by Calculated Risk on 2/03/2010 05:56:00 PM

Wednesday, February 03, 2010

LPS: Mortgage Delinquencies Reach 10%

From Jon Prior at HousingWire: Mortgage Delinquencies Pass 10%: LPS

Home-loan delinquency rates in the US reached 10% in December, up from the record-high 9.97% in November, according to Lender Processing Services ... which provides data on mortgage performance.More foreclosures and short sales coming!

Accounting for foreclosures in the pipeline, the total non-current rate stands at 13.3% .... When extrapolated for the entire mortgage industry, 7.2m mortgage loans are behind on their payments.

Note: the MBA reported the delinquency rate in Q3 was 9.64%; the MBA Q4 delinquency data will be released soon.

Housing Stock and Flow

by Calculated Risk on 2/03/2010 03:20:00 PM

Yesterday I posted some data from the Census Bureau that suggests there are about 1.8 million excess vacant housing units in the U.S. (above the normal levels).

IMPORTANT: The housing stock includes both owner occupied and rental units. I suspect many of the excess units absorbed will be by renters.

This raises a key question for the economy and jobs: How much longer until these excess housing units will be absorbed?

The answer depends on 1) how many net units are added to the housing stock, and 2) how many net households are formed. The table below shows about 650 thousand net housing units added to the stock in 2009.

Housing units include single family homes (included as 1 to 4 units), apartments (5+ units), and mobile homes. Demolitions are subtracted from the stock (note: demolitions are the hardest to estimate).

In 2009, because of the recession, fewer than normal net households were formed (probably around 650 thousand), so the excess inventory was not reduced.

NOTE: Table is based on Completions. Housing units added to stock:

| 2009 | 20101 | |

|---|---|---|

| 1 to 4 units | 535.4 | 500 |

| 5+ units | 260 | 125 |

| Mobile Homes2 | 53 | 60 |

| Sub-Total | 848.4 | 755.0 |

| Demolitions3 | 200 | 200 |

| Total | 648.4 | 485.0 |

1 Preliminary estimates for 2010.

2 Actual rate through November, December estimated.

3 estimated.

Notice for 2010 that the estimate is for 5+ unit completions to collapse. This is already in the works as shown in the following diagram:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The blue line is for multifamily starts and the red line is for multifamily completions. For the most part, all the multifamily units that will be delivered in 2010 have already been started since, according to the Census Bureau, it takes on average over 1 year to complete these projects.

Since multifamily starts collapsed in 2009, completions will collapse in 2010.

Similar logic applies to single family units, although these only take around 7 months to complete. Since there have been an average (SAAR) of 485 thousand units started over the last 6 months, completions will probably average under 500 thousand in the first half of the year. I was generous and added a little pickup later in the year, but it could easily be less. The D.R. Horton CEO said yesterday:

We expect our September quarter will be the most challenging as the tax credit for home sales will have expired. As we move past the selling season, we'll be able to get a better read on core demand and we'll adjust our business accordingly.The manufactured homes data is from the Census Bureau (and demolitions are estimated).

The good news is the population is growing at around 2.6 million people per year. And based on normal household formation to population ratios, this would usually mean 1.1 million or more net new households formed in 2010. Unfortunately job growth will probably be weak in 2010 and hold down household formation, but this suggests the number of excess units should finally start declining in 2010 - perhaps by more than 600 thousand units, perhaps even cut in half. (note: this doesn't include 2nd home buying that might also reduce the number of excess units).

Those expecting a sharp increase in residential construction this year will probably be disappointed since there are still a large number of excess vacant housng units - and, as I've noted many times, residential investment is usually one of the engines of recovery (both for GDP and jobs) - so I expect those looking for a "V-shaped" recovery will be disappointed too.

We are still a long way from significant job growth in residential construction, but we might actually see progress in reducing the excess inventory this year.

Special thanks to housing economist Tom Lawler who shared with me some of his thoughts on completions.

MBA: Mortgage Applications Increase to mid-December Levels

by Calculated Risk on 2/03/2010 12:15:00 PM

From earlier this morning ... the MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased of 21.0 percent on a seasonally adjusted basis from one week earlier. ...

