by Calculated Risk on 2/06/2010 11:15:00 PM

Saturday, February 06, 2010

Some Excerpts from Comedy Session at AEA Annual Meeting

A couple of past favorites, standup economist Yoram Bauman (see his classic Principles of economics, translated ) and singer Merle Hazard (Inflation or Deflation? and H-E-D-G-E ), appear in the video ...

Paying Credit Cards before Mortgage

by Calculated Risk on 2/06/2010 07:41:00 PM

From Michelle Singletary at the WaPo: Paying your credit card bill before the mortgage

TransUnion ... recently released a report showing that an increasing number of consumers are choosing to pay their credit card bills before their monthly mortgages. ... The percentage of people delinquent on their mortgages but current on credit cards jumped to 6.6 percent in the third quarter of 2009, up from 4.9 percent in the third quarter of 2008.Check out the numbers for California and Florida!

...

The percentage of consumers current on their credit cards but delinquent on their mortgages first surpassed the percentage of consumers up to date on their mortgages but delinquent on their credit cards in the first quarter of 2008, according to TransUnion.

"The implosion of the mortgage industry over the last 24 months, the resetting of adjustable-rate mortgages and the weak job market have all come together to redefine how consumers are managing their finances and meeting or not meeting their credit obligations," said Ezra Becker, director of consulting and strategy in TransUnion's financial services business unit.

This behavior first showed up with subprime borrowers, from Bloomberg in June 2007: Subprime Borrowers More Apt to Pay Card Debt, Ignore Mortgages

The riskiest borrowers in the U.S. are more likely to pay off their credit-card debt than their mortgage, bucking historical trends, a new study shows.Another "subprime" behavior goes mainstream ...

...

Bankers in the past have reasoned that consumers would give up everything else before they risked losing their homes, making mortgages less risky than other forms of lending. The report found borrowers with strong ratings still follow the historic trend of paying their mortgage before their credit-card debt.

The penchant of subprime borrowers to do the opposite may be ``a potential shift in this payment paradigm,'' the study said.

Construction Employment Outlook

by Calculated Risk on 2/06/2010 03:57:00 PM

TIME asks: The Great Recession: Will Construction Workers Survive?

Nationally, unemployment fell to 9.7% in January, but in construction it jumped to 24.7% ... "In the previous 14 years, I had not been out of work for more than one week," says Pat O'Connor, 57, a Connecticut carpenter. With no work since July, O'Connor says, "It is a bad dream turning into a nightmare. Is construction dead? It's just horrible right now. No one expected this. It's a depression."And it won't get better in 2010.

The following graph shows construction employment (total) and as a percent of non-farm payroll employment.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Although construction employment is off 2.1 million workers since the peak, there will be no increase any time soon.

Looking at the graph, it appears construction employment continues to decline for a time after a recession ends - or only picks up a little. However this masks the contributions from the two components of construction: residential and non-residential.

Residential investment (and residential construction) usually leads the economy out of recession, and non-residential construction lags the economy. Unfortunately the BLS didn't start breaking out residential construction employment until recently, but that is the pattern.

This time any improvement in residential construction employment will be small, in fact completions in 2010 will be at an all time record low (see: Housing Stock and Flow).

The TIME article notes:

In downtown Los Angeles, just east of Little Tokyo, one of the only active construction sites is a 53-unit apartment building at Alameda and 4th Street.And when that is completed, the opportunities will be few. In 2010 the number of 5+ unit completions will collapse:

The blue line is for multifamily starts and the red line is for multifamily completions. For the most part, all the multifamily units that will be delivered in 2010 have already been started since, according to the Census Bureau, it takes on average over 1 year to complete these projects.

The blue line is for multifamily starts and the red line is for multifamily completions. For the most part, all the multifamily units that will be delivered in 2010 have already been started since, according to the Census Bureau, it takes on average over 1 year to complete these projects.Since multifamily starts collapsed in 2009, completions will collapse in 2010 - and construction employment will suffer.

And non-residential investment (and employment) is still getting crushed (see: Q4: Office, Mall and Lodging Investment). As these projects are completed, more construction workers will be let go.

So the outlook for construction employment in 2010 is grim.

Jobs and the Unemployment Rate

by Calculated Risk on 2/06/2010 12:38:00 PM

This is probably worth reviewing again, and I've added several graphs to show the relationship between net payroll jobs (establishment survey) and the unemployment rate (household survey) over different periods.

