by Calculated Risk on 2/21/2010 08:49:00 PM

Sunday, February 21, 2010

Chief Lending Officer Pleads Guilty to Concealing Material Facts from FDIC

The Bank of Clark County was the 2nd bank to fail in 2009. It had assets of $440 million and is estimated to have cost the Deposit Insurance Fund between $120 and $145 million.

From Courtney Sherwood at the Portland Business Journal: Former Bank of Clark County executive pleads guilty to felony charge (ht Jason)

[A] plea agreement filed Friday in U.S. District Court ... outlines former Chief Lending Officer David Kennelly’s guilty plea on a count of “scheme to conceal material facts.”These were appraisals related to C&D (Construction & Development) loans and obviously showed huge losses for the bank. Hiding material information from examiners is pretty stunning ...

...

The bank ordered new appraisals on 23 real estate-backed loans to prepare for [a November 2008 safety and soundness examination by the FDIC and Washington state bank examiners].

Before regulators arrived, Kennelly told a vice president identified as “K.B.” that there were several appraisals that Kennelly “did not want to see the light of day,” ...

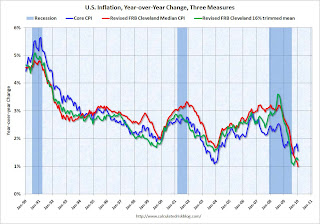

Graph of Core CPI, and Cleveland Fed Measures of Inflation

by Calculated Risk on 2/21/2010 05:00:00 PM

A combination of significant resource slack, and a policy of pushing down rents (an unintended consequence of the first time homebuyer tax credit), pushed core inflation (CPI minus food and energy) negative in January for the first time since 1982. This was no surprise.

Professor Krugman has more and suggests focusing on the Cleveland Fed measures of inflation:

[C]ore CPI has been behaving erratically lately, making me doubt whether it’s still a good guide to underlying inflation (by which I mean the trend in prices that, unlike commodity prices, have a lot of inertia).That inspired me to put all three measures on one graph:

What I find myself looking at these days are the Cleveland Fed “trimmed” inflation measures, which exclude outlying large price movements; the ultimate trim is the median, the rise in the price of the median category. And these indicators tell a story of dramatic disinflation in the face of a weak economy ... We may have to start calling the Fed chairman Bernanke-san, after all.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year change in core CPI, and the two Clevelend Fed measures of inflation (median and trimmed mean). All three measures are moving down.

If we just look at the last three months, Core CPI is essentially unchanged and the Median is only up at about a 0.5% annual rate.

Despite all the talk about the Fed possibly raising the Fed funds rate in the 2nd half of 2010, with high unemployment and low measured inflation, it is very unlikely that the Fed will raise the Fed Funds rate any time soon - probably not until 2011 at the earliest.

Weekly Summary and a Look Ahead

by Calculated Risk on 2/21/2010 12:12:00 PM

Update: The FDIC Quarterly Banking Profile (Q4) will probably be released mid-week (ht Greg)

This will be a busy week for economic data highlighted by several key economic releases for both residential and commercial real estate: Case-Shiller house prices, new home sales, existing home sales, the Moodys' commercial property price index and the CRE related Architecture Billings Index will all be released this week.

On Tuesday, the S&P Case-Shiller House Price Index for December (actually three month average of Oct, Nov, and Dec) and the Q4 National Index will be released. The consensus is for the Composite 20 Index to have declined 3.1% from Dec 2008 - or basically flat from November to December (seasonally adjusted).

On Wednesday, the Census Bureau will report on New Home Sales for January. The consensus is for an increase to about 360 thousand (SAAR), from 342 thousand in December. Also the February AIA Architecture Billings Index will be released, and this will probably show a continued contraction in commercial real estate architectural billings (a leading indicator for non-residential construction). Also on Wednesday, Fed Chairman Ben Bernanke will provide the Semiannual Monetary Policy Report to the House Committee on Financial Services.

On Thursday, the Durable Goods report will be released, and the closely watched weekly report on initial unemployment claims. I also expect the Moodys/REAL Commercial Property Price Index for December will be released.

On Friday, the first revision to the Q4 GDP report will be released (consensus is for unchanged from the initial report of 5.7% GDP growth annualized in Q4), the Chicago Purchasing Managers' Index for February (consensus is for continued expansion, but a decline to 60 from 61.5 last month), and Existing Home Sales for January. Consensus is for a 1% increase in existing home sale to 5.5 million (SAAR) from 5.45 million in December (I'll take the under).

There will be several Fed speeches during the week, and probably more bank failures announced on Friday.

And a summary of last week ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.Total housing starts were at 591 thousand (SAAR) in January, up 2.8% from the revised December rate, and up 24% from the all time record low in April 2009 of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for eight months.

Single-family starts were at 484 thousand (SAAR) in January, up 1.5% from the revised December rate, and 36% above the record low in January and February 2009 (357 thousand). Just like for total starts, single-family starts have been at about this level for eight months.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).Note: any number under 50 indicates that more builders view sales conditions as poor than good.

The housing market index (HMI) was at 17 in February. This is an increase from 15 in January.

The record low was 8 set in January 2009. This is still very low - and this is what I've expected - a long period of builder depression. The HMI has been in the 15 to 19 range since May.

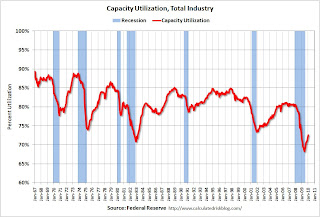

From the Fed: "Industrial production increased 0.9 percent in January following a gain of 0.7 percent in December. ... The capacity utilization rate for total industry rose 0.7 percentage point to 72.6 percent, a rate 8.0 percentage points below its average from 1972 to 2009."

From the Fed: "Industrial production increased 0.9 percent in January following a gain of 0.7 percent in December. ... The capacity utilization rate for total industry rose 0.7 percentage point to 72.6 percent, a rate 8.0 percentage points below its average from 1972 to 2009."This graph shows Capacity Utilization. Capacity utilization at 72.6% is still far below normal - and far below the pre-recession levels of 80.5% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

Also - this is the highest level for industrial production since Dec 2008, but production is still 10.1% below the pre-recession levels at the end of 2007.

This graph shows mortgage delinquencies by "bucket" (time deliquent).

This graph shows mortgage delinquencies by "bucket" (time deliquent).Loans 30 days delinquent declined in Q4, but are still above the levels in 2007 - and at about the level of early 2008 - when prices were falling sharply.

The 60 day bucket also declined in Q4, but it is still above the levels of 2008.

The 90 day and 'in foreclosure' rates are at record levels. Obviously the lenders have been slow to start foreclosure proceedings and to actually foreclose.

This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

This graph shows the national LoanPerformance data since 1976. January 2000 = 100.The national average of home prices declined 1.0 percent in December 2009 compared to November 2009. The index is off 3.7% over the last year, and off 28.2% from the peak.

The index has declined for four consecutive months.

This is the house price indicator used by the Fed.

Best wishes to all.

NY Times Goodman: The New Poor

by Calculated Risk on 2/21/2010 09:00:00 AM

Peter Goodman at the NY Times profiles a few of the long term unemployed: Millions of Unemployed Face Years Without Jobs

Even as the American economy shows tentative signs of a rebound, the human toll of the recession continues to mount, with millions of Americans remaining out of work, out of savings and nearing the end of their unemployment benefits.According to a recent National Employment Law Project (NELP) report, 1.2 million people will lose their unemployment benefits in March, and 5 million will be ineligible for federal unemployment benefits by June.

Economists fear that the nascent recovery will leave more people behind than in past recessions, failing to create jobs in sufficient numbers to absorb the record-setting ranks of the long-term unemployed.

Call them the new poor: people long accustomed to the comforts of middle-class life who are now relying on public assistance for the first time in their lives — potentially for years to come.

Yet the social safety net is already showing severe strains. Roughly 2.7 million jobless people will lose their unemployment check before the end of April unless Congress approves the Obama administration’s proposal to extend the payments, according to the Labor Department.

Saturday, February 20, 2010

Unofficial Problem Bank List increases to 617

by Calculated Risk on 2/20/2010 09:31:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

The Unofficial Problem Bank List increased by a net of 12 institutions this week with 15 additions and 3 removals. However, aggregate assets fell by about $500 million to $329 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Removals include two of the four institutions that failed on Friday -- La Jolla Bank, FSB ($3.8 billion) and Marco Community Bank ($138 million). It appears that the other failures -- George Washington Savings Bank, and The La Coste National Bank were not subject to any formal enforcement action.

The other removal was Hiawatha National Bank ($45 million) as the OCC terminated a Formal Agreement in April 2009 but waited until this month to disclose the termination.

Among the 15 additions are National Bank of Commerce, Superior, WI ($573 million); The Farmers National Bank of Prophetstown, Prophetstown, IL ($410 million); and The Farmers National Bank of Buhl, Buhl, ID ($386 million), which is the first appearance of an Idaho-based institution on the list.

As anticipated in the February 5th commentary, Palm Desert National Bank came back on the list this week as the OCC issued a Consent Order after terminating a Formal Agreement.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Nevada Casinos Lose $6.7 Billion in 2009

by Calculated Risk on 2/20/2010 06:48:00 PM

Something a little different ...

From Cy Ryan at the Las Vegas Sun: Report: Casinos lost money for second time in history

The state Gaming Control Board today released its “Gaming Abstract” for fiscal year 2009, which ended June 30, showing a net loss of $6.7 billion among the 260 major casinos in Nevada.Total revenues were down from $25.0 billion in fiscal 2008 to $22.0 billion in fiscal 2009. Gambling was off 12.7%, room revenue off 16.6% (hotels are getting crushed everywhere), but beverage sales were flat!

Clubs along the Las Vegas Strip, which makes up 53 percent of the gambling revenue in Nevada, registered a $4.1 billion loss.

...

The only other time Nevada gaming companies reported a loss was in 2003, of $33.5 million, said Frank Streshley, chief of tax and licensing for the board.

Rooms occupied (number of nights) declined from 42.8 million in 2008 (occupancy rate of 86.8%) to 41.6 million in 2009 or 82.2% occupancy rate. The average daily rate (ADR) declined from $119.46 in 2008 to $102.46 in 2009.

In addition to the $3 billion decrease in revenue, the casinos saw a $4.8 billion increase in Other G&A expenses - probably from write downs of bad investments. Also casino payroll employment was off 12.3% or almost 25,000 employees.

The two pillars of the Las Vegas economy have been gaming and construction. Construction is dead - and will be for some time because of all the excess capacity. And gaming is struggling too.

German Finance Minister: No Concrete Plan to Aid Greece

by Calculated Risk on 2/20/2010 02:26:00 PM

Earlier today, according to Reuters, Der Spiegel magazine reported an aid package for Greece was being worked out: Up to 25 billion euros in aid mulled for Greece: report (ht Rajesh)

Now from Bloomberg: Germany Doesn’t Have Plan to Aid Greece, Finance Ministry Says

Germany’s Finance Ministry said it has no specific plans for helping Greece combat its deficit crisis, denying a magazine report ... It’s “incorrect” that Germany is considering a “concrete” plan for countries sharing the euro to pump billions in financial aid to Greece, ministry spokesman Martin Kreienbaum said in an e-mailed statement. “The Finance Ministry has taken no decisions in this regard,” the statement said.Apparently nothing has changed. Greece has a debt offering coming up next week, from the Financial Times: Greece set for critical test with bond issue

...

Greece is “not requesting money from any European Union taxpayer,” government spokesman George Petalotis said in an e- mailed statement today

Greece is close to attempting ... to raise €3bn-€5bn ($4bn-$6.7bn) as early as next week.The EU gave Greece a March 16th deadline to show progress on their budget deficit and I don't expect anthing to be announced until after that deadline.

...

Greece’s debt crisis remains acute [with] €20bn of bonds to be rolled over in April and May.

excerpted with permission

FDIC Bank Failure Update

by Calculated Risk on 2/20/2010 11:01:00 AM

There have been 188 bank failures in this cycle (starting in 2007):

| FDIC Bank Failures by Year | 2007 | 3 |

|---|---|

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 20 |

| Total | 188 |

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows bank failures by week in 2008, 2009 and 2010.

The FDIC started fast in 2010, but slowed down when the snow storm hit D.C.

My prediction is the FDIC will close more banks in 2010 than in 2009 (more than 140), but fewer banks than in 1989 - peak of the S&L crisis (534 banks).

The second graph shows bank failures by year since the FDIC was started.

The second graph shows bank failures by year since the FDIC was started.The 140 bank failures last year was the highest total since 1992 (181 bank failures).

For those interested in bank failures by number of institutions and assets, the December Congressional Oversight Panel’s Troubled Asset Relief Program report through Nov 30th for 2009 (see page 45).

Study: Mods just Delay Foreclosures, 6.1 Million to Lose Homes

by Calculated Risk on 2/20/2010 07:46:00 AM

Jeff Collins, at the O.C. Register, has a Q&A with Wayne Yamano, vice president at John Burns Real Estate Consulting: Loan mods won’t halt foreclosures, study shows

Register: Your study says that five million of the 7.7 million delinquent homes will go through foreclosure or a “foreclosure-related procedure.” How is this likely to occur?Burns Consulting doesn't think there will be flood of homes hitting the market - they expect these homes will be lost over a few years - so in their view there will not be "another leg down in pricing".

Wayne: Most shadow inventory will get out onto the market as an REO or short sale. In any event, it results in the homeowner losing their home, and that home being added to the supply of homes available for sale.

Register: Do the remaining 2.7 million borrowers get their loan payments caught up?

Wayne: Of the 7.7 million delinquent homeowners, we actually think that only about 1.6 million will be able avoid losing their homes, and that the remaining 6.1 million will lose their homes. We say that there is 5 million units of shadow inventory because we estimate that about 1.1 million delinquent homeowners already have their homes listed for sale, and we would not classify those homes as “shadow.”

Register: When will this wave of foreclosures hit, and how will this shadow inventory affect home prices?

Wayne: We don’t believe that the shadow inventory will be dumped onto the market all at once. Although we don’t believe modification efforts will truly save a lot of homeowners from losing their homes, we do believe that these programs are effective in delaying foreclosures and pushing out the additional supply to later years.

Friday, February 19, 2010

Deconstructing the House

by Calculated Risk on 2/19/2010 10:49:00 PM

Note: Two different stories with a theme ...

First, from an article in the Arizona Daily Star: Chandler man arrested for gutting foreclosed home (ht Mellanie)

Police say 35-year-old Daniel I. Clark was booked on suspicion of defrauding a secured creditor and criminal damage. Police say a neighbor of Clark's stopped an officer on patrol and reported that Clark was "deconstructing" his house.And here is the video of the bulldozer guy in Cincinnati featured on WKRP, uh, WLWT.com: