by Calculated Risk on 9/05/2010 11:45:00 AM

Sunday, September 05, 2010

Summary for Week ending Sept 4th

It was a busy week ...

The BLS reported:

1) Nonfarm payroll employment declined 54,000 in August.

2) however Decennial census employment declined 114,000.

3) so ex-Census, payrolls increased 60,000.

4) Private payrolls increased 67,000.

5) The unemployment rate increased to 9.6% from 9.5% in July.

6) Payrolls for June and July were revised up by 46,000 and 77,000 respectively.

A few graphs ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms aligned at the bottom of the recession (Both the 1991 and 2001 recessions were flat at the bottom, so the choice was a little arbitrary).

The dotted line shows the impact of Census hiring. In August, there were only 82,000 temporary 2010 Census workers still on the payroll. The number of Census workers will continue to decline - and the remaining gap between the solid and dashed red lines will be gone soon.

Here is the graph showing the same data but aligned at the beginning of the recession.

The Employment-Population ratio increased to 58.5% in August from 58.4% in July.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate increased to 64.7% from 64.6% in July. This is the percentage of the working age population in the labor force. The Participation Rate is very low, and as the employment picture improves, people will return to the labor force, and that will put upward pressure on the unemployment rate.

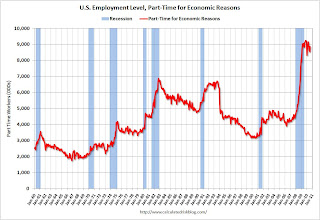

The BLS reported that "The number of persons employed part time for economic reasons ... increased by 331,000 over the month to 8.9 million."

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.7% in August from 16.5% in July.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.In August 2010, the number of unemployed for 27 weeks or more declined significantly to 6.249 million (seasonally adjusted) from 6.752 million in July. It appears the number of long term unemployed has peaked, but it is still very difficult for these people to find a job - and this is a very serious employment issue.

The 5 to 14 week category increased sharply in August and is now at the highest level since October 2009.

The underlying details of the employment report were mixed. The positives: the upward revisions to the June and July reports, a slight increase in hours worked for manufacturing employees (flat for all employees), an increase in hourly wages, and the decrease in the long term unemployed. Other positives include the slight increase in the employment-population ratio and the participation rate.

The negatives include the hiring of only 60,000 ex-Census, the increase in the unemployment rate (including U-6), and the increase in part time workers for economic reasons.

Overall this was a weak report and is consistent with a sluggish recovery.

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.47 million SAAR in August. That is down 18.9% from August 2009 (cash-for-clunkers), and down 0.5% from the July sales rate.

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.47 million SAAR in August. That is down 18.9% from August 2009 (cash-for-clunkers), and down 0.5% from the July sales rate.This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for August (red, light vehicle sales of 11.47 million SAAR from Autodata Corp).

The high for the year was in March, and sales have moved mostly sideways since then.

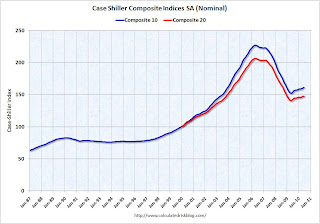

S&P/Case-Shiller released the monthly Home Price Indices for June (actually a 3 month average of April, May and June).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 29.0% from the peak, and up 0.3% in June (SA).

The Composite 20 index is off 28.4% from the peak, and up 0.3% in June (SA).

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in June seasonally adjusted.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in June seasonally adjusted.Prices in Las Vegas are off 56.5% from the peak, and prices in Dallas only off 4.8% from the peak.

Prices are probably falling right now (starting in July), but this will not show up in the Case-Shiller index for a few months since this an average of three months and reported with a significant lag (this was the June report).

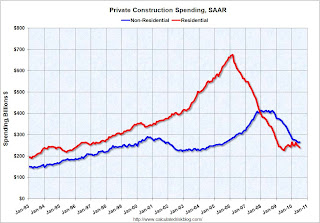

Overall construction spending decreased in July.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.From the Census Bureau: July 2010 Construction at $805.2 Billion Annual Rate

Private residential construction spending has turned down again - after the tax credit expired - and residential investment (RI) will be a drag on Q3 GDP. The "good" news is the overall drag from RI will be much smaller than during 2006, 2007 and 2008.

The Institute for Supply Management reported that the PMI increased to 56.3 in August from 55.5 in July.

This graph shows the regional Fed manufacturing surveys and the ISM index through August.

This graph shows the regional Fed manufacturing surveys and the ISM index through August.The Fed surveys suggested that the ISM index would probably decline, but the relationship is noisy. Based on this graph I'd expect either the Fed surveys to bounce back in September - or the ISM to decline. The internals of the ISM report were soft - the new orders index declined in August to 53.1 from 53.5 in July (still expanding, but at a slower pace). And the inventory index was up for the 2nd month in a row to 51.4 - and I expect the PMI to decline in September.

The August ISM Non-manufacturing index was at 51.5%, down from 54.3% in July. The employment index showed contraction in August at 48.2%. Note: Above 50 indicates expansion, below 50 contraction.

The August ISM Non-manufacturing index was at 51.5%, down from 54.3% in July. The employment index showed contraction in August at 48.2%. Note: Above 50 indicates expansion, below 50 contraction.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

The overall ISM index, and the employment index, are both at the lowest level since January.

Best wishes to all.

More stories on the long term unemployed

by Calculated Risk on 9/05/2010 09:02:00 AM

From Alana Semuels at the LA Times: For many unemployed workers, jobs aren't coming back. A few excerpts:

The U.S. safety net wasn't designed to withstand such a strain. The extent and duration of unemployment benefits vary by state, but 26 weeks is typical. Several federal extensions have increased that to 99 weeks in California and other hard-hit states. Even so, an estimated 3.5 million Americans will have run out of benefits by the end of the year. About 180,000 Californians have already fallen off the rolls.This article has several stories about people struggling with long term unemployment.

There are few other places to turn. Applications for federal food stamps and state programs such as CalWorks, which provides temporary assistance to families with children, are up sharply in recent years.

...

Desperation is growing, said Ofer Sharone, an assistant professor at MIT's Sloan School of Management who has spent the last year interviewing dozens of long-term jobless workers.

"The U.S. is clearly not equipped to deal with this high level of unemployment," Sharone said. "People are running out of benefits, health insurance, retirement and pensions."

This brings up two key points:

Saturday, September 04, 2010

Another potential home seller chases the market down

by Calculated Risk on 9/04/2010 11:26:00 PM

From Dina ElBoghdady at the WaPo: In struggling housing market, buyers and sellers are out of sync

ElBoghdady tells the story of an accidental landlord in the D.C. area - someone who wanted to sell, but wouldn't cut his price. So he rented his home instead, while he waited a few years for a better market. Earlier this year he tried to sell again at a lower price, but he still had no luck. Now he is dropping the price again, and there are still no buyers.

Now it sounds like he plans on renting the property, and he will once again wait for a better market to sell.

In a real estate bust, this strategy is called "chasing the market down" (or "chasing the price down").

Also, ElBoghdady writes that existing home sales "were far worse than some of the most pessimistic economists had expected". She must have missed this: Lawler: Existing Home Sales: “Consensus” vs. Likely

Unemployment Rate and Level of Education

by Calculated Risk on 9/04/2010 05:41:00 PM

Another graph by request ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

Note that the unemployment rate increased sharply for all four categories in 2008 and into 2009.

Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - but education didn't seem to matter as far as the recovery rate in unemployment following the 2001 recession. All four groups recovered slowly.

So far this year, the group with "less than a high school diploma" has recovered a little better than the more educated groups - although the unemployment rate increased for all four groups in August. And here is a graphic from the BLS based on 2009 data: Education pays ...

And here is a graphic from the BLS based on 2009 data: Education pays ...

This shows the unemployment rate and the the median weekly earnings by eight levels level of education.

The higher the education, the lower the unemployment rate - and the higher that median weekly earnings. Of course that doesn't necessarily mean that "education pays", because there is also a cost (both the actual cost and the opportunity cost), but in general education probably does pay (besides it is fun to learn).

And for Saturday readers, here are the employment posts yesterday (with many graphs):

Update: Total people receiving unemployment benefits

by Calculated Risk on 9/04/2010 01:21:00 PM

Here is a graph from the Atlanta Fed of the number of people receiving extended unemployment benefits ... Note: data as of Aug 7th - there were about 300,000 less people receiving benefits on Aug 14th (most recent data NSA). Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

The number of persons receiving extended benefits has shot up in the weeks following the reinstatement of the emergency unemployment compensation (EUC) program.That is an increase of almost 2 million people receiving aid since the program was reinstated.

Note: As people exhaust their regular benefits, they move on to receive extended benefits first through the federal EUC program and then their state’s extended benefits (EB) program.

• The number of persons receiving emergency unemployment compensation (EUC) has increased by nearly 1.6 million in the three weeks since the program was reinstated on July 22, 2010. For the week ending August 7, the number of claimants reached 4.9 million.

• Extended benefits (EB) claimants increased by more than 300,000 (or 50%) during the same period. There were 937,000 people claiming extended benefits for the week ending August 7.

• Currently, up to 73 weeks of benefits extensions are available including both the EUC and EB programs (53 weeks of EUC and 20 weeks of EB).

There are another 4.1 million people receiving regular unemployment benefits (NSA). So the total is close to 10 million (NSA).

Duration of Unemployment

by Calculated Risk on 9/04/2010 08:56:00 AM

An update by request ... Click on graph for larger image.

Click on graph for larger image.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Note: The BLS reports 15+ weeks, so the 15 to 26 weeks number was calculated.

In August 2010, the number of unemployed for 27 weeks or more declined significantly to 6.249 million (seasonally adjusted) from 6.752 million in July. It appears the number of long term unemployed has peaked, but it is still very difficult for these people to find a job - and this is a very serious employment issue.

The 5 to 14 week category increased sharply in August and is now at the highest level since October 2009 - and that is concerning.

Note: Even though these numbers are all seasonally adjusted, they can't be added together to calculate the unemployment rate. And a repeat of a popular graph ...

And a repeat of a popular graph ...

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

Best to all

Employment posts yesterday (with many graphs):

Friday, September 03, 2010

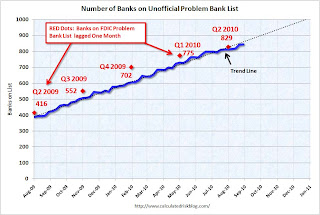

Unofficial Problem Bank List increases to 844 institutions

by Calculated Risk on 9/03/2010 10:56:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 3, 2010.

Changes and comments from surferdude808:

It was a comparatively quiet week for the Unofficial Problem Bank List as there were only four additions and no removals with the FDIC taking the long holiday weekend off from closures.

The additions include First National Bank of Chester County, Chester, PA ($1.2 billion Ticker: FCEC); Lafayette Savings Bank, FSB, Lafayette, IN ($379 million Ticker: LSBI); Oregon Community Bank & Trust, Oregon, WI ($195 million); and Hull Federal Savings Bank, Baltimore, MD ($27 million). Other changes include Prompt Corrective Action Orders issued by the Federal Reserve against First Community Bank ($2.6 billion Ticker: FSNM) and Sunrise Bank ($134 million) and OTS against AnchorBank, fsb ($4.0 billion Ticker: ABCW).

The Unofficial Problem Bank List includes 844 institutions with aggregate assets of $412 billion. This week the FDIC released its official count of problem institutions at 829 with assets of $403 billion as of June 30th.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the number of banks on the unofficial list. The number of institutions has more than doubled since we started the list in early August 2009 - even with all the bank failures (failures are removed from the list). The number of assets is up 50 percent over the last year.

On August 7, 2009, we listed 389 institutions with $276 billion in assets, and now the list has 844 institutions and $412 billion in assets.

The red dots are the number of banks on the official problem bank list as announced in the FDIC quarterly banking profile for Q2 2009 through Q2 2010. The dots are lagged one month because of the delay in announcing formal actions.

The unofficial count is close to the official count (the difference is mostly timing issues), and the FDIC will probably have close to 1,000 banks on the list by the end of the year.

NFIB: Small Businesses Still Not Hiring

by Calculated Risk on 9/03/2010 08:15:00 PM

From NFIB: Small Businesses Still Not Hiring

William C. Dunkelberg, chief economist for the National Federation of Independent Business [said] “In August, most firms did not change employment, but for those that did, 11 percent (up one point from July) increased average employment by 2.3 employees, but 13 percent (down two points) reduced their workforces by an average of 3.5 workers. Job creation still has not crossed the 0 line in the small business sector.Note: A large percentage of small businesses are in real estate related fields and that will keep hiring down for some time. The August survey will be released on Sept 14th, but once again the key problem is "weak sales".

...

“Over the next three months, 13 percent plan to reduce employment (up three points), and 8 percent plan to create new jobs (down one point), yielding a seasonally adjusted net 1 percent of owners planning to create new jobs, a point worse than July, but at least it’s positive.

“Overall, the job creation picture is still bleak. Weak sales and uncertainty about the future continue to hold back any commitments to growth, hiring or capital spending."

Earlier employment posts today (with many graphs):

Rail Traffic increases 5.7% in August compared to August 2009

by Calculated Risk on 9/03/2010 04:12:00 PM

From the Association of American Railroads: Rail Time Indicators. The AAR reports traffic in August 2010 was up 5.7% compared to August 2009 - and traffic was 11.6% lower than in August 2008.

However traffic declined 1.6% from July on a Seasonally Adjusted (SA) basis.

This graph shows U.S. average weekly rail carloads (NSA). Traffic increased in 16 of 19 major commodity categories year-over-year.

From AAR:

• U.S. freight railroads originated 1,179,447 carloads in August 2010, an average of 294,862 carloads per week. That’s up 5.7% from August 2009 though down 11.6% from August 2008 on a non-seasonally adjusted basis. It’s also the highest weekly average for any month since November 2008 and reverses a string of three straight months in which average unadjusted carloads fell in absolute terms.As the graph above shows, rail traffic collapsed in November 2008, and now, a year into the recovery, traffic has only recovered part way.

• However, on a seasonally adjusted basis, U.S. rail carloads fell 1.6% in August 2010 from July 2010. As the chart below ... shows, on an unadjusted basis rail traffic almost always increases from July to August. In that chart, note the upward slope of the line segment from July 2010 to August 2010. That slope is not as steep as the line segments for the same period in most other years on the graph, or for most prior years not shown on the chart. In a nutshell, that explains why seasonally adjusted rail traffic in August 2010 is down a bit when unadjusted traffic is up.

excerpts with permission

Employment Diffusion Indices

by Calculated Risk on 9/03/2010 02:03:00 PM

A few more comments:

Click on graph for larger image.

Click on graph for larger image.The BLS diffusion index for total private employment declined to 53.0 from 56.7 in July. For manufacturing, the diffusion index declined to 47.0 from 53.0 in July, and down sharply from 67.1 in April.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The increases in the diffusion indices in 2009 and earlier this year, was a clear positive in the monthly employment reports. However the decrease in the diffusion indices over the last few months (falling below 50% for manufacturing in August), is disappointing.

Earlier employment posts today (with many graphs):