As I noted yesterday, a common question is: How could there be fewer payroll jobs, but the unemployment rate declined? This is because the data comes from two separate surveys. The establishment survey showed a loss of 20,000 payroll jobs in January, but the household survey showed an increase in the employment level of 541,000.

The number to use for jobs is the establishment survey, but the unemployment number is based on the household survey. The two surveys can diverge over the short period, but over time it will all work out. This was a hot topic last year when the unemployment rate decline to 9.4% in July, and some commentators wondered if the unemployment rate had peaked (see: Unemployment and Net Jobs).

Here are a series of graphs showing this relationship over several different periods.

The first graph shows the one month change in net jobs (on the x-axis) as a percentage of the payroll jobs, and the change in the unemployment rate on the y-axis.

The data is for the last 40 years: 1969 through January 2010. Click on graph for large image.

Click on graph for large image.

Obviously there is a correlation - the more jobs added (further right on the x-axis), the more the unemployment rate declines (y-axis). And generally the more jobs lost, the more the unemployment rate increases. But R2 is only 0.31 on a monthly basis - pretty noisy.

The large Red triangle (with arrow) is the most recent month. It is somewhat of an outlier, but still on the edge of the scatter pattern.

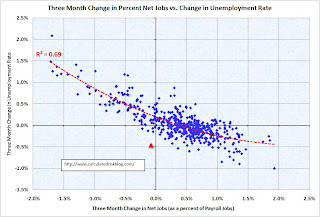

The second graph covers the same period but on a three month basis (note: this graph uses rolling three month periods, so the data is not all independent). Now we see a much sharper correlation. R2 is 0.69.

Now we see a much sharper correlation. R2 is 0.69.

The red triangle is the most recent three month period, and this is somewhat of an outlier.

Note that the trend line is a 2nd order polynomial. When the economy starts to add jobs, more people start looking for work - and the relationship between net jobs and the unemployment rate is not linear.

Lets expand this to two longer periods: six months and one year. The third graph is for the six month change in payroll jobs and the unemployment rate. R2 is 0.79.

The third graph is for the six month change in payroll jobs and the unemployment rate. R2 is 0.79.

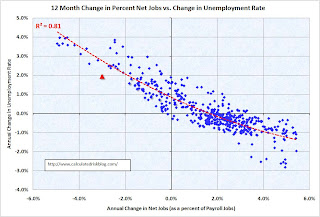

Once again the red triangle is for the most recent period. The change is on the edge of the scatter, but appears pretty normal. The increase in the unemployment rate is a little lower than expected over the last six months, probably because of the sharp decline in the number of people participating in the labor force. And the final graph is for the annual change. R2 is 0.81.

And the final graph is for the annual change. R2 is 0.81.

Once again this graph uses rolling periods, so the data is not independent.

The red triangle is for the most recent year, and is probably low because of the sharp decline in employment participation (one of the unusual features of the current employment recession).

So what does this mean going forward for the unemployment rate? It is probably reasonable to expect that the employment-population ratio has stopped falling. Therefore, to see consistent declines in the unemployment rate, we would probably have to see sustained payroll growth of over 150 thousand per month.

Since I expect the recovery to be sluggish, I wouldn't be surprised to see the unemployment rate at or near this level (or even higher) for some time.

Eurozone Update

by Calculated Risk on 2/06/2010 09:18:00 AM

María Teresa Fernández de la Vega, Spain’s deputy premier

From the Financial Times: Spain and Portugal fight to calm investors

Spanish and Portuguese debt and equity markets were hard hit by Greece-related doubts among investors, partly because Madrid and Lisbon ran up budget deficits to dampen the effects of the economic crisis and partly because of fears for eurozone cohesion.Reuters is quoting European Central Bank Governing Council member Ewald Nowotny as saying talk of a Eurozone breakup is "absurd". And Bloomberg is quoting Nowotny on the exchange rate:

...

“In a country with such high unemployment, how will it be possible to reduce the public deficit?” asked Prof [Juan José Toribio, economics professor at Iese Business School]

excerpted with permission

“There’s no worrying development. Foreign exchange rates naturally fluctuate.”And more from the NY Times: Debt Problems Chip Away at Fortress Europe

And from the WaPo: Debt crisis unsettles European economy

Senior officials at the major rating agencies on Friday played down the risk of an immediate debt crisis, saying even nations such as Greece have enough reserves to put off for months a day of financial reckoning. ... is especially hitting banks and other institutions with broad exposure to the sovereign debt of the "PIGS" of Europe -- Portugal, Ireland, Greece and Spain.And more from Paul Krugman on the problems of a single currency: The Spanish Tragedy

We might get further updates on Sunday ...

