The TARP Inspector General Neil Barofsky will also testify although Dealbook doesn't provide his statement. Barofsky's comments on the AIG bailout, the benefits to counterparties, and his investigations into possible misconduct will be closely scrutinized.

Mr. Baxter explained that the New York Fed felt compelled to pay out A.I.G.’s counterparties in full to unwind derivative contracts because “there was little time, and substantial execution risk and attendant harm of not getting the deal done by the deadline of Nov. 10,” when A.I.G. was scheduled to report its earning and could face downgrades from credit ratings agencies. That would have led to more collateral calls and even greater liquidity problems for A.I.G., Mr. Baxter said.

He added, “Even in a best-case scenario, we did not expect that the counterparties would offer anything more than a modest discount to par.” Under the circumstance, he said, “the Federal Reserve had little or no bargaining power.”

Oil Prices and China

by Calculated Risk on 1/26/2010 01:50:00 PM

Two weeks ago I suggested it might be time to start looking for signs of demand destruction for oil (like we did in the first half of 2008). So far domestic demand (as far as vehicle miles) is still increasing slightly, however demand growth in China might be slowing ...

From MarketWatch: Oil slumps on expected rise in supplies, China worries

Oil futures fell on Tuesday, pressured by concerns that China's attempt to slow its growth will curb demand and expectations that U.S. crude-oil supplies are rising.I think that needs a graph!

...

"China is really the driving force in this market," said Dan Flynn, energy trader at PFGBest.

...

Broad concerns about weak growth and demand globally were also heightened ahead of supply data due Tuesday and Wednesday, Flynn said.

"We still have an oil glut in the market place. All in all, [oil trading] should remain sideways to lower," he said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Shanghai SSE Composite Index and the Cushing, OK WTI Spot Price oil prices on a weekly basis (in blue).

The SSE Composite Index closed down 2.42% to 3,019.39 and oil prices are off from the recent high.

There appears to be a relationship between the two although the Shanghai Composite turned down in last 2007 and early 2008 - well before oil prices collapsed.

Case Shiller House Price Seasonal Adjustment

by Calculated Risk on 1/26/2010 11:11:00 AM

Case-Shiller released the November house price index this morning and most news reports focused on the small decrease, not seasonally adjusted (NSA), from October to November. As I noted earlier, the seasonally adjusted (SA) data showed a small price increase from October to November.

House price data has a clear seasonal pattern, and I think the headlines for this data should be the Seasonally Adjusted number.

The following graph shows the month-to-month change of the Case-Shiller Composite 10 index for both the NSA and SA data (annualized). Note that Case-Shiller uses a three-month moving average to smooth the data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Blue line is the NSA data. There is a clear seasonal pattern for house prices.

The red line is the SA data as provided by Case-Shiller.

The seasonal adjustment appears pretty good in the '90s, however it appears insufficient now. Still the SA data is probably a better indicator than the NSA data - and to be consistent I've kept reporting the SA data.

The second graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

NOTE: This is using the Seasonally Adjusted (SA) composite 10 series. The Stress Test scenarios use the Composite 10 index and starts in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and starts in December. Here are the numbers:

Case-Shiller Composite 10 Index, November: 157.66

Stress Test Baseline Scenario, November: 140.86

Stress Test More Adverse Scenario, November: 128.54

This puts house prices 12% above the baseline scenario and 22% above the more adverse scenario.

Case Shiller House Prices Increase Slightly in November

by Calculated Risk on 1/26/2010 09:00:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for November this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted data - some sites report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.4% from the peak, and up about 0.2% in November.

The Composite 20 index is off 29.5% from the peak, and up 0.2% in November.

NOTE: S&P reported this as "down", but they were using the NSA data. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 4.5% from November 2008.

The Composite 20 is off 5.3% from November 2008.

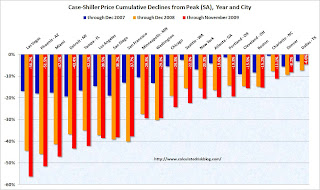

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October.

In Las Vegas, house prices have declined 56.2% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.6% from the peak. Several cities are showing price increases in 2009 including San Diego, San Francisco, Denver and Dallar. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

The impact of the massive government effort to support house prices led to small increases in prices over the Summer, and the question is what happens to prices as these programs end over the next 6 months. I expect further price declines in many cities.

Monday, January 25, 2010

ATA Truck Tonnage Index Increases in December

by Calculated Risk on 1/25/2010 11:11:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Jumped 2.1 Percent in December Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index climbed 2.1 percent in December, following a 2.6 percent increase in November. The latest gain boosted the SA index from 106.2 (2000=100) in November to 108.4 in December, its highest level since November 2008.As ATA Chief Economist Bob Costello noted, trucking benefited from the inventory correction, however he believes that is nearing completion.

...

ATA Chief Economist Bob Costello said that while tonnage jumped again on a month-to-month basis, the rate of increase may slow in the coming months. “The robust tonnage numbers in November and December were aided by better economic growth as well as a positive inventory effect,” Costello noted. “However, economic activity is expected to moderate in the current quarter, which will keep a lid on tonnage growth.”

...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.

Obama to Propose Partial 3 Year Budget Freeze

by Calculated Risk on 1/25/2010 07:56:00 PM

From McClatchy Newspapers: Officials: Obama will propose three-year spending freeze

President Barack Obama will propose a three-year freeze in non-security discretionary spending, senior administration officials said Monday.This is an important issue, but I'd rather wait to address the deficit until after we see clear signs of a recovery.

His budget proposal, to be unveiled in part with Wednesday's State of the Union speech and in detail next week, will urge Congress to keep overall spending at $447 billion a year for agencies other than those charged with national security and mandatory-spending programs such as Social Security and Medicare.

The freeze would take effect with the 2011 fiscal year starting Oct. 1 ...

It also wouldn't affect a 154 billion [dollar] jobs plan pending before Congress and backed by Obama, the officials said. One aide said that plan would be exempt because it would take effect this year, before the freeze.

Administration officials, who spoke on the condition of anonymity to not upstage the president, said that the three-year freeze would save $250 billion over a decade — if it's approved by an election-year Congress.

After three years, the total spent would be the lowest as a percentage of the total economy in 50 years. Spending on those agencies has increased by an average of 5 percent a year since 1993, the officials said.

Note: I have a long history of being a deficit hawk, but I don't want to see a repeat of the mistakes of 1937, see: A comment on the Deficit and National Debt

Fed MBS Purchase Program 92% Complete

by Calculated Risk on 1/25/2010 05:38:00 PM

From the Atlanta Fed weekly Financial Highlights:  Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

[T]the agency MBS purchase program nears its goal of $1.25 trillion.The Fed purchased an additional $12 billion net in MBS over the last week, bringing the total to over $1.15 trillion or just over 92% complete.The Fed purchased a net total of $14 billion of agency-backed MBS through the week of January 13. This brings its total purchases up to $1.14 trillion, and by the end of the first quarter 2010 the Fed will purchase $1.25 trillion (thus, it is 91% complete).

And on the concerns about the Fed ending the MBS purchase program from David Cho, Neil Irwin and Dina ElBoghdady at the WaPo: Stakes are high as government plans exit from mortgage markets

The wind-down of federal support for mortgage rates, set to end in two months, is a momentous test of whether the Obama administration and the Federal Reserve have succeeded in jump-starting the housing market and ensuring it can hold its own. ...The Fed has already slowed the MBS purchases, and 30 year mortgage rates are still hovering around 5%. I expect no change to the FOMC statement on Wednesday concerning the MBS purchase program.

Keeping the mortgage rates at historic lows ... was viewed within the administration as a central plank of the economic strategy last year, senior officials said. ... the policy ... helped revitalize home buying in some parts of the country and put money in the pockets of millions of homeowners who were able to refinance into lower monthly payments, the officials added.

"We did what we thought was necessary to stabilize the market, but we don't think the government should continue special efforts forever," said Michael S. Barr, an assistant secretary at the Treasury Department. "As you bring stability, private participants come back in. We do expect this now that the market has stabilized. I'm not going to say there will be no effect on rates, but we do think you are seeing market signs and market signals that there should be an orderly transition."

...

Administration and Fed officials expressed confidence that rates will rise only modestly -- perhaps a quarter of a percentage point. They attribute their optimism to the lengthy notice they have given the market.

CRE and Moral and Social Constraints to Strategic Defaults

by Calculated Risk on 1/25/2010 03:03:00 PM

On Tishman Speyer and Blackrock's strategic default on Peter Cooper Village and Stuyvesant Town ...

From the WSJ:

The Stuyvesant Town deal is one of several Tishman Speyer did at the top of the market that the company is trying to save. But the company itself isn't threatened. It took advantage of easy credit and investors' eagerness to buy into real estate during the good times. As a result, it didn't put much of its own cash into deals.Yes, it was a highly leveraged deal with little money at risk. And the debt was secured based on fantasy proforma statements (not unlike many stated income borrowers).

Tishman and Blackrock tried for a loan modification, but when they couldn't obtain one on acceptable terms, they choose to walk away because the property is worth far less than they owe even though they could afford to continue to make the payments.