"Mortgage application volume rebounded last week, returning the purchase and refinance indexes to levels from mid-December," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Rates continue to hover around 5 percent, quite low by historical standards, but are well above the record lows seen in 2009, and hence are not generating substantial refi volume. We expect that rates will rise over the next few months as the Federal Reserve winds down its MBS purchase program, and this will likely lead to a decline in refinance volume."

The Refinance Index increased 26.3 percent from the previous week and the seasonally adjusted Purchase Index increased 10.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.01 percent from 5.02 percent, with points increasing to 1.04 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

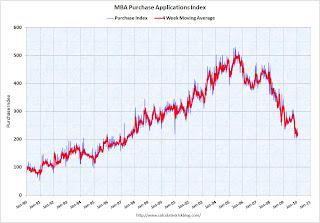

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is at about the same level as November 1997. The increase this week was just a rebound from the decline last week.

The decline in mortgage applications since October appears significant, and even with the increase in refinance applications last week, it also appears the refinance boom is ending.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.Every time the 10 year yield drops sharply, refinance activity picks up. But notice what happened at the end of 1995. The Ten Year yield dropped, but the increase in refinance activity was muted. This was because mortgage rates didn't fall below the rates of a couple years earlier - and many people had already refinanced at those lower rates. The same thing will happen this year and next - there will only be a surge in refinance activity if rates fall below the rates of 2009.

ISM Non-Manufacturing Shows Slight Expansion in January

by Calculated Risk on 2/03/2010 10:00:00 AM

This is another weak service report. According to this survey, the service sector barely expanded in January, and employment also contracted in the non-manufacturing sector "for the 25th consecutive month".

From the Institute for Supply Management: January 2010 Non-Manufacturing ISM Report On Business®

In January, the NMI registered 50.5 percent, indicating growth in the non-manufacturing sector after two months of contraction. A reading above 50 percent indicates the non-manufacturing sector economy is generally expanding; below 50 percent indicates the non-manufacturing sector is generally contracting.

...

"The NMI (Non-Manufacturing Index) registered 50.5 percent in January, 0.7 percentage point higher than the seasonally adjusted 49.8 percent registered in December, indicating growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased 1 percentage point to 52.2 percent, reflecting growth for the second consecutive month. The New Orders Index increased 2.7 percentage points to 54.7 percent, and the Employment Index increased 1 percentage point to 44.6 percent.

...

Employment activity in the non-manufacturing sector contracted in January for the 25th consecutive month. ISM's Non-Manufacturing Employment Index for January registered 44.6 percent.

emphasis added

ADP: Private Employment Decreased 22,000 in January

by Calculated Risk on 2/03/2010 08:32:00 AM

ADP reports:

Nonfarm private employment decreased 22,000 from December 2009 to January 2010 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from November to December 2009 was revised by 23,000, from a decline of 84,000 to a decline of 61,000.Note: ADP is private nonfarm employment only (no government jobs).

The January employment decline was the smallest since employment began falling in February of 2008.

On the Challenger job-cut report from MarketWatch: Planned layoffs rise for first time since July: Challenger Gray

Planned layoff announcements at major U.S. corporations increased 59% in January, reaching 71,482 from a nine-year low of 45,094 seen in December, according to the latest job-cut tally by Challenger Gray & Christmas.The BLS reports on Friday, and the consensus is for a small net gain in payroll jobs in January, on a seasonally adjusted (SA) basis, and the unemployment rate flat at 10.0%.

It was the first month-to-month increase since July, the outplacement firm reported Wednesday.

Layoff plans ran 70% lower than the 241,749 announced in January 2009, which was a seven-year high..

The relatively strong ISM manufacturing and ADP reports suggest a positive BLS number on Friday.

NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

by Calculated Risk on 2/03/2010 01:12:00 AM

Note from NMHC: "Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged."

So the increase in the index to 38 implies lower occupancy rates and lower rents - "looser" apartment conditions - but at a slower pace of contraction than the previous quarter.

From the National Multi Housing Council (NMHC): Apartment Market Conditions Steady; Sales Volume and Equity Financing Improve, According to NMHC Quarterly Survey

The Market Tightness Index’s sub-50 reading of 38 indicates that vacancy and/or rent conditions deteriorated over the last quarter. Thirty percent of respondents said markets were looser, meaning higher vacancies and/or lower rents; only seven percent reported that markets were tighter.

...

