by Calculated Risk on 2/14/2010 08:48:00 PM

Sunday, February 14, 2010

Five Million Workers to Exhaust Unemployment Benefits by June

Note: Scroll down or click here for a look ahead and weekly summary.

Back in December, the qualification dates for existing tiers of unemployment benefits were extended for an additional two months. Time is up at the end of February.

Now another extension is needed or millions of workers will lose benefits over the next few months.

The National Employment Law Project (NELP) released a new report last week showing that ...

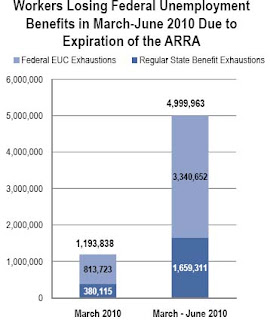

1.2 million jobless workers will become ineligible for federal unemployment benefits in March unless Congress extends the unemployment safety net programs from the American Recovery and Reinvestment Act (ARRA). By June, this number will swell to nearly 5 million unemployed workers nationally who will be left without any jobless benefits.

...

Currently, 5.6 million people are accessing one of the federal extensions (34-53 weeks of Emergency Unemployment Compensation; 13-20 weeks of Extended Benefits, a program normally funded 50 percent by the states).

This table shows the NELP's projections:

This table shows the NELP's projections: Of the almost 1.2 million workers facing a cut off of benefits in March alone:The following graph is based on the January employment report and shows the number of workers unemployed for 27 weeks or more ...380,000 workers will exhaust their 26 weeks of state benefits without accessing the temporary EUC extension program or the permanent federal program of Extended Benefits. Another 814,000 workers will not be eligible to continue receiving EUC past their current tier of benefits.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are a record 6.31 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.1% of the civilian workforce. (note: records started in 1948).

The current qualification dates extension being considered is for another three months. Cynics might argue that some Senators want to limit the extension to an additional three months, so they can use the popular benefit extension in May to once again extend the homebuyer tax credit - hopefully the cynics are wrong!

Housing Market Index, Housing Starts and the Expiring Tax Credit

by Calculated Risk on 2/14/2010 04:43:00 PM

The NAHB Housing Market Index for February, and Housing Starts for January will both be released this week, see: Weekly Summary and a Look Ahead.

As a review, here is a graph showing the relationship between the two series: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the December data for single family starts.

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month. Since the NAHB index declined in January (it is released a month ahead of starts), we usually wouldn't expect much of an increase in January single family housing starts.

However there might be an increase in starts (single family) in January since many builders started a few extra homes in anticipation of the expiration of the first time home buyer tax credit. It takes about six months to build an average home, so the builders can't wait until the expected buying rush in April to start building a home - they have to close by the end of June.

Here are some comments from the Feb 2nd D.R. Horton conference call:

In [Q2 2010], we expect strong closings since homes must close by June 30th for the extended tax credit. ... We expect [Q3] will be the most challenging as the tax credit for home sales will have expired. As we move past the selling season, we'll be able to get a better read on core demand and we'll adjust our business accordingly.”Residential investment1 is one of the best leading indicators for the economy, and the best indicators for RI are the NAHB HMI, housing starts, and new home sales. Usually housing starts lead changes in unemployment too - see Housing Starts, Vacant Units and the Unemployment Rate - so the sideways movement in the NAHB HMI and housing starts suggest unemployment will stay elevated for some time.

...

We are prepared for the spring selling season and for current demand created by the Federal home buyer tax credit with our current spec level.

We will continue to manage our spec levels very closely as we move closer to the April 30th sales contract deadline for the home buyer tax credit.

Note 1: The largest components of residential investment are new home construction, and home improvement. This also includes brokers' commissions and some minor categories.

Weekly Summary and a Look Ahead

by Calculated Risk on 2/14/2010 12:11:00 PM

The U.S. markets will be closed on Monday for Presidents' Day, but there might be some more news from Europe and China.

On Tuesday, the Empire Manufacturing Survey (February) and the NAHB Housing Market Index survey (February) will be released. The consensus is for a slight uptick in builder confidence to 16 or 17 from 15 in January.

On Wednesday, the Census Bureau will release Housing Starts for January. The consensus is for an increase to close to 600,000 since many homebuilders started a few extra spec homes trying to beat the deadline for the homebuyer tax credit. As an example, here is a quote from Andrew Konovodoff, president of Town and Country Homes (from Daily Herald):

"Last year 50 percent of our buyers purchased homes using a tax credit and so far this year 35 percent of buyers have used one," Konovodoff said. "We are not a spec builder, but even we have started spec homes in anticipation of a rush this spring. Currently we have 30 homes that can close by the end of June."Also on Wednesday, the Fed will release the Industrial Production and Capacity Utilization numbers for January. The consensus is for a 0.8% increase. The FOMC minutes for the January meeting will also be released.

On Thursday the Producer Price Index, initial weekly Unemployment Claims, and the Philly Fed Survey will all be released.

And on Friday, the Consumer Price Index and more bank failures.

There will be several Fed speeches during the week, and the West Coast port data and the Department of Transportation vehicle miles driven for December will probably be released.

And a summary of last week ...

The Census Bureau reported that the U.S. trade deficit increased to $40.2 billion, up from $36.4 billion in November.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through December 2009.

Both imports and exports increased in December. On a year-over-year basis, exports are up 7.4% and imports are up 4.6%. This is an easy comparison because of the collapse in trade at the end of 2008.

The MBA reported that the "seasonally adjusted Purchase Index decreased 7.0 percent from one week earlier".

The MBA reported that the "seasonally adjusted Purchase Index decreased 7.0 percent from one week earlier". This graph shows the MBA Purchase Index and four week moving average since 1990.

The decline in mortgage applications since October appears significant.

The BLS released the Job Openings and Labor Turnover Summary for December.

This graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and light blue added together equals total separations.

This graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and light blue added together equals total separations.According to the JOLTS report, there were 4.073 million hires in December, and 4.238 million separations, or 165 thousand net jobs lost. The comparable CES report showed a loss of 150 thousand jobs in December (after revisions).

Separations have declined sharply from earlier in 2009, but hiring has not picked up. Quits (light blue on graph) are at a new low too. Usually "quits" are employees who have already found a new job (as opposed to layoffs and other discharges).

The low turnover rate is another indicator of a very weak labor market.

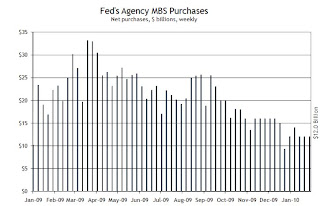

The following graph is from the Atlanta Fed Financial Highlights, and shows the Fed MBS purchases by week:

From the Atlanta Fed:

From the Atlanta Fed: The Fed purchased an additional $11 billion net in MBS through the week of Feb 10th, bringing the total to $1.188 trillion or just over 95% complete.The Fed purchased a net total of $12 billion of agency-backed MBS through the week of February 3, bringing its total purchases up to $1.177 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 94% complete).

"Optimism has clearly stalled in spite of the improvements in the economy in the second half of 2009. Small business owners entered 2010 the same way they left 2009 – depressed. The quarterly Index readings have been below 90 for 7 quarters, indicative of the severity and pervasiveness of this recession."

Best wishes to all.

Greece: Detailed Action Expected

by Calculated Risk on 2/14/2010 09:18:00 AM

From The Economist: European finance ministers meet to discuss bailing out the Greek economy

EUROPE'S finance ministers meet for two days, beginning on Monday February 15th ... a vague promise of aid for Greece did little to lessen uncertainty, finance ministers will be expected to produce more concrete measures.From The Times: Economic boost from Europe for Greece

GREECE was given fresh hope of a financial lifeline yesterday when Jean-Claude Juncker, chairman of Europe’s finance ministers, said action would be taken to support its beleaguered economy.Meanwhile, in a poll of Germans from Reuters: Germans say euro zone may have to expel Greece: poll

...

In an interview with a German newspaper, he said: “We have many instruments ready and will use them if necessary.”

A majority of Germans want debt-ridden Greece to be thrown out of the euro zone if necessary and more than two-thirds oppose handing Athens billions of euros in credit, [in a Emnid poll for Bild am Sonntag newspaper] published on Sunday.

Saturday, February 13, 2010

Report: Half of Mortgages are at Rates above 6 Percent

by Calculated Risk on 2/13/2010 10:16:00 PM

From Dina ElBoghdady and Renae Merle at the WaPo: Refinancing unavailable for many borrowers

The refinancing wave that swept the nation when mortgage rates hit historic lows last year is petering out, leaving behind millions of homeowners who could not qualify for the best rates.Many of these homeowners have been unable to refinance because they have little or no equity in their homes (many have negative equity), some have lost their jobs and can't qualify, and others have been rejected because lenders have tightened standards.

Half of the nation's borrowers have mortgages with rates above 6 percent even though the average rate on 30-year, fixed rate mortgages has been about 5 percent for most of the past year, according to research firm First American CoreLogic.

The following graph shows the MBA seasonally adjusted Refinance index since 1990.

Click on graph for larger image in new window.

Click on graph for larger image in new window.As the article mentions, there was a huge wave of refinance activity in 2003 when mortgage rates fell below 6%, and house prices increased sharply.

There was another refinance boom starting at the end of 2008 and through the first half of 2009 when mortgage rates fell below 5%.

Now, even with rates near 5%, it appears the recent refinance boom is mostly over. Those that can refinance already have - and those that can't are out of luck.

Wall Street and Greece Debt

by Calculated Risk on 2/13/2010 07:18:00 PM

From Louise Story, Landon Thomas Jr. and Nelson D. Schwartz at the NY Times: Wall Street Helped to Mask Debts Shaking Europe. A brief excerpt:

In 2001, just after Greece was admitted to Europe’s monetary union, [Goldman Sachs] helped the government quietly borrow billions, people familiar with the transaction said. That deal, hidden from public view because it was treated as a currency trade rather than a loan, helped Athens to meet Europe’s deficit rules while continuing to spend beyond its means.The quote from Hardouvelis is on target. Many on Wall Street just care about short term fees and large bonuses, and politicians just want to push the problems into the future. A perfect match ... except for all the people who are eventually hurt by their actions.

...

Critics say that such deals, because they are not recorded as loans, mislead investors and regulators about the depth of a country’s liabilities.

...

“Politicians want to pass the ball forward, and if a banker can show them a way to pass a problem to the future, they will fall for it,” said Gikas A. Hardouvelis, an economist and former government official who helped write a recent report on Greece’s accounting policies.

Wall Street did not create Europe’s debt problem. But bankers enabled Greece and others to borrow beyond their means, in deals that were perfectly legal.

Simon Johnson on Greece

by Calculated Risk on 2/13/2010 02:59:00 PM

Another view ...

Simon Johnson writes at Baseline Scenario: Greece Derails – Is Europe Far Behind?

Already facing serious difficulties – both internal and with regard to its EU partners (see our longer essay in Saturday’s WSJ) – Greece’s predicament just became substantially worse.Here is the piece in the WSJ from Simon Johnson and Peter Boone: The Greek Tragedy That Changed Europe Update: When I linked to it, the title was "How Much Does a Grecian Urn?"

Speaking on national television this evening, the Greek Prime Minister – George Papandreou – lashed out at the European Union (presumably meaning mostly Germany) for creating a “psychology of looming collapse which could be self-fulfilling.” He also implied that Greece was being treated, in some senses, like a “lab animal.”

...

Greece is well down the path to becoming regarded more like Argentina – a country that struggles over many decades (and whose leaders frequently rail against the world) and for which episodes of reasonable prosperity and new economic models are punctuated by gut-wrenching crises, most of which do not shake the world.

Will the EU save Greece? Much will depend on how bad the situation could become in other “related” (in the eyes of the financial markets) places.

But destabilizing actions or inflammatory statements by Greece make an orderly rescue less likely and put another major international economic crisis firmly on the table.

Greece is just one of several global financial concerns right now ...

States: Send Money!

by Calculated Risk on 2/13/2010 11:30:00 AM

From CNNMoney: States to Senate: Send more federal aid

States are looking to the federal government for more help balancing their budgets, but the Senate is not heeding their call. ...If Zandi is correct the vast majority of state layoffs are still to come.

States are looking at a total budget gap of $180 billion for fiscal 2011, which for most of them begins July 1. These cuts could lead to a loss of 900,000 jobs, according to Mark Zandi, chief economist of Moody's Economy.com.

To close this gap, governors and lawmakers will be forced to lay off state employees, cut services and postpone capital projects ...

Already, states laid off 44,000 workers in the 12 months ending in January, according to federal labor statistics.

Unofficial Problem Bank List at 605

by Calculated Risk on 2/13/2010 08:34:00 AM

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

The Unofficial Problem Bank List saw minor changes during the week and the total number of institutions remained unchanged at 605 but aggregate assets increased slightly to $329.4 billion from $328.7 billion last week.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

There was one addition – Broadway Bank, Chicago, IL ($1.2 billion), and one removal -- Mt. Washington Co-operative Bank, South Boston, MA ($501 million), which was acquired via an unassisted merger with East Boston Savings Bank, Boston, MA during January 2010.

The only other change is a Prompt Corrective Action order issued by the Federal Reserve against Marco Community Bank, Marco Island, FL ($138 million) on February 2, 2010.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Friday, February 12, 2010

Global Concerns and Summary

by Calculated Risk on 2/12/2010 09:31:00 PM

It looks like no bank failures this week, but there were renewed global concerns today:

The cost of insuring Dubai's sovereign debt against default rose to its highest level since November as concerns resurfaced over the emirate's large debt. ... On Wednesday, the Al-Ittihad newspaper reported that Dubai World would this month ask creditors to freeze payments on 80 million dirhams ($21.8 million) of debt for six months, until its restructuring is complete.

China ordered banks to set aside more deposits as reserves for the second time in a month to cool the fastest-growing economy after loan growth accelerated and property prices surged.

The reserve requirement will increase 50 basis points, or 0.5 percentage point, effective Feb. 25, the People’s Bank of China said on its Web site today. The current level is 16 percent for big banks and 14 percent for smaller ones.

The total gross domestic product increased by one-tenth of 1 percent in the 16-nation euro area during the fourth quarter, compared with a year earlier, according to an initial estimate from Eurostat, the European Union’s statistics agency. The same tepid rate was also recorded for the 27 members of the European Union as a whole.

Also:

Best to all