In research paper last year on homeowners with negative equity walking away: Moral and Social Constraints to Strategic Default on Mortgages by Guiso, Sapienza and Zingales, the authors wrote:

"[P]eople who know someone who defaulted are 82% more likely to declare their intention to do so." And "as defaults become more common", there is a "contagion effect that reduces the social stigma associated with default".

Imagine a homeowner who bought at the top, "took advantage of easy credit", put little or money down, and now finds themselves owing far more than the property is worth. And now imagine they hear of large landlords (or Morgan Stanley last year) just walking away from CRE loans. Does that reduce the social stigma and contribute to residential strategic defaults?

Update: Diana Olick at CNBC asks a similar question: Strategic Defaults

More on Existing Home Sales

by Calculated Risk on 1/25/2010 12:14:00 PM

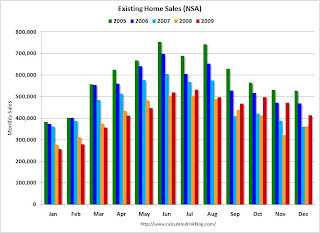

Earlier the NAR released the existing home sales data for December; here are a few more graphs ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows NSA monthly existing home sales for 2005 through 2009 (see Red columns for 2009).

Sales (NSA) in December were much higher than in December 2007 and 2008.

The second graph shows existing home sales (left axis) through December, and new home sales (right axis) through November. The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent spike in existing home sales was due primarily to the first time homebuyer tax credit.

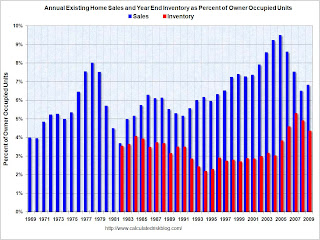

Eventually - when the housing market is more healthy - the ratio of existing to new home sales will probably return to the historical relationship. The third graph shows existing home sales and year end inventory as a percent of total owner occupied homes.

The third graph shows existing home sales and year end inventory as a percent of total owner occupied homes.

Both sales and inventory are above the normal range, although reported inventory has been declining for two years.

Both sales and inventory are being heavily impacted by government policies (boosting sales through tax credits and low mortgage rates, and limiting inventory through modification programs). There is probably a substantial "shadow inventory" that will come on the market, but the timing and size of the inventory are unknown.

The term "shadow inventory" is used in different ways. I consider all of the following to be "shadow inventory":

Probably the most important point to remember is that what matters for the economy and jobs is new home sales and residential investment. Until the excess housing inventory is reduced (both home and the rental units), new residential investment will be under pressure.REOs. There are bank owned properties that have not been put on the market yet. Foreclosures in process and seriously delinquent loans (although some of these may be in the modification process). New high rise condos. These properties are not included in the new home inventory report from the Census Bureau, and do not show up anywhere unless they are listed. Homeowners waiting for a better market. These are homeowners waiting for better market conditions to sell.

Existing Home Sales decline Sharply in December

by Calculated Risk on 1/25/2010 10:00:00 AM

The NAR reports: December Existing-Home Sales Down but Prices Rise; 2009 Sales Up

Existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 16.7 percent to a seasonally adjusted annual rate of 5.45 million units in December from 6.54 million in November, but remain 15.0 percent above the 4.74 million-unit level in December 2008.

For all of 2009 there were 5,156,000 existing-home sales, which was 4.9 percent higher than the 4,913,000 transactions recorded in 2008; it was the first annual sales gain since 2005.

...

Total housing inventory at the end of December fell 6.6 percent to 3.29 million existing homes available for sale, which represents a 7.2-month supply at the current sales pace, up from a 6.5-month supply in November.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Dec 2009 (5.45 million SAAR) were 16.7% lower than last month, and were 15% higher than Dec 2008 (4.74 million SAAR).

Of course many of the transactions in November were due to first-time homebuyers rushing to beat the initial expiration of the tax credit (that has now been extended). That pushed sales far above the historical normal level; based on normal turnover, existing home sales would be in the 4.5 to 5.0 million SAAR range.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.29 million in December from 3.52 million in November. The all time record high was 4.57 million homes for sale in July 2008.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.29 million in December from 3.52 million in November. The all time record high was 4.57 million homes for sale in July 2008. This is not seasonally adjusted and December is usually the lowest month of the year - so this decline is mostly seasonal.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 7.2 months in December.

A normal market has under 6 months of supply, so this is still high.

This decline was expected. I'll have more later ... but remember to ignore the median prices (that is distorted by the mix), and to focus more on new home sales than existing home sales.