“This quarter saw a continued uptick in sales volume and equity financing, which represent another step, albeit a small one, toward a more normal transactions market, after 2009 recorded the lowest number of transactions of the decade,” said NMHC Chief Economist Mark Obrinsky.

“The weakest performing index is the Market Tightness Index,” said Obrinsky, “underscoring the fact that full recovery of occupancy and rents will require job growth to return to the economy. When that happens, and as a large wave of Echo Boomers begins to enter a supply-constrained market, we should see above average rent growth.”

emphasis added

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

This data is for apartment buildings. The data released yesterday from the Census Bureau - showing a 10.7% rental vacancy rate - includes all rental units.

Tuesday, February 02, 2010

NYTimes: More Homeowners Just Walk Away

by Calculated Risk on 2/02/2010 09:03:00 PM

“We’re now at the point of maximum vulnerability. People’s emotional attachment to their property is melting into the air.”From David Streitfeld at the NY Times: No Aid or Rebound in Sight, More Homeowners Just Walk Away. A few excerpts:

Sam Khater, senior economist at First American CoreLogic.

New research suggests that when a home’s value falls below 75 percent of the amount owed on the mortgage, the owner starts to think hard about walking away, even if he or she has the money to keep paying.Streitfeld is referring to the recent negative equity report from First American CoreLogic, see: Negative Equity Report for Q3

...

The number of Americans who owed more than their homes were worth was virtually nil when the real estate collapse began in mid-2006, but by the third quarter of 2009, an estimated 4.5 million homeowners had reached the critical threshold, with their home’s value dropping below 75 percent of the mortgage balance.

Some excerpts from that report:

Nearly 10.7 million, or 23 percent, of all residential properties with mortgages were in negative equity as of September, 2009. An additional 2.3 million mortgages were approaching negative equity, meaning they had less than five percent equity. Together negative equity and near negative equity mortgages account for nearly 28 percent of all residential properties with a mortgage nationwide. The rise in negative equity is closely tied to increases in pre-foreclosure activity. At one end of the spectrum, borrowers with equity tend to have very low default rates. At the other end, investors tend to default on their mortgages once in negative equity more ruthlessly: their default rate is typically two to three percent higher than owner-occupied homes with similar degrees of negative equity. For the highest level of negative equity, investors and owners behave very similarly and default at similar rates (Figure 4). Strategic default on the part of the owner occupier becomes more likely at such high levels of negative equity.

Here is figure 4 from the report.

Here is figure 4 from the report. The default rate increases sharply for homeowners with more than 20% negative equity.

As Streitfeld noted, there are an estimated 4.5 million homeowners with more than 25% negative equity. According to the chart, maybe only 10% of them are currently in default. If, as First American CoreLogic senior economist Sam Khater said, "people's emotional attachment to their property is melting into the air", then we might see a surge in defaults by homeowners with negative equity.

And more from the NY Times:

In 2006, Benjamin Koellmann bought a condominium in Miami Beach. By his calculation, it will be about the year 2025 before he can sell his modest home for what he paid. Or maybe 2040.

Benjamin Koellmann paid $215,000 for his apartment in Miami Beach in 2006, but now units are selling in foreclosure for $90,000. “There is no financial sense in staying,” he said.

“People like me are beginning to feel like suckers,” Mr. Koellmann said. “Why not let it go in default and rent a better place for less?”

ABI: Personal Bankruptcy Filings Up 15% from January 2009

by Calculated Risk on 2/02/2010 06:11:00 PM

A couple of key points:

From the American Bankruptcy Institute: January Consumer Bankruptcy Filings Decrease 10 Percent from December

The 102,254 consumer bankruptcies filed in January represented a 10 percent decrease nationwide from the 113,274 consumer filings recorded in December, according to the American Bankruptcy Institute (ABI) relying on data from the National Bankruptcy Research Center (NBKRC). NBKRC’s data also showed that the January 2010 consumer filings represented a 15 percent increase over the 88,773 consumer filings recorded in January 2009.

“While January represented a drop in filings from the previous month, high unemployment rates, unsustainable mortgage burdens and other economic stresses will push more consumers to seek the financial relief of bankruptcy in 2010,” said ABI Executive Director Samuel J. Gerdano. “Consumer filings this year will likely surpass the 1.4 million consumer filings recorded in 2009.”

emphasis added

U.S. Light Vehicle Sales 10.8 Million SAAR in January

by Calculated Risk on 2/02/2010 04:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

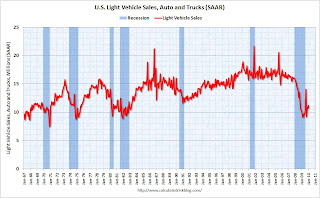

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for January (red, light vehicle sales of 10.78 million SAAR from AutoData Corp). The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This is the lowest level since October and below the levels of last July. Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July.

The current level of sales are still very low, and are still below the lowest point for the '90/'91 recession (even with a larger population).

D.R. Horton Conference Call on Housing Market

by Calculated Risk on 2/02/2010 01:02:00 PM

A few excerpts from the D.R. Horton conference call (ht Brian). A couple of key points:

D.R. Horton CEO: Profitability in the second quarter will be challenging as we will not close as many homes in the second quarter as we did in the first quarter [CR Note: their fiscal 2nd quarter is the calendar year 1st quarter].

We are entering the quarter with 4,136 homes in backlog and we will need to realize a backlog conversion rate over greater than 100% to reach profitability. With the extension and expansion of the home buyer tax credit and with our available housing inventory, a high backlog conversion rate is entirely achievable. But we do not expect to be as profitable as we were this quarter.

In the third quarter, we expect strong closings since homes must close by June 30th for the extended tax credit [Once again, he is referring to calendar Q2]. The third quarter will probably be our strongest quarter for profits this year. We expect our September quarter will be the most challenging as the tax credit for home sales will have expired. As we move past the selling season, we'll be able to get a better read on core demand and we'll adjust our business accordingly.”

[CR Note: The question is: what is the core demand? Most of their current sales are first time homebuyers, and homebuyers using government loan programs]

“90% of our mortgage company's business was captive during the quarter. Our company wide capture rate was approximately 61%. Our average FICO score was 702 and our average combined loan to value was 93%. Our product mix in the quarter was essentially 100% agency eligible with government loans accounting for 63% of our volume.

Our homes in inventory at the end of the December, totaled 11,500. Of which, 1,100 were models, 7,300 were speculative, and 2,900 of these specs were completed.

Of the first quarter closings captured by our mortgage company, 66% were to first time buyers who typically purchase spec homes, so we manage our total number of homes in inventory and number of speculative homes to match expected demand. Our unsold completed homes older than six months were 600 homes at December 31st, 2009, down from 800, at September 30th. We are prepared for the spring selling season and for current demand created by the Federal home buyer tax credit with our current spec level.

We will continue to manage our spec levels very closely as we move closer to the April 30th sales contract deadline for the home buyer tax credit.

Analyst: When you talk about fourth quarter being potentially your most difficult quarter and you just talked about that on margin, is that the expectation that you might have to lower prices after the expiration of the tax credit and do you actually think that 4Q volumes to be lower than say 2Q, which could be pretty rare?

Horton: Actually we do believe that fourth quarter volumes will be less than the second quarter and the third quarter volumes just simply we believe a number of sales, we don't know exactly how many, but we believe that a number of sales are being driven by the tax credit. So to the extent that that tax credit expires, clearly that will adversely affect our sales in the fourth quarter. Relative to inventory we're focusing on reducing our inventory post March to comply with the expiration of the tax credit. To the extent that there's more volume than we anticipate in the fourth quarter, we can ramp our inventory back up again.

Analyst: You provided some pretty good color on your expectations for gross margins over the rest of the year. Just wondering if you might also provide a little color on normalized gross margins in a healthy new homes selling environment being kind of anywhere in the 18 to 22% range. The 17% that you've sort of implicitly guided toward is a bit low, just wondering on your view, how high does it get and how long do you think it might take to get there?

Horton: Well first of all, I think you need to have job growth in the economy, and there's obviously no job growth to speak of today and secondly I think we have to have consumer confidence and thirdly I believe that a number of people in the country are still under water on their mortgages, and I think those three things have to be cleared up before we start to have, to get back to more normalized margins. The way that we are managing our business model here is, is that we certainly think that we've got two more challenging years ahead of us. I don't expect job growth or consumer confidence to change dramatically, so I don't expect 18 to 22% gross margins on a consistent basis for a couple of years.