by Calculated Risk on 2/23/2010 09:37:00 AM

Tuesday, February 23, 2010

Case-Shiller House Prices increase in December

Note: as usual, the S&P website crashes when they release the monthly house price data. I'll post some graphs when the data is available.

The WSJ reports:

[The composite 10 and 20] indexes dropped 0.2% from the previous month, although adjusted for seasonal factors, they increased 0.3%.More from Reuters: Home Prices Fall 2.5% as Market Recovery Still Weak (note: Reuters is reporting the NSA data).

...

Month-to-month gainers were led by Los Angeles, which rose 1%. Chicago again fared worst, falling 1.6%.

Report: State Tax Revenues decline in Q4

by Calculated Risk on 2/23/2010 08:10:00 AM

From the Rockefeller Institute: States Reported Fifth Consecutive Drop in Tax Collections in the Fourth Quarter of 2009 (ht Ann)

State tax revenues declined by 4.1 percent nationwide during the final quarter of calendar 2009, the fifth consecutive quarter of reduced collections, according to a report issued today by the Rockefeller Institute of Government.Here is the report: Final Quarter of 2009 Brought Still

The five straight quarters of year-over-year decline in overall tax collections represent a record length of such decreases, the Institute said.

...

“Calendar 2009 will be remembered as bringing historically sharp declines in tax revenue to states,” the report says. “Revenue gains toward the end of calendar 2009 were often driven by legislated tax increases rather than growth in the economy and tax base.”

Despite revenue gains in some states during the fourth quarter, the report concludes, “another negative quarter for the nation as a whole would not be unexpected. The troubling fiscal picture for states remains clearly in place.”

More Declines in State Tax Revenue

Tax revenues are still weak, and most states are still running large deficits. As a recent CNNMoney article notes:

States are looking at a total budget gap of $180 billion for fiscal 2011, which for most of them begins July 1. These cuts could lead to a loss of 900,000 jobs, according to Mark Zandi, chief economist of Moody's Economy.com.This suggests that more state and local government job cuts are coming.

Monday, February 22, 2010

Judge Accepts "Half-baked justice" in BofA-SEC Settlement

by Calculated Risk on 2/22/2010 11:36:00 PM

Louise Story at the NY Times writes: Judge Accepts S.E.C.’s Deal With Bank of America

[A] federal judge wrote on Monday that he had reluctantly approved a $150 million settlement with the Securities and Exchange Commission.And from the Judge:

"In short, the proposed settlement, while considerably improved over the vacuous proposal made last August in connection with the Undisclosed Bonuses case, is far from ideal. Its greatest virtue is that it is premised on a much better developed statement of the underlying facts and inferences drawn therefrom, which, while disputed by the Attorney General in another forum, have been carefully scrutinized by the Court here and found not to be irrational. Its greatest defect it that it advocates very modest punitive, compensatory, and remedial measures that are neither directed at the specific individuals responsible for the nondisclosures nor appear likely to have more than a very modest impact on corporate practices or victim compensation. While better than nothing, this is half-baked justice at best."I always enjoy some judicial snark.

Judge Jed S. Rakoff, Feb 22, 2010

Norris: Weather to Impact February Job Numbers

by Calculated Risk on 2/22/2010 08:32:00 PM

Floyd Norris writes at the NY Times: Horrid Job Number Coming

It snowed this month in much of the United States. ... Both the household survey (which produces the unemployment rate) and the employer survey (which produces the job count) ask about workers in the week during which the 12th of the month fell [the week of the blizzards].Apparently the weather negatively impacted the jobs report in January 1996, and net employment turned negative for one month in the middle of a huge job boom.

...

That means that a lot of people who had jobs may report they did not work during the week, and companies may say they had fewer people on the payroll than they would have cited a week earlier or later. If so, we may get a truly horrid job number.

Maybe the snow storms will impact the BLS report in February. Maybe not. ADP also uses payroll employment on the 12th of the month, so they should also be impacted.

Perhaps we will be able to tell if the weather had an impact by looking at weekly initial unemployment claims and the ISM reports (monthly surveys). Just something to remember next week ...

WSJ: Treasury Considering Appeal Process for HAMP

by Calculated Risk on 2/22/2010 05:07:00 PM

From James Hagerty at the WSJ: U.S. Weighs Changes to Mortgage-Relief Program

The U.S. Treasury is considering new ... proposals ... to give borrowers 30 days to respond after being denied a modification of their loan terms under the ... HAMP. During that period, which would allow borrowers to appeal against the decision, the servicer couldn't put the home up for sale at a foreclosure auction.Probably the main impact of HAMP has been to keep the supply of distressed properties down by delaying the inevitable. In most cases, this would just be another delay ...

...

A Treasury spokeswoman said the proposals are among "many ideas under consideration in the administration's ongoing housing stabilization efforts." She added: "This proposal has not been approved and there are no immediate planned announcements on the issue."

Servicers also would be required to provide a "written certification" that a borrower isn't eligible for HAMP before a foreclosure sale can be held.

...

These measures would likely further slow down the foreclosure process.

Survey: Short Sales Increase in January

by Calculated Risk on 2/22/2010 02:56:00 PM

From Campbell Surveys: Short Sales See Big Jump in Activity During January

According to the latest Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions, short sales accounted for a substantial 15.9% of home purchase transactions in January. This was well above the share of other distressed property activity – damaged real estate owned or REO (13.4%) and move-in ready REO (13.8%) – and represented a big jump for short sales.

...

“Short sales activity took a temporary dip in November around the expected expiration of the first-time homebuyer tax credit,” reported Thomas Popik, research director for the Campbell/Inside Mortgage Finance survey. “Few first-time homebuyers wanted to take the chance that their short sale transaction wouldn’t be approved by the November 30 deadline. But now that the tax credit has been extended, we see first-time homebuyers once again snapping up attractively priced short sales.”

Survey results showed that short sales typically sell for only 91% of listing price. In contrast, move-in ready REO sells for 99% of listing price, on average.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Source: Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions, Campbell Communications, Jan 2010

This graph, based on data from Campbell Communications, shows the break down of distressed sales of all transactions by three categories: 1) move in ready REOs, 2) damaged REOs (sold mostly to investors), and 3) short sales.

I expect 2010 will be the year of the "short sale" and the percentage of short sales will increase further after the servicers implement the Treasury's HAFA program .

Moody's: CRE Prices increase 4.1% in December 2009

by Calculated Risk on 2/22/2010 01:10:00 PM

Via the MSN Money, from Moody's:

US commercial real estate prices as measured by Moody's/REAL Commercial Property Price Indices (CPPI) increased for the second month in a row in December, rising 4.1%.Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

...

"Although we are unable to conclude that the bottom to the commercial real estate market is here, we do believe that the period of large price declines is over," says Moody's Managing Director Nick Levidy. "We will need to see data from the first few months of 2010 to develop a better picture of where things stand."

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices peaked in late 2007 and are now 40.8% below the peak in October 2007. Prices are at about the same level as early 2003.

More from Bloomberg: U.S. Commercial Property Index Rises 4.1% in December

Fed's Yellen: Economic Outlook and Monetary Policy

by Calculated Risk on 2/22/2010 11:04:00 AM

From San Francisco Fed President Janet Yellen: The Outlook for the Economy and Monetary Policy. Excerpts:

... I’m not at all convinced that a V-shaped recovery is in the cards. That fourth-quarter leap in GDP overstates the underlying momentum of the economy. Much of it was due to a slowdown in the pace at which businesses were drawing down inventory stocks compared with earlier in the year. Less than half of the fourth-quarter growth reflected higher sales to customers. Those sales did grow, but at a lackluster 2.2 percent. It appears that businesses are getting their inventories closer in line with sales, which is a good thing. But such inventory adjustments can be a potent source of growth only for a few quarters. I’d feel much more confident about the prospect for a sustained robust recovery if I saw evidence of more vigorous growth in actual sales.There is much more in the speech. Dr. Yellen's outlook is a little more optimistic than me (I think growth will be more sluggish in 2010).

... my business contacts tell me the consumer mindset is still in a fragile state. Clearly, the big weight hanging over everyone’s heads is jobs. ...

The housing sector appears to have stabilized, but here too I don’t see any signs of a sharp turnaround. New home sales and construction finally stopped falling last year and have been reasonably stable, albeit at very low levels, for several months. Existing home sales surged late last year in response to the homebuyer tax credit. But, the credit expires this spring, so this source of support won’t be around much longer. The housing sector has also been benefiting from the Fed’s policy of buying mortgage-backed securities. These purchases appear to have helped keep home finance rates low. But, the Fed is now in the process of tapering off these purchases and plans to stop them at the end of March. As support from Federal Reserve and other government programs phases out, there is a risk that the housing market could weaken again.

...

Put it all together and you have a recipe for a moderate rate of economic growth, well below the spritely pace set in the fourth quarter. The current quarter appears on course to post growth of around 3 percent. I see the economy gradually picking up steam over the remainder of this year as households and businesses regain confidence, financial conditions improve, and banks increase the supply of credit. I expect growth of about 3½ percent for the year as a whole, picking up to about 4½ percent next year, with private demand coming on line to pick up the slack as government stimulus programs fade away.

...

This brings us to a subject that is of paramount concern to all of us—the job situation. This recession has been very severe, indeed. The U.S. economy has shed 8.4 million jobs since December 2007. That’s more than a 6 percent drop in payrolls, the largest percentage point decline since the demobilization following World War II. The unemployment rate, which was 5 percent at the start of the recession, rose to around 10 percent in late 2009. The rates of job openings and hiring are also stuck at very low levels. These statistics represent a tragedy for our country, our communities, and each of the families and individuals who have had to cope with a loss of livelihood.

There is a glimmer of good news on the employment front. The pace of job losses has slowed dramatically and some indicators, such as gains in temporary jobs, suggest that we may be close to a turnaround in the labor market. I was encouraged to see the unemployment rate drop from 10 percent to 9.7 percent in January. Nonetheless, given my forecast of moderate growth and a shrinking, but still sizable, output gap, I expect unemployment to remain painfully high for years. The rate should edge down from its current level to about 9¼ percent by the end of this year and still be about 8 percent by the end of 2011, a far cry from full employment.

I should warn that there is a great deal of uncertainty surrounding this forecast.

Chicago Fed: Economic Activity Increased in January

by Calculated Risk on 2/22/2010 08:33:00 AM

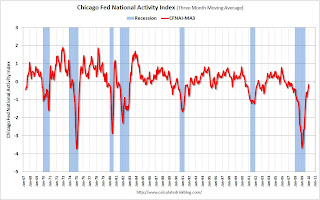

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity increased sharply in January

The Chicago Fed National Activity Index was +0.02 in January, up from –0.58 in December. ...

The index’s three-month moving average, CFNAI-MA3, increased to –0.16 in January from –0.47 in December, reaching its highest level since July 2007. January’s CFNAI-MA3 suggests that, consistent with the early stages of a recovery following a recession, growth in national economic activity is beginning to near its historical trend. With regard to inflation, the amount of economic slack reflected in the CFNAI-MA3 indicates subdued inflationary pressure from economic activity over the coming year.

Production-related indicators made a positive contribution to the index for the seventh consecutive month. As a group, they contributed +0.45 in January, up from +0.14 in December. ...

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A CFNAI-MA3 value below –0.70 following a period of economic expansion indicates an increasing likelihood that a recession has begun. A CFNAI-MA3 value above –0.70 following a period of economic contraction indicates an increasing likelihood that a recession has ended. A CFNAI-MA3 value above +0.20 following a period of economic contraction indicates a significant likelihood that a recession has ended.Although the CFNAI-MA3 improved in January, the index is still negative. According to Chicago Fed, it is still too early to call the official recession over - although the likelihood that a recession has ended is increasing.

Sunday, February 21, 2010

Sunday Night Futures

by Calculated Risk on 2/21/2010 11:59:00 PM

The U.S. futures are up a little tonight:

Futures from CNBC show the S&P 500 up a couple of points.

Here are the futures from barchart.com

Most of the Asian markets are up tonight, with the Nikkei and Hang Seng up over 2.5%.

From Bloomberg: Asian Stocks, Oil Advance as U.S. Interest Rate Concern Eases

Asian stocks jumped the most since November, oil rose and the yen fell on speculation Federal Reserve Chairman Ben S. Bernanke will signal that U.S. interests rates will be kept near a record low.The article suggests some investors misunderstood the increase in the discount rate. Bernanke testifies on Wednesday (see Weekly Summary and a Look Ahead), and he will definitely say that the Fed will hold rates low for an extended period.

Best to all.