by Calculated Risk on 2/01/2010 10:21:00 AM

Monday, February 01, 2010

Construction Spending Declines in December

Residential construction spending was off slightly in December, and is now about 10% above the bottom in June 2009. I expect some growth in residential spending in 2010, but the increases will probably be sluggish until the large overhang of existing inventory is reduced.

Non-residential increased slightly in December, but the trend is clearly down. The collapse in non-residential construction spending continues ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending decreased in December, and nonresidential spending increased slightly.

Private residential construction spending is now 61.5% below the peak of early 2006.

Private non-residential construction spending is 22.0% below the peak of October 2008. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is off 17.7% on a year-over-year (YoY) basis.

Residential construction spending is down 10.3% from a year ago, and the negative YoY change is getting smaller.

Only over the last few months - for the first time since the housing bust started - has nonresidential spending been off more on a YoY basis than residential.

Here is the report from the Census Bureau: December 2009 Construction at $902.5 Billion Annual Rate

ISM Manufacturing Index Shows Expansion in January

by Calculated Risk on 2/01/2010 10:00:00 AM

PMI at 58.4% in January, up sharply from 54.9% in December.

From the Institute for Supply Management: January 2009 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in January for the sixth consecutive month, and the overall economy grew for the ninth consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.As noted, any reading above 50 shows expansion.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector grew for the sixth consecutive month in January as the PMI rose to 58.4 percent, its highest reading since August 2004 when it registered 58.5 percent. This month's report provides significant assurance that the manufacturing sector is in recovery. Both the New Orders and Production Indexes are above 60 percent, indicating strong current and future performance for manufacturing. This month, 13 of 18 industries reported growth, up from nine industries last month, and this is a good indication that the impact of the recovery is expanding."

...

ISM's Employment Index registered 53.3 percent in January, which is 3.1 percentage points higher than the seasonally adjusted 50.2 percent reported in December. This is the second month of growth in manufacturing employment, and the highest reading since April 2006 (54.9 percent). An Employment Index above 49.8 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

emphasis added

December PCE and Saving Rate

by Calculated Risk on 2/01/2010 08:30:00 AM

From the BEA: Personal Income and Outlays, November 2009

Personal Personal income increased $44.5 billion, or 0.4 percent, and disposable personal income (DPI) increased $45.9 billion, or 0.4 percent, in December, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $22.6 billion, or 0.2 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in December, compared with an increase of 0.4 percent in November.

...

Personal saving -- DPI less personal outlays -- was $534.2 billion in December, compared with $506.3 billion in November. Personal saving as a percentage of disposable personal income was 4.8 percent in December, compared with 4.5 percent in November.

Click on graph for large image.

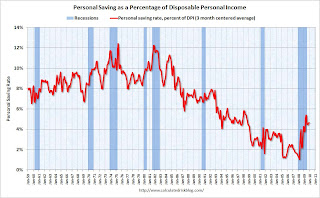

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the December Personal Income report. The saving rate was 4.8% in December.

I expect the saving rate to continue to rise over the next couple of years - possibly to 8% or more - slowing the growth in PCE.

The following graph shows real Personal Consumption Expenditures (PCE) through December (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The question is what happens to PCE growth in 2010?

Sunday, January 31, 2010

Next Stimulus: $100 Billion

by Calculated Risk on 1/31/2010 10:43:00 PM

Note: earlier posts:

From the Financial Times: Obama plans $100bn jobs push

Robert Gibbs, ... called for a bill “somewhere in the $100bn range” ... Mr Obama championed the idea of a jobs bill in his State of the Union address last week – calling for $30bn for community bank lending to small businesses, a new small business tax credit and a tax incentive for all businesses to invest ...And from the LA Times: Obama pairs a push for jobs with proposed spending cuts

excerpted with permission

The details aren't clear, but this is smaller than the bill approved by the House of Representatives in December.

Is this really "Walking Away"?

by Calculated Risk on 1/31/2010 06:51:00 PM

The NY Post has an article: I'm walking from my underwater mortgage

I stopped paying my $1,450-a-month mortgage ... in September 2008 -- after making the hard decision to walk away from my mortgage because it is hopelessly underwater.First, "walking away" usually means the homeowner can afford to pay their mortgage, but are choosing to strategically default (or in the language of servicers "ruthlessly default") simply because they owe more than their home is worth.

... in this case I had no practical solutions to my financial dilemma -- I lost my job, was turned down for a mortgage modification and owed a lot more than the house is worth.

I am a single parent with three children, one with medical issues. So, with only unemployment benefits and child-support money, I decided to pull the plug on my mortgage payments.

...

This house originally cost $100,000. In 2005, as the housing market heated up and I needed cash, I refinanced it. An appraiser said it was worth $154,000 ... I cashed out the house at that value.

Today, with the housing market in bad shape, the house is worth about $120,000. On top of that, it is starting to fall apart.

This homeowner lost her job and has other financial issues. Yes, she owes more than her house is worth, but this sounds like a normal foreclosure caused by financial distress.

Second, why is her mortgage payment $1,450 per month on a $154,000 mortgage? Is that a 10%+ interest rate? Is this PITI? Is there a 2nd with Tony Soprano? Perhaps the reporter could have explained this a little better.

Third, if she stopped paying her mortgage in September 2008, what has the bank been doing?

There are no foreclosure signs up -- because there is no bank forcing it.Why isn't the bank foreclosing? What are the foreclosure laws in Pennsylvania? Are these recourse loans? Why isn't the reporter asking questions?

The only good thing about this article is it gives me an excuse to link to Tanta's advice to reporters from two years ago: Let's Talk about Walking Away

I actually believe that reporters should never abandon their skepticism anywhere, including here. ... the danger arises that an "echo chamber" starts to create conventional wisdom about default behavior, which may be hard to challenge if it turns out to be a bit of an exaggeration.

Weekly Summary and a Look Ahead

by Calculated Risk on 1/31/2010 02:38:00 PM

The most anticipated economic release this week is the BLS employment report on Friday. The consensus is for a small net gain in payroll jobs in January, on a seasonally adjusted (SA) basis, and the unemployment rate flat at 10.0%. My guess is the report will still show net job losses, and the unemployment rate will increase slightly. We will have a better idea after the ADP and ISM reports are released earlier in the week.

Two points on the employment report: 1) the annual benchmark revision for March 2009 will be released as part of the report. This will probably show over 800,000 more jobs lost than the original reports (my graphs will include the revisions), and 2) January is heavily adjusted for seasonal factors - even in good years there are around 2.5 million payroll jobs lost in January. The SA number is the one to follow.

On Monday the BEA will release the Personal Income and Spending report for December. The quarterly data was released on Friday, along with the GDP report, so we already have a good idea for December. Along with this release, the BEA will release supplemental data for hotel, office and mall investment.

Also on Monday the ISM Manufacturing report for January will be released (expectations are for a small decline from 55.9), construction spending for December (another decline is expected), and possibly the Fed's Senior Loan Officers’ Survey.

On Tuesday, auto sales for January will be reported (expect a small decline to under 11 million SAAR), Personal Bankruptcy Filings for January, Pending Home sales, and the Q4 Housing Vacancies and Homeownership report from the Census Bureau (expect a record vacancy rate). Also on vacancies, the NMHC Quarterly Survey of Apartment Market Conditions will probably be released this week.

On Wednesday, the ADP employment report (estimates are for around 40,000 jobs lost) will be released and the ISM non-manufacturing report (small increase expected).

On Thursday, Jobless Claims and Factory Orders.

And then on Friday, the BLS employment report, consumer credit and more bank failures.

And a summary of last week ...

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 5.7 percent in the fourth quarter of 2009, (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.And from my comments on the Q4 GDP report:

Any analysis of the Q4 GDP report has to start with the change in private inventories. This change contributed a majority of the increase in GDP, and annualized Q4 GDP growth would have been 2.3% without the transitory increase from inventory changes.

Unfortunately - although expected - the two leading sectors, residential investment (RI) and personal consumption expenditures (PCE), both slowed in Q4.PCE slowed from 2.8% annualized growth in Q3 to 2.0% in Q4. RI slowed from 18.9% in Q3 to just 5.7% in Q4.

...

The transitory boost from inventory changes is frequently a great kick start to the economy at the beginning of a recovery - as long as the leading sectors (PCE and RI) are also picking up. This report has to be viewed as concerning ... and is reminiscent of Q1 1981 and Q1 2002 ... both examples of inventory changes making large contributions to GDP, but underlying growth remained weak.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Dec 2009 (5.45 million SAAR) were 16.7% lower than last month, and were 15% higher than Dec 2008 (4.74 million SAAR).

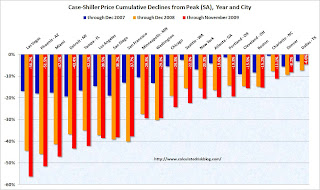

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 30.4% from the peak, and up about 0.2% in November.

