by Calculated Risk on 2/17/2010 04:11:00 PM

Wednesday, February 17, 2010

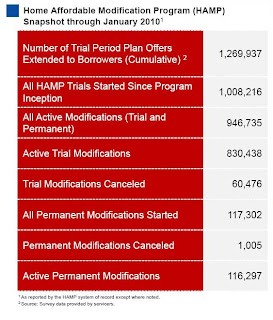

HAMP: 116,000 Permanent Mods, Over 1,000 Permanent Mods Cancelled

From Treasury: Administration Releases January Loan Modification Report

Click on graph for larger image  in new window.

in new window.

Just over 116,000 modifications are now permanent.

Here is the link at Treasury. See here for a list of reports.

If there were 416,471 cumulative HAMP trial modifications in August - how come there were only 116,297 permanent mods and 60,476 disqualified modifications by the end of January? The numbers don't add up.

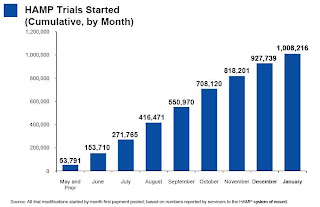

What happened to the other 240,000 modifications? I guess they we will find out in the February report when the servicers start removing delinquent borrowers from the trial modification program. The second graph shows the cumulative HAMP trial programs started.

The second graph shows the cumulative HAMP trial programs started.

Notice that the pace of new trial modifications has slowed sharply from over 150,000 in Septmenber to just over 80,000 in January 2010. This is slowest pace since May 2009 and is probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers.

Edit: Also - 1,005 permanent modifications have already failed. At first that seemed high considering those borrowers made all the trial modification payments ... but I suppose that is about the expected re-default rate.

FOMC Minutes: Expect "slow improvement in the labor market"

by Calculated Risk on 2/17/2010 02:00:00 PM

In the most recent FOMC statement, the Fed removed all references to residential housing. This was in recognition that the housing sector is not as strong as it appeared in November or December. This makes the FOMC Minutes a little more interesting this month ... first, as a review, here are the housing comments from the last three FOMC statements:

Nov, 2009: "Activity in the housing sector has increased over recent months"

Dec, 2009: "The housing sector has shown some signs of improvement over recent months."

Jan, 2010: No comment.

And here are the January FOMC minutes on residential real estate:

The recovery in the housing market slowed in the second half of 2009, even though a number of factors supported housing demand. Interest rates for conforming 30-year fixed-rate mortgages remained historically low. ... Sales of new homes also turned down in November and December, retracing part of their recovery earlier in the year. Similarly, starts of single-family homes retreated a little from June to December after advancing briskly last spring. ...And the economic outlook:

By and large, participants judged that residential investment had stabilized but did not expect housing construction to make a sizable contribution to economic growth during the next year or two.

In their discussion of the economic situation and outlook, participants agreed that the incoming data and information received from business contacts, though mixed, indicated that economic growth had strengthened in the fourth quarter, that firms were reducing payrolls at a less rapid pace, and that downside risks to the outlook for economic growth had diminished a bit further. Participants saw the economic news as broadly in line with the expectations for moderate growth and subdued inflation in 2010 that they held when the Committee met in mid-December; moreover, financial conditions were much the same, on balance, as when the FOMC last met. Accordingly, participants' views about the economic outlook had not changed appreciably. Many noted the evidence that the pace of inventory decumulation slowed quite substantially in the fourth quarter of 2009 as firms increased output to bring production into closer alignment with sales. Participants saw the slower pace of inventory reductions as a welcome indication that, in general, firms no longer had large inventory overhangs. But they observed that business contacts continued to report great reluctance to build inventories, increase payrolls, and expand capacity. Participants expected the economic recovery to continue, but most anticipated that the pickup in output and employment growth would be rather slow relative to past recoveries from deep recessions. A moderate pace of expansion would imply slow improvement in the labor market this year, with unemployment declining only gradually. Most participants again projected that the economy would grow somewhat more rapidly in 2011 and 2012, generating a more pronounced decline in the unemployment rate, as financial conditions and the availability of credit continue to improve. In general, participants saw the upside and downside risks to the outlook for economic growth as roughly balanced. Participants agreed that underlying inflation currently was subdued and was likely to remain so for some time. Some noted the risk that, with output well below potential over the next couple of years, inflation could edge further below the rates they judged most consistent with the Federal Reserve's dual mandate for maximum employment and price stability; others, focusing on risks to inflation expectations and the challenge of removing monetary accommodation in a timely manner, saw inflation risks as tilted toward the upside, especially in the medium term.

