by Calculated Risk on 9/09/2010 10:27:00 PM

Thursday, September 09, 2010

From Loan Modification Purgatory to Foreclosure Hell

David Lazarus has an interesting foreclosure story in the LA Times: Suddenly, their house is taken over

A few details:

The couple fell behind on their mortgage payments (he works in construction). Wells Fargo put them in a HAMP three month trial modification program in December, and they made all their payments.

After the three months were up, Ellen Kahara said, they were told by Wells that their case was still under review and that they should keep making the $1,400 payments. They did.On August 18th there was a knock on the door - it was the new owner who had bought the home at foreclosure!

The bank continued requesting paperwork as part of its review process. ... The Kaharas received a letter from Wells dated Aug. 11 saying that their application for a permanent loan modification had been rejected. The letter said the Kaharas would have 30 days to discuss other options available to them.

"No foreclosure sale will be conducted and you will not lose your home during this 30-day period," the letter said.

Obviously Wells Fargo made a huge mistake with the foreclosure, but perhaps just as outrageous is how they strung the couple along for months - collecting seven or eight monthly payments - and then finally denied the permanent modification when they were ready to foreclose.

Double Digit Unemployment Rate early next year?

by Calculated Risk on 9/09/2010 06:44:00 PM

From Ethan Harris, Bank of America North American Economist, and others, Growth recession, Sept 3rd:

"[F]or most of 2010 and 2011, employment growth is not expected to keep up with the rise in the labor force, which means the unemployment rate heads north. We expect a steady increase to 10.1% by the second quarter with a slow fall slightly below 10.0% by the end of 2011."From Ed McKelvey, Goldman Sachs senior economist today:

"[W]e expect payroll gains to slow to 25,000 per month (ex Census workers) and the jobless rate to drift up to 10% over the next half year."With growth slowing in the 2nd half (and into 2011), this means the unemployment rate will probably tick up too (unless the participation rate falls further). I've been expecting the unemployment rate to stay elevated, and probably increase further - and the main reason is the same as for the BofA and Goldman analysts: the general slowing economy.

Weekly Update on European Bond Spreads

by Calculated Risk on 9/09/2010 02:29:00 PM

Here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of Sept 7th): Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

Peripheral European bond spreads (over German bonds) have risen since the August FOMC meeting.Note: The Atlanta Fed data is a couple days old. Nemo has links to the current data on the sidebar of his site. The bond spreads have eased slightly over the last couple of days.

Irish and Portuguese bond spreads are currently at all-time highs, while the spread for Greek bonds remains extremely elevated.

Since the August FOMC meeting, the 10-year Greece-to-German bond spread has risen by 146 basis points (bps) ... through September 7. Similarly, with other European peripherals’ spreads, Portugal’s is higher by 99 bps during the period, and Spain’s is up by 20 bps.

Note: A big story today was the report that Deutsche Bank is seeking to raise 9 billion euros.

Government Employment since 1976

by Calculated Risk on 9/09/2010 12:23:00 PM

Menzie Chinn at Econbrowser posted a graph of total government employment over the last decade: The "Ever-Expanding" Government Sector, Illustrated

In response to the comments to his post, here are a couple of additional graphs: Click on graph for larger image.

Click on graph for larger image.

This graph shows federal, state, and local government employment as a percent of the civilian noninstitutional population since 1976 (all data from the BLS).

Federal government employment has decreased over the last 35 years (mostly in the 1990s), state government employment has been flat, and local government employment has increased.

Note the small spikes very 10 years. That is the impact of the decennial census. The second graph shows government employment excluding education as a percent of the civilian noninstitutional.

The second graph shows government employment excluding education as a percent of the civilian noninstitutional.

The percent of federal and state government employment (ex-education) have all declined. Local government employment has been steady - so overall government employment (ex-education) as a percent of the civilian population is down over the last 35 years.

Trade Deficit declines in July

by Calculated Risk on 9/09/2010 09:11:00 AM

The Census Bureau reports:

[T]otal July exports of $153.3 billion and imports of $196.1 billion resulted in a goods and services deficit of $42.8 billion, down from $49.8 billion in June, revised.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through June 2010.

Although imports declined in July, imports have been increasing much faster than exports.

The second graph shows the U.S. trade deficit, with and without petroleum, through July.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The decrease in the deficit in July was across the board, although the oil deficit only declined slightly. And the trade gap with China declined slightly to $25.92 billion from $26.15 billion in June - essentially unchanged.

This is the 2nd largest monthly trade deficit since the 2008 collapse in trade.

Weekly Initial Unemployment Claims decline

by Calculated Risk on 9/09/2010 08:30:00 AM

UPDATE: BofA noted this morning that 9 states reported delays in filing jobless claims because of labor day weekend ... so the actual was probably higher (ht Brian)

The DOL reports on weekly unemployment insurance claims:

In the week ending Sept. 4, the advance figure for seasonally adjusted initial claims was 451,000, a decrease of 27,000 from the previous week's revised figure of 478,000. The 4-week moving average was 477,750, a decrease of 9,250 from the previous week's revised average of 487,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 9,250 to 477,750.

Claims for last week were revised up from 472,000 to 478,000.

This is the lowest level for weekly claims since early July, but it is still very high - and the current level of the 4-week average suggests a weak job market.