The Composite 20 index is off 29.5% from the peak, and up 0.2% in November.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October. In Las Vegas, house prices have declined 56.2% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.6% from the peak. Several cities are showing price increases in 2009 including San Diego, San Francisco, Denver and Dallar. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

This graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

This graph shows monthly new home sales (NSA - Not Seasonally Adjusted).Note the Red columns for 2009. In December 2009, a record low 23 thousand new homes were sold (NSA); this ties the previous record low set in December 1966.

Sales in December 2008 were at 26 thousand.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 4% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 4% above the low in January. Sales of new one-family houses in December 2009 were at a seasonally adjusted annual rate of 342,000 ... This is 7.6 percent (±14.6%)* below the revised November rate of 370,000 and is 8.6 percent (±15.2%)* below the December 2008 estimate of 374,000.

Fannie Mae reported this week that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.29% in November, up from 4.98% in October - and up from 2.13% in November 2008.

Fannie Mae reported this week that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.29% in November, up from 4.98% in October - and up from 2.13% in November 2008.Some of these loans are in modification programs, but this is quite a hockey stick!

The owners of Stuyvesant Town and Peter Cooper Village ... have decided to turn over the properties to creditors, officials said Monday morning.

Best wishes to all.

TARP Inspector General: Government Programs "risk re-inflating bubble"

by Calculated Risk on 1/31/2010 11:01:00 AM

To the extent that the crisis was fueled by a “bubble” in the housing market, the Federal Government’s concerted efforts to support home prices risk re-inflating that bubble in light of the Government’s effective takeover of the housing market through purchases and guarantees, either direct or implicit, of nearly all of the residential mortgage market.From Office of the Special Inspector General for the Troubled Asset Relief Program: Quarterly Report to Congress, January 30, 2010 (ht Ronald Orol, MarketWatch)

The following SIGTARP table shows the government support of the residential market (note: a few smaller program are not included for simplicity). This is from Section 3 of the report that discusses these programs:

Section 3 concludes:

Mechanisms for Supporting Home Prices

Supporting home prices is an explicit policy goal of the Government. As the White House stated in the announcement of HAMP for example, “President Obama’s programs to prevent foreclosures will help bolster home prices.”384

In general, housing obeys the laws of supply and demand: higher demand leads to higher prices. Because increasing access to credit increases the pool of potential home buyers, increasing access to credit boosts home prices. The Federal Reserve can thus boost home prices by either lowering general interest rates or purchasing mortgages and MBS. Both actions, which the Federal Reserve is pursuing, have the effect of lowering interest rates, which increases demand by permitting borrowers to afford a higher home price on a given income. Similarly, the Administration is boosting home prices by encouraging bank lending (such as through TARP) and by instituting purchase incentives such as the First-Time Homebuyer Tax Credit. All of these actions increase the demand for homes, which increases home prices. In addition to direct Government activity, home prices can be lifted by general expectations among homebuyers of future price increases. Figure 3.7 provides a graphic representation of the relationship between possible Government actions and their impact on home prices.

This flow chart from the report shows the possible mechanisms for supporting house prices.

This flow chart from the report shows the possible mechanisms for supporting house prices.We've been discussing this for some time, and there is a good chance that house prices will fall further as the government support is withdrawn since house prices appear too high based on price-to-income and price-to-rent ratios.

Other key points:

• To the extent that huge, interconnected, “too big to fail” institutions contributed to the crisis, those institutions are now even larger, in part because of the substantial subsidies provided by TARP and other bailout programs.

• To the extent that institutions were previously incentivized to take reckless risks through a “heads, I win; tails, the Government will bail me out” mentality, the market is more convinced than ever that the Government will step in as necessary to save systemically significant institutions. This perception was reinforced when TARP was extended until October 3, 2010, thus permitting Treasury to maintain a war chest of potential rescue funding at the same time that banks that have shown questionable ability to return to profitability (and in some cases are posting multi-billion-dollar losses) are exiting TARP programs.

• To the extent that large institutions’ risky behavior resulted from the desire to justify ever-greater bonuses — and indeed, the race appears to be on for TARP recipients to exit the program in order to avoid its pay restrictions — the current bonus season demonstrates that although there have been some improvements in the form that bonus compensation takes for some executives, there has been little fundamental change in the excessive compensation culture on Wall Street.