The weakness in labor markets continued to be an important concern for the FOMC; moreover, the prospects for job growth remained an important source of uncertainty in the economic outlook, particularly in the outlook for consumer spending. While the average pace of layoffs diminished substantially in recent months, few firms were hiring. The unusually large fraction of individuals who were working part time for economic reasons, as well as the uncommonly low level of the average workweek, pointed to a gradual increase in payrolls for some time even if hours worked were to increase substantially as the economic recovery proceeded. Indeed, many business contacts again reported that they would be cautious in hiring, saying they expected to meet any near-term increase in demand by raising existing employees' hours and boosting productivity, thus delaying the need to add employees.

emphasis added

Housing Starts, Vacant Units and the Unemployment Rate

by Calculated Risk on 2/17/2010 12:29:00 PM

The following two graphs are updates from previous posts with the housing start data released this morning.

The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing through Q4 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Notice that total starts are not rebounding quickly as a number of analysts expected. Instead starts have moved sideways for the last eight months.

It is very unlikely that there will be a strong rebound in housing starts with a near record number of vacant housing units.

The vacancy rate has continued to climb even after housing starts fell off a cliff. Initially this was because of a significant number of completions. Also some hidden inventory (like some 2nd homes) have become available for sale or for rent, and lately some households have probably doubled up because of tough economic times. The second graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

The second graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Summer 2010 since housing starts bottomed in April 2009. However, since I expect the housing recovery to be sluggish, I also expect unemployment to remain high throughout 2010.

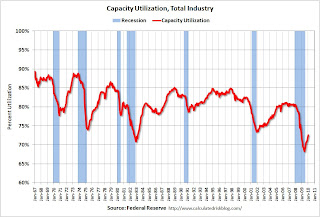

Industrial Production, Capacity Utilization Increase in January

by Calculated Risk on 2/17/2010 09:28:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.9 percent in January following a gain of 0.7 percent in December. Manufacturing production rose 1.0 percent in January, with increases for most of its major components, while the indexes for both utilities and mining advanced 0.7 percent. At 101.1 percent of its 2002 average, output in January was 0.9 percent above its year-earlier level. The capacity utilization rate for total industry rose 0.7 percentage point to 72.6 percent, a rate 8.0 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 6% from the record low set in June (the series starts in 1967).

Capacity utilization at 72.6% is still far below normal - and far below the the pre-recession levels of 80.5% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

Also - this is the highest level for industrial production since Dec 2008, but production is still 10.1% below the pre-recession levels at the end of 2007.

Housing Starts increase Slightly in January

by Calculated Risk on 2/17/2010 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 591 thousand (SAAR) in January, up 2.8% from the revised December rate, and up 24% from the all time record low in April 2009 of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for eight months.

Single-family starts were at 484 thousand (SAAR) in January, up 1.5% from the revised December rate, and 36% above the record low in January and February 2009 (357 thousand). Just like for total starts, single-family starts have been at about this level for eight months.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:It is important to note that many home builders started a few extra spec homes in January hoping to have them completed and sold before the home buyer tax credit expires. It takes about six months to build an average home, so the builders couldn't wait to start construction until the expected buying rush in April since they have to close by the end of June.

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 591,000. This is 2.8 percent (±11.5%)* above the revised December estimate of 575,000 and is 21.1 percent (±12.3%) above the January 2009 rate of 488,000.

Single-family housing starts in January were at a rate of 484,000; this is 1.5 percent (±11.3%)* above the revised December figure of 477,000.

Housing Completions:

Privately-owned housing completions in January were at a seasonally adjusted annual rate of 659,000. This is 12.4 percent (±7.8%) below the revised December estimate of 752,000 and is 15.3 percent (±10.5%) below the January 2009 rate of 778,000.

Single-family housing completions in January were at a rate of 427,000; this is 12.9 percent (±7.1%) below the revised December rate of 490,000.

As I've noted before, this low of starts is both good news and bad news. The good news is the excess housing inventory is being absorbed - a necessary step for housing (and the economy) to recover.

The bad news is economic growth will probably be sluggish - and unemployment elevated - until residential investment picks up.

MBA: Mortgage Purchase Applications Decline

by Calculated Risk on 2/17/2010 07:00:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.1 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 1.2 percent from the previous week and the seasonally adjusted Purchase Index decreased 4.0 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages remained unchanged at 4.94 percent, with points increasing to 1.09 from 1.06 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The 4 week average of the seasonally adjusted purchase index declined to 221.7, just above the 12 year low set in early January.

Refinance activity also declined even with rates below 5%, since most borrowers who are able to refinance already have - and the other half of homeowners with mortgages are unable to refinance for several reasons. (see: Dina ElBoghdady and Renae Merle at the WaPo: Refinancing unavailable for many borrowers ).

Tuesday, February 16, 2010

LA Area Port Traffic in January

by Calculated Risk on 2/16/2010 09:50:00 PM

Note: this data is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports. LA area ports handle about 40% of the nation's container port traffic.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was down 0.7% compared to January 2009. (down 4.2% compared to last year using three month average)

Loaded outbound traffic was up 31.8% from January 2009. (+25.5% using three months average) This was an easy YoY comparison for exports, because U.S. exports fell off a cliff in near the end of 2008.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline at the end of the year. Import traffic will decline sharply in February, but that is just the seasonal pattern.

Exports recovered somewhat in the first half of 2009, however export traffic has essentially been flat since last summer. Export growth was one of the key drivers of the economy in 2009, but it now appears - based on traffic - that export growth has stalled.

TransUnion: Mortgage Delinquencies at All Time High

by Calculated Risk on 2/16/2010 07:32:00 PM

From TransUnion: TransUnion Finds National Mortgage Delinquencies Jumped 10.24 Percent at End of 2009 (ht jb)

TransUnion's quarterly analysis of trends in the mortgage industry found that mortgage loan delinquency (the ratio of borrowers 60 or more days past due) increased for the 12th straight quarter, hitting an all-time national average high of 6.89 percent for the fourth quarter of 2009. This quarter marks the first time the mortgage delinquency rate increase did not decelerate after doing so for three consecutive periods.The MBA reports on Q4 delinquency and foreclosure rates on Friday.

This statistic, which is traditionally seen as a precursor to foreclosure, increased 10.24 percent from the previous quarter's 6.25 percent average. Year-over-year, mortgage borrower delinquency is up approximately 50 percent (from 4.58 percent).

...

"At the national level, these results are in part due to seasonality effects. Consumers tend to run low on cash at the end of the year, after spending for the holidays, but before receiving year-end bonuses and tax refunds," said FJ Guarrera, vice president of TransUnion's financial services business unit. ... "The continuing rise in foreclosures, in conjunction with low consumer confidence in the housing market, continues to hinder housing value appreciation and impede recovery in the mortgage industry. Furthermore, there is wave of adjustable rate mortgages (ARMs) that have yet to reset. Many of these are Option and Alt-A loans. When the interest rates on these loans reset many consumers potentially will not be able to meet their debt obligations."

....

TransUnion's forecasts for 2010 are slightly more pessimistic than before due to questions concerning house price appreciation, the continued high level of unemployment, and the potential eroding of consumer confidence as the effects of the government stimulus begin to fade.

"We believe that the 60-day mortgage delinquency rate will peak between 7.5 and 8 percent over the course of 2010, depending on the prevailing economic conditions associated with the housing market," said Guarrera.

emphasis added

CNBC's Olick: Treasury Concerned about Next Wave of Foreclosures

by Calculated Risk on 2/16/2010 04:35:00 PM

From Diana Olick at CNBC: What Mortgage Modifications Say About the Housing Market

Treasury officials today said they are still concerned about a coming wave of foreclosures, many from pay option ARMs and many from the prime jumbo basket, particularly hard hit by unemployment.Olick also notes that the HAMP report for January has been delayed by weather until tomorrow. And she reports that only 2/3 of HAMP borrowers are current on their payments.

A couple of comments:

The main reason 1/3 of HAMP borrowers are delinquent is because some servicers didn't adequately pre-qualify borrowers before putting them in the program. The Treasury recently changed the guidelines for placing borrowers in to a trial program, and these more stringent pre-qualification requirements must be implemented by June. Most servicers have already started using the new requirements, and the number of new trial modifications will probably slow dramatically.

As James Haggerty at the WSJ noted this morning:

Loan servicers ... seem to have "nearly exhausted the supply of plausible candidates for loan modifications" and will find that many loans are "unredeemable," [a] S&P study says.Note: the HAMP report tomorrow will be for January. Although the number of permanent modifications probably increased significantly, the actual number will still be very low compared to the number of HAMP trial modifications. Also - it is the report for February that will be VERY interesting because the servicers have been instructed to remove many of the delinquent borrowers from the program after Jan 31, 2010.

Distressed Sales: Sacramento as an Example

by Calculated Risk on 2/16/2010 02:43:00 PM

This will probably be the year of the "short sale", especially after the Home Affordable Foreclosure Alternatives starts (scheduled for April 5th).

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the January data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. Almost 69 percent of all resales (single family homes and condos) were distressed sales in January.

Note: This data is not seasonally adjusted, and the decline in sales from December to January was about normal. The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs had been declining, and the percent of short sales had been steadily increasing. In January REOs were up to 45% - the highest percent since last September - and the percent short sales declined slightly to 23.6%.

The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs had been declining, and the percent of short sales had been steadily increasing. In January REOs were up to 45% - the highest percent since last September - and the percent short sales declined slightly to 23.6%.

Now that the trial modification period has ended, I expect the REO sales to increase. Also, I expect the percentage of short sales to be higher in 2010 than in 2009 - but probably not as high as foreclosures (it will be interesting to watch).

Also total sales in January were off 23.4% compared to January 2009; the eight month in a row with declining YoY sales.

On financing, over half the sales were either all cash (26.7%) or FHA loans (28.5%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.