by Calculated Risk on 9/01/2010 06:54:00 PM

Wednesday, September 01, 2010

Personal Bankruptcy Filings: Down from July, Up from August 2009

Note: The number of filings is volatile month to month - and August is frequently a bit lower than July.

From the American Bankruptcy Institute: August Consumer Bankruptcy Filings fall 8 Percent this Month

The 127,028 consumer bankruptcies filed in August represented a 8 percent decrease nationwide over the 137,698 filings recorded in July 2010, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). Though a decrease from the previous month, NBKRC’s data also showed that the August 2010 consumer filings represented a 6 percent increase from the 119,874 consumer filings recorded in August 2009. ...

“While monthly filings are volatile, consumer bankruptcies are still the highest they have been since Congress overhauled the bankruptcy law in 2005,” said ABI Executive Director Samuel J. Gerdano. “Consumer filings remain on track to top 1.6 million filings in 2010.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

In 2005 the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" was enacted. Since then the number of bankruptcy filings has increased steadily.

U.S. Light Vehicle Sales 11.5 Million SAAR in August

by Calculated Risk on 9/01/2010 04:00:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.47 million SAAR in August. That is down 18.9% from August 2009 (cash-for-clunkers), and down 0.5% from the July sales rate. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for August (red, light vehicle sales of 11.47 million SAAR from Autodata Corp).

The high for the year was in March, and sales have moved mostly sideways since then. The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current month sales rate. The current sales rate is still below the bottom of the '90/'91 recession - when there were fewer registered drivers and a smaller population.

This was below most forecasts of around 11.6 million SAAR.

Some comments on August ISM Manufacturing Index

by Calculated Risk on 9/01/2010 12:15:00 PM

The Institute for Supply Management reported this morning that the PMI increased to 56.3 from 55.5 in July. Expectations were for a decrease to 53.0. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is an update to the graph showing the regional Fed manufacturing surveys and the ISM index through August.

The Fed surveys suggested that the ISM index would probably decline, but the relationship is noisy. Based on this graph I'd expect either the Fed surveys to bounce back in September - or the ISM to decline. Here is a long term graph that hopefully puts the uptick in August in perspective.

Here is a long term graph that hopefully puts the uptick in August in perspective.

In addition to the increase in the PMI, the production index increased to 59.9 from 57.0, and the employment index increased from 58.6 in July to 60.4. That suggests increased manufacturing employment in August.

However the new orders index declined in August to 53.1 from 53.5 in July (still expanding, but at a slower pace). And the inventory index was up for the 2nd month in a row to 51.4.

This report was somewhat better than expected, but I still expect the index to decline over the next couple of months.

General Motors: Sales off sharply from August 2009

by Calculated Risk on 9/01/2010 11:18:00 AM

Note: Sales in August 2009 were boosted by "Cash-for-clunkers".

From MarketWatch: GM August U.S. sales down 24.9% to 185,176 units

General Motors Co. said Wednesday that U.S. sales in August slumped 24.9% to 185,176 vehicles from 246,479 in August 2009.Note: in August 2009 U.S. light vehicle sales were 14.1 million (SAAR). This was related to "Cash-for-clunkers" - also General Motors emerged from bankruptcy on July 10, 2009.

I'll add reports from the other major auto companies as updates to this post.

Update1: From MarketWatch: Ford U.S. August sales slide 10.7% to 157,503

From MarketWatch: Chrysler U.S. August sales rise 7% to 99,611 units

NOTE: Once all the reports are released, I'll post a graph of the estimated total August light vehicle sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET. Most estimates are for an increase to 11.6 million SAAR in August from the 11.5 million SAAR in July.

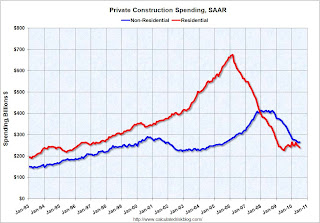

Construction Spending declines in July

by Calculated Risk on 9/01/2010 10:15:00 AM

Note: the ISM PMI increased to 56.3 from 55.5 in July (I'll have more later).

Overall construction spending decreased in July. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

From the Census Bureau: July 2010 Construction at $805.2 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during July 2010 was estimated at a seasonally adjusted annual rate of $805.2 billion, 1.0 percent (±1.4%)* below the revised June estimate of $813.1 billion. The July figure is 10.7 percent (±1.8%) below the July 2009 estimate of $901.2 billion.Private residential construction spending has turned down again - after the tax credit expired - and residential investment (RI) will be a drag on Q3 GDP. The "good" news is the overall drag from RI will be much smaller than during 2006, 2007 and 2008.

...

Spending on private construction was at a seasonally adjusted annual rate of $506.4 billion, 0.8 percent (±1.3%)* below the revised June estimate of $510.7 billion. Residential construction was at a seasonally adjusted annual rate of $240.3 billion in July, 2.6 percent (±1.3%) below the revised June estimate of $246.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $266.1 billion in July, 0.8 percent (±1.3%)* above the revised June estimate of $264.0billion.

ADP: Private Employment decreases 10,000 in August

by Calculated Risk on 9/01/2010 08:15:00 AM

ADP reports:

Private sector employment decreased by 10,000 from July to August on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from June to July was revised down slightly, from the previously reported increase of 42,000 to an increase of 37,000.Note: ADP is private nonfarm employment only (no government jobs).

The decline in private employment in August confirms a pause in the recovery already evident in other economic data.

...

Unlike the estimate of total establishment employment to be released on Friday by the Bureau of Labor Statistics (BLS), today’s figure does not include the effects of federal hiring — and now firing — for the 2010 Census.

The consensus was for ADP to show an increase of about 20,000 private sector jobs in August, so this was below consensus.

The BLS reports on Friday, and the consensus is for a decrease of 90,000 payroll jobs in August, on a seasonally adjusted (SA) basis, with the loss of around 116,000 temporary Census 2010 jobs (+26,000 ex-Census).

MBA: Purchase Application activity suggests low level of existing home sales in August and September

by Calculated Risk on 9/01/2010 07:33:00 AM

The MBA reports: Mortgage Applications Increase as Rates Hit New Low in MBA Weekly Survey

The Refinance Index increased 2.8 percent from the previous week and is at its highest level since May 1, 2009. The seasonally adjusted Purchase Index increased 1.8 percent from one week earlier.

...

"Refinancing activity picked up again last week, reaching new 15-month highs, as borrowers took advantage of even lower mortgage rates. The drop in mortgage rates was in line with Treasury rates as the latest data continue to show weak economic growth and an exceptionally weak housing market," said Michael Fratantoni, MBA's Vice President of Research and Economics. "The sharp decline in MBA's Purchase Application index in May had provided a clear leading indicator of the drops in new and existing home sales that were reported for June and July. Despite the slight increase in purchase activity in the past week, the continued low level of purchase applications indicates we are unlikely to see an increase in new home sales reported for August or existing home sales reported for September."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.43 percent from 4.55 percent, with points increasing to 1.34 from 0.89 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The contract rate is a new low for this survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Usually I start the graph in January 1990, but this shorter term graph shows that the purchase index has been moving sideways since May of this year.

As the MBA's Fratantoni noted, this suggests existing home sales in August and September will be around the same level as in July.

Tuesday, August 31, 2010

Existing Home Inventory declines slightly in August

by Calculated Risk on 8/31/2010 07:10:00 PM

Tom Lawler reports that at the end of August, listings on Realtor.com totaled 4,007,860, down 0.7% from 4,038,133 at the end of July. This is 2.5% above August 2009.

The NAR reported inventory at 3.98 million at the end of July, and at 3.924 million in August 2009. So they will probably report inventory at close to 4 million for August.

Since sales probably only increased slightly in August, the months-of-supply metric will be in double digits again in August and probably still over 12 months.

Note: there is a seasonal pattern for existing home inventory. Usually inventory peaks in July and declines slightly through October - and then declines sharply at the end of the year as sellers take their homes off the market for the holidays.

Restaurant Index shows contraction in July

by Calculated Risk on 8/31/2010 04:14:00 PM

This is one of several industry specific indexes I track each month.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Same store sales and customer traffic both declined in July (on a year-over-year basis). This is the fourth consecutive month of declines.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading above 100 shows expansion for this index.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remained Uncertain in July as Restaurant Performance Index Remains Essentially Flat

As a result of soft sales and traffic levels and a deteriorating outlook among restaurant operators, the National Restaurant Association’s comprehensive index of restaurant activity remained essentially flat in July. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.4 in July, down 0.1 percent from June and its fourth consecutive decline. In addition, the RPI stood below 100 for the third consecutive month, which signifies contraction in the index of key industry indicators.Restaurants are a discretionary expense, and this contraction could be because of the sluggish recovery or might suggest further weakness in consumer spending in the months ahead.

...

Restaurant operators reported negative same-store sales for the fourth consecutive month in July, with the overall results similar to the June performance.

...

Restaurant operators also reported a net decline in customer traffic levels in July.

...

Restaurant operators have become less optimistic about their prospects for sales growth in recent months.

emphasis added

FOMC August Minutes: Both employment and inflation to fall short of dual mandate

by Calculated Risk on 8/31/2010 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee

Economic outlook:

Members still saw the economic expansion continuing, and most believed that inflation was likely to stabilize near recent low readings in coming quarters and then gradually rise toward levels they consider more consistent with the Committee's dual mandate for maximum employment and price stability. Nonetheless, members generally judged that the economic outlook had softened somewhat more than they had anticipated, particularly for the near term, and some saw increased downside risks to the outlook for both growth and inflation. Some members expressed a concern that in this context any further adverse shocks could have disproportionate effects, resulting in a significant slowing in growth going forward. While no member saw an appreciable risk of deflation, some judged that the risk of further near-term disinflation had increased somewhat. More broadly, members generally saw both employment and inflation as likely to fall short of levels consistent with the dual mandate for longer than had been anticipated.And on policy:

All but one member concluded that it would be appropriate to begin reinvesting principal received from agency debt and MBS held in the SOMA by purchasing longer-term Treasury securities in order to keep constant the face value of securities held in the SOMA and thus avoid the upward pressure on longer-term interest rates that might result if those holdings were allowed to decline. Several members emphasized that in addition to continuing to develop and test instruments to facilitate an eventual exit from the period of unusually accommodative monetary policy, the Committee would need to consider steps it could take to provide additional policy stimulus if the outlook were to weaken appreciably further. Given the softer tone of recent data and the more modest near-term outlook, members agreed that some changes to the statement's characterization of the economic and financial situation were necessary.Not much new ...