Volcker: "How to Reform Our Financial System"

by Calculated Risk on 1/31/2010 08:46:00 AM

Here is an OpEd in the NY Times from Paul Volcker: How to Reform Our Financial System

A few excerpts:

The further proposal set out by the president recently to limit the proprietary activities of banks approaches the problem from a complementary direction. The point of departure is that adding further layers of risk to the inherent risks of essential commercial bank functions doesn’t make sense, not when those risks arise from more speculative activities far better suited for other areas of the financial markets.And Volcker concludes:

The specific points at issue are ownership or sponsorship of hedge funds and private equity funds, and proprietary trading — that is, placing bank capital at risk in the search of speculative profit rather than in response to customer needs. Those activities are actively engaged in by only a handful of American mega-commercial banks, perhaps four or five. Only 25 or 30 may be significant internationally.

Apart from the risks inherent in these activities, they also present virtually insolvable conflicts of interest with customer relationships, conflicts that simply cannot be escaped by an elaboration of so-called Chinese walls between different divisions of an institution. The further point is that the three activities at issue — which in themselves are legitimate and useful parts of our capital markets — are in no way dependent on commercial banks’ ownership. These days there are literally thousands of independent hedge funds and equity funds of widely varying size perfectly capable of maintaining innovative competitive markets. Individually, such independent capital market institutions, typically financed privately, are heavily dependent like other businesses upon commercial bank services, including in their case prime brokerage. Commercial bank ownership only tilts a “level playing field” without clear value added.

emphasis added

I am well aware that there are interested parties that long to return to “business as usual,” even while retaining the comfort of remaining within the confines of the official safety net. They will argue that they themselves and intelligent regulators and supervisors, armed with recent experience, can maintain the needed surveillance, foresee the dangers and manage the risks.There is much more in the piece, but Volcker makes it clear:

In contrast, I tell you that is no substitute for structural change, the point the president himself has set out so strongly.

I’ve been there — as regulator, as central banker, as commercial bank official and director — for almost 60 years. I have observed how memories dim. Individuals change. Institutional and political pressures to “lay off” tough regulation will remain — most notably in the fair weather that inevitably precedes the storm.

The implication is clear. We need to face up to needed structural changes, and place them into law. To do less will simply mean ultimate failure — failure to accept responsibility for learning from the lessons of the past and anticipating the needs of the future.

1) There are huge competitive advantages of being "too big to fail", so naturally these banks want to continue with "business as usual".

2) Although improved regulation and capital requirements are important, structural changes are critical.

Saturday, January 30, 2010

Daily Show: CNBC Financial Advice

by Calculated Risk on 1/30/2010 10:31:00 PM

A little flashback from Jon Stewart: CNBC Financial Advice

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| CNBC Financial Advice | ||||

| www.thedailyshow.com | ||||

| ||||

FDIC Bank Failure Update

by Calculated Risk on 1/30/2010 05:44:00 PM

There have been 183 bank failures in this cycle (starting in 2007):

| FDIC Bank Failures by Year | 2007 | 3 |

|---|---|

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 15 |

| Total | 183 |

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows bank failures by week in 2008, 2009 and 2010.

The FDIC is off to a fast start in 2010.

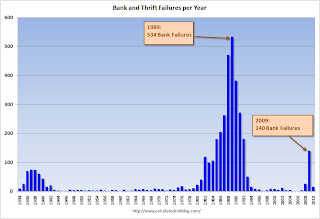

My prediction is the FDIC will close more banks in 2010 than in 2009 (more than 140), but fewer banks than in 1989 - peak of the S&L crisis (534 banks).

The second graph shows bank failures by year since the FDIC was started.

The second graph shows bank failures by year since the FDIC was started.The 140 bank failures last year was the highest total since 1992 (181 bank failures).

And since people always ask, the third graph is of bank failures by number of institutions and assets, from the December Congressional Oversight Panel’s Troubled Asset Relief Program report.

Note: This is through Nov 30th for 2009.

Note: This is through Nov 30th for 2009.From the report (page 45):

Figure 11 shows numbers of failed banks, and total assets of failed banks since 1970. It shows that, although the number of failed banks was significantly higher in the late 1980s than it is now, the aggregate assets of failed banks during the current crisis far outweighs those from the 1980s. At the high point in 1988 and 1989, 763 banks failed, with total assets of $309 billion.167 Compare this to 149 banks failing in 2008 and 2009, with total assets of $473 billion.168Note: This is in 2005 dollars and this includes the failure of WaMu in 2008 with $307 billion in assets that didn't impact the DIF.

I'll update the losses for the Deposit Insurance Fund (DIF) over the next few weeks.