by Calculated Risk on 2/12/2010 07:23:00 PM

Friday, February 12, 2010

Greece Still Slippery

From the Financial Times: Greek austerity ‘comes before any bail-out’

[A] senior [German] government official insisted European Union leaders had not given Greece any firm promises of financial assistance, he said they had signalled the possibility of help once the government of George Papandreou had implemented a tough and sustainable austerity programme.Originally investors expected a detailed plan early next week when the eurozone finance ministers meet, but now it appears there will be no plan released.

excerpted with permission

These "mixed messages" have upset Greek Prime Minister Papandreou, from the Financial Times: Greece turns on EU critics

In a televised address to his cabinet, [George Papandreou] criticised EU members for sending “mixed messages about our country . . . that have created a psychology of looming collapse which could be self-fulfilling”.Sorry for the bad pun in the post title.

FDIC Responds to "Blatantly False" Video

by Calculated Risk on 2/12/2010 06:34:00 PM

A number of readers have sent me a video that is obviously inaccurate. I usually don't do "take downs", so I'm happy to see the FDIC has responded ...

From the FDIC: FDIC Provides Additional Information on its Loss Share Agreement With OneWest Bank

FDIC Director of Public Affairs Andrew Gray said, "It is unfortunate but necessary to respond to blatantly false claims in a web video that is being circulated about the loss-sharing agreement between the FDIC and OneWest Bank. Here are the facts: OneWest has not been paid one penny by the FDIC in loss-share claims. The loss-share agreement is limited to 7% of the total assets that OneWest services, and OneWest must first take more than $2.5 billion in losses before it can make a loss-share claim on owned assets. In order to be paid through loss share, OneWest must have adhered to the Home Affordable Modification Program (HAMP).Supplemental Facts about the Sale of Indymac F.S.B. to OneWest Bank

The producers of this video perpetuate other falsehoods. The FDIC has not requested to borrow money from the Treasury Department. Indeed, we continue to be funded by the banking industry through assessments, not by taxpayers as claimed in the video.

This video has no credibility. Regardless of the personal or professional motivations behind its production, there is always a responsibility to be factually correct and transparent. The FDIC made available a fact sheet on the day that the sale of IndyMac was announced that details the terms of the contract. It's too bad that the creators of this video opted to premise it on falsehoods."

The FDIC is absolutely correct.

Moody's: CMBS Delinquency-Rate Increases Sharply

by Calculated Risk on 2/12/2010 04:03:00 PM

From Moody's:

The delinquency rate on CMBS conduit and fusion loans increased by more than 50 basis points in January, bringing the total rate to 5.42%. The total delinquent balance is now more than $36 billion, a $3 billion increase over the month before. By dollar and basis points, this is the largest increase in the delinquency rate thus far in the downturn, as measured by the Moody’s Delinquency Tracker (DQT).On sectors:

emphasis added

The retail delinquency rate rose 72 basis points and currently stands at 5.24%. The 72 basis point increase was more than 1.5 times higher than any increase in the history of the retail DQT ...Hotels and multi-family are the worst, but delinquencies are increasing in every category - especially for retail.

The office delinquency rate rose 34 basis points, and although that represents the second largest increase to the office DQT to date ... the office DQT, which currently stands at 3.53%, is the lowest of the five major sectors ...

The multifamily delinquency rate now stands at 8.77%, a 63 basis point increase over the month before. ...

The hotel DQT increased 75 basis points and currently stands at 9.82%.

Here is WSJ article

China Stimulus: High Speed Rail

by Calculated Risk on 2/12/2010 02:37:00 PM

The rapid expansion of high speed rail in China is pretty astounding ...

From the NY Times: China’s Project to Build Fast Trains Is Spurring Growth

The Chinese bullet train, which has the world’s fastest average speed, connects Guangzhou, the southern coastal manufacturing center, to Wuhan, deep in the interior. In a little more than three hours, it travels 664 miles ... Even more impressive, the Guangzhou to Wuhan train is just one of 42 high-speed lines recently opened or set to open by 2012 in China.This is part of the stimulus package:

Faced with mass layoffs at export factories [due to the global financial crisis], China ordered that the new rail system be completed by 2012 instead of 2020, throwing more than $100 billion in stimulus at the projects.It sounds like they are building the pyramids!

Administrators mobilized armies of laborers — 110,000 just for the 820-mile route from Beijing to Shanghai, which will cut travel time there to 5 hours from 12 when it opens next year.

Inventory Cycle and GDP

by Calculated Risk on 2/12/2010 11:51:00 AM

In Q4 2009 a majority of the increase in GDP was due to changes in private inventories. That can be a little confusing ...

First, GDP is Gross Domestic Production. What is being estimated is "domestic production", but what is being measured is mostly domestic consumption.

Right away we can see that if something is produced domestically and then exported, it will not show up in domestic sales. So exports are added to the equation, and imports subtracted. Investment and Government spending are also added to measures of consumption, and we frequently see an equation like this for GDP:

Y: GDP

C: Consumption

I: Investment

G: Government spending

NX: Exports - imports.

But what about changes in inventories? The same ideas apply. What is measured are sales and changes in inventory, and then production is calculated:

The following simple table shows how this works, and how it impacts GDP.

| Sales | Production | Inventory | I/S | GDP | |

|---|---|---|---|---|---|

| Q1 | 100 | 100 | 100 | 1.00 | -- |

| Q2 | 101 | 101 | 100 | 0.99 | 4.1% |

| Q3 | 102 | 102 | 100 | 0.98 | 4.0% |

| Q4 | 103 | 103 | 100 | 0.97 | 4.0% |

| Q5 | 100 | 104 | 104 | 1.04 | 3.9% |

| Q6 | 97 | 100 | 107 | 1.10 | -14.5% |

| Q7 | 97 | 96 | 106 | 1.09 | -15.1% |

| Q8 | 98 | 93 | 101 | 1.03 | -11.9% |

| Q9 | 99 | 98 | 100 | 1.01 | 23.3% |

| Q10 | 100 | 100 | 100 | 1.00 | 8.4% |

The first four quarters just show normal growth. Sales increase by one unit each quarter, and since inventory is steady, production increases with sales. This gives annualized GDP growth of 4%, and a slightly declining inventory-to-sales ratio (assuming inventory stay at the same level).

Now look at Q5. Sales suddenly drop, but production still increases since the decline in sales was a surprise. This pushes up inventories. Production is measured from sales (100) plus increase in inventory (+4) and GDP still increases.

Now in Q6 sales fall further to 97. The company reacts to the decline in sales and only produces 100 widgets. Inventory still increases (+3), but the combination of sales and inventory changes in Q6 is less than in Q5, so GDP declines sharply (marked in red).

In Q7 sales have bottomed, but the company is still cutting back on producton because they have too much inventory. For Q7, Production = Sales (97) plus changes in inventory (-1) giving production of 96 widgets. That is sharply below the 100 widget production of the prior quarter, so even though sales have bottomed, GDP declines sharply.

In Q8 sales increase slightly, but the company still has too much inventory, and they cut production further - resulting in a decline in GDP.

Finally in Q9, sales increase again by one unit, and the company can now increase production almost to the level of sales. Inventory is still declining (production is less than sales), but production has increased sharply compared to Q8. This shows up as a surge in GDP of 23% in this example.

Remember production in Q9 was calculated from sales and changes in inventory. Production of 98 widgets = Sales of 99 widgets, minus 1 unit for decline in inventory. The increase in production from 93 units in Q8 to 98 unites in Q9 is what shows up in the GDP report.

By Q10 sales and production are pretty much back in equilibrium, but at a lower level than the peak. Now further increases in production depend on increases in sales.

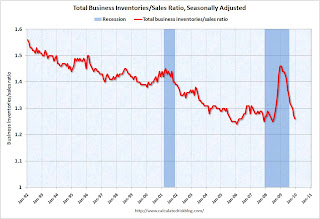

And that brings us to the Manufacturing and Trade Inventories and Sales report from the Census Bureau today that showed inventories declined slightly in December (seasonally adjusted).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The Census Bureau reported:

Inventories. Manufacturers’ and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,310.7 billion, down 0.2 percent (±0.1%) from November 2009 and down 9.7 percent (±0.4%) from December 2008.This report suggests that inventories are back in line with sales, and the inventory cycle is mostly over (there will probably still be a positive contribution in Q1 2010 from changes in private inventories). Further increases in production will now depend on increases in consumption (or exports).

Inventories/Sales Ratio. The total business inventories/sales ratio based on seasonally adjusted data at the end of December was 1.26. The December 2008 ratio was 1.46.

China Tightens and Europe Slows

by Calculated Risk on 2/12/2010 09:15:00 AM

From Bloomberg: China Raises Bank Reserve Requirement to Cool Economy

China ordered banks to set aside more deposits as reserves for the second time in a month to cool the fastest-growing economy after loan growth accelerated and property prices surged.And from Eurostat: Euro area and EU27 GDP up by 0.1%

The reserve requirement will increase 50 basis points, or 0.5 percentage point, effective Feb. 25, the People’s Bank of China said on its Web site today. The current level is 16 percent for big banks and 14 percent for smaller ones.

GDP increased by 0.1% in both the euro area1 (EA16) and the EU271 during the fourth quarter of 2009, compared with the previous quarter, according to flash estimates published by Eurostat, the statistical office of the European Union. In the third quarter of 2009, growth rates were +0.4% and +0.3% respectively.Germany's economy stalled (no change), and Latvia saw the biggest decline (-3.2%).

And Greece's economy shrunk by 0.8%, possibly exacerbating the Greek debt crisis.

Note: Europe numbers are quarter-to-quarter. In the U.S. the GDP is annualized.

Retail Sales increase 0.5% in January

by Calculated Risk on 2/12/2010 08:30:00 AM

On a monthly basis, retail sales increased 0.5% from December to January (seasonally adjusted), and sales were up 4.7% from January 2009 (easy comparison).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed.

The red line shows retail sales ex-gasoline and shows the increase in final demand ex-gasoline has been sluggish. The second graph shows the year-over-year change in retail sales since 1993.

The second graph shows the year-over-year change in retail sales since 1993.

Retail sales increased by 4.7% on a YoY basis. The year-over-year comparisons are easy now since retail sales collapsed in late 2008. Retail sales bottomed in December 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $355.8 billion, an increase of 0.5 percent (±0.5%)* from the previous month and 4.7 percent (±0.5%) above January 2009.

...

Gasoline stations sales were up 29.0 percent (±1.5%) from January 2009

New Jersey: State of Fiscal Emergency

by Calculated Risk on 2/12/2010 12:52:00 AM

From Reuters: New Jersey governor declares fiscal emergency

New Jersey Governor Chris Christie on Thursday declared a "fiscal emergency," allowing him to reserve or freeze state spending as part of his plan to tackle one of the largest 2011 deficits among U.S. states.Just a late night budget update ...

...

The deficit in the current budget, which ends on June 30, is $2.2 billion, while the gap in the following budget has spiked to $11 billion from a forecast of $8 billion in November ... the largest per-capita budget shortfall of any U.S. state

Thursday, February 11, 2010

Short Sales: Arm’s Length Transactions

by Calculated Risk on 2/11/2010 08:43:00 PM

One of the key problems with a short sale is making sure the buyer is an unrelated party; "an arm’s length transaction".

I'm aware of a property being offered as a short sale in SoCal where the agent is the wife of the owner, and she has been, uh, unhelpful to some prospective buyers. I just heard last night that the lender has reached a short sale agreement with a buyer who just happens to be a close friend of the agent. Why am I not surprised? Perhaps this is the best deal for the lender, but I have my doubts.

Jim the Realtor has a "rant" about another agent who apparently took a short sale listing, never put it in the MLS, and then - apparently after getting a short sale agreement - put the listing in the MLS for a few minutes because the lender required a copy of the listing ... I have more doubts about this being the best deal for the lender.

I don't think either of the above deals meets the HAFA requirements. Of course both of the transactions above are not HAFA short sales.

And remember Jillayne's discussion of the Short Sale Negotiator? Under HAFA, those fees have to come out of the real estate commission:

The amount of the real estate commission that may be paid, not to exceed 6% of the contract sales price, and notification if any portion of the commission must be paid to a contractor of the servicer that has been retained to assist the listing broker with the transaction.Finally, I'd suggest HAFA go a step further and have the lender hire the real estate agent for short sales and deed-in-lieu transactions, not the owner. I think there is too much incentive for under-the-table payments to the current homeowner, aka short sale fraud.

Fed MBS Purchase Program 95% Complete

by Calculated Risk on 2/11/2010 05:15:00 PM

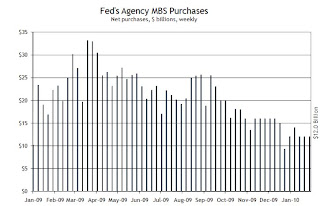

The countdown continues ...

The following graph is from the Atlanta Fed Financial Highlights, and shows the Fed MBS purchases by week:  Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

The Fed purchased an additional $11 billion net in MBS through the week of Feb 10th, bringing the total to $1.188 trillion or just over 95% complete.The Fed purchased a net total of $12 billion of agency-backed MBS through the week of February 3, bringing its total purchases up to $1.177 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 94% complete). In the first nine months of the program (January-September 2009), the Fed’s average weekly purchase of MBS was $23.3 billion. Since October 2009, however, it has declined to $14.6 billion per week; the Fed needs to purchase only about $9.2 billion per week through March 2010 to reach its goal.

Mortgage rates were just under 5% last week, from Freddie Mac: 30-Year Fixed-Rate Mortgage Dips Below 5 Percent Again

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.97 percent with an average 0.7 point for the week ending February 11, 2010, down from last week when it averaged 5.01 percent. Last year at this time, the 30-year FRM averaged 5.16 percent.However, with the Ten Year Treasury yield increasing today to 3.73% (from around 3.6% last week), I expect rates to be above 5% again next week.