Wednesday, September 08, 2010

The Frugal are Losers Too

by Calculated Risk on 9/08/2010 08:34:00 PM

From Graham Bowley at the NY Times: Debtors Feast at the Expense of the Frugal

For example, anyone keeping $500,000 in a 12-month certificate of deposit earning a rate of 1.5 percent annually — one of the best savings rates available nationally these days — would earn $7,500 a year, hardly enough to live on. Just three years ago, that same investment would have generated $26,250.Obviously retired people, living on bond yields, are taking a hit as bonds mature. And this is pushing some conservative investors into riskier assets too.

... Anyone investing $500,000 in 10-year Treasuries at current yields would earn $13,500 a year.

The BEA has been reporting that Personal interest income has been falling since Sept 2008, and I expect interest income will fall further as bonds and CDs mature.

Lawler: Again on Existing Home Months’ Supply: What’s “Normal?”

by Calculated Risk on 9/08/2010 04:49:00 PM

CR Note: This is from economist Tom Lawler.

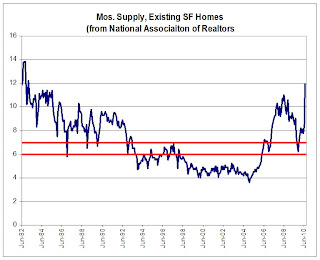

It has become “common practice” when talking about the “months’ supply” of existing homes for sale for folks to say that the “normal” months’ supply, or the months’ supply that means it is neither a “buyers” or a “sellers” market, is around 6 to 7 months. Yet here is the history of months’ supply for existing SF homes from the National Association of Realtors. Click on graph for larger image in new window.

Click on graph for larger image in new window.

As one can see, this “metric” actually has not been in the six-to-seven month range very often. From mid-1982 through 1992, the months’ supply measure was above seven months in all but a handful of months, while from 1998 to the spring of 2006 it was always below six months.

The measure, of course, is quite volatile, and sorta weird in that the inventory number (the numerator) is not seasonally adjusted while the sales data (the denominator) is seasonally adjusted. The measure also can be extremely volatile as sales tend to be impacted more by “special factors” (weather, tax credits, etc.) than listings.

But the measure is only one of many measures that may be “indicative” of “excess” supply, and it probably isn’t even close to the best measure. However, it is the most timely, so folks watch it closely – but sometimes place WAY to much meaning in month-to-month swings.

CR Note: The above was from economist Tom Lawler.

From CR: I'm one of the people who has called 6 to 7 months a "normal" months-of-supply. As the graph above shows, it is hard to define a normal based on the last 30 years.

I've heard the 6 to 7 months metric for years - and it fits the data I have. Perhaps the idea that 6 to 7 months is "normal" comes from new home inventory. This graph shows new home inventory back to 1963 (unfortunately Tom Lawler's graph only goes back to 1982).

This graph shows new home inventory back to 1963 (unfortunately Tom Lawler's graph only goes back to 1982).

For new homes, it does look like around 6 months supply is normal. I suspect if the existing home graph went back to the '60s, something like 6 months would be normal.

Lawler's caution is something to keep in mind. But double digit months-of-supply is clearly very high.

Consumer Credit Declines in July

by Calculated Risk on 9/08/2010 03:09:00 PM

The Federal Reserve reports:

In July, total consumer credit decreased at an annual rate of 1-3/4 percent. Revolving credit decreased at an annual rate of 6-1/4

percent, and nonrevolving credit increased at an annual rate of 1/2 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the increase in consumer credit since 1978. The amounts are nominal (not inflation adjusted).

Revolving credit (credit card debt) is off 15.2% from the peak. Non-revolving debt (auto, furniture, and other loans) is off 1.1% from the peak. Note: Consumer credit does not include real estate debt.

Fed's Beige Book: Continued growth, but "widespread signs of a deceleration"

by Calculated Risk on 9/08/2010 02:00:00 PM

Note: This is based on information collected on or before August 30, 2010.

From the Federal Reserve: Beige book

Reports from the twelve Federal Reserve Districts suggested continued growth in national economic activity during the reporting period of mid-July through the end of August, but with widespread signs of a deceleration compared with preceding periods.And on real estate:

...

Manufacturing activity expanded further on balance, although the pace of growth appeared to be slower than earlier in the year. Most Districts reported further gains in production activity and sales across a broad spectrum of manufacturing industries. However, New York, Richmond, Atlanta, and Chicago noted that the overall pace of growth slowed, while Philadelphia, Cleveland, and Kansas City reported that demand softened compared with the previous reporting period.

Activity in residential real estate markets declined further. Most District reports highlighted evidence of very low or declining home sales, which many attributed to a sustained lull following the expiration of the homebuyer tax credit at the end of June. Some Districts, such as New York and Dallas, noted that the expiration of the tax credit created especially weak conditions for lower-priced homes, while others, including Philadelphia and Kansas City, identified the high end of the market as the primary weak spot. Residential construction activity declined in most areas in response to weak demand.Pretty weak, but still growing in August.

...

Demand for commercial, industrial, and retail space generally remained depressed. Vacancy rates stayed at elevated levels in general and rose further in a few Districts, placing substantial downward pressure on rents.