Friday, February 05, 2010

Unofficial Problem Bank List increases to 605

by Calculated Risk on 2/05/2010 10:47:00 PM

Note: Earlier employment posts today:

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

During the week, the Unofficial Problem Bank List changed by a net of six institutions to 605 and aggregate assets increased to $328.7 billion from $322.5 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Deletions include the one failure tonight -- 1st American State Bank of Minnesota, and one action that was terminated by the OCC against Palm Desert National Bank during January. However, look for Palm Desert National Bank to come back on the list in the near future as the Federal Reserve issued a Written Agreement against the bank’s parent company this week. Frequently during this cycle, the OCC will terminate a Supervisory Agreement only to replace it with a Cease & Desist or Consent Order.

There were eight additions this week including Bank of Smithtown, Smithtown, NY ($2.7 billion, Ticker: SMTB); CF Bancorp, Port Huron, MI ($1.8 billion, Ticker: CTZN); The Cowlitz Bank, Longview, WA ($578 million, Ticker: CWLZ); and Stoneham Savings Bank, Stoneham, MA ($426 million).

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Mortgage Bankers Association Half Off Sale

by Calculated Risk on 2/05/2010 08:15:00 PM

From the WaPo: Mortgage bankers group sells D.C. offices to Bethesda company (ht John, Ann)

The Mortgage Bankers Association ... fell victim to the collapse of the market and sold its $90 million headquarters in downtown Washington on Friday for $41 million.Sounds like they were drinking their own Kool-Aid!

...

The Mortgage Bankers Association moved into the building in 2008 just as the real estate market was crashing ...

Bank Failure #16: 1st American State Bank of Minnesota, Hancock, Minnesota

by Calculated Risk on 2/05/2010 05:41:00 PM

February's sweet sixteen

Embraced now by Feds

by Soylent Green is People

From the FDIC: Community Development Bank, FSB, Ogema, Minnesota, Assumes All of the Deposits of 1st American State Bank of Minnesota, Hancock, Minnesota

1st American State Bank of Minnesota, Hancock, Minnesota was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ... As of December 31, 2009, 1st American State Bank of Minnesota had approximately $18.2 million in total assets and $16.3 million in total deposits. ...Small banks count too.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.1 million. ... 1st American State Bank of Minnesota is the 16th FDIC-insured institution to fail in the nation this year, and the third in Minnesota. The last FDIC-insured institution closed in the state was Marshall Bank, N.A., Hallock , January 29, 2010.

Consumer Credit Declines for Record 11th Straight Month

by Calculated Risk on 2/05/2010 03:19:00 PM

The Federal Reserve reports:

Consumer credit decreased at an annual rate of 4-3/4 percent in the fourth quarter of 2009. Revolving credit decreased at an annual rate of 13 percent, and nonrevolving credit was unchanged on net. In December, consumer credit decreased at an annual rate of 3/4 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year (YoY) change in consumer credit. Consumer credit is off 4.0% over the last 12 months.

Consumer credit has declined for a record 11 straight months - and declined for 14 of the last 15 months and is now 4.8% below the peak in July 2008. It is difficult to get a robust recovery without an expansion of consumer credit - unless the recovery is built on business investment and exports (seems unlikely to be robust).

Note: The Fed reports a simple annual rate (multiplies change in month by 12) as opposed to a compounded annual rate. Consumer credit does not include real estate debt.

Employment Diffusion Index

by Calculated Risk on 2/05/2010 01:37:00 PM

Usually I include a graph of the employment diffusion index in one of my employment posts - a measure of how widespread job losses (or gains) are - but the BLS moved everything around today, so it took me some time to find the data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The BLS diffusion index for total private employment increased to 46.8 from 41.3 in December. This is the same level as in November.

Think of this as a measure of how widespread job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The diffusion index had been trending up, meaning job losses are becoming less widespread.

However a reading of 46.8 still shows a minority of industries are adding workers, and I'd expect the diffusion index to be at or above 50 when the employment recovery begins.

Earlier employment posts today: