by Calculated Risk on 9/16/2010 04:35:00 PM

Thursday, September 16, 2010

Update: Regional Fed Surveys and ISM

Note: Usually I don't watch this very closely, but right now I'm looking for signs of a slowdown in manufacturing. Eventually a watched pot does boil ...

By request - now that the Empire State and Philly Fed manufacturing surveys for September have been released - here is an update to the graph I posted last month: Click on graph for larger image in new window.

Click on graph for larger image in new window.

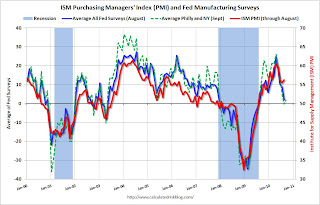

For this graph I averaged the New York and Philly Fed surveys (dashed green, through September), and averaged five surveys including New York, Philly, Richmond, Dallas and Kansas City (blue, through August).

The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

Last month, when the ISM survey came in slightly better than expected, I wrote: "Based on this graph, I'd expect either the Fed surveys to bounce back in September - or the ISM to decline."

So far there has been little "bounce back" in the Fed surveys.

Hotel Occupancy Rate: "Bumpy Week"

by Calculated Risk on 9/16/2010 01:57:00 PM

Hotel occupancy is one of several industry specific indicators I follow ...

From HotelNewsNow.com: STR: US hotel industry has bumpy week

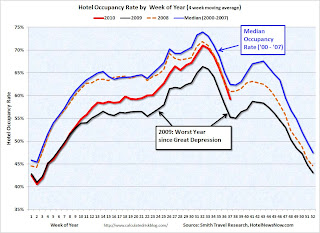

The U.S. hotel industry reported a decrease in average daily rate ADR for the first time in 13 consecutive weeks for the week of 5-11 September 2010, according to data from STR.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

ADR fell 2.0% to US$92.84, occupancy increased 2.7% to 54.2%, and revenue per available room ended the week virtually flat with a 0.7% increase to US$50.32.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 7.2% compared to last year (the worst year since the Great Depression) and 5.1% below the median for 2000 through 2007.

The occupancy rate has fallen below the levels of 2008 again - and 2008 was a tough year for the hotel industry!

Important: Even with the occupancy rate close to 2008 levels, 2010 is a much more difficult year. The average daily rate (ADR) is off 14% from 2008 levels - so even with the similar occupancy rates, hotel room revenue is off sharply.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Misc: China's Exchange Rate, Foreclosures, Poverty and Walking Away

by Calculated Risk on 9/16/2010 11:57:00 AM

A few articles:

It is the judgment of the IMF that, in view of the very limited movement in the Chinese currency, the rapid pace of productivity and income growth in China relative to its trading partners, the size of its current account surplus, and the substantial level of ongoing intervention in exchange markets to limit the appreciation of the Chinese currency, the renminbi is significantly undervalued.

We share that assessment. We are concerned, as are many of China’s trading partners, that the pace of appreciation has been too slow and the extent of appreciation too limited.

We will take China’s actions into account as we prepare the next Foreign Exchange Report, and we are examining the important question of what mix of tools, those available to the United States as well as multilateral approaches, might help encourage the Chinese authorities to move more quickly.

Bank repossessions ... increased about 3 percent from the month before to 95,364, a record high. At the same time the number of properties that received default notices—the first step in the foreclosure process—decreased 1 percent from a month ago and fell 30 percent from a year ago ...

Forty-four million people in the United States, or one in seven residents, lived in poverty in 2009, an increase of 4 million from the year before, the Census Bureau reported on Thursday.Here is the Census Bureau report.

The poverty rate climbed to 14.3 percent — the highest since 1994 — from 13.2 percent in 2008.

[T]he majority of Americans still believe [walking away] is unacceptable, according to a report from Pew Research Center.Here is the Pew Research report.

On the other hand, more than a third (36 percent) say the practice is at least sometimes acceptable.

Philly Fed Index shows contraction in September

by Calculated Risk on 9/16/2010 10:00:00 AM

Here is the Philadelphia Fed Index: Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of -7.7 in August to -0.7 in September. The index, which has been negative for two consecutive months, suggests that growth has stalled over the last two months (see Chart). Indexes for new orders and shipments continued to indicate weakness this month: The new orders index fell 1 point, remaining negative for the third consecutive month, and the shipments index decreased 3 points, remaining negative for the second consecutive month.

Firms reported near steady employment this month but lower average work hours for existing employees. The percentage of firms reporting increases in employment (18 percent) narrowly edged out the percentage reporting decreases (16 percent). The index for employment was slightly positive this month, increasing 5 points from its negative reading in August. Indicative of weaker activity, more firms reported declines in average work hours for existing employees (30 percent) than reported increases (8 percent).emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

This index turned down sharply in June and July and was negative in August and September (indicating contraction).

These surveys are timely, but noisy. However this is further evidence of a slowdown in manufacturing. This was slightly worse than the consensus view of a reading of 3.8 (slight expansion).

Weekly initial unemployment claims decline slightly

by Calculated Risk on 9/16/2010 08:32:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Sept. 11, the advance figure for seasonally adjusted initial claims was 450,000, a decrease of 3,000 from the previous week's revised figure of 453,000 [revised up from 451,000]. The 4-week moving average was 464,750, a decrease of 13,500 from the previous week's revised average of 478,250.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 13,500 to 464,750.

This is the lowest level for weekly claims since early July, but it is still very high - the 4-week moving average has been moving sideways at an elevated level for about 10 months - and that suggests a weak job market.

Wednesday, September 15, 2010

Elizabeth Warren to lead Consumer Financial Protection Bureau, unofficially

by Calculated Risk on 9/15/2010 09:22:00 PM

From the NY Times: Warren to Unofficially Lead Consumer Agency

Elizabeth Warren, who conceived of the Consumer Financial Protection Bureau, will oversee its establishment as an assistant to President Obama, an official briefed on the decision said Wednesday evening.I think Ms. Warren is an excellent choice.

The decision, which Mr. Obama is to announce this week, would allow Ms. Warren, a Harvard law professor, to effectively run the new agency without having to go through a potentially contentious confirmation battle in the Senate.

The two key housing problems

by Calculated Risk on 9/15/2010 07:00:00 PM

I think there are two key problems for the housing market: 1) the excess supply of existing housing units, and 2) negative equity.

The excess supply is keeping pressure on residential investment, and therefore on employment and economic growth. As new households are formed, the excess supply will be absorbed - but this is happening very slowly.

Hence the quote of the day:

Time Warner Cable ... CFO Robert Marcus said "subscriber environment very, very weak," thanks to high unemployment, high ... vacancies and "really anemic new home formation."It takes jobs to create households, and usually housing is the key driver for employment growth in the early stages of a recovery. So this is a trap: the excess supply means weak employment growth, leading to few new households, so the excess supply is absorbed slowly - putting off more robust employment growth.

The excess supply is also pushing down house prices (prices are just starting to fall again). Lower prices will eventually help clear the market, however lower prices will push more homeowners into negative equity.

And negative equity is the other key problem for housing. It is difficult for homeowners with negative equity to sell, it is difficult to move for employment or other reasons, it is hard to refinance, and it is demoralizing for many homeowners (especially those with substantial negative equity).

Negative equity frequently leads to distressed sales (short sales or foreclosures), and losses for lenders.

At the end of Q2, CoreLogic reported that "11 million, or 23 percent, of all residential properties with mortgages were in negative equity". And an "additional 2.4 million borrowers had less than five percent equity". With house prices falling, several million more properties will be in a negative equity position later this year and in 2011.

"Negative equity continues to both drive foreclosures and impede the housing market recovery. With nearly 5 million borrowers currently in severe negative equity, defaults will remain at a high level for an extended period of time," said Mark Fleming, chief economist with CoreLogic.The negative equity problem is intractable. The administration has pushed modifications (HAMP), short sales (HAFA), the Fannie 125% LTV refinance program (HARP), the FHA short refinance option (for lenders willing to write down principal) and a number of other programs. These have had limited success so far (the FHA short refinance option just started).

It is important to note that falling house prices helps clear the excess supply, although more jobs and more households is the preferred solution. However falling prices makes the negative equity problem worse.

The "good" news is the banks were stress tested for much lower house prices. The following graph shows the two bank stress test scenarios compared to the Case-Shiller Composite 10 Index.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The heavy government support for house prices has kept prices well above the baseline scenario. With prices higher than projected, fewer homeowners are in negative equity, and banks have taken fewer write downs than originally expected. Meanwhile many homeowners have been able to refinance into Fannie and Freddie (or FHA insured) loans putting the future risk on the taxpayer.

Based on the stress test results, the large banks should be able to handle further price declines - and falling prices will help clear the excess supply.

Both of these problems are very frustrating and will take time to resolve, but this suggests that policy should not be targeted at trying to support house prices.

Quote of the Day from Time Warner Cable: "anemic new home formation"

by Calculated Risk on 9/15/2010 03:44:00 PM

Via Dow Jones (ht Brian):

Time Warner Cable ... CFO Robert Marcus said "subscriber environment very, very weak," thanks to high unemployment, high ... vacancies and "really anemic new home formation."Although housing completions are at a record low (adding few net new housing units to the housing stock), additional household formation is key to absorbing the overhang of excess housing units.

Cartoon: "Signs of the Times"

by Calculated Risk on 9/15/2010 02:47:00 PM

From cartoonist Eric G. Lewis:

CoreLogic: House Prices decline 0.6% in July

by Calculated Risk on 9/15/2010 11:18:00 AM

Notes: CoreLogic reports the year-over-year change. The headline for this post is for the change from June 2010 to July 2010. The CoreLogic HPI is a three month weighted average of May, June and July and is NSA.

From CoreLogic (formerly First American LoanPerformance): CoreLogic Home Price Index Remained Flat in July

CoreLogic ... today released its Home Price Index (HPI) that showed that home prices in the U.S. remained flat in July as transaction volumes continue to decline. This was the first time in five months that no year-over-year gains were reported. According to the CoreLogic HPI, national home prices, including distressed sales showed no change in July 2010 compared to July 2009. June 2010 HPI showed a 2.4 percent year-over-year gain compared to June 2009. ...

Although home prices were flat nationally, the majority of states experienced price declines and price declines are spreading across more geographies relative to a few months ago. Home prices fell in 36 states in July, nearly twice the number in May and the highest since last November when national home prices were declining," said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is flat over the last year, and off 28% from the peak.

The index is 6.1% above the low set in March 2009, and I expect to see a new post-bubble low for this index later this year or early in 2011.