by Calculated Risk on 9/21/2010 08:31:00 PM

Tuesday, September 21, 2010

On the GMAC Foreclosure Stories

I was going to ignore this, but I realized Tanta had written some informative and entertaining pieces that will help everyone understand the issues.

First an update from Bloomberg earlier today: Ally Says GMAC Mortgage Mishandled Affidavits on Foreclosures

Ally Financial Inc., whose GMAC Mortgage unit halted evictions in 23 states amid allegations of mishandled affidavits, said its filings contained no false claims about home loans.The basic facts are:

The “defect” in affidavits used to support evictions was “technical” and was discovered by the company, Gina Proia, an Ally spokeswoman, said in an e-mailed statement.

This is great for the lawyers (fighting foreclosure), and costly for the lender, but this is nothing new - except that GMAC must not have been paying attention!

The best reporting on the GMAC story comes from 2007 (just change the name of the lender) - and you can learn all about affidavits from Tanta's posts:

And what Tanta wrote in 2007 applies to the GMAC stories:

To summarize: there were dollars on the table encouraging secondary market participants to get real sloppy. ... The big news here is that the true cost of doing business is belatedly showing up. I happen to think that's a more important story than was originally reported.Another amazing story is that three years later all these lenders haven't realized how sloppy the original work was!

Note that all of these stories were for non-GSE lenders and/or loans that were in private label MBS. These guys tried to cut corners everywhere, and they are now paying the price for being sloppy. They deserve to be ridiculed ...

Links on Lawrence Summers' Departure

by Calculated Risk on 9/21/2010 06:50:00 PM

From the White House: Dr. Lawrence H. Summers, Director of the National Economic Council, to Return to Harvard University at the End of the Year

From Bloomberg: Summers to Leave White House After Election

From the NY Times: Top White House Economic Adviser to Depart

This is quite a turnover: Christina Romer, Peter Orszag, and now Lawrence Summers. I expect Treasury Secretary Timothy Geithner will stay on (just a guess) - and I have no idea who will replace Summers.

Paving the Way for QE2

by Calculated Risk on 9/21/2010 03:44:00 PM

Fed Chairman Ben Bernanke suggested in his August 27th speech at Jackson Hole that additional easing would probably require “significant weakening of the outlook” or a meaningful decline in inflation expectations (or further disinflation).

The change to the FOMC statement today on inflation suggests the second criteria might have been met:

"Measures of underlying inflation are currently at levels somewhat below those the Committee judges most consistent, over the longer run, with its mandate to promote maximum employment and price stability."This was a significant downgrade from the statement last month:

"Measures of underlying inflation have trended lower in recent quarters ..."The FOMC and staff forecasts will be presented next month (Note: earlier I thought it might be today), and these forecasts will probably be revised down again. That will probably meet the "significant weakening of the outlook" criteria.

Also - the two key economic releases between now and the two day meeting on November 2nd and 3rd are the September employment report (to be released on October 8th) and the Q3 GDP advance estimate (to be released on October 29th). Barring a significant upside surprise in one or both of those reports, it appears QE2 might arrive as early as November.

This statement today was pretty clear: The FOMC "is prepared to provide additional accommodation if needed to support the economic recovery and to return inflation, over time, to levels consistent with its mandate."

FOMC Statement: "Prepared to provide additional accommodation "

by Calculated Risk on 9/21/2010 02:15:00 PM

Paving the way for QE2 ...

From the Fed:

Information received since the Federal Open Market Committee met in August indicates that the pace of recovery in output and employment has slowed in recent months. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising, though less rapidly than earlier in the year, while investment in nonresidential structures continues to be weak. Employers remain reluctant to add to payrolls. Housing starts are at a depressed level. Bank lending has continued to contract, but at a reduced rate in recent months. The Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be modest in the near term.

Measures of underlying inflation are currently at levels somewhat below those the Committee judges most consistent, over the longer run, with its mandate to promote maximum employment and price stability. With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to remain subdued for some time before rising to levels the Committee considers consistent with its mandate.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period. The Committee also will maintain its existing policy of reinvesting principal payments from its securities holdings.

The Committee will continue to monitor the economic outlook and financial developments and is prepared to provide additional accommodation if needed to support the economic recovery and to return inflation, over time, to levels consistent with its mandate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh.

Voting against the policy was Thomas M. Hoenig, who judged that the economy continues to recover at a moderate pace. Accordingly, he believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted and will lead to future imbalances that undermine stable long-run growth. In addition, given economic and financial conditions, Mr. Hoenig did not believe that continuing to reinvest principal payments from its securities holdings was required to support the Committee’s policy objectives.

FOMC Preview

by Calculated Risk on 9/21/2010 12:25:00 PM

In general I think little will change in the FOMC statement this month.

Update: The FOMC (and staff) will present their updated forecasts in November, but the forecasts will not be available until the minutes are released. Since the previous forecasts were too optimistic (see table below1), it is very likely their new forecasts will be are lower - but it is unclear if this will be mentioned in the statement today.

In a research note yesterday, Goldman Sachs suggested the following four possibilities (from "dovish" to "hawkish"):

1. No substantive change in the policy statement.Goldman's view is the focus would be on #2 and #3. I think #4 is off the table for now, and #1 is still a possibility.

2. Recognition of a weaker economic outlook, but without an explicit signal that renewed unconventional easing is under consideration.

3. An explicit signal that renewed easing is under consideration.

4. An announcement of renewed easing.

1Here are the forecasts from the June 22-23, 2010 (and May 9th) FOMC meeting. The Fed revised down their forecasts in June, but they were still too optimistic:

| Economic projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| 2010 | 2011 | 2012 | |

| Change in Real GDP | 3.0% to 3.5% | 3.5% to 4.2% | 3.5% to 4.5% |

| April projection | 3.2% to 3.7% | 3.4% to 4.5% | 3.5% to 4.5% |

| Unemployment Rate | 9.2% to 9.5% | 8.3% to 8.7% | 7.1% to 7.5% |

| April projection | 9.1% to 9.5% | 8.1% to 8.5% | 6.6% to 7.5% |

| PCE Inflation | 1.0% to 1.1% | 1.1% to 1.6% | 1.0% to 1.7% |

| April projection | 1.2% to 1.5% | 1.1% to 1.9% | 1.2% to 2.0% |

State Unemployment Rates in August: "Little changed" from July

by Calculated Risk on 9/21/2010 10:00:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

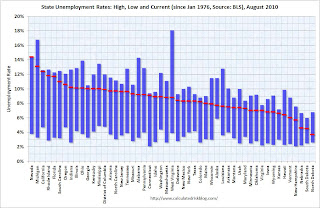

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Thirteen states now have double digit unemployment rates (up from eleven last month). A number of other states are close.

Nevada set a new series high at 14.4% and now has the highest state unemployment rate. Michigan held the top spot for over 4 years until May.

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in August. Twenty-seven states recorded unemployment rate increases, 13 states registered rate decreases, and 10 states and the District of Columbia had no rate change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada again reported the highest unemployment rate among the states, 14.4 percent in August, which was a new series high for the state. (All region, division, and state series begin in 1976.) The states with the next highest rates were Michigan, 13.1 percent, and California, 12.4 percent. North Dakota continued to register the lowest jobless rate, 3.7 percent, followed by South Dakota and Nebraska, at 4.5 and 4.6 percent, respectively.

emphasis added

Single Family Housing Starts increase slightly in August

by Calculated Risk on 9/21/2010 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

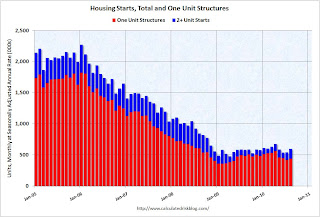

Total housing starts were at 598 thousand (SAAR) in August, up 10.5% from the revised July rate of 541 thousand (revised down from 546 thousand), and up 25% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

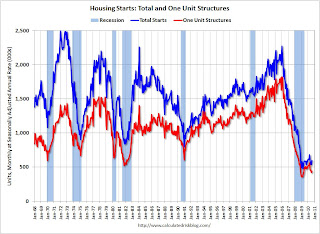

Single-family starts increased 4.3% to 438 thousand in August. This is 22% above the record low in January 2009 (360 thousand).  The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over a year - with a slight up and down over the last several months due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over a year - with a slight up and down over the last several months due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was above expectations of 550 thousand, mostly because of the volatile multi-family starts. As I've mentioned many times - this low level of starts is good news for the housing market longer term (there are too many housing units already), but bad news for the economy and employment short term.

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 598,000. This is 10.5 percent (±11.9%)* above the revised July estimate of 541,000 and is 2.2 percent (±9.7%)* above the August 2009 rate of 585,000.

Single-family housing starts in August were at a rate of 438,000; this is 4.3 percent (±12.4%)* above the revised July figure of 420,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 569,000. This is 1.8 percent (±2.0%)* above the revised July rate of 559,000, but is 6.7 percent (±1.4%) below the August 2009 estimate of 610,000.

Single-family authorizations in August were at a rate of 401,000; this is 1.2 percent (±1.0%) below the revised July figure of 406,000.

Monday, September 20, 2010

Flash Crash Report due in the next two weeks

by Calculated Risk on 9/20/2010 09:40:00 PM

From Graham Bowley at the NY Times: Ex-Physicist Leads Inquiry into Flash Crash

[The] long-awaited report on the so-called flash crash, in partnership with the Commodity Futures Trading Commission, is due to be published in the next two weeks.Hopefully the explanation will be clear and understandable.

...

[The SEC's Gregg Berman says] the report will zero in on a specific sequence of events that preceded the crash. He says it will tell a clear story about what happened in the markets on that stomach-churning day, beyond simply pointing a finger at the perils of the kind of high-speed computer trading that dominates today’s markets.

“The report will clearly demonstrate how market conditions and events prior to the flash crash led to the extreme price moves,” he said.

...

“Many market participants told us, ‘We’re not quite sure what happened over all, but this is what my firm saw and the actions we took,’ ” Mr. Berman said. “It was like ‘C.S.I.’ We wanted to interview everyone around.”

Europe Update: European Financial Stability Facility rated AAA

by Calculated Risk on 9/20/2010 04:17:00 PM

The European bailout fund, called the European Financial Stability Facility (EFSF), received the expected AAA rating today.

From the NY Times: European Bailout Fund Gets Top Rating From Credit Agencies

The European Financial Stability Facility, as the fund is known, was rated AAA by Moody’s Investors Service, Standard & Poor’s and Fitch Ratings. Standard & Poor’s said its understanding was that “guarantees from member governments supporting the repayment of E.F.S.F. obligations will be unconditional, irrevocable and timely, and thereby consistent with our criteria for sovereign guarantees.”The facility will not be "pre-funded", but will only raise funds when a member state asks for help.

The ratings are preliminary because no member state has yet called on the facility for help, and it has thus issued no debt.

Key European analysts had expected that countries would wait until the rating was secured before asking for help. Now there is a focus on Ireland and Portugal - the two countries most likely to ask for help in the near term.

The yields for Ireland and Portugal 10 year bonds are now above the crisis levels back in May.

And from Bloomberg: Honohan Says Irish Government Must Cut Deficit at Faster Pace

The extra yield that investors demand to hold 10-year Irish bonds over German bunds today exceeded 400 basis points for the first time as the government struggles to convince investors it can cap the cost of bailing out its banking system. Portugal is also being punished by investors, with the spread on its bonds also touching a record today. That’s fueling concerns that both countries may have to follow Greece and ask the European Union and the International Monetary Fund for a rescue.And something else to watch from the WSJ: ECB Steps Up Its Bond Buys Amid Worries

“We think there is a measurable risk that Ireland and Portugal will access the EFSF and IMF, but probably only early next year,” Goldman Sachs Group Inc. Chief European Economist Erik Nielsen said in a note yesterday.

The European Central Bank has increased its purchases of government bonds amid rising concerns in financial markets about the ability of Greece, Ireland and Portugal to repay their debts.

...

Bond buys by the ECB, though higher in recent weeks than during much of the summer, are still a fraction of what they were when the program started.

Moody's: Commercial Real Estate Price Index declined 3.1% in July

by Calculated Risk on 9/20/2010 01:08:00 PM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index declined 3.1% in July. This is a repeat sales measure of commercial real estate prices.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.