by Calculated Risk on 2/10/2010 10:01:00 AM

Wednesday, February 10, 2010

Bernanke: Federal Reserve's exit strategy

Fed Chairman Ben Bernanke's prepared statement: Federal Reserve's exit strategy. In this testimony, Bernanke outlines the steps to unwind monetary stimulus. An excerpt:

I currently do not anticipate that the Federal Reserve will sell any of its security holdings in the near term, at least until after policy tightening has gotten under way and the economy is clearly in a sustainable recovery. However, to help reduce the size of our balance sheet and the quantity of reserves, we are allowing agency debt and MBS to run off as they mature or are prepaid. The Federal Reserve is currently rolling over all maturing Treasury securities, but in the future it may choose not to do so in all cases. In the long run, the Federal Reserve anticipates that its balance sheet will shrink toward more historically normal levels and that most or all of its security holdings will be Treasury securities. Although passively redeeming agency debt and MBS as they mature or are prepaid will move us in that direction, the Federal Reserve may also choose to sell securities in the future when the economic recovery is sufficiently advanced and the FOMC has determined that the associated financial tightening is warranted. Any such sales would be at a gradual pace, would be clearly communicated to market participants, and would entail appropriate consideration of economic conditions.A few points:

As a result of the very large volume of reserves in the banking system, the level of activity and liquidity in the federal funds market has declined considerably, raising the possibility that the federal funds rate could for a time become a less reliable indicator than usual of conditions in short-term money markets. Accordingly, the Federal Reserve is considering the utility, during the transition to a more normal policy configuration, of communicating the stance of policy in terms of another operating target, such as an alternative short-term interest rate. In particular, it is possible that the Federal Reserve could for a time use the interest rate paid on reserves, in combination with targets for reserve quantities, as a guide to its policy stance, while simultaneously monitoring a range of market rates. No decision has been made on this issue; we will be guided in part by the evolution of the federal funds market as policy accommodation is withdrawn. The Federal Reserve anticipates that it will eventually return to an operating framework with much lower reserve balances than at present and with the federal funds rate as the operating target for policy.

Trade Deficit increases to $40.2 Billion in December

by Calculated Risk on 2/10/2010 08:49:00 AM

The Census Bureau reports:

[T]otal December exports of $142.7 billion and imports of $182.9 billion resulted in a goods and services deficit of $40.2 billion, up from $36.4 billion in November, revised. December exports were $4.6 billion more than November exports of $138.1 billion. December imports were $8.4 billion more than November imports of $174.5 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through December 2009.

Both imports and exports increased in December. On a year-over-year basis, exports are up 7.4% and imports are up 4.6%. This is an easy comparison because of the collapse in trade at the end of 2008.

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $73.20 in December - up 87% from the low in February (at $39.22). Oil import volumes were up sharply in December.

Overall trade continues to increase, although both imports and exports are still below the pre-financial crisis levels.

MBA: Mortgage Purchase Applications Decline, Rates Fall below 5.0%

by Calculated Risk on 2/10/2010 07:28:00 AM

The MBA reports: Purchase Applications Decline in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.2 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 1.4 percent from the previous week and the seasonally adjusted Purchase Index decreased 7.0 percent from one week earlier. ... The four week moving average is up 0.8 percent for the seasonally adjusted Purchase Index, while this average is up 4.8 percent for the Refinance Index.

The refinance share of mortgage activity increased to 69.7 percent of total applications from 69.2 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.94 percent from 5.01 percent, with points increasing to 1.06 from 1.04 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The decline in mortgage applications since October appears significant.

Refinance activity picked up slightly with the decline in mortgage rates.

Tuesday, February 09, 2010

Rail Traffic Flat in January Compared to 2009

by Calculated Risk on 2/09/2010 09:17:00 PM

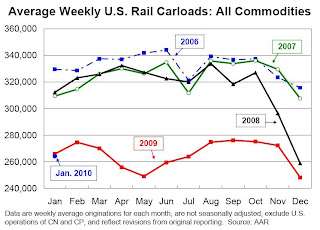

From the Association of American Railroads: Rail Time Indicators. The AAR reports traffic in January 2010 was down 0.7% compared to January 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows U.S. average weekly rail carloads. It is important to note that excluding coal, traffic is up 11.3% from January 2009, and traffic increased in 13 of the 19 major commodity categories.

Housing: In addition to the decline in coal, two key building materials were also down YoY from January 2009: Forest products (off 27.0%) and Nonmetallic minerals & prod. (crushed stone, gravel, sand was off 16.6%). This fits with the recent data on housing starts, new home sales, and the NAHB home builder index that shows residential investment is flat and non-residential investment is declining sharply.

From AAR:

• U.S. freight railroads originated 1,056,684 carloads in January 2010, an average of 264,171 carloads per week — down 0.7% from January 2009 (265,983 average) and down 17.7% from January 2008’s 321,040 average.

• Carloads excluding coal were up 11.3% (58,467 carloads) in January 2010 from January 2009, though they were still down 19.9% from January 2008.

• In January 2010, 13 of the 19 major commodity categories tracked by the AAR saw carload gains compared with January 2009. Carloads of chemicals were up 13.2% from last year, while carloads of primary metal products (predominantly steel) were up 28.0%.

• The biggest carload percentage gain in January 2010 went to motor vehicles and parts, carloads of which were up 65.7% in January 2010 from January 2009’s severely depressed level.

emphasis added

More Greece, Revised Economic Release Schedule

by Calculated Risk on 2/09/2010 06:56:00 PM

Note: The Census Bureau will release the Trade Balance report tomorrow as scheduled, but Retail Sales (January) and the Manufacturing and Trade Inventories and Sales (December) will be delayed until Friday due to inclement weather.

On Greece from the Financial Times: Berlin looks to build Greek ‘firewall’

"We’re thinking about what we should do if the crisis spills from Greece into other euro countries. So it’s more about finding firewalls, containing the problem, than principally about helping the Greeks.” [A German government official] added there were ”no concrete plans” as yet.And from The Times: Storm over bailout of Greece, EU's most ailing economy

excerpted with permission

And from Professor Krugman, a nice explanation with charts: Anatomy of a Euromess

It's Pig'd!

by Calculated Risk on 2/09/2010 04:00:00 PM

Image and acronym from Gubbmint Cheese who writes: Tanta Vive!

Note: Tanta is my former co-blogger who created the Mortgage PigTM

| It's Pig'd ... Italy Turkey Spain Portugal Ireland Greece Dubai.. |

And a few articles ...

From the WSJ: Germany Considers Loan Guarantees for Greece

Germany is considering a plan with its European Union partners to offer Greece and other troubled euro zone members loan guarantees ...From Bloomberg: European Officials Consider Greek Bailout on Budget

The proposed plan would be done within the EU framework but led by Germany ... A final decision on the plan may not come this week

From Dow Jones: S&P: More Euro-Zone Sovereign Downgrades Possible In 2010

CBRE: Retail Cap Rates Increase Sharply in Q4

by Calculated Risk on 2/09/2010 02:31:00 PM

From CB Richard Ellis: U.S. Retail Cap Rates

Ending at 9.01%, cap rates were up again. The 35 basis point gain is slightly lower than the last few quarters (43 and 46 b.p.). Rates are now the highest recorded since the Q1 2003 start date of our series.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from CBRE shows the retail cap rate since 2003. Note that 2009 is an average annual rate, and the cap rate in Q4 was at 9.01% - the highest since the series started.

Also on retail, Reis recently reported that the strip malls vacancy rate hit 10.6% in Q4, the highest on record (starting in 1991). And rents are falling:

Factoring in months of free rent and the landlord's portion of the cost for interiors, effective rent fell 0.8 percent to $16.75 per square foot, wiping out rent gains over the past nearly four years.Sharply higher vacancy rates, lower rents, reduced leverage and much higher cap rates - this is what Brian calls the "neutron bomb for RE equity"; destroys CRE investors (and lenders), but leaves the buildings still standing.

Cap Rate: the net operating income divided by the current value (or purchase price). Net operating income excludes depreciation and interest expenses. Say an investor paid $100 thousand in cash for a retail property, the investor would expect to clear $8,710 in cash per year after expenses with an 8.71% cap rate (the $8,710 is before paying income taxes that depend on financing and depreciation).

Report: Euro Zone Agrees to Help Greece

by Calculated Risk on 2/09/2010 12:10:00 PM

UPDATE: Reuters Headline Changed to: Report of EU Help for Greece Is Now Described as 'Unfounded'

That didn't take long ...

From Reuters: Euro Zone Agreed in Principle to Aid Greece: Report

"The decision on help for Greece has been taken in principle within the euro zone," [a senior German coalition source] said.From Bloomberg: U.S. Stocks Gain on Prospects for Bailout of Greece by EU

“You have to do the necessary measures in order for us to support you,” [Olli Rehn, who takes over as EU economic affairs commissioner tomorrow] said of Greece in an interview in Strasbourg, France today. “This will be further discussed in the coming days. We are talking about support in the broad sense of the word. I cannot specify it now.”

BLS: Few Job Openings in December

by Calculated Risk on 2/09/2010 10:04:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 2.5 million job openings on the last business day of December 2009, the U.S. Bureau of Labor Statistics reported today. The job openings rate was little changed over the month at 1.9 percent. The job openings rate has held relatively steady since March 2009. The hires rate (3.1 percent) and the separations rate (3.2 percent) were essentially unchanged in December.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. Remember the CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people.

The following graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and light blue added together equals total separations.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (purple line) and separations (red and light blue together) are pretty close each month. When the purple line is above total separations, the economy is adding net jobs, when the purple line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 4.073 million hires in December, and 4.238 million separations, or 165 thousand net jobs lost. The comparable CES report showed a loss of 150 thousand jobs in December (after revisions).

Separations have declined sharply from earlier in 2009, but hiring has not picked up. Quits (light blue on graph) are at a new low too. Usually "quits" are employees who have already found a new job (as opposed to layoffs and other discharges).

The low turnover rate is another indicator of a very weak labor market.

NFIB: Small Business Owners Report "shortage of customers"

by Calculated Risk on 2/09/2010 08:52:00 AM

From Reuters: Dark clouds hang over U.S. small businesses: survey

The outlook of small business owners remained bleak at the start of the new year, according to a survey released on Tuesday by the National Federation of Independent Business. ... But the group also said that seven of the index's 10 components rose, indicating conditions could soon improve. Better outlooks on jobs, inventories and capital spending have helped push the index up 1.3 points since December, the group saidAnd a few excerpts from the report:

The National Federation of Independent Business Index of Small Business Optimism improved slightly in January to 89.3, 1.3 points above December's reading. January's index is 8.3 points higher than the survey's second lowest reading reached in March 2009 (the lowest reading was 80.1 in 1980). But optimism has clearly stalled in spite of the improvements in the economy in the second half of 2009. The quarterly Index readings have been below 90 for 7 quarters, indicative of the severity and pervasiveness of this recession.And the number one problem:

"Small business owners entered 2010 the same way they left 2009, depressed," said William Dunkelberg, NFIB chief economist. "The biggest problem continues to be a shortage of customers."

...

Owners reported workforce reductions that average .52 workers per firm, basically unchanged for the past several months. Nine percent of the owners increased employment by an average of 3 workers per firm, but 19 percent reduced employment an average of 3.9 workers per firm (seasonally adjusted).

... still more firms planning to cut jobs than planning to add.

"The biggest problem continues to be a shortage of customers." ... Only 5 percent of the owners reported "finance" as their number one business problem (up one point).It appears that small business hiring has been very weak during the current "recovery", and this survey suggests the reason is weak end demand, a "shortage of customers".