by Calculated Risk on 2/06/2010 03:57:00 PM

Saturday, February 06, 2010

Construction Employment Outlook

TIME asks: The Great Recession: Will Construction Workers Survive?

Nationally, unemployment fell to 9.7% in January, but in construction it jumped to 24.7% ... "In the previous 14 years, I had not been out of work for more than one week," says Pat O'Connor, 57, a Connecticut carpenter. With no work since July, O'Connor says, "It is a bad dream turning into a nightmare. Is construction dead? It's just horrible right now. No one expected this. It's a depression."And it won't get better in 2010.

The following graph shows construction employment (total) and as a percent of non-farm payroll employment.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Although construction employment is off 2.1 million workers since the peak, there will be no increase any time soon.

Looking at the graph, it appears construction employment continues to decline for a time after a recession ends - or only picks up a little. However this masks the contributions from the two components of construction: residential and non-residential.

Residential investment (and residential construction) usually leads the economy out of recession, and non-residential construction lags the economy. Unfortunately the BLS didn't start breaking out residential construction employment until recently, but that is the pattern.

This time any improvement in residential construction employment will be small, in fact completions in 2010 will be at an all time record low (see: Housing Stock and Flow).

The TIME article notes:

In downtown Los Angeles, just east of Little Tokyo, one of the only active construction sites is a 53-unit apartment building at Alameda and 4th Street.And when that is completed, the opportunities will be few. In 2010 the number of 5+ unit completions will collapse:

The blue line is for multifamily starts and the red line is for multifamily completions. For the most part, all the multifamily units that will be delivered in 2010 have already been started since, according to the Census Bureau, it takes on average over 1 year to complete these projects.

The blue line is for multifamily starts and the red line is for multifamily completions. For the most part, all the multifamily units that will be delivered in 2010 have already been started since, according to the Census Bureau, it takes on average over 1 year to complete these projects.Since multifamily starts collapsed in 2009, completions will collapse in 2010 - and construction employment will suffer.

And non-residential investment (and employment) is still getting crushed (see: Q4: Office, Mall and Lodging Investment). As these projects are completed, more construction workers will be let go.

So the outlook for construction employment in 2010 is grim.

Jobs and the Unemployment Rate

by Calculated Risk on 2/06/2010 12:38:00 PM

This is probably worth reviewing again, and I've added several graphs to show the relationship between net payroll jobs (establishment survey) and the unemployment rate (household survey) over different periods.

As I noted yesterday, a common question is: How could there be fewer payroll jobs, but the unemployment rate declined? This is because the data comes from two separate surveys. The establishment survey showed a loss of 20,000 payroll jobs in January, but the household survey showed an increase in the employment level of 541,000.

The number to use for jobs is the establishment survey, but the unemployment number is based on the household survey. The two surveys can diverge over the short period, but over time it will all work out. This was a hot topic last year when the unemployment rate decline to 9.4% in July, and some commentators wondered if the unemployment rate had peaked (see: Unemployment and Net Jobs).

Here are a series of graphs showing this relationship over several different periods.

The first graph shows the one month change in net jobs (on the x-axis) as a percentage of the payroll jobs, and the change in the unemployment rate on the y-axis.

The data is for the last 40 years: 1969 through January 2010. Click on graph for large image.

Click on graph for large image.

Obviously there is a correlation - the more jobs added (further right on the x-axis), the more the unemployment rate declines (y-axis). And generally the more jobs lost, the more the unemployment rate increases. But R2 is only 0.31 on a monthly basis - pretty noisy.

The large Red triangle (with arrow) is the most recent month. It is somewhat of an outlier, but still on the edge of the scatter pattern.

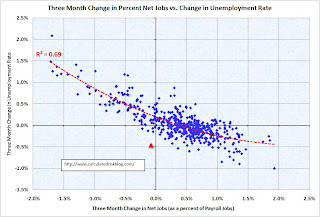

The second graph covers the same period but on a three month basis (note: this graph uses rolling three month periods, so the data is not all independent). Now we see a much sharper correlation. R2 is 0.69.

Now we see a much sharper correlation. R2 is 0.69.

The red triangle is the most recent three month period, and this is somewhat of an outlier.

Note that the trend line is a 2nd order polynomial. When the economy starts to add jobs, more people start looking for work - and the relationship between net jobs and the unemployment rate is not linear.

Lets expand this to two longer periods: six months and one year. The third graph is for the six month change in payroll jobs and the unemployment rate. R2 is 0.79.

The third graph is for the six month change in payroll jobs and the unemployment rate. R2 is 0.79.

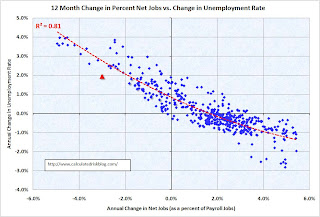

Once again the red triangle is for the most recent period. The change is on the edge of the scatter, but appears pretty normal. The increase in the unemployment rate is a little lower than expected over the last six months, probably because of the sharp decline in the number of people participating in the labor force. And the final graph is for the annual change. R2 is 0.81.

And the final graph is for the annual change. R2 is 0.81.

Once again this graph uses rolling periods, so the data is not independent.

The red triangle is for the most recent year, and is probably low because of the sharp decline in employment participation (one of the unusual features of the current employment recession).

So what does this mean going forward for the unemployment rate? It is probably reasonable to expect that the employment-population ratio has stopped falling. Therefore, to see consistent declines in the unemployment rate, we would probably have to see sustained payroll growth of over 150 thousand per month.

Since I expect the recovery to be sluggish, I wouldn't be surprised to see the unemployment rate at or near this level (or even higher) for some time.

Eurozone Update

by Calculated Risk on 2/06/2010 09:18:00 AM

María Teresa Fernández de la Vega, Spain’s deputy premier

From the Financial Times: Spain and Portugal fight to calm investors

Spanish and Portuguese debt and equity markets were hard hit by Greece-related doubts among investors, partly because Madrid and Lisbon ran up budget deficits to dampen the effects of the economic crisis and partly because of fears for eurozone cohesion.Reuters is quoting European Central Bank Governing Council member Ewald Nowotny as saying talk of a Eurozone breakup is "absurd". And Bloomberg is quoting Nowotny on the exchange rate:

...

“In a country with such high unemployment, how will it be possible to reduce the public deficit?” asked Prof [Juan José Toribio, economics professor at Iese Business School]

excerpted with permission

“There’s no worrying development. Foreign exchange rates naturally fluctuate.”And more from the NY Times: Debt Problems Chip Away at Fortress Europe

And from the WaPo: Debt crisis unsettles European economy

Senior officials at the major rating agencies on Friday played down the risk of an immediate debt crisis, saying even nations such as Greece have enough reserves to put off for months a day of financial reckoning. ... is especially hitting banks and other institutions with broad exposure to the sovereign debt of the "PIGS" of Europe -- Portugal, Ireland, Greece and Spain.And more from Paul Krugman on the problems of a single currency: The Spanish Tragedy

We might get further updates on Sunday ...

Friday, February 05, 2010

Unofficial Problem Bank List increases to 605

by Calculated Risk on 2/05/2010 10:47:00 PM

Note: Earlier employment posts today:

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

During the week, the Unofficial Problem Bank List changed by a net of six institutions to 605 and aggregate assets increased to $328.7 billion from $322.5 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Deletions include the one failure tonight -- 1st American State Bank of Minnesota, and one action that was terminated by the OCC against Palm Desert National Bank during January. However, look for Palm Desert National Bank to come back on the list in the near future as the Federal Reserve issued a Written Agreement against the bank’s parent company this week. Frequently during this cycle, the OCC will terminate a Supervisory Agreement only to replace it with a Cease & Desist or Consent Order.

There were eight additions this week including Bank of Smithtown, Smithtown, NY ($2.7 billion, Ticker: SMTB); CF Bancorp, Port Huron, MI ($1.8 billion, Ticker: CTZN); The Cowlitz Bank, Longview, WA ($578 million, Ticker: CWLZ); and Stoneham Savings Bank, Stoneham, MA ($426 million).

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Mortgage Bankers Association Half Off Sale

by Calculated Risk on 2/05/2010 08:15:00 PM

From the WaPo: Mortgage bankers group sells D.C. offices to Bethesda company (ht John, Ann)

The Mortgage Bankers Association ... fell victim to the collapse of the market and sold its $90 million headquarters in downtown Washington on Friday for $41 million.Sounds like they were drinking their own Kool-Aid!

...

The Mortgage Bankers Association moved into the building in 2008 just as the real estate market was crashing ...

Bank Failure #16: 1st American State Bank of Minnesota, Hancock, Minnesota

by Calculated Risk on 2/05/2010 05:41:00 PM

February's sweet sixteen

Embraced now by Feds

by Soylent Green is People

From the FDIC: Community Development Bank, FSB, Ogema, Minnesota, Assumes All of the Deposits of 1st American State Bank of Minnesota, Hancock, Minnesota

1st American State Bank of Minnesota, Hancock, Minnesota was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ... As of December 31, 2009, 1st American State Bank of Minnesota had approximately $18.2 million in total assets and $16.3 million in total deposits. ...Small banks count too.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.1 million. ... 1st American State Bank of Minnesota is the 16th FDIC-insured institution to fail in the nation this year, and the third in Minnesota. The last FDIC-insured institution closed in the state was Marshall Bank, N.A., Hallock , January 29, 2010.

Consumer Credit Declines for Record 11th Straight Month

by Calculated Risk on 2/05/2010 03:19:00 PM

The Federal Reserve reports:

Consumer credit decreased at an annual rate of 4-3/4 percent in the fourth quarter of 2009. Revolving credit decreased at an annual rate of 13 percent, and nonrevolving credit was unchanged on net. In December, consumer credit decreased at an annual rate of 3/4 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year (YoY) change in consumer credit. Consumer credit is off 4.0% over the last 12 months.

Consumer credit has declined for a record 11 straight months - and declined for 14 of the last 15 months and is now 4.8% below the peak in July 2008. It is difficult to get a robust recovery without an expansion of consumer credit - unless the recovery is built on business investment and exports (seems unlikely to be robust).

Note: The Fed reports a simple annual rate (multiplies change in month by 12) as opposed to a compounded annual rate. Consumer credit does not include real estate debt.

Employment Diffusion Index

by Calculated Risk on 2/05/2010 01:37:00 PM

Usually I include a graph of the employment diffusion index in one of my employment posts - a measure of how widespread job losses (or gains) are - but the BLS moved everything around today, so it took me some time to find the data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The BLS diffusion index for total private employment increased to 46.8 from 41.3 in December. This is the same level as in November.

Think of this as a measure of how widespread job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The diffusion index had been trending up, meaning job losses are becoming less widespread.

However a reading of 46.8 still shows a minority of industries are adding workers, and I'd expect the diffusion index to be at or above 50 when the employment recovery begins.

Earlier employment posts today:

Unemployed over 26 Weeks and Seasonal Adjustment

by Calculated Risk on 2/05/2010 11:16:00 AM

Unemployed over 26 Weeks Click on graph for larger image in new window.

Click on graph for larger image in new window.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are a record 6.31 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.1% of the civilian workforce. (note: records started in 1948)

The number of long term unemployed is one of the key stories of this recession. Last year, David Leonhardt at the NY Times wrote an excellent piece about this: Wages Grow for Those With Jobs, New Figures Show

In the job market, at least, the recession’s pain has been unusually concentrated.Seasonal Adjustment

...

People who have lost their jobs are struggling terribly to find new ones. Since the downturn began in 2007, companies have been extremely reluctant to hire new workers, and few new companies have started. The economy and the job market are churning very slowly.

...

Try thinking of it this way: All of the unemployed people in the country are gathered in a huge gymnasium that’s been turned into a job search center. The fact that this recession is the worst in a generation means that there are many, many people in the gym. The fact that the economy is churning so slowly means that there is not much traffic into and out of the gym.

If you’re inside, you will have a hard time getting out. Yet if you’re lucky enough to be outside the gym, you will probably be able to stay there. The consequences of a job loss are terribly high, but — given that the unemployment rate is almost 10 percent — the odds of job loss are surprisingly low.

Back in November, Floyd Norris at the NY Times asked: Did Unemployment Really Rise?

The economic reactions over the weekend to Friday’s employment report all started from the assumption that things grew much worse in October. The unemployment rate leaped to 10.2 percent from 9.8 percent. Another 190,000 jobs vanished.Norris was referring to the "Not Seasonally Adjusted" (NSA) number. I suppose now Norris will ask "Did unemployment really fall?". The NSA number for unemployment was 10.6% in January - a sharp increase from December, as opposed to the 9.7% SA headline number.

Actually, none of that happened.

In reality, the government report says unemployment rates remained steady at 9.5 percent.

HOWEVER, as I pointed out when Norris wrote his article, there is a strong seasonal pattern to employment (and unemployment), and the Seasonally Adjusted number is the one to use. So if you see analysis featuring the NSA number (without pointing out the seasonal pattern to employment), just ignore it.

Earlier employment posts today:

Employment-Population Ratio, Part Time Workers, Temporary Workers

by Calculated Risk on 2/05/2010 09:39:00 AM

A common question is: how could there be fewer payroll jobs, but the unemployment rate declined? This is because the data comes from two separate surveys. The unemployment Rate comes from the Current Population Survey (CPS: commonly called the household survey), a monthly survey of about 60,000 households.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 400,000 business establishments nationwide.

The establishment survey showed a loss of 20,000 payroll jobs in January, but the household survey showed an increase in the employment level of 541,000. The number to use for jobs is the establishment survey, but the unemployment number is based on the household survey and the surveys can diverge over the short period, but over time this will work out (for more on the differences, see: Jobs and the Unemployment Rate).

Here are a few more graphs based on the employment report ...

Employment-Population Ratio

The Employment-Population ratio ticked up slightly to 58.4% in January, after plunging since the start of the recession. This is about the same level as in 1983. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

The Labor Force Participation Rate increased slightly to 64.7% (the percentage of the working age population in the labor force). This is at the level of the early 80s.

Temporary Workers

From the BLS report:

In January, temporary help services added 52,000 jobs. Since reaching a low point in September 2009, temporary help services employment has risen by 247,000.

This graph shows temporary help services (seasonally adjusted) and the unemployment rate. Unfortunately the data on temporary help services only goes back to 1990, but it does appear temporary help and the unemployment rate have been inversely correlated.

This graph shows temporary help services (seasonally adjusted) and the unemployment rate. Unfortunately the data on temporary help services only goes back to 1990, but it does appear temporary help and the unemployment rate have been inversely correlated.The thinking is that before companies hire permanent employees following a recession, employers will first increase the hours worked of current employees and also hire temporary employees. Since the number of temporary workers increased sharply, some people think this might be signaling the beginning of an employment recovery.

However, there has been some evidence of a shift by employers to more temporary workers, and the saying may become "We are all temporary now!", so use this increase with caution.

Note: the Census Bureau hired 9,000 temporary workers in January as part of the decennial census, and now employs 24,000 temporary workers.

Part Time for Economic Reasons

From the BLS report:

The number of persons who worked part time for economic reasons (sometimes referred to as involuntary part-time workers) fell from 9.2 to 8.3 million in January. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined sharply to 8.3 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined sharply to 8.3 million. The all time record was set in October.

Overall there were some positives in the report: the unemployment rate declined, average hours worked increased slightly, part time workers declined, and the employment-population ratio ticked up slightly (after plunging sharply). This is just one month - and January is the always a little tricky because of the heavy seasonal adjustment. I'll have even more later ...

Earlier employment post today: