by Calculated Risk on 9/24/2010 04:51:00 PM

Friday, September 24, 2010

National Credit Union Administration announces plan to manage $50 billion in impaired assets

Press Release: NCUA Adopts Reforms for Corporate Credit Union System, Protects Consumers

The National Credit Union Administration today assumed control of three undercapitalized corporate credit unions, announced a plan to isolate the impaired assets in the corporate credit union system, and finalized a set of stronger regulations - key elements in its efforts to resolve the financial challenges facing corporate credit unions without disrupting consumer service.The WSJ reports:

...

Setting the plan into motion required conservatorship today of three additional corporate credit unions that are not viable: Members United Corporate Federal Credit Union of Warrenville, Illinois; Southwest Corporate Federal Credit Union of Plano, Texas; and Constitution Corporate Federal Credit Union of Wallingford, Connecticut. In 2009, U.S. Central Corporate Federal Credit Union of Lenexa, Kansas, and Western Corporate Federal Credit Union of San Dimas, California, were also placed into conservatorship.

Friday's moves include the seizure of three wholesale credit unions and an unusual plan by government officials to manage $50 billion of troubled assets inherited from failed institutions. To help fund the rescue, the National Credit Union Administration plans to issue $30 billion to $35 billion in government-guaranteed bonds, backed by the shaky mortgage-related assets.These "corporate credit unions" don't serve the general public - they are owned by the "natural person" credit unions - and all the "natural person" money held at these corporate credit unions was guaranteed early last year. But this is another $50 billion in "troubled" assets that will need to be worked through.

DOT: Vehicle Miles driven increase slightly in July

by Calculated Risk on 9/24/2010 03:23:00 PM

The Department of Transportation (DOT) reported that vehicle miles driven in June were up 0.8% compared to July 2009:

Travel on all roads and streets changed by 0.8% (2.2 billion vehicle miles) for July 2010 as compared with July 2009.

Cumulative Travel for 2010 changed by 0.2% (2.9 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the rolling 12 month total vehicle miles driven.

On a rolling 12 month basis, vehicle miles driven are mostly moving sideways. Miles driven are still 1.8% below the peak in 2007.

Back in 2008, vehicle miles turned strongly negative on a "month over the same month of the prior year" basis, and that was one of the pieces of data that helped me correctly predict oil prices would decline sharply in the 2nd half of 2008. So far we haven't seen a sharp decline in vehicle miles - but we also haven't seen a strong increase.

Early next year this will be the longest period with the rolling 12-months miles driven below the previous peak since the DOT started tracking this series. The current longest slump followed the 1979 oil crisis and lasted for 40 months (starting in 1979 and lasting through the recession of the early '80s).

Home Sales: Distressing Gap

by Calculated Risk on 9/24/2010 01:31:00 PM

By request, here is an update - this graph shows existing home sales (left axis) and new home sales (right axis) through August. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due partially to distressed sales).

Note: it is important to note that existing home sales are counted when transaction are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Initially the gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The two spikes in existing home sales were due primarily to the first time homebuyer tax credit (the initial credit last year, followed by the extension to April 30th / close by June 30th). There were also two smaller bumps for new home sales related to the tax credit.

Since new home sales are reported when contracts are signed, the 2nd spike for new home sales was in April and then sales collapsed in May. The 2nd spike for existing home sales was in May and June, and then existing home sales collapsed in July.

I expect that eventually this gap will be closed. However that will only happen after the huge overhang of existing inventory (especially distressed inventory) is significantly reduced.

New Home Sales August 2010 (Repeat with graphs)

by Calculated Risk on 9/24/2010 10:58:00 AM

Note: I apologize for the technical difficulties this AM.

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 288 thousand. This is unchanged from July.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted or annualized).

Note the Red columns for 2010. In August 2010, 25 thousand new homes were sold (NSA). This is a new record low for August.

The previous record low for the month of August was 34 thousand in 1981; the record high was 110 thousand in August 2005.

The second graph shows New Home Sales vs. recessions for the last 47 years. The dashed line is the current sales rate.

The second graph shows New Home Sales vs. recessions for the last 47 years. The dashed line is the current sales rate.

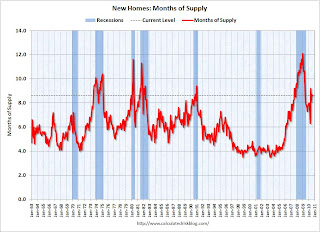

Sales of new single-family houses in August 2010 were at a seasonally adjusted annual rate of 288,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is unchanged (±16.7%)* from the revised July rate of 288,000 and is 28.9 percent (±11.0%) below the August 2009 estimate of 405,000.And another long term graph - this one for New Home Months of Supply.

Months of supply decreased to 8.6 in August from 8.7 in July. The all time record was 12.4 months of supply in January 2009. This is still very high (less than 6 months supply is normal).

Months of supply decreased to 8.6 in August from 8.7 in July. The all time record was 12.4 months of supply in January 2009. This is still very high (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of August was 206,000. This represents a supply of 8.6 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. The 288 thousand annual sales rate for August is just above the all time record low in May (282 thousand). This was another very weak report. New home sales are important for the economy and jobs - and this indicates that residential investment will be a sharp drag on GDP in Q3.

New Home Sales: Unchanged from July, Worst August on Record

by Calculated Risk on 9/24/2010 10:00:00 AM

NOTE: My host (Google) is not uploading images this morning - I'm working on a fix. You can follow the links to the images.

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 288 thousand. This is unchanged from July.

Here is the graph for New Home Sales NSA.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted or annualized).

Note the Red columns for 2010. In August 2010, 25 thousand new homes were sold (NSA). This is a new record low for August.

The previous record low for the month of August was 34 thousand in 1981; the record high was 110 thousand in August 2005.

The second graph shows New Home Sales vs. recessions for the last 47 years.

Sales of new single-family houses in August 2010 were at a seasonally adjusted annual rate of 288,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is unchanged (±16.7%)* from the revised July rate of 288,000 and is 28.9 percent (±11.0%) below the August 2009 estimate of 405,000.And another long term graph - this one for New Home Months of Supply.

The third graph is for Months of Supply

Months of supply decreased to 8.6 in August from 8.7 in July. The all time record was 12.4 months of supply in January 2009. This is still very high (less than 6 months supply is normal).

The seasonally adjusted estimate of new houses for sale at the end of August was 206,000. This represents a supply of 8.6 months at the current sales rate.The final graph shows new home inventory.

The 288 thousand annual sales rate for August is just above the all time record low in May (282 thousand). This was another very weak report. New home sales are important for the economy and jobs - and this indicates that residential investment will be a sharp drag on GDP in Q3.

Note: Sorry for the technical problems.

Durable Goods Orders decreased 1.3% in August

by Calculated Risk on 9/24/2010 08:30:00 AM

From the Census Bureau:

New orders for manufactured durable goods in August decreased $2.5 billion or 1.3 percent to $191.2 billion, the U.S. Census Bureau announced today. Down three of the last four months, this decrease followed a 0.7 percent July increase. Excluding transportation, new orders increased 2.0 percent. Excluding defense, new orders decreased 1.2 percent.This was below the consensus for a decline of 1.0%.

...

Shipments of manufactured durable goods in August, down following two consecutive monthly increases, decreased $3.1 billion or 1.5 percent to $197.9 billion.

Next up: New home sales at 10 AM ET.

Thursday, September 23, 2010

Obama pushes China on exchange rate

by Calculated Risk on 9/23/2010 10:09:00 PM

From David Sanger at the NY Times: With Warning, Obama Presses Chinese Leader on Currency

President Obama increased pressure on China to immediately revalue its currency on Thursday, devoting most of a two-hour meeting with China’s prime minister to the issue and sending the message, according to one of his top aides, that if “the Chinese don’t take actions, we have other means of protecting U.S. interests.”The old imbalances have returned - as the trade data and west coast port traffic data show - but I don't have much confidence that the Chinese will take action.

But Prime Minister Wen Jiabao barely budged ...

European Bond Spreads

by Calculated Risk on 9/23/2010 06:54:00 PM

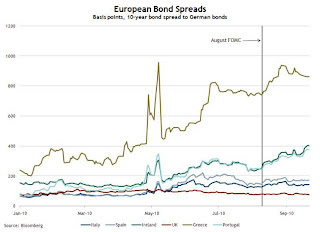

Here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of Sept 22nd):

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

European bond spreads have for the most part risen and remain elevated since the August FOMC meeting.As of today, the Ireland-to-German spread has increased to 418 bps, and the Portugal-to-German spread has increased to 402 bps - both new records.

Note: The Atlanta Fed data is a couple days old. Nemo has links to the current data on the sidebar of his site.

And from Liz Alderman at the NY Times: In Europe, a Mood of Austerity and Anxiety. And some video interviews from different countries ...

Philly Fed State Coincident Indexes

by Calculated Risk on 9/23/2010 04:09:00 PM

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty states are showing increasing three month activity. The index decreased in 6 states, and was unchanged in 4.

Based on the one month data, this three month activity map be turning red again.

Here is the Philadelphia Fed state coincident index release for August.

In the past month, the indexes increased in 27 states, decreased in 16, and remained unchanged in seven for a one-month diffusion index of 22. Over the past three months, the indexes increased in 40 states, decreased in six, and remained unchanged in four (California, Iowa, Indiana, and Missouri) for a three-month diffusion index of 68.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. The indexes increased in 27 states, decreased in 16, and remained unchanged in 7. Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

This is the fewest number of states showing increasing activity since January of this year.

Hotel Occupancy Rate: Just below 2008 levels

by Calculated Risk on 9/23/2010 02:03:00 PM

Hotel occupancy is one of several industry specific indicators I follow ...

From HotelNewsNow.com: STR: US hotels back on track in weekly results

Overall, the industry’s occupancy increased 6.7% to 63.5%, average daily rate was up 1.8% to US$100.25, and revenue per available room ended the week up 8.6% to US$63.66.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 6.8% compared to last year (the worst year since the Great Depression) and 5.7% below the median for 2000 through 2007.

The occupancy rate has fallen below the levels of 2008 again - and 2008 was a tough year for the hotel industry!

Important: Even though the occupancy rate is close to 2008 levels, 2010 is a much more difficult year. The average daily rate (ADR) is off more than 10% from 2008 levels - so even with the similar occupancy rates, hotel room revenue is off sharply compared to two years ago.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com